If economic conditions improve this year, a race could unfold for a new wave of Private Equity (PE) assets potentially coming to market. But before making any moves, it’s critical for investors to understand the complex dealmaking landscape.

Last year, the European PE industry experienced a severe downturn. In fact, the deal volume for buyouts was down by almost 20% in the first three quarters of 2023 compared with the same period in 2022 — and it was down by about 15% when compared against the same period in 2021. For deal value, the picture is even more devastating, with Q1-Q3 2023 deal value down by 60% and 71% for 2022 and 2021, respectively.1

This development was caused by a combination of headwinds including rising inflation, high interest rates, and the slow recovery of major economies, which fueled uncertainty for investors. Consequently, many PE funds in Europe held onto their portfolio companies for longer than they would typically do and postponed deals that they might have pursued in the previous years. All in all, we estimate that there are now more than 250 overdue exits in the portfolios of PE firms in Europe. Despite lower fundraising last year, the dry powder level remains high with an estimated $2.59 trillion globally waiting to be allocated.2 The main headwinds and their implications for uncertainty in the PE industry are:

Key drivers leading to the current backlog of deals and overdue exits

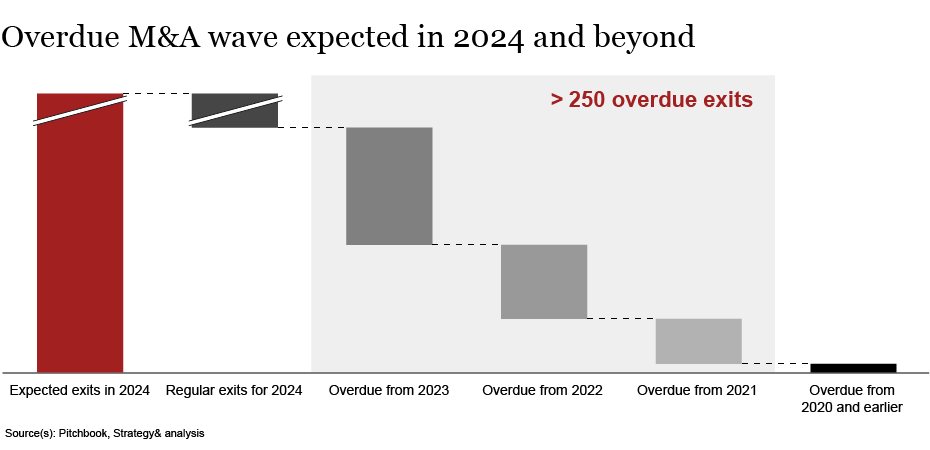

With all of these headwinds creating an unfavorable environment, many investors decided that it was not the best time to exit their portfolio companies if they wanted to achieve their deal target.5 Therefore, a significant backlog of assets has piled up in the portfolios of investors that will likely hit the market in 2024 and beyond when economic conditions improve.

- 1Methodology: The analysis is based on data from a PwC database and other intelligence platforms like Pitchbook for the period between January 2016 and December 2023. The data focusses on European companies (EU27 + UK) that are backed by PE funds and generate an annual revenue of more than €100 million. We estimated the average holding period of portfolio companies per industry based on the latest available data but we also know that average holding periods of assets vary by industry. Based on the year of investment, we estimated an expected year of exit. Following this methodology, we calculated the number of deals with the potential to create a wave of overdue deals on top of the 2024 regular deal flow.

- 2Findings: Over the past three years, the European PE industry has developed a significant backlog of deals and exits caused by the headwinds occurring since mid-2022. We estimate that more than 250 overdue deals could come to market in 2024 and beyond. This wave of M&A deals is largely due to the fact that many portfolio companies did not complete exits in 2022 and 2023.

Recommended reading

Commercial due diligence for increasing corporate value

Portfolio optimization

What to expect for PE deals and exits in 2024 and beyond

Based on our analysis, many deals and exits we might see in 2024 and beyond originate from overdue deals in 2023 as well as some from 2022 and 2021. As our analysis shows, ~50% of all overdue deals expected for 2024 and beyond come from the backlog of deals that were expected for 2023. In total, we see more than 250 overdue deals in the portfolios which we expected to transact in 2024 and beyond.

For both buyers and sellers, the coming wave of deals and exits offers significant opportunities in the months ahead. With companies being held for longer than usual, the portfolios of PE investors are ready for an overhaul offering vast value creation potential to be captured.

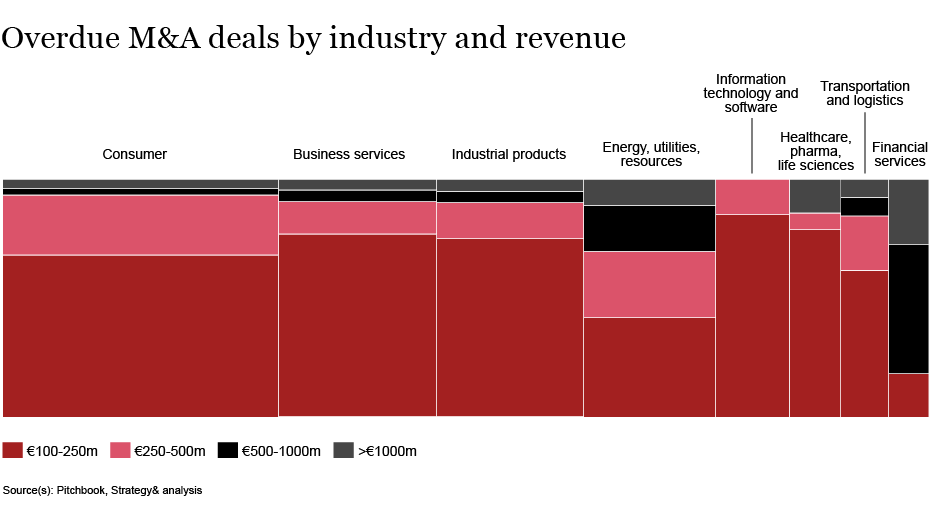

Looking into the potential deal flow for 2024 and beyond, we expect more than 60% of assets to be in the consumer markets (~30%), business services (~17%), and industrial products (~16%) industries. Given that these three industries have been dominating the European PE market for the past several years, this isn’t surprising. 85% of overdue deals and exits have annual revenues between €100 million and €500 million highlighting the importance and attractiveness of the larger mid-market segment. To capture this market opportunity larger mid-market PE funds, need to be particularly close to the three core industries i) consumer markets, ii) business services and iii) industrial products. For large PE funds the energy, utilities, resources, and financial services industries appear to be the right hunting grounds as the majority of the overdue deals and exits with revenues above €500 million contribute to these sectors.

For the consumer markets, industrial products and business services industries, our analysis suggests that more than 150 assets within the set revenue range are likely to come to market in 2024 and beyond. With more than 90% of assets (93% consumer markets, 91% for business services and 90% for industrial products) with revenue between €100 million to €500 million — slightly above the cross-industry average — this segment in particular offers attractive investment opportunities for mid-cap funds. As these industries have suffered from higher inflation levels and increased energy costs the margin-pressure on portfolio companies is high. At the same time, the current situation offers potential for new investors to act anti-cyclical, design effective value creation strategies and put them to work with their newly acquired portfolio companies.

Why the time may be coming for portfolio overhauls

Based on our analysis, 2024 could bring a significant uptake in deal activity for the European PE market. Deals that were expected to come to market but were postponed due to challenging and unfavorable economic and market conditions built up a significant backlog in investors’ portfolios. With inflation levels coming down again and interest rates expected to decline in 2024, uncertainty for investors will also decrease, however, additional geopolitical tensions might create further challenges. At the same time, within the asset backlog, a certain number of companies are performing below expectations and the turnaround might take longer than expected. Given the profile of deals expected to start emerging in the next several months, this year could be an optimal time for funds to overhaul their portfolios. Embracing these opportunities while staying patient might be the spirit for the upcoming months.

Phillip Robbers co-authored this article.