Following decades of global integration, recent geopolitical developments indicate a shift towards a less connected and more multipolar world. Many states are now looking closer to home to find reliable partners for more resilient growth models1 and resort to new measures to safeguard and strengthen their geopolitical position. These changes in geopolitics bear increasing risks for globally operating Multinational Corporations (MNCs) and require a strategic recalibration of foreign investments.

In this article, we describe the increasing exposure to business risks resulting from recent geopolitical developments and outline a framework to address them by building resilience to prepare for future scenarios with a neutral perspective. Using the case of foreign investment in China as an illustrative example, we show how MNCs can now rethink their strategic engagement to ensure further success of their global operations in these uncertain times.

Managing opportunities and risks

Over the past few decades, many MNCs have invested in China, seeking to capitalize on its booming economy. Access to one of the largest markets, skilled labor, and natural resources are just few of the countless opportunities that have allured foreign investments to Chinese shores. To this day, the country remains a growth and investment priority for many MNCs2.

However, these opportunities are coupled with substantial risks for MNC performance, fueled by recent developments in three areas:

- 1Changes in geopolitics: Latest global changes in geopolitics are characterized, among other things, by a trend towards fragmentation of the world3 and a recalibration of global power dynamics, in which China seeks to position itself as an increasingly influential player4 5. Amidst these changes, geopolitical tensions (e.g., between the United States and China) are rising, leading to an increased risk of political sanctions and boycotts unfavorable for international business. Ultimately, these tensions hold the potential to culminate in military conflicts and result in drastic MNC performance impact in affected countries. For instance, a potential conflict over Taiwan could disrupt supply chains and lead to a complete halt of operations in China.

Due to these changes in geopolitics, China and several Western players (e.g., United States and European Union) increasingly utilize economic levers to support geopolitical positioning, leading to elevated risks for intellectual property (IP) and regulatory pressure for globally operating MNCs. - 2Risks for intellectual property: International economic interactions are more and more characterized by a race for leadership in IP and technology (e.g., US CHIPS and Science Act) such as Artificial Intelligence, as this plays a key part in the future prosperity of many nations. In this context, some countries rely on export bans to protect locally developed technologies, while seeking to get access to innovations from abroad. Internationally operating companies thus face increasing difficulties to safeguard their IP6. For example, market entry in China for foreign companies may be linked to a forced technology transfer. Seeking to further build a competitive advantage for national companies, an increasing number of countries also rely on measures such as state subsidies (e.g., tax policies) favorable for local players. In China, many German companies lament for example favorable treatment of domestic companies concerning access to markets, information and political stakeholders7.

- 3Regulatory pressure: The regulatory and compliance landscapes around the globe are evolving. Both Western actors and China are increasing regulatory pressure. The increasing numbers of stringent norms and policies are posing challenges to MNCs. For example, the highly complex digital compliance landscape in China with regulations such as the Chinese Data Security Law or People Information Protection Law imposes strict data handling rules, including requirements for cross-border transfer. Compliance failure will lead to punitive measures.

De-risking economic relations with China

From a pragmatic business standpoint, these increasing risks render a re-evaluation of China strategy inevitable: MNCs need to foster their resilience to thrive in these uncertain times. As IT and business are seamlessly coupled nowadays, especially MNCs’ digital foundation must be fortified to continue operating in China. In this article, we thus focus especially on building digital resilience.

On top of business considerations, MNCs are increasingly pressured by governments to revise their dependencies from China. While Germany`s recently published China strategy underlines the importance of economic partnerships with China and does not seek to “decouple”, it expects companies instead to “de-risk” their China relations8. This means for MNCs that they can uphold their overall China business to benefit from corresponding opportunities. However, they must revise and de-risk dependencies. This can include various mitigation measures of different severity, ranging from anticipating risks to partly decoupling or diversifying operations from China.

However, while the German government does not demand mandatory stress tests for companies regarding their China business, companies will increasingly have to develop transparent China-related risk and impact analyses to prepare for possible worst-case scenarios. The war in Ukraine caught many companies off guard, and the hasty decoupling of economic relations with Russia had a large impact on Germany and other Western economies that could have been attenuated by prior resilience efforts. On the one hand, the dependence on Russian energy impacted the German energy-intensive industry. On the other hand, many companies operating in Russia completely stopped their local activities at high cost. These incidents demonstrate that caution is advised for international business relations in these times characterized by fueled risk and uncertainty.

Transparency is key: Assessing and evaluating future scenarios and risk exposure

To de-risk China relations effectively, MNCs first need to understand their risk exposure and the impact of different possible future scenarios on their business. Clearly defined reference scenarios with progressive level of severity (e.g., best/ middle/ worst case) and concretization in the specific MNC context are required. They serve the transparent derivation and quantitative impact estimation across the company, which is key to define targeted mitigation measures dependent on MNCs’ particular risk appetite and posture.

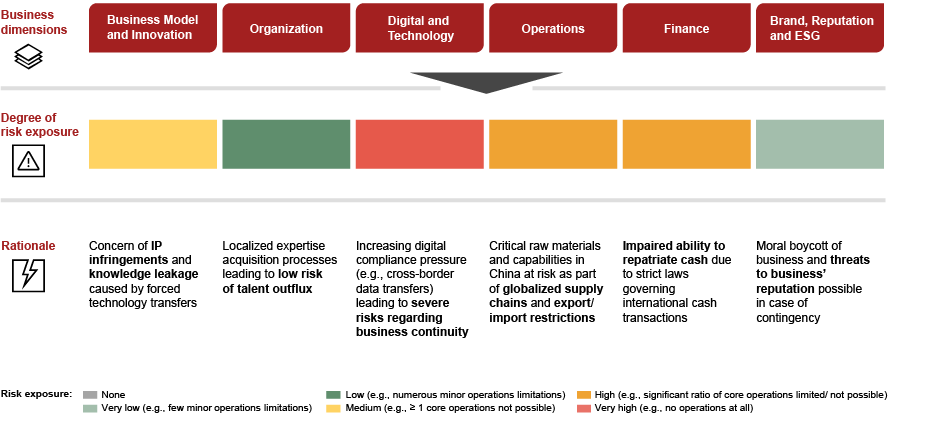

Based on our experience, assessing risk exposure along six business dimensions can enable companies to develop their risk strategies effectively.

While risk exposure per business dimension can vary for different companies, the “Digital and Technology” dimension usually is one of the most critical ones for companies operating in China. As business operations depend on the underlying enabling IT infrastructure and applications, a temporary impairment of the performance of IT systems (e.g., for internet connectivity) could lead to a complete halt of operations. For example, in the worst-case scenario, inter-regional data exchange could be totally interrupted, thereby making access to global applications impossible and localization mandatory. On the infrastructure side, public could be restricted to China-based vendors only.

To safeguard their operations in China, MNCs therefore especially need to build digital and technological resilience. In the following, we will show our methodology for how to mitigate risks and build resilience.

How MNCs can build digital resilience

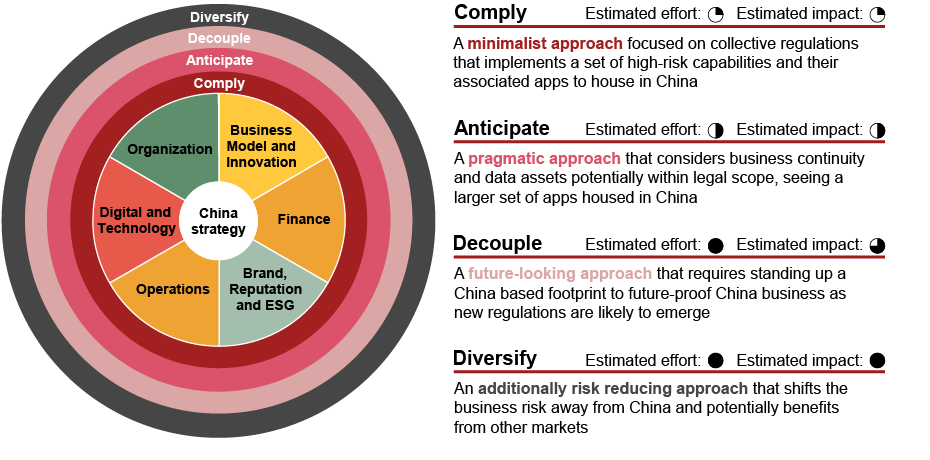

Drawing from our expertise, we developed a proven framework featuring four response archetypes to de-risk operations in China and build digital resilience.

Each of these response archetypes contains concrete mitigation measures that can be applied selectively to match the respective risk exposure and risk appetite of MNCs. In the "Digital and Technology" dimension, options like compliance, anticipation, and decoupling are particularly relevant, as localizing IT systems can ensure better regulatory compliance and reduce level of inter-dependencies.

To build digital resilience, a company might, for example, migrate applications with high-risk exposure and criticality to a local vendor (e.g., the ERP system), while maintaining the status quo for others (e.g., the global document management system). Applying our framework selectively thus allows for a tailored risk mitigation that is as well effective and cost optimized.

A comprehensive perspective

When crafting a de-risking strategy for business, a broad set of expertise is needed to account for all relevant aspects, as implications of geopolitical and regulatory scenarios have to be mapped on technology and operations with a strategic and business-driven perspective. A lack of expertise in any single facet may compromise the effectiveness of resilience efforts. For example, misinterpreting regulations or misjudging geopolitical developments can lead to inaccurate risk evaluations. MNCs should thus base their resilience efforts on a comprehensive analysis.

Success story

Developing a China digital resilience strategy at a leading Europe-headquartered chemicals company

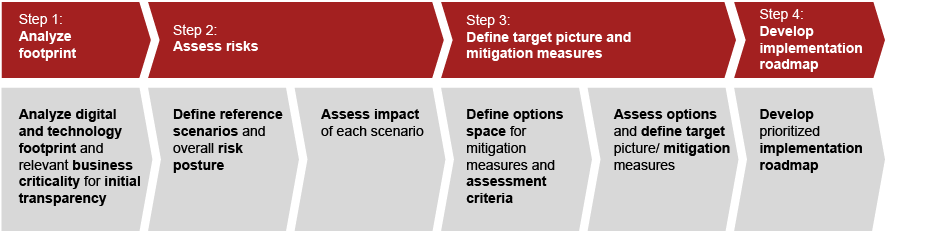

Combining expertise in digital and technology strategy, geopolitics as well as data and IT compliance, we supported a leading Europe-headquartered chemicals company with significant operations in China in the development of its digital China resilience strategy.

We leveraged our structured four steps approach to enable a conscious resilience decision with focus on the “Digital and Technology” dimension as the foundation for operations in China. After gaining initial transparency on the local footprint and the usage of non-locally hosted services in China, business criticality as well as interdependencies, we defined actionable and concrete scenarios, calibrated to the risk posture of the MNC. Considering impact and possible options, mitigation measures were defined and integrated into a prioritized roadmap.

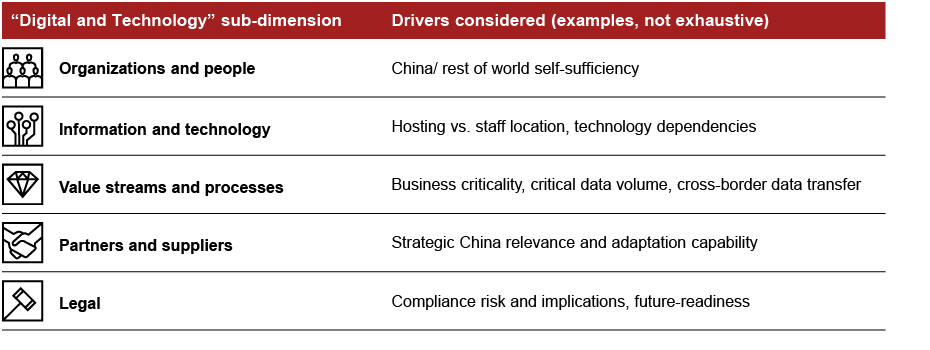

Our framework is composed of five sub-dimensions as well as underlying drivers. In this specific digital resilience context, it enabled a systematic risk assessment and definition of mitigation measures. As an example, the level of self-sufficiency of the “Digital and Technology” organization in China and in the rest of the world has been considered. Top-down view and bottom-up views have been combined to ensure robustness and holism of the strategy.

The results of the successful engagement are highly beneficial for future readiness and increased the resilience of our client:

- Increased transparency on the local “Digital and Technology” footprint and dependencies in China, the corresponding risk level and main risk drivers per business division, “Digital and Technology” function and granular service

- Facilitated conscious decision-making on reference scenario in line with MNC’s risk appetite

- Developed an optimized and targeted resilience/ risk mitigation strategy and roadmap

- Established a structured framework to support sustained efforts for refinement and adaptation of the resilience strategy based on continuous signal monitoring (e.g., geopolitics, public authorities, markets) considering volatile context

Global business on a stable digital foundation

Business need and government pressure to rethink relations with China are growing. Despite a rising awareness and initial considerations, effective de-risking by a significant share of Europe-headquartered companies (e.g., Germany) has not fully been implemented yet9. For example, import dependencies of Germany with China remain on a high level10.

In light of fueled business risks for foreign investments and dependencies, it is now time for many MNCs to catch up on resilience efforts to prepare for future scenarios. Indeed, significant time is required for implementation of defined strategy, which is no longer feasible in case of risk materialization. An early start can also maximize impact, for example through the proactive definition of guidelines and avoidance of sunk cost in already running high-cost initiatives.

While resilience efforts can never completely prevent economic losses in case of disruptions, well prepared MNCs can withstand as well as respond and recover faster from possible crises. Building digital resilience can allow companies to capitalize on the many opportunities in markets around the globe, with a significantly lower vulnerability to external circumstances, in a context of increasing geopolitical uncertainty.

Thomas Sigrist, Max Chen, Simon Gruber, and Katherina Ho also contributed to this article.

Contact us

Dr. Christian Kaspar

Partner, Strategy& Germany

Manuel Seiferth

Partner, PwC Germany

Dr. Markus Weiss

Director, Strategy& Switzerland