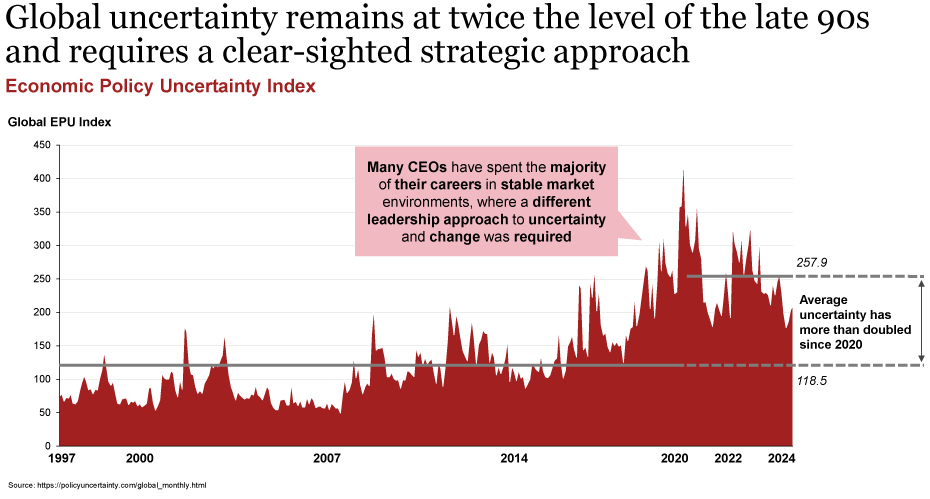

“This time last year, for the ninth year in a row, I warned you that there had never been a more uncertain outlook for our business. My message this year is exactly the same, only more so. The fog of unpredictability is again playing havoc with the clear skies of planning.”1 As 2024 is now more than half over, the 2024 fictive CEO letter as worded does not seem too exaggerated and might equally serve as a good draft for 2025.2 In particular the downturn on global stock markets in August 2024 confirms this perspective, which does not convey an overly optimistic outlook and a sense of predictability.

Companies across industries are confronting structural and fundamental challenges, such as stagnant productivity and a shrinking talent pool. Faced with a pessimistic outlook on growth, many companies are responding via budget cuts or traditional cost-cutting programs. But the targets once communicated as “corporate sprint” have now resulted in exhausted teams, frustrating workshop loops, and limited credibility of the narratives bridging the gap to the next growth cycle.

Moreover, as future growth cycles are expected to become shorter and steeper, companies risk getting trapped in a never-ending sequence of spending and cutting, without addressing underlying issues. The fact that countries across Europe continue to drop in the IMD competitiveness index does not sound encouraging either: Germany alone dopped from a ranking of 15 to 24 in only two years.3

This does not sound like the right time for a CEO seeking “THE masterpiece”, praised by loyal followers, stakeholders, and most assuredly by his or her media audience. Rather, an incoming CEO may well find her- or himself surrounded by a self-inflated and in many cases dysfunctional CxO team, carefully observed by colleagues exhausted by earlier projects and challenged by investors reluctant to grant a full 100 days for those first successes. In such a situation, the CEO would do well to heed advice from an earlier generation when faced with challenges and uncertainties.

“It is not the critic who counts; not the man who points out how the strong man stumbles or where the doer of deeds could have done better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs and comes up short again and again, because there is no effort without error or shortcoming…; but who knows the great enthusiasms, the great devotions; who spends himself in a worthy cause; who, at the best, knows, in the end, the triumph of high achievement, and who, at the worst, if he fails, at least he fails while daring greatly, so that his place shall never be with those cold and timid souls who knew neither victory nor defeat.”

Theodore Roosevelt,Speech at the Sorbonne (Paris), April 23rd, 19104As a doer of deeds, the CEO knows that the only way to break the pattern of decline and establish sustainable growth is to focus everyone’s full attention on a clear-sighted strategy and invest in the differentiating capabilities to make that strategy succeed – to render themselves fit for growth.

Convergence of red-light indicators demand action

In times of stable market conditions, one or two alarming economic factors might be enough to persuade a company to challenge its mode of operating and way to play. Now, to an unprecedented extent, many such indicators are flashing red all at once. People could get used to reading about the continued decline in industry, already down 20% from 2018. Investments for industrial manufacturing are down towards an all-time low and limited in most cases to regulatory updates. It does not look like a robust recovery is around the corner either. Recent European Union forecasts point to flat growth for several years to come. Even if a short-term boost is precipitated by more favorable conditions such as lower gas prices and capital costs, a reduction in overhead costs alone will certainly not generate the momentum required for sustainable growth.

A reality check of relevant indicators reveals that many key indicators are flashing red at the same time5

- 1Change of growth paradigm: European de-coupling from growth dynamics in other markets paired with shorter but more volatile growth cycles - with an average duration of 4 months since the end of the economic slowdown in 2019

- 2Decreasing production output: Lower output in sectors at the industrial core of Europe, e.g., -15% output in base metals or -10% output in chemical products

- 3Redirected investments: Asset decisions reside abroad and are not made in favor of European countries, e.g., EUR55 bn less in direct investments to Germany compared to 2019

- 4Lagging improvements: Over the last 5 years labor productivity in Europe has been stagnating (+0.9%), while patent publications have fallen (by up to -32%) for major technologies

- 5Regulation-driven overload: Well-intended regulatory requirements are maximizing the cost of bureaucracy, which is one of the top 3 reasons for delayed transformation

- 6Competing volumes from abroad: Production volumes from Asia are cannibalizing domestic business (e.g. +27% imports from China)

- 7Failing pricing mechanisms: Increased volatility has put margins under continuous up-and downward pressure, with variability of margins 1.2x higher in Europe compared to the US and 2x to China

- 8Spiking 'fear gauge': CBOE Volatility Index has reached 65 points in August, the highest level since 2020; also the corresponding EURO STOXX 50 Volatility Index has spiked to the highest level since early 2023

Indeed, any short-term uplift in fortunes will soon be followed by the same predicament when the prevailing circumstances deteriorate once again. To make matters worse, periods of growth are expected to last for more compressed periods, leading to recurring short bursts of organizational expansion and contraction in a corporate version of Groundhog Day. Meanwhile, the intrinsic challenges remain unaddressed.

The most astute business leaders have learned over time that fundamentally reorienting the organization towards long-term growth is the only option. Waiting for the most opportune time to accomplish this transformation would be an error, as delay will only allow competitors to forge ahead and leave you floundering. The time for action is now, even in the most demanding times.

Making the turn off the road to nowhere

Chief executives themselves know that they have big problems on their hands. According to the 2024 PwC CEO survey, almost half (45%) are not confident that their company will be viable ten years from now if it continues on its current path. Most expect technology, and GenAI in particular, to boost efficiency and productivity, while also improving the quality of products and services. However, the survey suggests that this is only a rather vague assumption, with little coherent purpose and direction. The majority are still debating exactly what they want to achieve with this technology, and for what ultimate objective.

Amid this pessimism, and some fumbling in the dark about what innovative technology can bring, many companies are going about their normal routine of cost-cutting in a downturn. However, without integrating these cuts into the framework of a sustainable long-term growth strategy, they are only postponing crucial choices and storing up more troublesome issues for themselves further down the line.

Even the short-term goal of reducing labor costs is beset by complications. As the skilled labor market is diminishing, companies are paying a higher price than they had originally anticipated to replace workers in traditional, mainly transactional roles. Moreover, within the next couple of years they will simply come under pressure to dispense with these expensive workers when the potential impact of AI becomes fully apparent.

Instead of just ploughing on regardless, accelerating the implementation of cost-cutting measures with ever-increasing determination in a bid to secure the desired outcome, companies need to acknowledge that this approach will not succeed in delivering results either on time or on a sustainable basis. They should take a short pause and review how these initiatives fit into their growth plans over the long term.

Getting Fit for Growth

In today’s economic uncertainty, CEOs must transcend temporary fixes and embrace a strategy that ensures long-term resilience and growth. Instead of incremental adjustments or cutting money on the wrong things for the wrong reasons and at the wrong time, CEOs need to move ahead of the wave and switch from a reactive to a proactive mode.

Strategy&’s Fit for Growth* formula promises a sustainable transformation, rather than temporary measures to paper over the cracks. The focus is not cost cutting per se, but the reallocation of funds and talent towards areas that the company views as strategically vital.

Indeed, the first stage of the approach is to examine existing strategy and be clear about long-term priorities, all of which would remain constant in the face of fluctuations in the external economic environment.

The next stage is to double down on differentiating capabilities, conducting a zero-based review of the company’s cost structure and illuminating where exactly to invest and how to pay for it. Instead of cutting or increasing expenses from the previous year's budget, this method starts with no preconceptions or biases and instead builds a new budget through evaluating the relevance of each set of costs to the agreed organizational strategy. In this way, certain legacy costs can be eliminated, others can be ruthlessly rationalized while still maintaining the requisite quality, and the remaining budget can be channeled with maximum effect to those areas that offer critical competitive advantage and differentiation.

It is likely that this fresh thinking will also require a reimagining of the existing operating model: What can still work well? What organizational change is needed, and what changes in the way we collaborate? How can we best integrate and leverage the opportunities that come with advances in the technology?

Lastly, the CEO needs to carry the organization with him or her. Evolving the culture calls for engagement and buy-in at multiple levels, so that the behaviors needed to shape the future and underpin long-term success become embedded and promoted. Correctly applied, the Fit for Growth approach can thus set the company apart for years to come, and the corporate Groundhog Day can be cast aside as a relic of the past.

*Fit for Growth is a registered service mark of PwC Strategy& LLC in the United States.

Become Fit for Growth

Discover how Strategy& can support your business in achieving outperformance, turnaround, and restructuring. Explore our comprehensive service offerings and visit our functional team's website for more details.