We’re already seeing leaders express their desire to move in this direction. According to a 2021 Verdantix global survey of 400 senior executives, a significant percentage of respondents identified GHG emissions management IT systems as their top priority.2 As leaders are increasingly looking for these kinds of systems, the ESG software industry is expected to experience a “bonanza” of fast growth. As of last year, the penetration of ESG software in Europe was estimated to be at only 12 to 14%, but market growth of more than 12% p.a. is expected over the next 5 years (source: Strategy& EHS and ESG software market model).

Increasingly, market growth will be fueled by the new Corporate Sustainability Reporting Directive (CSRD), which will become effective in 2024 and require the disclosure of standardized ESG topics by more than 50,000 companies in the EU.3 Other geographies are introducing similar legislation, including in the US, the UK, and Australia.

The fragmented landscape forms an attractive base case for investors to either enter the market via platform play or a focused consolidation strategy. In this article, we’ll explore what drivers are supporting market growth, look at how to segment a competitive landscape with hundreds of providers, and examine both strategies using two case studies.

1) Statista/Computerwoche/ Computerworld

2) 2021 Verdantix Global Corporate Survey: ESG And Sustainability Governance, Strategies, and Priorities

3) https://normative.io/insight/csrd-explained/

Strong growth is expected with vast headroom

Despite its fragmented nature, the ESG software market is already very large. Our analysis indicates a European and North American total addressable market (TAM) of more than €9 billion in 2021, of which ~€6 billion was estimated to be serviceable based on the profile of addressable companies and whether the adoption of ESG software is realistic given its complexity and cost. Europe accounts for ~50% of the serviceable available market (SAM), but has a notably lower penetration rate of 12 to 14% versus ~40% in the US, the UK, and Canada (source: Strategy& EHS and ESG software market model).

The market is characterized by strong momentum from a variety of directions, including external factors as well as internal aspirations within companies and the need for process optimization, which is set to increase the adoption rate of ESG software in companies. Looking ahead, three primary growth drivers should be considered: regulation, operational improvements, and the demand for transparency.

Primary growth drivers for the ESG software market

First, regulatory changes - both within Europe and through standards set at the international level - are a critical factor driving industry growth. Businesses soon will have to publish comprehensive information on sustainability-related issues such as environmental concerns, social concerns, employee treatment, respect for human rights, anti-corruption and anti-bribery, and diversity on corporate boards.4 Beyond that, companies may want to do more than what is legally required by adhering to international standards for self-regulation. More specifically, here’s a look at some of the regulations coming into effect soon:

- The Non-Financial Reporting Directive (NFRD), also known as Directive 2014/95/EU, imposes responsibilities on about 12,000 major firms in the EU. To verify the objectives of the European Green Deal and other regulations, there is, however, a strong regulatory momentum beyond this directive.

- The Corporate Sustainability Reporting Directive (CSRD), which will take effect in fiscal year 2024 and is expected to touch some 50,000 companies in the EU, including SMEs, was issued by the European Commission in November 2022, and will replace the NFRD while adding onto NFRD requirements. The CSRD adopts a dual materiality perspective, meaning that it requires businesses to record both the effects of business actions on sustainability aspects and the impact of sustainability aspects on the company's financial status.

- In addition to European regulations, an increasing number of international organizations are setting sustainability standards. Companies often follow these voluntarily, as a way of informing key stakeholder groups such as investors, partners, and customers via sustainability reports based on international standards. Those standards include the PRI (Principles of Responsible Investment), TCFD (Task Force on Climate-related Financial Disclosure), ISSB (International Sustainability Standards Board), CDP (Carbon Disclosure Project), and SASB (Sustainability Accounting Standards Board).5

In addition to regulatory pressure, the increasing adoption of ESG software can be explained by the opportunity for operational improvements necessary to meet changing demands of both customers and investors. While the current penetration of ESG software is still low, most forecasts expect it to increase significantly, accounting for around 5 to 7 percentage points of the estimated 12.5% annual market growth (source: Strategy& market model). The main operational benefits of adopting ESG software are:

- productivity gains and cost savings, which are typically realized through time savings due to digitized standardization;

- reduced risks (e.g. through outages and accidents) and lower insurance premiums; and

- information transparency and consistency due to a standardized and reliable ESG database that reports metrics according to the same methodology.

Finally, from a revenue perspective, the demands placed on companies by end users (i.e. customers) are changing. ESG software is a crucial instrument for improving stakeholder relations by satisfying rising demands for information transparency, which affects brand reputation related to ESG and, in turn, revenues.

4) Council of the European Union, European Parliament:

https://www.consilium.europa.eu/en/press/press-releases/2022/11/28/council-gives-final-green-light-to-corporate-sustainability-reporting-directive/;

https://www.europarl.europa.eu/news/en/press-room/20221107IPR49611/sustainable-economy-parliament-adopts-new-reporting-rules-for-multinationals

5) https://www.brightest.io/sustainability-reporting-standards

Strategy& view on the ESG software landscape

Segmentation by positioning or heritage

Our long list of players shows that more than 200 firms are already playing in the ESG software niche, which creates a somewhat fragmented landscape. But these players do have different positionings, clustered by their heritage:

- EHS&Q companies: This group of players emerges from the environment, health, safety, and quality (EHS&Q) software market. Enablon, Sphera, or Quentic, for example, are strategically repositioning themselves to partially rebrand and jump on the ESG bandwagon. This segment of players has already been widely acknowledged and has a comprehensive offering in the market.

- Financial reporting firms: These firms are actively increasing the depth and breadth of non-financial KPIs on offer, integrating ESG into their core product suite (e.g. Cube and Insight Software). Already recognized in their core area, they’re now also slowly establishing themselves in the sustainability field.

- Point solutions: A variety of ESG pure-play companies are coming into the market, highly specialized as point solutions. These now make up the majority of firms by number and focus on a broad variety of ESG topics. Many of them are currently still specializing in customer groups in particular industries and are gradually expanding their offerings.

- ERP software vendors: Lastly, traditional vendors like SAP and Oracle are adding ESG data modules to their enterprise solutions. This is an area to watch, though these players typically lack experience, brand awareness, and ESG-specific know-how.

Segmentation by function

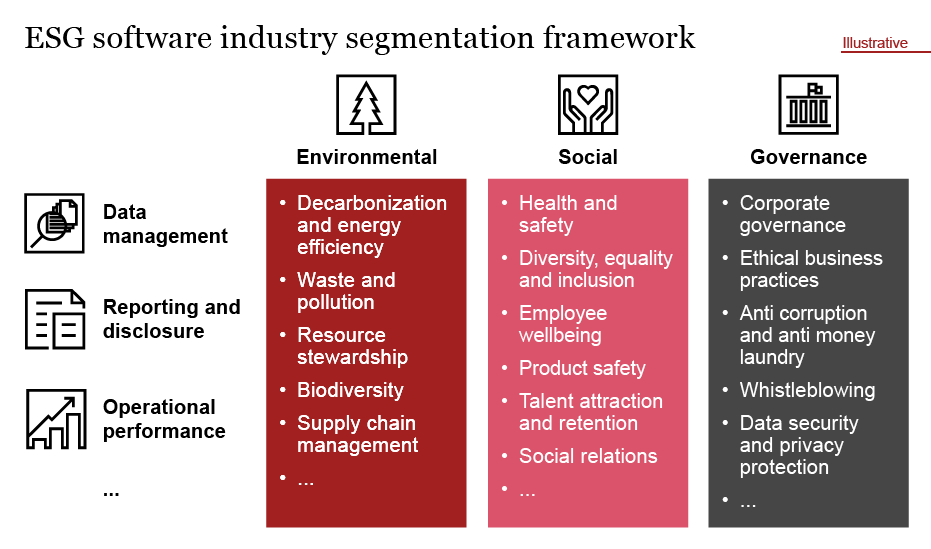

While a segmentation by heritage is useful in understanding the evolution of the market and certain strengths of players, we have also segmented the landscape by functions and focus areas - horizontally and vertically.

ESG software providers typically offer various horizontal functionalities relevant to ESG (e.g. data management, reporting and disclosure, operational performance, etc.). They then apply these vertically across the three E, S, and G verticals, or focus clearly on a sub-area (e.g. waste management). We’ve observed two types of players:

- Sizeable and comprehensive players, who serve multiple horizontals and verticals – as of 2022, there appear to be less than ten of these large integrated players (e.g. velocityEHS, Quentic, and Sphera), with revenues greater than €50 million.

- Smaller and specialized point solution players, who generally focus on individual horizontals and verticals – we observe more than 300 of these companies in Europe (e.g. Sylvera, Greenly, planA and ecolyze) which typically have less than €10 million in revenues.

Segmentation by vertical

At this stage, the environmental area and, in particular, point solutions for carbon management (e.g. measurement, reduction, offsetting) have attracted the most attention in the market. Recent years have seen small players in this segment raise large sums of money within short periods of time. For example, U.S.-based Persefoni raised $101 million in their series B in 2021, and France-based Sweep secured $95 million between 2021 and 2022. We expect carbon management to continue to grow, as firms will increasingly need to deliver on their net-zero pledges.

Segmenting by horizontal

Horizontals include, but are not limited to:

- Data management: This area mainly includes tools that help to collect and aggregate sustainability metrics in the enterprise. Today’s big data mindset means that organizations typically want to collect as much data as possible, so ESG data management solutions can help focus on what is necessary beyond meeting reporting requirements, and generate valuable insights. This software especially supports companies that are still at the beginning of evaluating their ESG data and do not have those anchored in their systems. ESG data can be used, for example, to identify and correct sustainability weaknesses and thereby prevent risks.

- Reporting and disclosure: This area is mostly designed to meet regulatory requirements and is therefore closely aligned with predefined standards. However, a number of solutions expand beyond this horizontal into the analytics segment, offering data analytics capabilities that go beyond regulatory requirements.

- Operational performance: This type of ESG software enables progress towards KPIs and targets by identifying, tracking, and supporting the optimization of key operational metrics of the company and its supply chain. Two prominent aspects to be tracked are emissions and activities along the supply chain.

Our analysis indicates that reporting and disclosure software, in particular, has grown in scale over the past years, given companies’ continuing regulatory focus, while other functionalities remain more nascent. Moving forward, however, we expect the data management segment to also experience a boost in terms of adoption, as ESG data becomes more ingrained in commercial decision-making.

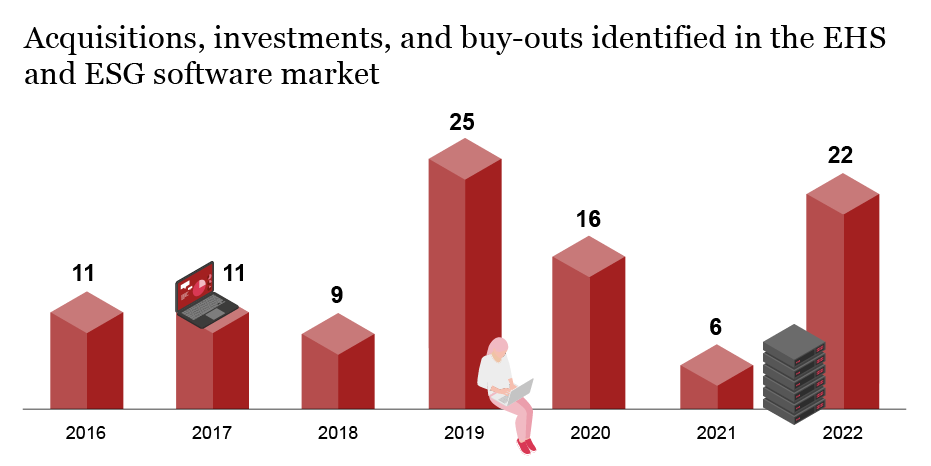

Recent deals illustrate two key ways to play

The initial consolidation of individual players has already begun, though it remains at an early stage. Larger PE-backed players are strengthening their positioning, taking advantage of the momentum in the market. While there are many options for investors to enter or scale in the ESG software market, a platform play or a more focused consolidation play strategy are the most attractive approaches.

Two Case studies illustrate two among many options for investors on how to approach the ESG software market - either via a 1) platform play strategy or more 2) focused consolidation play:

6) https://www.mergermarket.com/intelligence/view/2414032

7) https://www.mergermarket.com/intelligence/view/2965728

Rich hunting grounds remain

Based on our analysis and experience in the market, the ESG software bonanza is just getting started, offering investors an alluring number of buy-and-build opportunities. Fast market growth, sizeable headroom, and a fragmented landscape render the industry particularly attractive. It is now up to entrepreneurial investors to take advantage - particularly in the most attractive subsegments of ESG software (e.g. carbon management and data management), looking at the wide variety of smaller point solutions to either build up as platforms or consolidate in horizontals. If you’d like to share your thoughts or discuss ways to play in the fragmented ESG software landscape, we’d love to hear from you.

Thomas Sengbusch, Tim Martiniak, and Annika Ullmayer also co-authored this article.