Elevating the role of the finance function as a strategic business advisor

Chief Financial Officers (CFOs) and their finance functions are at a crossroads, facing unparalleled operational challenges while also presented with a once-in-a-generation strategic opportunity. On one side, they must expertly manage ongoing business demands, meet escalating regulatory expectations, and control operational costs. On the other, they are increasingly crucial in guiding the broader enterprise's performance amidst continual disruption.

Today, CFOs are evolving into Chief Value Officers, tasked with safeguarding and enhancing the value that businesses and their products currently generate. At the same time, they are pivotal in shaping strategies that will foster additional, sustainable value in the future. This dual role is propelling the transformation agenda for finance functions within banks, necessitating the adoption of cutting-edge technologies and reimagined operating models.

Our collaborations with some of the world's leading banks on their finance transformations have provided us with unique insights into how organizations are tackling these challenges and the keys to their success.

The finance function is under pressure to deliver more significant business value amid an evolving landscape of compelling external megatrends.

However, this cannot be achieved without investing in the right finance operating model, skills, and behaviors. Our research reveals:

- Only 24% of banks explicitly connect their growth strategies to key performance indicators (KPIs).

- Over half of CEOs (54%) express dissatisfaction with financial forecasts, and 55% are unhappy with the management information they receive.

- Alarmingly, 60% of organizations still depend on manual spreadsheets for reporting and insights.

Thrive in a complex and shifting environment

In a rapidly evolving landscape, a dynamic and multifaceted strategy is essential for addressing challenges and capturing opportunities. Enhance your overall strategy with the following key action points:

Shared capabilities

Develop centers of excellence and achieve economies of scale by consolidating shared capabilities.

Global process ownership

Establish end-to-end, enterprise-wide processes, clearly defining finance's role within them.

Touchless operations

Reduce manual tasks by leveraging automation and maximizing your core platform investments.

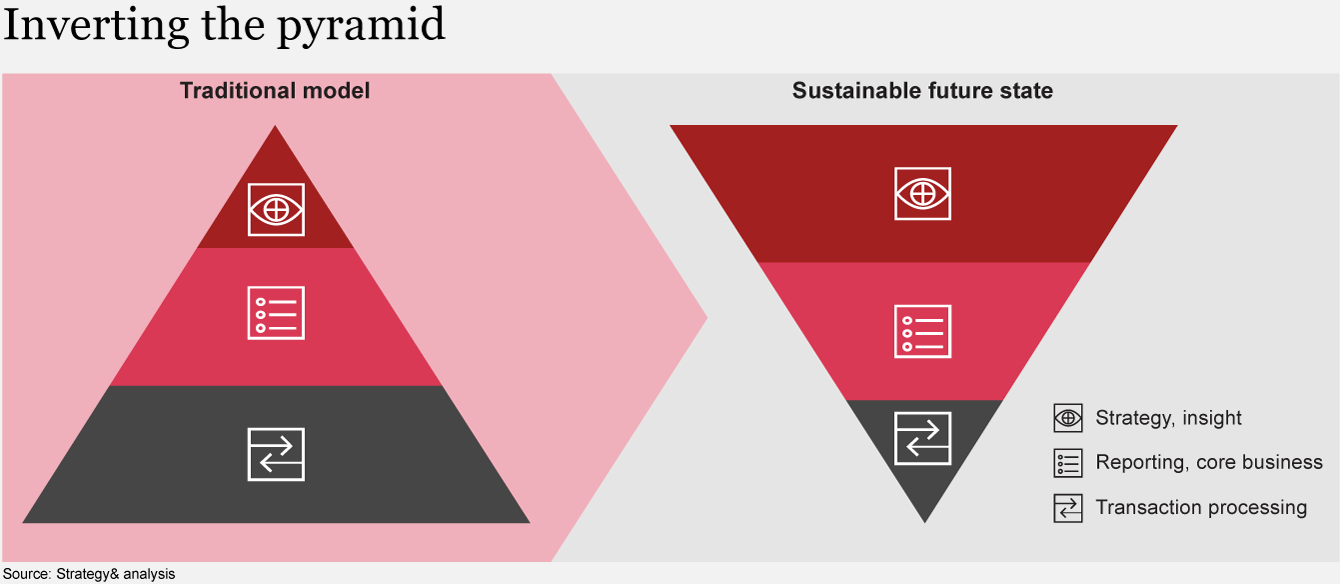

Insight-led partnering

Empower business partners to act as performance co-pilots by transitioning from manual reporting to trust-based, insight-driven dialogue.

Talent

Engage your team in the transformation journey by creating meaningful work and eliminating mundane tasks.

GenAI

Embrace the possibilities of GenAI, experimenting safely and at pace to identify use cases.

Strategic success factors to master the finance transformation

Modernizing the finance function is a longstanding goal, but implementing change across a multi-region, multi-platform, mission-critical function is no small task. Here are the critical success factors to elevate and optimize your transformation efforts:

-

Get the phasing right

With limited investment capital, finite change capacity, and competing priorities, it's crucial to carefully map out your transformation journey and prioritize effectively.

-

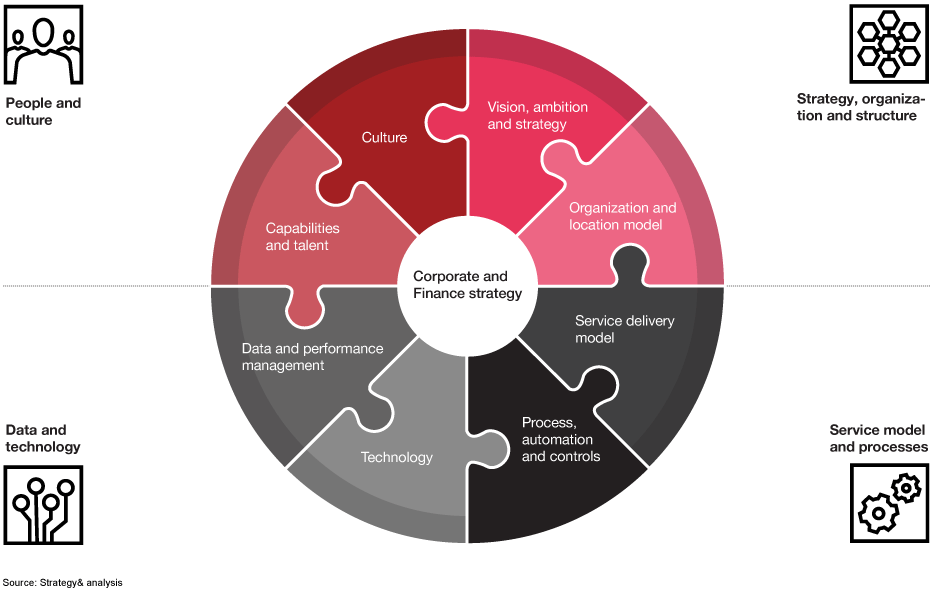

Take a holistic approach

A partial view on transformation will only yield partial benefits. To fully maximize your transformation efforts, consider all the elements outlined in the graphic below, driven by your vision and strategy for the finance function.

-

Don't transform in isolation

Since finance aspires to co-pilot the business, transforming in isolation doesn't make sense. Engage the broader business early, co-create the vision, and jointly shape the transformation journey.

-

Be outcome-led, based on what you want and need to achieve

Focus on what you want and need to achieve from the outset. Clearly define desired outcomes — both business and functional, financial and non-financial. Set tangible goals for what you aim to accomplish and by when.

-

Embrace transformation-as-usual

Transformation is a mindset, not a one-time event. In today's world, finance functions must continuously evolve, anticipating challenges and seizing opportunities as they arise.

Conclusion: Take a holistic approach

As banks set out to enhance the performance of their finance functions, they are poised to redefine their value proposition as strategic advisors to the business. This transformation can unlock additional value by reshaping the organization and mindset of the finance function, addressing the myriad challenges faced by banks and their CFOs today and in the future.

Sandro Kanzian has co-authored this report. Further contributions were made by David Heppes, Jaideep Honap, and Katrin Schröder.