Given the recent shifts in supply, infrastructure advancements, regulatory frameworks, and cost dynamics, it is crucial to thoroughly assess the readiness of German industry to embrace hydrogen as a key energy carrier. Looking at the German industry's expansion of the necessary infrastructure, it can be observed that the planned hydrogen supply might not be sufficient to reach every market participant, leaving Germany’s south undersupplied.

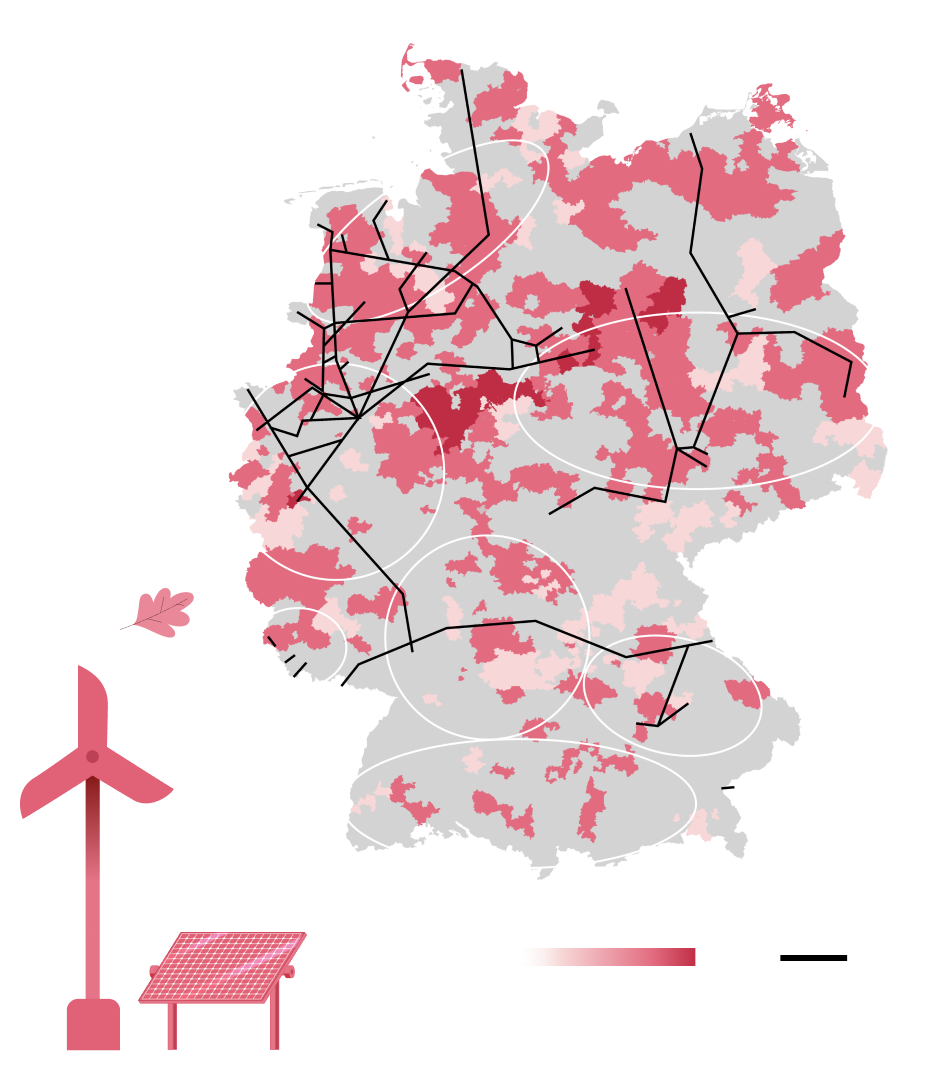

Currently, 120 hydrogen projects are in planning, under construction or already in operation in Germany, providing around five gigawatts (GW) of electrolysis capacity. By 2030, this capacity could grow to 30 GW. While large parts of the country are to be supplied with a 5,100 km pipeline network, a double supply gap is emerging in the south. The Freiburg-Munich axis, for example, will not be sufficiently connected to the European hydrogen network by 2030, nor will the region have enough photovoltaics or wind power plants to produce green hydrogen on site. Likewise, the transmission capacity in the electric grid might be insufficient to supply the south with green electricity from the north. Yet it is in the south that the second-highest demand for hydrogen is expected.

H2 readiness of German industry

- 1Capacity of renewable energy sources will remain limited in the foreseeable future

- 2Significant hydrogen imports are not expected to materialize before 2035, and not reach every market participant

- 3Scarcity of resources requires fast and vigorous action

- 4The availability of green energy and hydrogen will determine if industrial companies will grow and invest in a location, or if they will relocate from it

- 5Politicians will need to simplify regulations in order to facilitate the hydrogen ramp-up

Outlook on green energy supply options until 2030

There are seven regional clusters of potential off-takers, covering ~90% of total estimated hydrogen demand until 2030. The planned hydrogen supply will reach six of the seven major H2 demand hubs while the energy demand of the H2 expansion covers already up to 20% of planned renewable energy sources. The following map shows that H2 supply options seem to be limited for south of Germany although recently announced plans might alleviate this gap.

Hydrogen-relevant industries

In some industries, preparations for the hydrogen economy are already in full swing. Steel mills, for example, have long been experimenting with pilot plants to produce fossil-free steel based on green hydrogen. Semiconductor factories are planning their own electrolysis capacities, and mineral oil refineries want to use green hydrogen to reduce their Scope 1 emissions. Overall, the use of green hydrogen will be concentrated in six core industries and will prevail where hydrogen is used as a molecule or as a high-temperature fuel. By 2023, 80% of hydrogen demand will be covered by six industries:

- Steel industry

- Semiconductor sector

- Petroleum sector

- Chemical industry

- Ceramics industry

- Glass industry

Hydrogen archetypes until 2030

With regard to hydrogen applications, four infrastructure-related archetypes will emerge during the next decade where each of them faces unique challenges that need to be overcome through immediate actions:

… is located in areas with access to planned pipelines and needs to secure sufficient capacities on hydrogen grid

… has access to green electrons and needs to analyze locations, products and infrastructure

… may decarbonize through electrification and needs to assess capacity of electric grid to drive electrification

… has limited access to energy infrastructure and needs to invest into expansion of own renewable energy sources

Christian Brand and Michael Meyer have also contributed to this report.