Can defense companies be compatible with an ESG investment focus?

Before the war in Ukraine, the defense sector faced a decline in interest from institutional investors due to Environmental, Social and Governance (ESG) concerns. The number of shareholding institutional investors went down as a consequence, despite the sector’s profitability. This trend was influenced by the public's perspective.

The start of the war in Ukraine in February 2022, however, represented a turning point. Public perception shifted, and interest among institutional investors in the defense sector resurged. The number of institutional investors investing in the 16 major defense companies therefore increased by 6% in 2022, and there is expected to be further growth in 2023. This changing landscape brings up important questions about whether defense companies can align with ESG investments and how they can maintain their position in the ESG field over time.

This study concentrates on a subset of 16 companies, with defense-related revenues accounting for a minimum of 30 percent of total revenue. Since there is no universally accepted set of ESG criteria, the analysis focused on criteria that directly apply to the defense sector. These criteria were divided into three categories - hard, medium, and easy - based on their potential for improvement within the industry.

The impact of public perception and regulation on ESG compatibility

Companies throughout the world increasingly consider ESG factors in their decision making. This is partly due to the implicit social pressure exerted in recent years by concerned citizens, who have observed the intensifying impact of climate change. It also comes from international frameworks, like the Sustainable Development Goals set by the United Nations (UN), and the principles for corporate behavior outlined by the UN Global Compact. These frameworks are not legally binding but provide guidance. Furthermore, the perception of the defense industry seems to have changed since the start of the war in Ukraine, which is the main focus of this analysis. Investors and the public now have a more positive view of it.

This shift in public opinion is mainly due to a greater understanding of the importance of national security and the recognition of how defense protects democratic values and human rights. In the ESG investment world, there is now a better understanding of the defense industry, which takes into account both ethical concerns and the crucial role of defense capabilities in preserving peace and stability.

In a jungle of ESG criteria, only a few determine investments in defense

Institutional investors typically make investment decisions based on a set of criteria that they define or that are provided by indexes. This is particularly true for ESG considerations in financial investments. A few ESG criteria usually determine if an institution will invest in a particular asset or choose to divest from it.

Types of ESG exclusion criteria

Criteria classification*

| Hard-to-abate criteria Criteria inherently unmet by defense companies due to their core business nature |

Examples of hard-to-abate criteria used by several ESG funds and indexes include the exclusion of companies involved in controversial weapons, nuclear weapons, uranium and/ or nuclear energy. In terms of hard-to-abate criteria, companies will need to reinvent themselves and should consider exploring opportunities in related markets that are more ESG-compliant. |

| Medium-to-abate criteria Criteria some defense companies can potentially achieve by altering specific practices |

Medium-to-abate criteria can potentially be met by some defense companies by altering specific practices in their operations. Examples include carbon emissions and conducting business with countries considered to be non-democratic. |

| Easy-to-abate criteria Universal criteria applied to all companies, emphasizing ESG compliant business practices |

Easy-to-abate criteria are universal aspects of ESG that apply to all industries and that emphasize ESG-compliant business conduct. They encompass the obligation to practice carbon emissions disclosure, and to address general ESG issues throughout the value chain. |

*The detailed criterias can be found in our study

How should defense companies embrace ESG?

Defense companies have confined their ESG endeavors to compliance with general ESG and regulatory standards. Their efforts to meet easy-to-abate or medium-to-abate criteria have not been evaluated because the entire industry was mostly excluded from the ESG domain due to the dominance of stricter, hard-to-abate exclusion criteria.

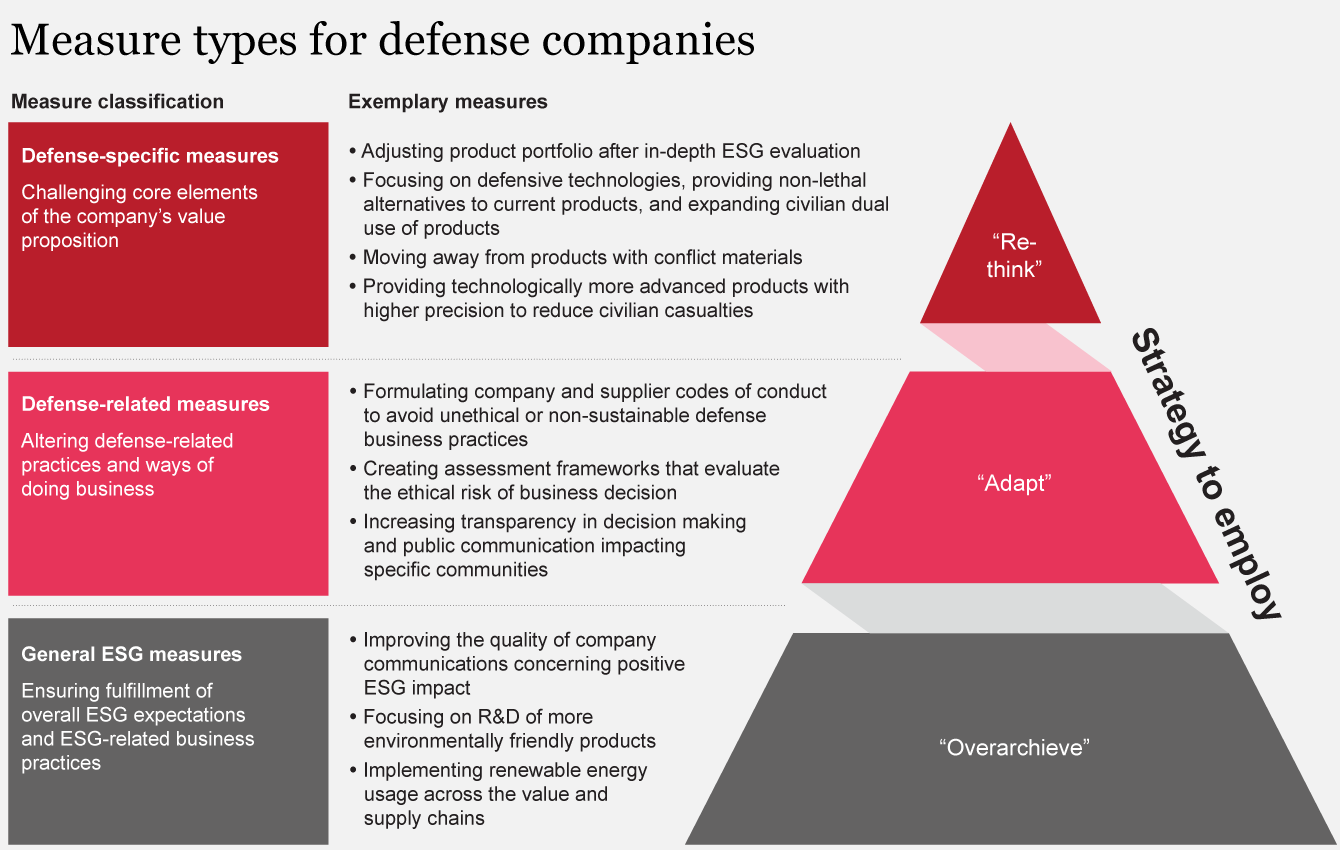

As the perception changes, there may be an increase in investor interest in defense companies, with a greater emphasis on their ESG compliance. To boost their ESG preparedness, defense companies should pursue three types of measures:

Conclusion

In light of the change in public perception as well as ESG indexes and funds potentially reconsidering defense-related ESG criteria, there is a clear business need for defense companies to focus on improving their ESG-related performance.

While it is uncertain if investor sentiment will continue to be strongly influenced by ESG considerations, defense companies should take advantage of the current momentum by implementing individual strategies that encompass defense-specific, defense-related, and general ESG measures. This can not only position the defense industry well for future capital markets but also support its role in promoting sustainable progress.

Nick Reiff, Manuel Männle, Piet Ramsl and Svenja Kirsch have also contributed to this report.