Addressing changing consumer preferences requires auto players to gear up their user interfaces and business models. The eleventh annual Digital Auto Report is a global consumer survey with a focus on the U.S., EU and China. It consists of a quantitative market outlook until 2035 based on regional structural research and interviews with key industry executives at OEMs and suppliers, leading academics and industry analysts.

Connected services – Share of participants rating feature as important

- Safety and navigation remain the most important connected services features while on-demand functions are on the rise

- In Germany and the US, the willingness to pay is at ~20€ / month, while it is at ~40€ in China. Experts are more conservative on consumer willingness to pay

Germany

United States

China

Question: "Which connected service categories are particularly important to you?"

2023

2021

2020

Share of participants rating engine types as likely for next purchase (%)

- Germans are still sceptical towards BEV cars as only 35%of consumers would consider getting one. In the US, there is more openness with ~50%

- Chinese consumers exhibit opposite preferences with BEV being most popular before hybrid and ICE engines

Germany

United States

China

Question: "Assuming you wanted to buy/ lease/ subscribe to a passenger car, how likely are you to consider the following types of engines?"

Age bracket

18-34yo

35-54yo

55+yo

Automated driving – Consumer attitudes

- 60 – 70% of German and US respondents are sceptical towards L4 automated cars while in China, there are only 15% sceptical consumers

- Willingness to pay for robo- vs. driver-driven taxis is lower in the US and China compared to Germany. Younger Germans are willing to pay more than older Germans

Question: "How comfortable would you feel using an autonomous vehicle (Level 4)?"

Very comfortable

Rather comfortable

Rather not comfortable

Not comfortable at all

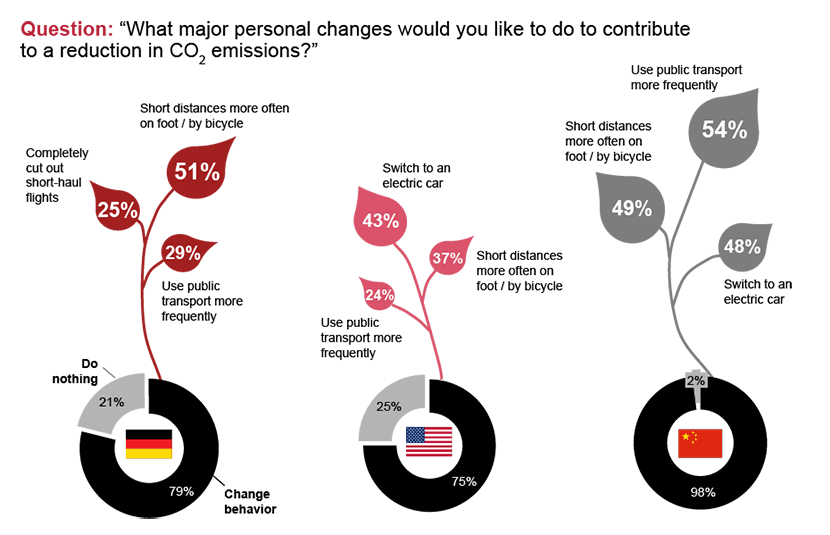

Top 3 contributions to CO2 reduction

- The purchase of a new or used car is still the preferred option, although car subscription models are gaining traction

- In Germany and China, respondents want to contribute to CO2 reduction – mainly by more walking/cycling and using public transport

Implications for auto players

A holistic ecosystem approach beyond core business is key to succeed in the future

Akshay Singh, Steven Jiang, Kentaro Abe and Milos Bartosek also contributed to this report.