Software-defined vehicles catalyze automotive transformation

Software-defined vehicles (SDVs) represent a groundbreaking shift by separating hardware from software, creating architecture-driven platforms, and centralizing electrical and electronic (E/E) systems. Although no manufacturer has yet introduced a fully realized SDV, companies in China and the US are leading the development charge. This evolution is reshaping the automotive value chain, with markets for software development (+€36bn), E/E development (+€13bn), and E/E component supply (+€199bn) projected to grow at an impressive ~5% CAGR until 2035, surpassing the industry average.

European manufacturers are expected to enhance their capabilities and continue driving the European ecosystem in partnerships. Conversely, tech companies dominate the Chinese market, disrupting traditional value chains and reshaping value propositions. European OEMs could see profits potentially increase by €20bn by 2035 due to the expanding market size and the shift to more profitable value pools in an OEM-partnering scenario. However, if the transformation falters, €20bn in profits could be at risk.

In this report, we analyze the global SDV market and provide strategic recommendations to help automotive companies strengthen their position in the value chain and maintain a competitive edge.

What are software-defined vehicles?

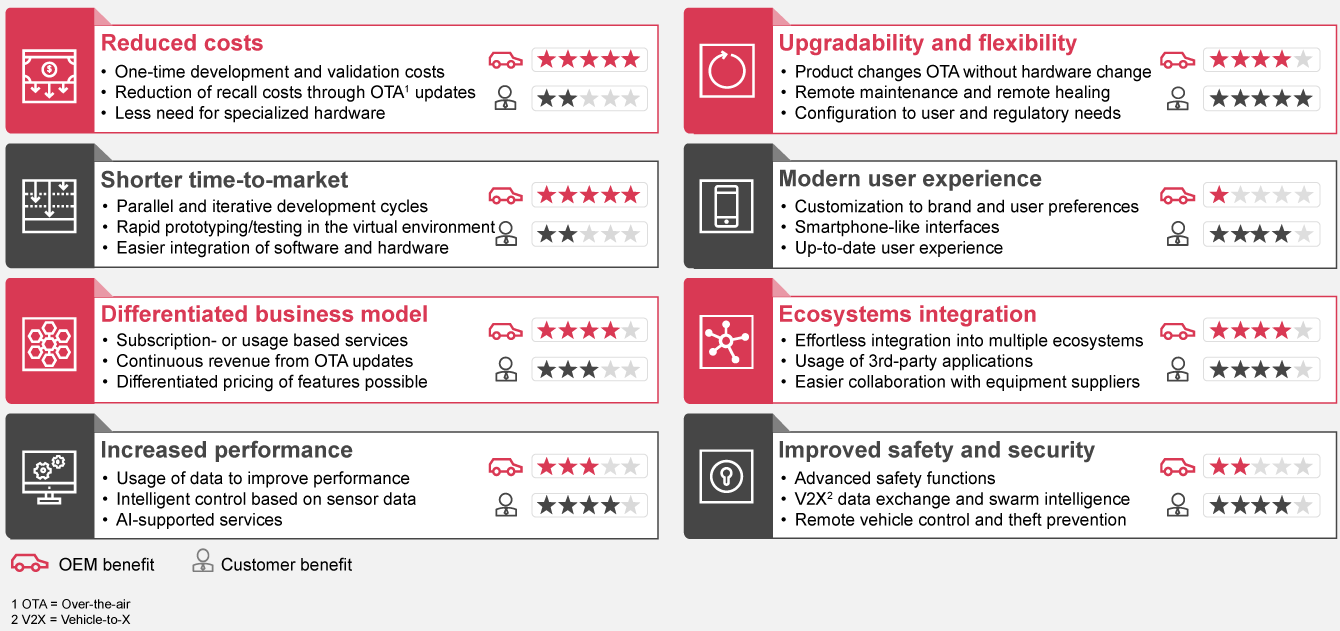

A software-defined vehicle (SDV) is an automobile that relies on digital technology. All functionalities, including driving, entertainment, communication, safety, and comfort, are enabled, managed, controlled, and customized through software.

SDVs are connected to the cloud and interact digitally with their environment. New functionalities are continuously deployed over the air without requiring hardware changes.

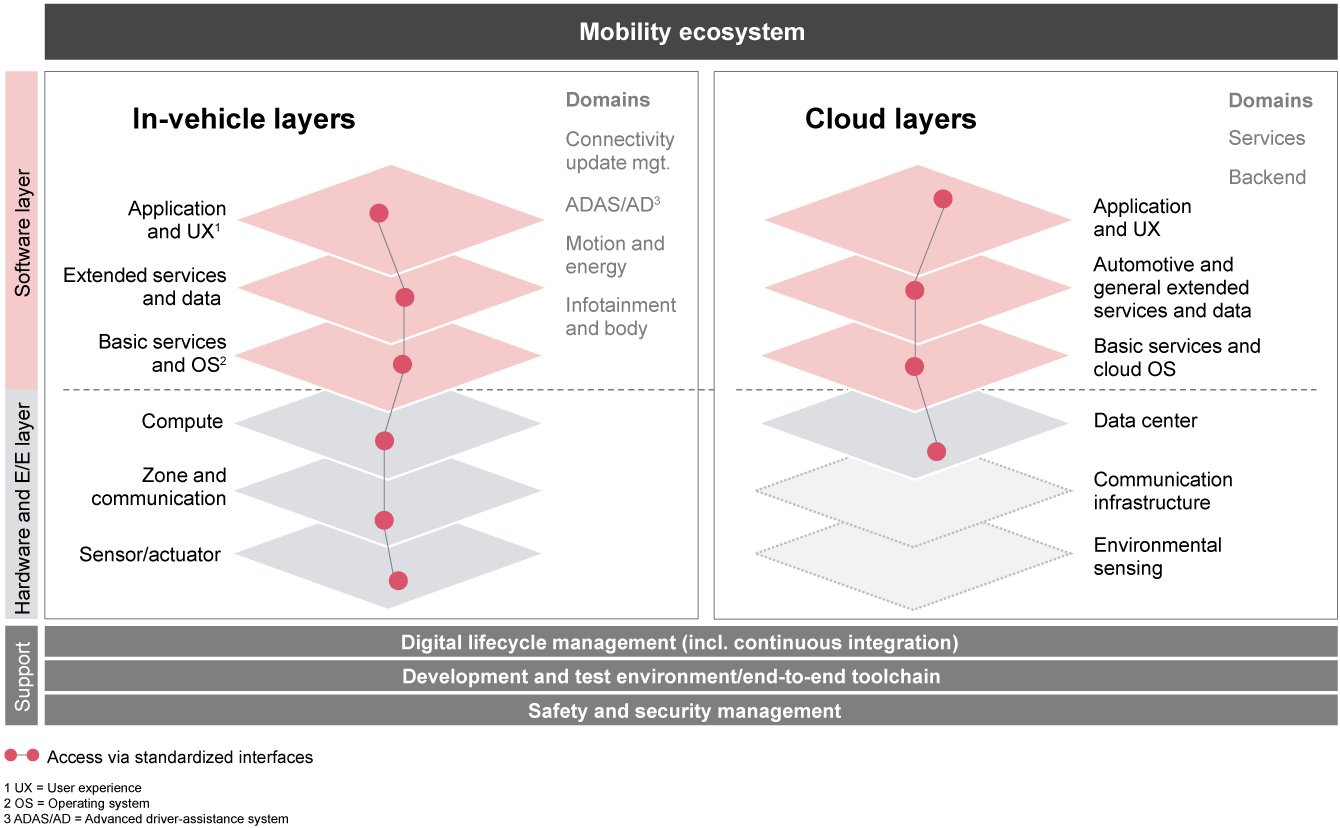

The software-defined vehicle architecture stack

SDVs necessitate a sophisticated layered architecture that separates software development and operations from hardware constraints. This design allows for the creation of applications and functionalities by integrating underlying services across layers. These services are accessed both across and within layers through standardized APIs, ensuring seamless interoperability and flexibility.

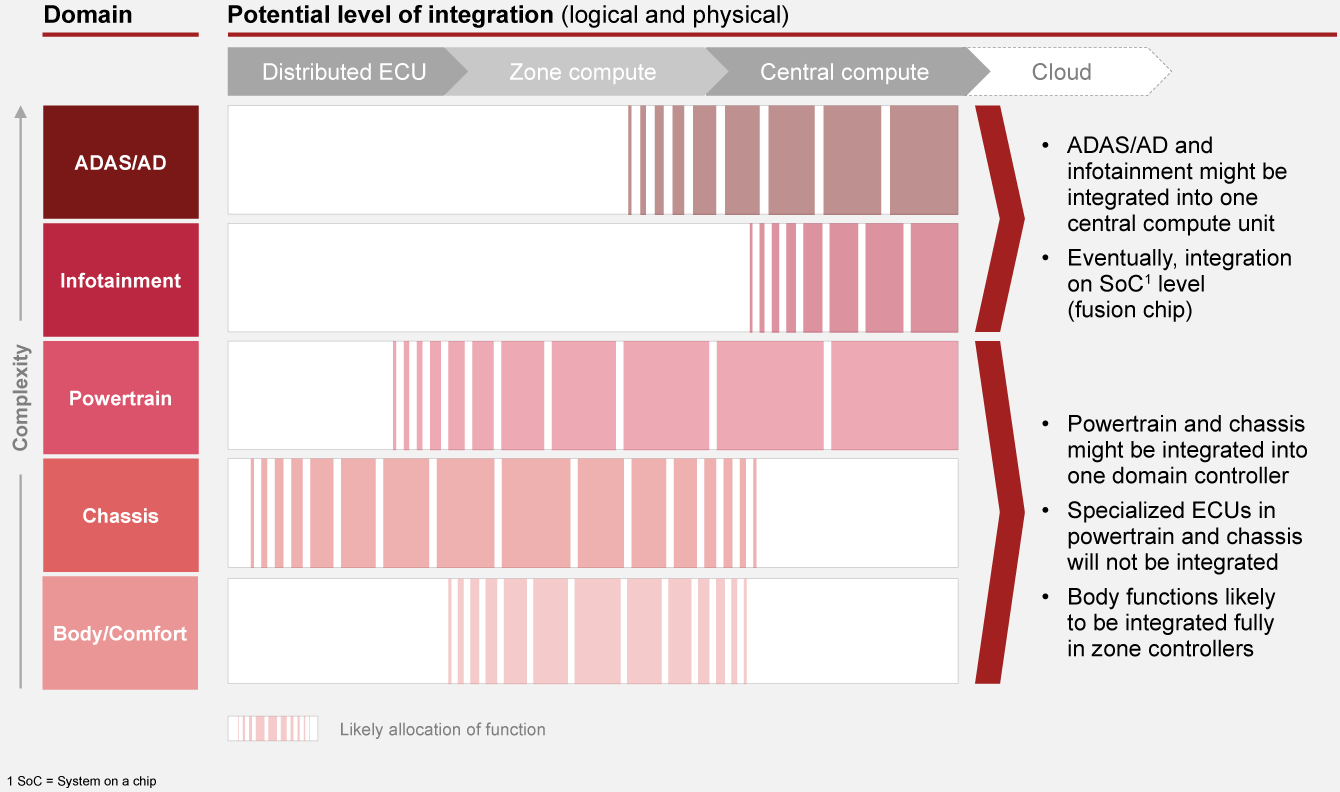

Level of functionality integration

The degree of centralization is determined by the specific needs of each functionality. For instance, ADAS/AD and infotainment functions could be combined into a single central compute unit. Conversely, powertrain and chassis functions might be managed by a unified domain controller, while specialized electronic control units (ECUs) within these domains will remain separate. Body functions are expected to be fully integrated into zone controllers.

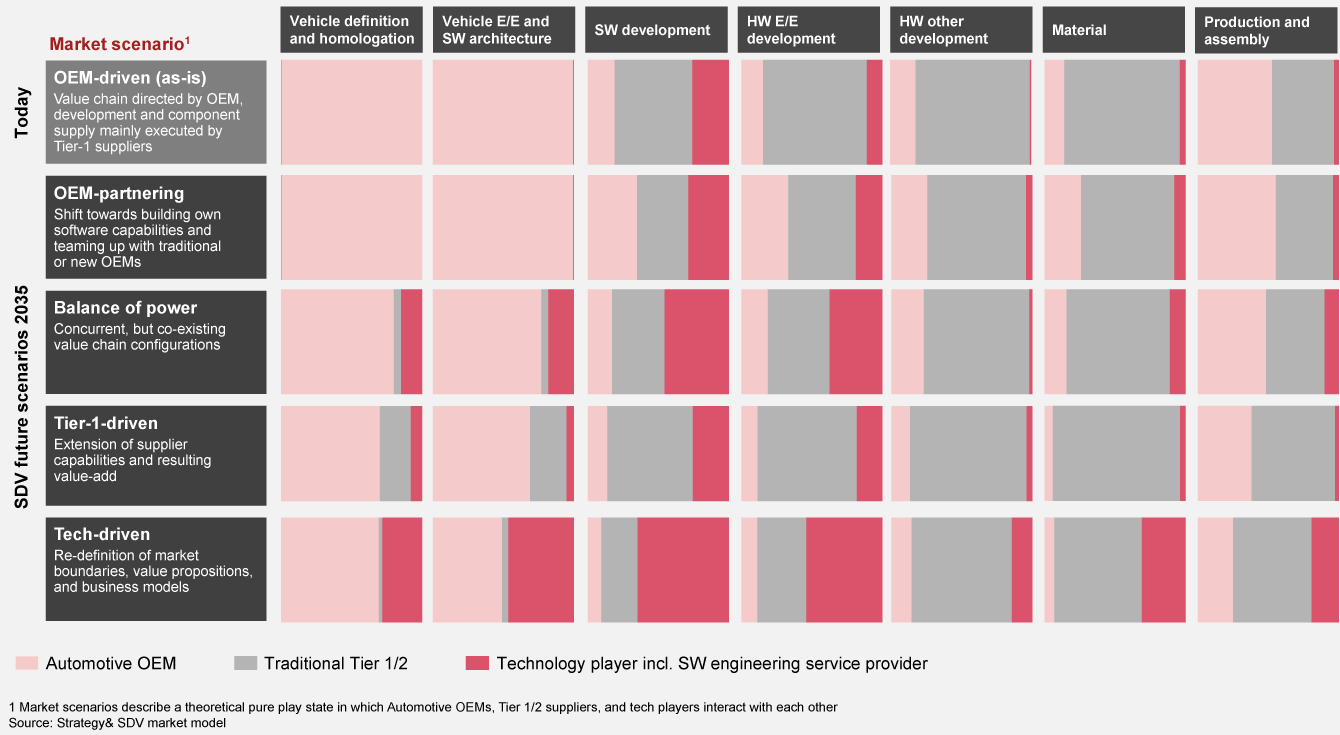

Four future scenarios for the software-defined vehicle market

We outline four future pure play scenarios for the SDV market, including a tech-dominated scenario where technology companies emerge as the new OEMs:

By 2035, an annual growth rate of 3.2% is anticipated, resulting in a total value-add of $3.1 trillion. Future profit potential in the automotive market will depend on the evolving market scenario.

Value-add and profit development from software-defined vehicles for European OEMs

The anticipated SDV market scenarios vary across regions and are influenced by ecosystem, technology, customer preferences, and regulatory characteristics. The value-add by European OEMs is projected to range between €100 billion and €330 billion, depending on the future market scenario.

Value-add in 2035 [€ bn]

European market scenario1)

Note: Numbers in brackets show differences to as-is of EUR ~170 Bn in 2025. This chart shows a snippet. For the full chart and detailed values, please refer to our study

The transition from hardware-centric to software-defined products is also shifting profit pools. The highly profitable software sector is experiencing above-market growth, attracting new players. By 2035, depending on the strategic direction, way-to-play, and execution capabilities of the OEMs, profit changes could vary significantly, from a potential increase of €20 billion to a decrease of about €20 billion.

Tier-1 suppliers have the chance to proactively define the software-defined vehicle ecosystem

By engaging in various segments of the SDV value chain, Tier-1 suppliers can play a leading role in defining the industry's future through the following strategic approaches:

| SDV platform provider ('Horizontal play') |

SDV domain solution provider ('Vertical play') |

Component specialist (Tier-1 software or hardware) |

Design and develop as a service | Made-to-order producer | |

|---|---|---|---|---|---|

| Value proposition | Offers an integrated, turn-key SDV tech ecosystem and software layer for OEMs | Offers domain-specific and integrated hardware and software solutions to OEMs | Offers leading technology, special-purpose software or hardware to OEMs | Offers design, development, testing and/or homologation services to OEMs | Offers scalable made-to-order production and vehicle assembly services globally |

| SDV value chain | Broad coverage across all SDV-differentiating steps with high in-house investments | Selective coverage for specific domains, partnering for E/E development | Narrow software or hardware-specific coverage for development or material | Focus on development activities (specific or broad), no component supply | Narrow coverage in vehicle definition, focus on scalable development and production |

Strategies for automotive players to secure their position in the value chain

In light of the rapid transition towards software-defined vehicles, automotive players must act swiftly and implement the following five critical actions.

- 1Define on an SDV strategy and market positioning

- 2Shift from global to regional focus

- 3Adopt hardware-independent software architecture

- 4Excel in partnerships

- 5Modernize the development ecosystem

Martin Gerhardus, Dr. Marcus Witter, and Dr. Claus Gruber have also contributed to this report.