Many European capitals recently witnessed a series of farmers protesting to express their grievances against stricter environmental regulation, rising prices, burdening bureaucracy or the suspension of tax benefits. This falls within current discussions on how the food industry – grocery retailers and Consumer Packaged Goods companies – can strengthen their engagement with agricultural suppliers. Albeit that there are no universal solutions to all the challenges faced by the agricultural industry, this article nevertheless aims to offer food for thought on how the food industry can improve collaboration with their agricultural suppliers, as well as practical guidance on how this could be implemented.

Executive summary

Farming is facing multiple challenges today, such as climate change, changing demand, a shrinking labor force and persistent economic pressures. As these challenges are intensifying, they affect not only farming but the food industry as a whole, impacting the supply chains of Consumer Packaged Goods companies (CPGs) and grocery retailers. To tackle these challenges, two main, interlinked actions are open to farmers – bolstering their efforts in regenerative farming practices, and utilizing new digital technologies.

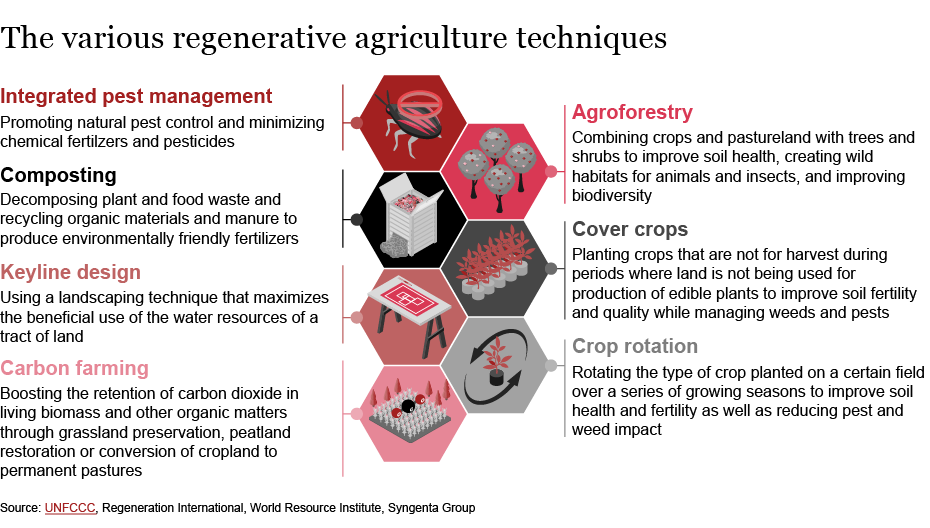

Regenerative farming practices such as composting, agroforestry, integrated pest management or crop rotation are re-emerging on the market. These can help farmers to improve their sustainability record in various areas, from greenhouse gas (GHG) emissions to water pollution or land use, while also improving productivity and efficiency. At the same time, ongoing technological advancements in recent decades are shaping the future of agriculture by means of digitization, also leading to improvements in terms of sustainability, productivity and efficiency.

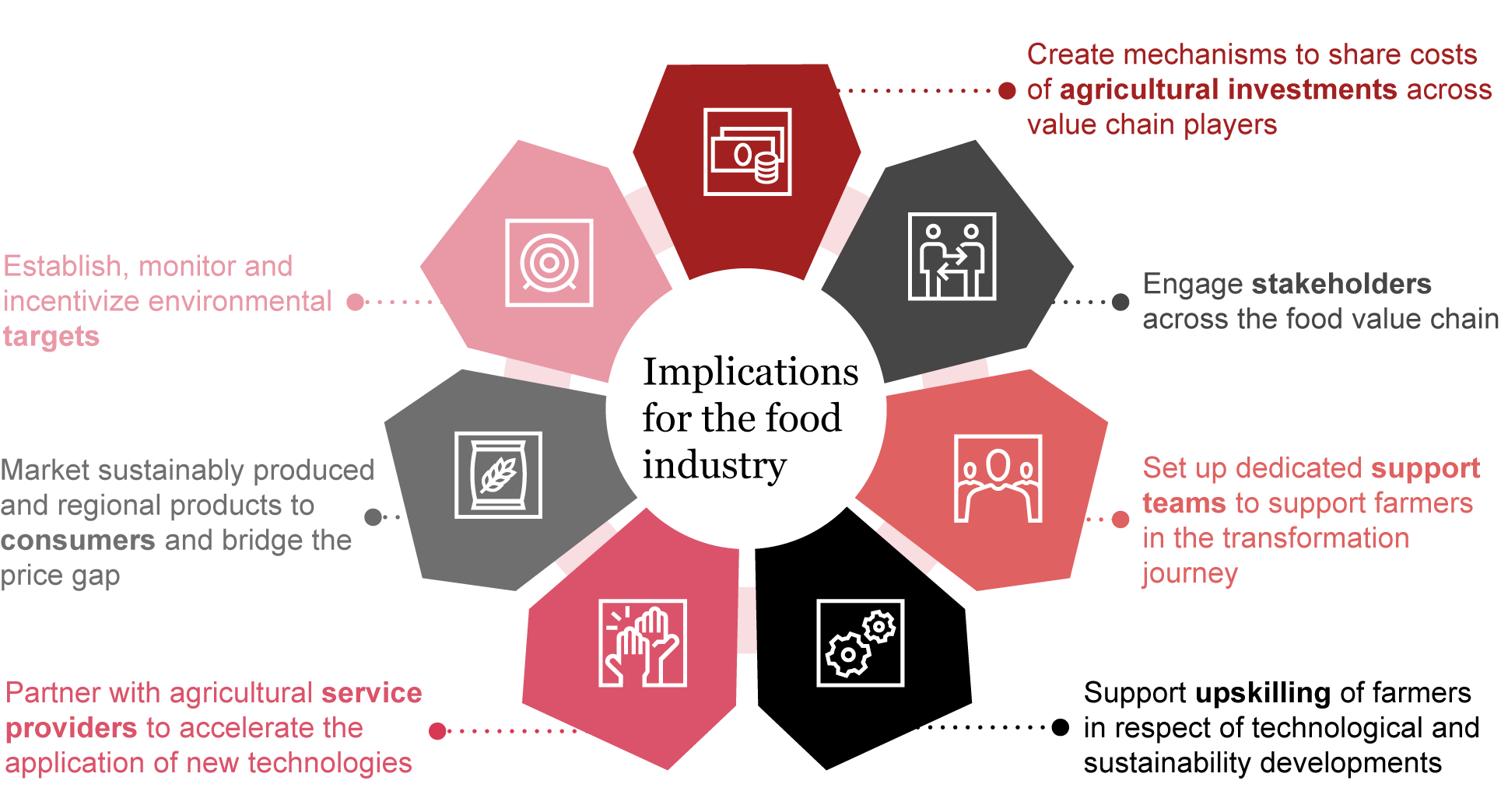

However, the introduction of these sustainability measures and technologies depends heavily on different factors, such as regulation, infrastructure and resources. Farmers by themselves currently often lack the capabilities, funds and incentives to make sufficient investments in these areas. Retailers and CPGs therefore need to engage more closely with agricultural suppliers if they want to see sustainability and technological advancement in agriculture, and hence mitigate the risk of increasing supply costs and disruption while at the same time improve their sustainability record. With the following measures, retailers and CPGs can not only support their agricultural suppliers, but also pave the way to a new agricultural revolution:

- 1Create mechanisms to share costs of agricultural investments across value chain players

- 2Engage stakeholders across the food value chain

- 3Set up dedicated support teams to support farmers in the transformation journey

- 4Support upskilling of farmers in respect of technological and sustainability developments

- 5Partner with agricultural service providers to accelerate the application of new technologies

- 6Market sustainably produced and regional products to consumers and bridge the price gap

- 7Establish, monitor and incentivize environmental targets

Current challenges in farming

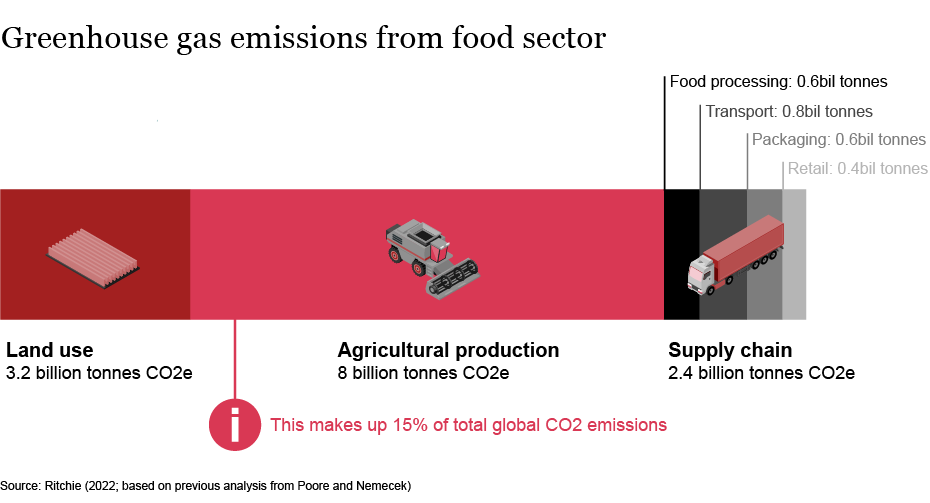

Farmers have had to confront all manner of challenges over the past decades, including price fluctuations, bargaining power of suppliers and customers, regulation, as well as labor shortages. The difficulties facing agriculture, however, are becoming even more daunting. The OECD has defined three main issues that agriculture must cope with: feeding a growing population, providing a livelihood for millions of people in the agricultural sector, and curbing the industry’s impact on the environment while dealing with the effects of climate change. For example, the global food system needs to satisfy a population expected to grow from 7.5 billion to nearly 10 billion by 2050, while agriculture is already responsible for 8 billion tons CO2-equivalent (CO2e), or 15% of global GHG emissions (see below).

Farmers need to respond by increasing sustainability, productivity, and efficiency. However, various factors complicate this task. First, the pressure to generate cost-effective production and competitive prices makes it difficult to invest in technological upgrades in machinery and equipment or pay attractive salaries to the workforce. Second, complying with burgeoning regulation increases farmers’ workload. Third, the growth of land consumption makes agricultural land scarcer and more expensive. Further, there might be more challenges ahead: While agriculture is still currently exempted from the European Union (EU) Emissions Trading System, voices calling for its inclusion are becoming louder. This introduction of a GHG levy could add substantial agricultural production costs.

Risks for the food industry

While the difficulties faced by farmers have not always been appreciated by the food industry, today’s challenges can have a direct impact on the business of CPGs and grocery retailers. They bear substantial risks for the supply chains of the food industry, impact whether sustainability compliance requirements can be met and have a major influence on climate targets.

While demand for food is increasing worldwide, supply is becoming less robust. Various factors, such as changing weather patterns, extreme weather events, water scarcity and soil degradation, have reduced crop yields across the world. At the same time, the demand for organic and sustainable products has recently been growing rapidly in Europe. However, in 2021, organic farming accounted for only 11% of the area used for agriculture in Germany. This creates a risk of rising purchase prices and increases the likelihood of stockouts in the food industry.

Given upcoming legislation and reporting requirements (such as the Corporate Sustainability Reporting Directive, CSRD, or the German Supply Chain Act), regulators and other stakeholders will scrutinize the sustainability of companies more closely. Retailers and CPGs on the one hand face the risk of being made accountable for environmental issues in their supply chains. On the other hand, they require sustainability data on farm level to ensure that all reporting requirements can be fulfilled.

Actions at the farm level have a huge influence on the total Scope 3 emissions of food companies. Most retailers have committed to significant emission reduction targets - for example, Ahold Delhaize committed to reduce Scope 3 emissions by 15% in the period from 2018 to 2030. To have a chance of achieving these climate targets, emissions from the supply chain necessarily need to be reduced.

How to increase sustainability, productivity, and efficiency through new farming practices

Either introducing a holistic regenerative farming approach or selecting individual practices can help farmers to increase sustainability in various ways, from GHG emissions to water pollution or land use, while also boosting productivity and efficiency.

Regenerative Agriculture (RegenAg) is an outcome-based farming approach that protects and improves soil health, biodiversity, climate and water resources. It improves crop yields, reducing the need for chemical fertilizers or pesticides, capturing more carbon and reducing water consumption. RegenAg uses a variety of agricultural techniques in combination, although these techniques can also be used independently and still offer benefits to farmers. An overview of different techniques is shown below.

Introducing these practices, however, requires time and resources. First, it demands substantial labor for both the upskilling and the actual physical implementation of measures on the farm. Second, investments in new land, equipment, construction measures or plant seeds need to be made. Finally, changes in farming practice (such as any of those described above) might lead to decreased crop yields in the years after the transition, before the benefits of the respective practice can be exploited in the medium to long term.

Nevertheless, there are some examples of success stories in the transition to RegenAg practices. For example, Gut & Bösel, the 3,000 hectare farm of former banker Benedikt Bösel, not only implements various RegenAg techniques, but also collaborates with startups or research projects focusing on regenerative agriculture.

How to increase sustainability, productivity, and efficiency through digital enablers

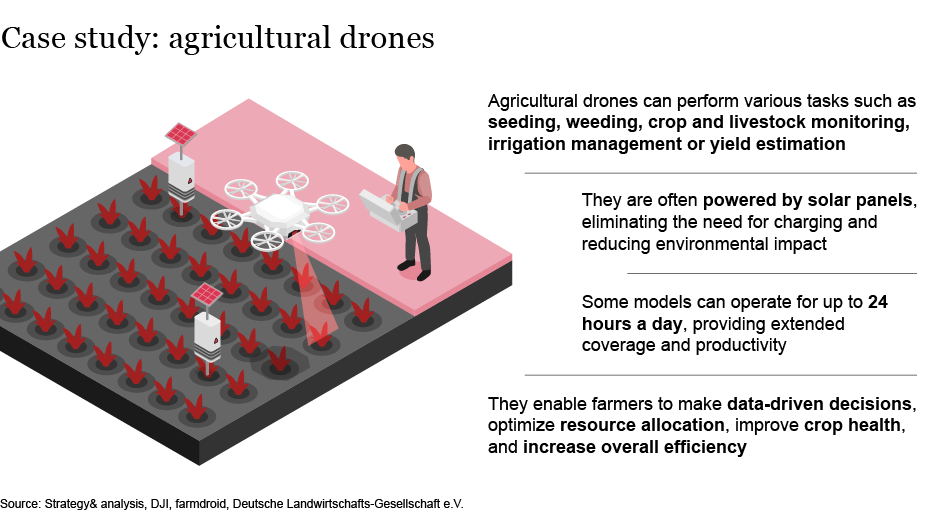

Technological advancements in recent decades are shaping the future of agriculture through digitization, and are confronting global challenges. Progress in agricultural technology has encompassed innovations such as precision farming, software systems, mobile applications, and other digital tools that have been integrated into traditional farming practices. These developments will surely continue, as the future of digitization in farming offers tremendous potential. Several trends, such as artificial intelligence (AI), robotics, and augmented/virtual reality (AR/VR), are likely to shape the trajectory of such innovation in the future.

Digitization permits more streamlined processes, data-driven decision-making, and the use of technology to optimize resource utilization. However, it should be noted that some more advanced agricultural technologies currently lack maturity, which has a negative impact on productivity and efficiency due to the increased labor involved and the susceptibility to error.

Nevertheless, the following examples outline how technological solutions could potentially improve water use, land use, GHG emissions and crop yields, and in this way counter the above global challenges.

In addition to these examples, which mainly apply to arable farming, livestock farmers can use similar technologies to achieve the same goals.

Below are two such examples:

- Health monitoring: Wearable sensors and smart devices can monitor the health of individual animals in real time, detecting early signs of illness and leading to prompt intervention. This monitoring reduces the risk of spread of disease, and improves the overall well-being of livestock.

- Automated feeding systems: Digital systems can automate and optimize the feeding process based on the specific nutritional needs of individual animals or groups. This not only improves efficiency, but also reduces overfeeding and waste.

Implications for retailers and CPGs

Introducing these technologies and sustainability measures depends heavily on various factors, such as regulation, infrastructure, and resources. However, farmers often lack the capabilities, funds and incentives to invest in digitization or sustainability.

High levels of investment in technological infrastructure are certainly necessary to enable widespread usage and equitable access. It is a huge challenge for small farmers to invest on such a scale, and the food industry has so far shown little desire to support them. Indeed, digitization currently means little else for farmers but hard work – they face a complex regulatory environment, and often appear to be not incentivized to introduce technologies. Challenges related to data privacy and cybersecurity also need to be tackled.

If retailers and CPG companies want to combat those challenges and witness technological and sustainability developments in agriculture, they need to bolster their engagement with agricultural suppliers. In this way, they can reduce the risk of rising costs and supply disruptions, promote regulatory sustainability compliance and take a step forward in achieving their greenhouse gas reduction targets.

In particular, retailers and CPG companies should undertake the following measures:

Conclusion

Albeit that these recommended actions mean additional responsibilities for grocery retailers and CPGs, there also is considerable potential for the industry. Firstly, by engaging more closely with agricultural suppliers, supply chains can be made more robust, mitigating the risk of increasing costs or insufficient supply. Secondly, supporting agricultural suppliers in adopting regenerative farming practices facilitates retailers’ and CPGs’ compliance with regulatory sustainability requirements, reducing the risk of financial or reputational damage. Thirdly, promoting increased sustainability on the agricultural level has both a substantial positive impact on Scope 3 emissions, contributing to the achievement of near- and long-term climate targets, and on other ESG factors such as water use, land use and crop yields. Therefore, taking these measures is not only beneficial to farmers, but also for the entire food industry.