Over the past few years, consumers in Germany have encountered sparse shelves in the supermarket - along with price surges and changed products. And these unsettling experiences are the direct result of disruptions in global supply chains, which began with the Covid-19 outbreak in 2020 and again increased in response to the war in Ukraine. Germany, despite its high level of self-sufficiency in some food categories like meat (121%)1 and wheat (101%),1 is likely to continue noticing the effects of supply chain disruptions due to its strong integration into the global economy.

But the important questions to ask now are: Why is this still happening and what can be done about it? To find out, we recently conducted some new research to understand how German food value chains are connected with suppliers in China.

How much of our regional grocery revenues depend on supplies that come from Chinese suppliers?

China is the world’s largest animal feed producer. It holds 68%1 of the global wheat stock. And it also produces the majority of exotic fruits like tangerines. While we know Chinese companies play a huge, complex role in the production of processed foods, which are then distributed around the world, often times there isn’t full transparency on who or what vendor is supplying what ingredient or source material. So, over time, the domestic food sector in Germany has become quite connected with companies in China - and now, as geopolitical changes arise, the regional food sector needs to be mindful of the potential risks associated with these business relationships.

1 Agristat, Alltech Global feed survey, Verbraucherzentrale, Die Welt, La Stampa

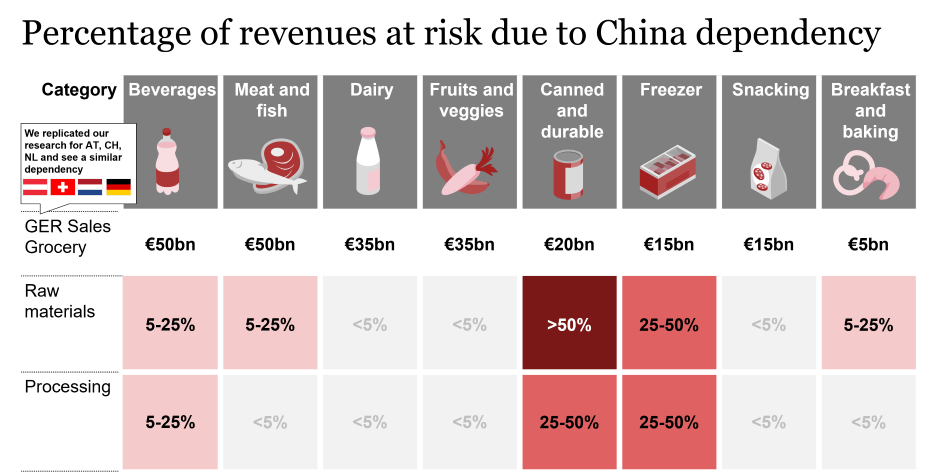

To better understand the scale of potential risks associated with our local food supply, including businesses in China, we analyzed more than 175 subcategories in the food and beverage sector and aggregated the results. Additionally, we questioned more than 30 experts on their perspectives regarding their companies’ connections with businesses in China within their respective part of the food sector. Overall, the results showed that a significant proportion of the German grocery market relies on trade with China.

Strategy& analysis

The largest dependencies we identified were in canned and durable foods, as well as freezer foods. Both of those categories have more than 50% or up to 50% of revenues at risk, which means that both their revenues and products will be affected in some way (e.g., through prices, availability, or quality) if there are obstructions of trade with China. Beverages, along with meat and fish, have between 5% and 25% of revenues at risk. And the categories of breakfast and baking also report some reliance.

-

Tomato case study

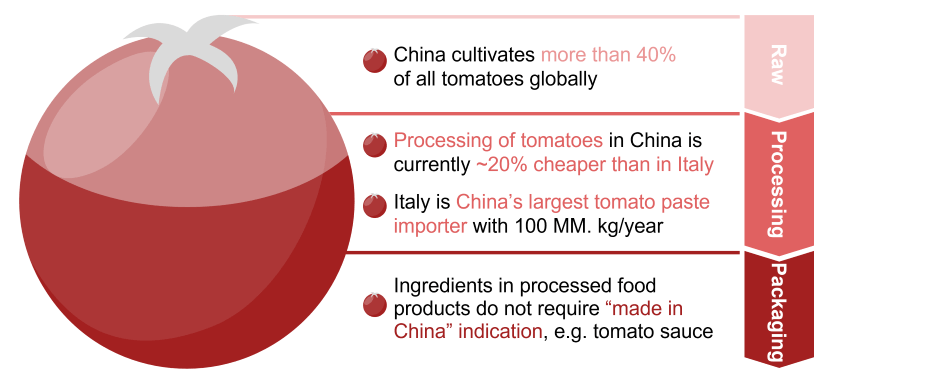

In addition, our research shows that vegetables and fruit ingredients for products like ketchup are often grown in China before being shipped to other parts of the world for processing. Processed food items that contain tomatoes in the category of canned and durable products are frequently subject to this practice.

-

Alaska Pollock case study

Fruit and vegetables from China also play an important role in the freezer category, but for this category one prime example is the Alaska Pollock. That fish, which is often used in fish sticks, is typically fished by fishermen in the Bering Sea, and then brought to China for processing.

-

Wiener sausages case study

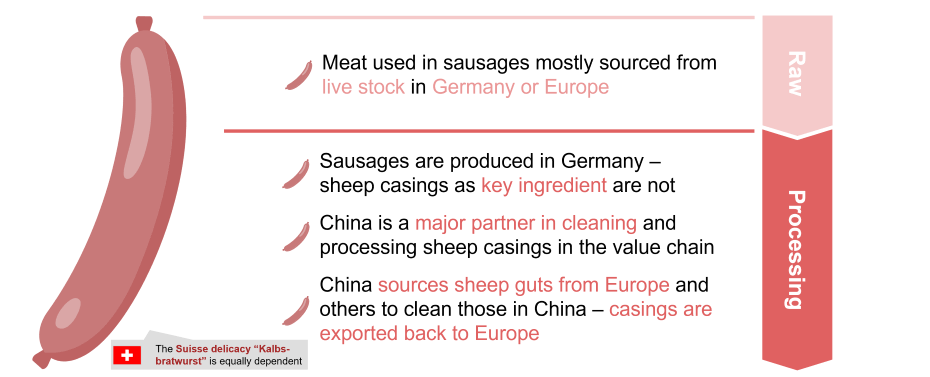

European countries also rely on China for ingredients used in processed meats. Many types of sausages use sheep casings, for example, and China is a major player in processing these sheep casings.

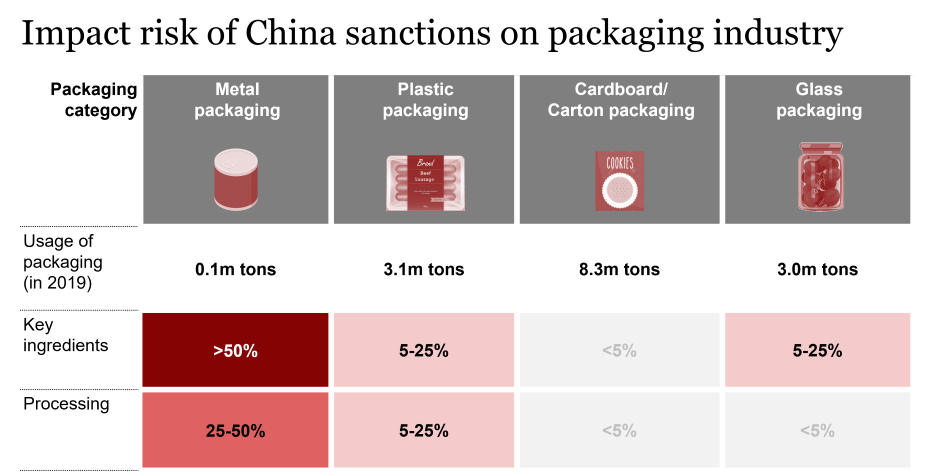

In addition, there are interesting similarities to the packaging industry. The metal packaging used in cans, for instance, often begins with key ingredients sourced from China or may even be produced there. After all, China is the largest producer of aluminum, tin, steel, and magnesium, which are all critical ingredients for cans. For glass and plastic packaging, the similarities may be more subtle. Although EU countries produce most of this kind of packaging independently from China, the resources and ingredients are traded globally, and changes or disruptions in the Asian economy can affect prices and availability in other places.

Strategy& analysis

What role could sanctions on or from China play?

In times of political disagreements, sanctions can be enacted, and they can create considerable challenges for players in the food and beverage industry even if, in terms of securing the world's food supply, policymakers are likely to prioritize maintaining agricultural trade. Given the interconnections discussed above, sanctions - including trade barriers, financial transaction sanctions, tariffs, and moral boycotts - could significantly disrupt the flow of goods, raise costs, and ultimately reduce access to markets.

Trade barriers, for example, apply restrictions on traded quantities, hence they can limit or completely block imports and exports. The most common form of trade barriers are tariffs imposed by the government on imports. Such tariffs can lead to higher trading costs, in turn often increasing the market prices for goods. Financial sanctions, such as bans or restrictions on transactions, can freeze financial assets and therefore restrict the movement of payments or capital. Finally, a moral boycott of consumers or companies could also be a likely scenario.

All four types of sanctions can lead to price hikes and/ or supply shortages and even lead to an uncontrollable spiral of (counter)measures and even an escalation of the conflict if the sanctioned party reacts. That’s why it’s critical to understand and prepare for potential risks facing your business.

How can you mitigate your supply chain risks?

To assess and mitigate the risk of your portfolio, start with these three steps:

- 1Create transparency. Analyze your product assortment along the full value chain, potentially leveraging our proprietary transparency database to help. This process allows you to identify your key value chain connections with China, including the origin of your ingredients as well as products used during the processing of goods and packaging.

- 2Reprioritize the most relevant use cases. Evaluate products based on relevancy (e.g., revenue or profit) and your exposure in China to define different risk clusters. This will help you identify which product categories are at a higher risk of being impacted by sanctions.

- 3Formulate an implementation plan. For high-risk clusters, define how to mitigate the impact on your company in case of sanctions.

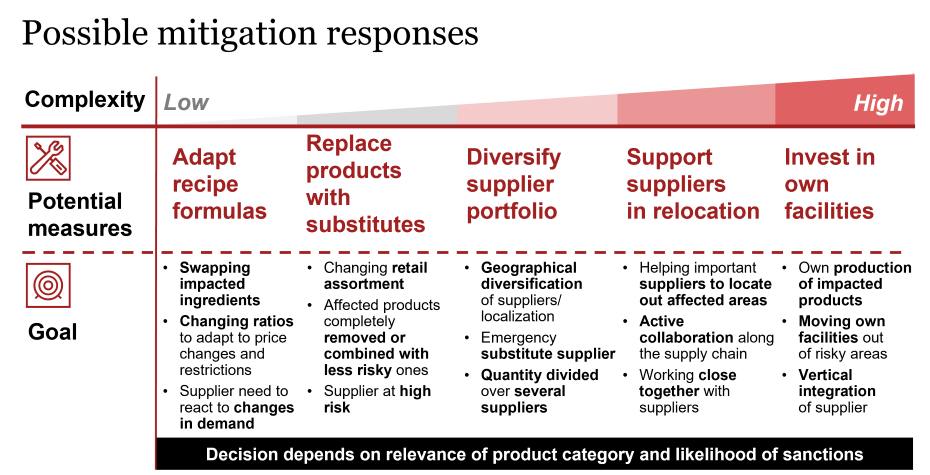

The good news is, there are many mitigation responses available. You might adapt some of your recipe formulas, which could be as simple as changing ratios or swapping impacted ingredients to adjust to price changes and quantity restrictions. Or, you might need to invest in your own production of certain resources, which could be a more complex strategy. That might necessitate building or buying your own facilities to produce impacted products, moving facilities out of risky areas, and vertically integrating suppliers. The decision of which response to take depends on the relevance of the product category and the likelihood of sanctions. But whatever choices you make, the most important thing is being ready to react quickly so that you can continue to meet your customers’ demands. Otherwise, consumers will find substitutes.

To start, think about how to increase your transparency and diversification of the global food supply chain. Doing so could help securing supply by ensuring that supermarket shelves remain full of goods, and it can help your company by securing revenues.

Sven Weber and Raoul Isselhard also contributed to this article.