Why companies need to start rethinking packaging

The food and beverage (F&B) industry has experienced turbulent times in recent years. Economic and geopolitical challenges including high levels of inflation have caused costs to skyrocket. Additionally, increasingly stringent regulation, consumer demand for sustainability, supply shortages while consumer buying power is dropping, make the situation even more challenging. With these unprecedented pressures F&B companies are facing, rethinking packaging can help ease this tension.

Holistic packaging optimization along the entire value chain can reduce packaging costs by up to 30% across different material types while simultaneously reducing environmental impact, for example in the form of greenhouse gas emissions reductions. Therefore, companies should actively prioritize packaging optimization, otherwise they risk being left behind.

For this report, we analyzed 20 of the largest F&B companies worldwide from the retail and CPG space on their individual packaging sustainability efforts. While examining the driving factors and regulatory requirements for packaging today, we highlight the gap to close between sustainability targets and regulatory requirements, and how they can successfully transform packaging strategy to deal with internal and external pressures. As part of a series on F&B packaging, this report will be complemented by individual deep dives on specific aspects of packaging optimization.

What are the driving factors for F&B packaging?

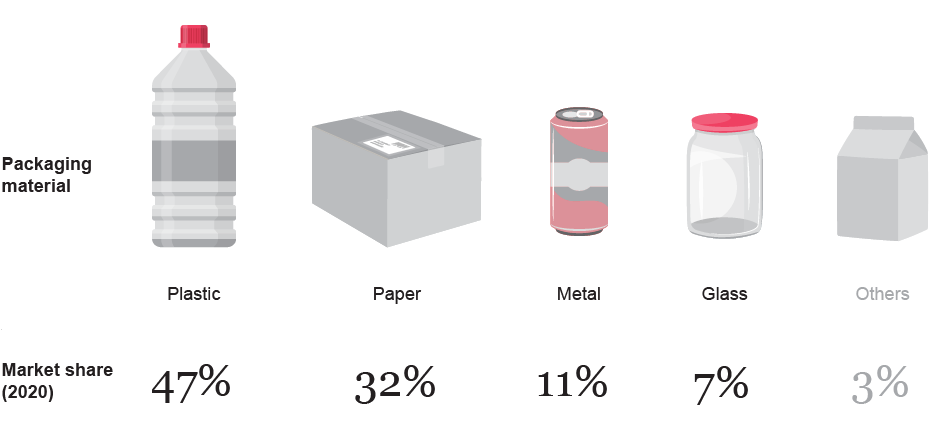

Four packaging materials are most prevalent for F&B packaging:

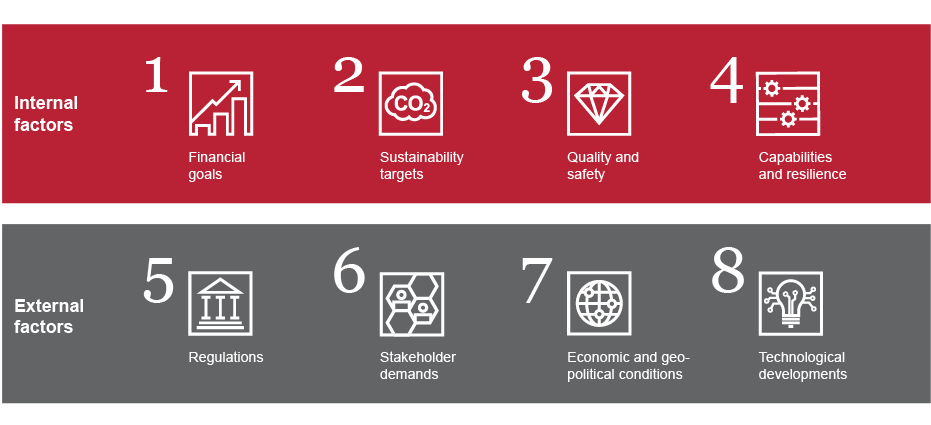

To achieve financial and sustainability objectives through packaging optimization, F&B companies need to consider eight internal and external factors that affect decision-making:

Two external factors are worth taking a closer look at in the current market: Stakeholder demands (6) and regulation (5).

On the stakeholder side, there are fundamental changes in attitudes toward sustainability, particularly among consumers: Their willingness to pay for sustainable packaging is limited. Regarding regulation, global efforts to reduce emissions and plastics waste may lead to binding laws. In Europe, three directives currently being discussed could have far-reaching effects on F&B packaging.

Regulatory landscape for packaging

How do F&B company targets compare to regulatory requirements?

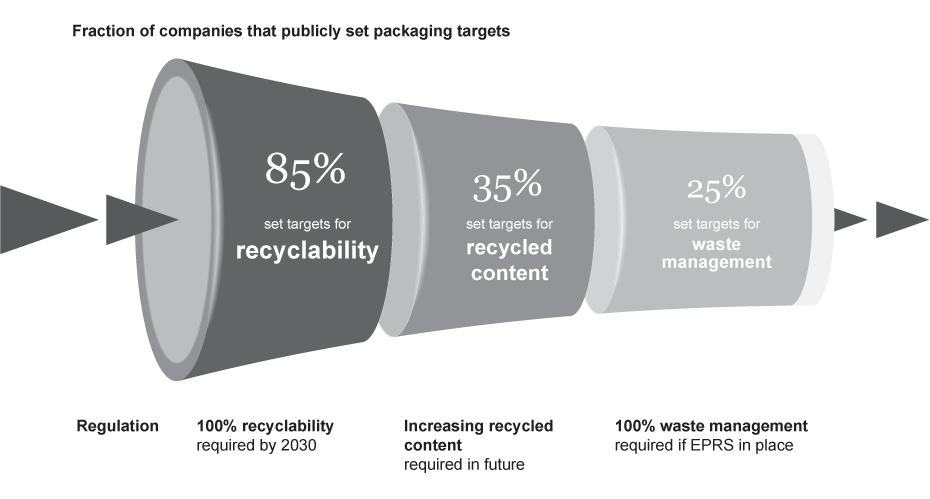

In light of these increasing regulatory requirements, all of the analyzed F&B companies with a focus on different packaging materials such as beverage companies, convenience food producers or retailers have put in place some form of sustainable packaging targets. However, it is evident that only few have anchored these in specific packaging regulation at this stage.

How can F&B companies win with packaging?

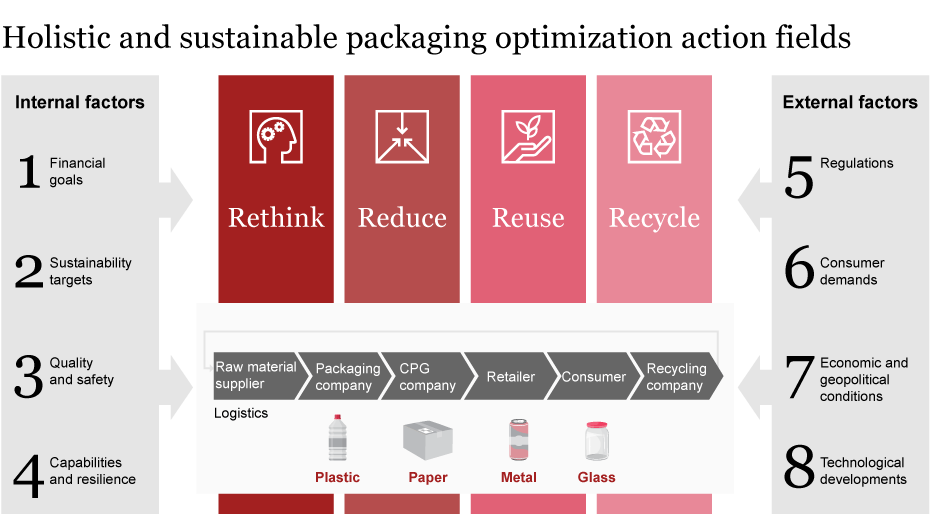

To increase profitability and fulfil mandatory as well as voluntary targets, companies need to optimize packaging in an economic and sustainable way. In this respect we consider four action fields: Rethink, reduce, reuse, and recycle.

The first action field necessitates a fundamental rethinking of product and portfolio design, business processes, or even the overarching business model itself. Often, this requires F&B companies to be open to structural changes to address profitability and improve sustainability. To ensure long-term material access and a lasting competitive advantage, F&B companies may need to expand into other segments of the value chain such as the recycling market and think about which capabilities to build up in-house versus outsourcing.

Reducing resource consumption is a strategic lever for F&B companies aiming to realize cost savings while fulfilling sustainability metrics. The most obvious approach focuses on reducing packaging material itself, as done through lightweighting or new designs with less material. In addition to lower volumes, the reduction of energy requirements, transportation needs, and waste related to packaging are on the agenda.

Packaging designed for multiple uses, such as refillable containers or returnable crates, can reduce volumes of single-use waste. Reuse approaches are also an opportunity towards closed-loop systems that have the potential to strengthen bonds with consumers and improve a company’s market position. However, it is crucial to assess whether reuse is feasible and beneficial in each specific instance.

The pivotal role of recycling is widely known. However, doing it correctly remains an important pillar. A major aspect is the usage of materials that are readily recyclable and support existing recycling infrastructure. Additionally, the increase of recycled content in packaging contributes to a circular economy, with recycled material facilitating waste reduction and resource conservation.

What actions should F&B companies take right now?

The playing field for companies is diverse and ranges from quick wins to structural, long-term measures. In either case, an individually tailored approach to a company’s product or business situation is essential.

In many cases, companies lack a powerful internal stakeholder as well as the required capabilities to drive packaging optimization. Sustainability departments seem to be the first contact for this topic. However, in most cases, procurement or category management departments are often the driving force behind packaging optimization, primarily pursuing commercial aspects.

To tackle the topic effectively, companies need to address the following aspects now, which sit at the intersection of commercials and sustainability:

- 1Work cross-functionally

- 2Integrate cost and sustainability packaging KPIs

- 3Analyze and challenge your own portfolio

- 4Engage in value chain and ecosystem collaboration

Sebastian Weber, Tim Martiniak, Alexandra Ausma and Marc Wangrin have also contributed to this report.