As part of our series on packaging articles, we are turning the spotlight on aluminum next. This lightweight, yet sturdy material has been a staple in the sector due to its malleability and ability to preserve the quality and extend the shelf life of countless products. Its prominence is evident with metal packaging overall, including aluminum, holds an approximately 11% share of the overall packaging market, surging to about 30-40% within beverage category businesses.

However, the F&B industry must now reconcile aluminum's benefits with the growing urgency to lower carbon footprints and implement sustainable packaging. The production of aluminum is quite energy-intensive, accounting for approximately 3% of global direct industrial carbon emissions1. Packaging makes up around 16% of global market application of aluminum2 thus, its decarbonization is critical. Stricter regulations and consumer calls for sustainability require a rethinking of established packaging models. The F&B sector's small influence, owing to the limited share of packaging in overall aluminum production, over the broader aluminum market compounds the challenge, potentially limiting leverage with suppliers. To thrive amidst these complexities, the F&B industry should chart a course that addresses current demands while anticipating the needs of the future.

This article delves into the complex challenges facing the substrate and outlines strategic measures for F&B enterprises to optimize aluminum packaging.

Case study: Diageo has recently announced the pilot launch of an aluminum bottle for its iconic Baileys Original Irish Cream brand, replacing the original glass bottle. The new bottle is five times lighter than the traditional glass bottle and, according to Diageo, “reduces its carbon footprint by 44%”3. Switching to light-weight aluminum packaging is expected to further yield cost benefits when rolled-out across markets.

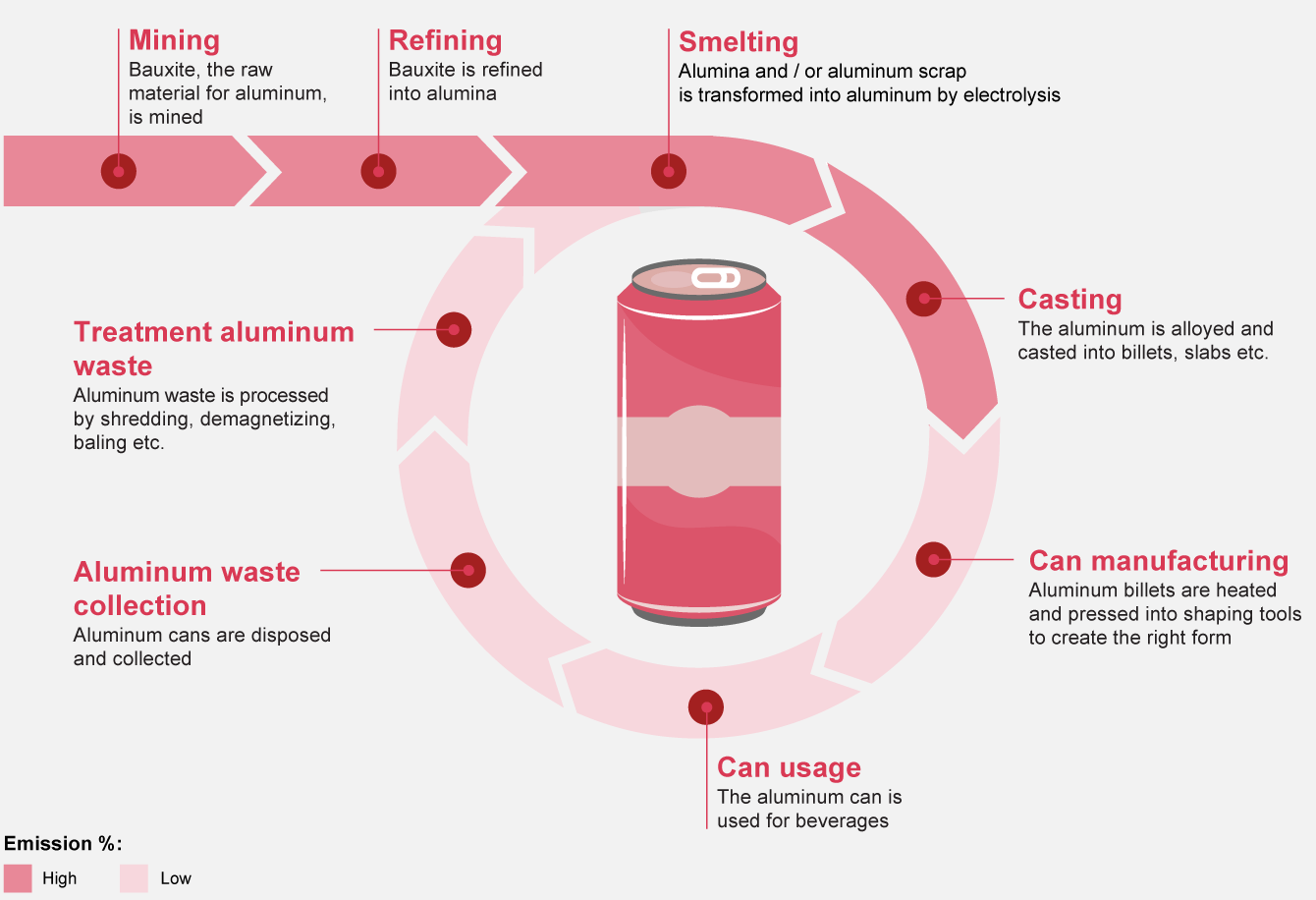

Circular journey of aluminum packaging: from bauxite to can and back

The transformation from bauxite ore to a functional can involves a series of complex and energy-intensive processes: mining, refining, smelting, casting, rolling, and can pressing. Among these, smelting stands out as the most carbon-intensive step, contributing approximately 80% of the total carbon emissions associated with can production4. This significant carbon footprint is primarily due to the elevated levels of electricity required to reduce alumina to pure aluminum, especially when sourced from fossil fuels. China is the leading producer of aluminum (60% of global production today), with approximately 70% of Chinese volumes utilizing coal-fired production.

However, aluminum cans exhibit a remarkable potential for end-of-life recovery. On average, around 75% of end-of-life aluminum is recaptured globally through efficient downstream waste collection systems. This reclaimed material is then reintroduced into the manufacturing cycle. Use of this recycled 'secondary' aluminum reduces emissions by up to 95% compared with the use of primary aluminum5.

Key challenges for the sector

The aluminum sector, and consequently aluminum packaging, are facing three emerging complexities which will shape this sector for years to come. Let us briefly look into each:

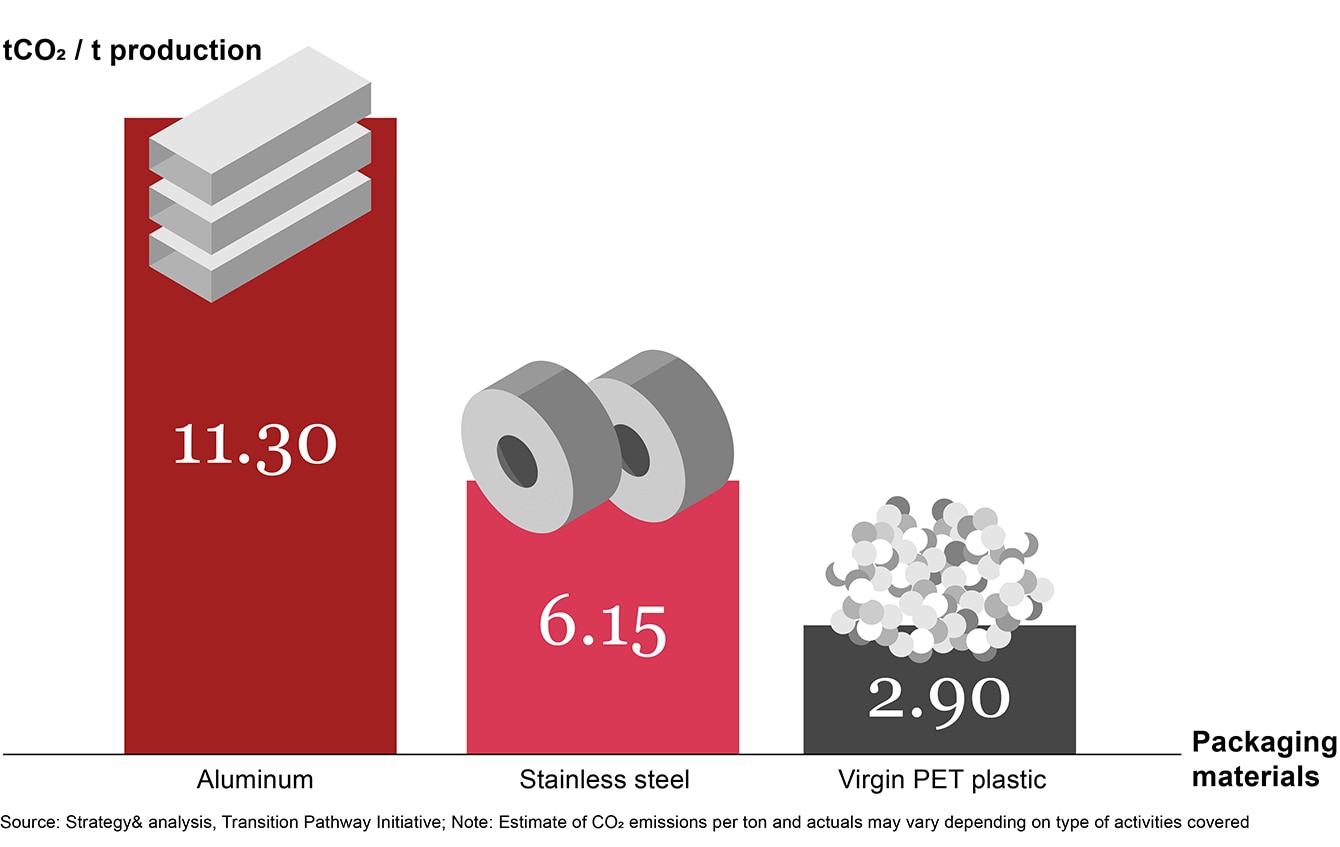

The aluminum sector is under intense pressure to reduce its carbon footprint, aiming to halve its carbon intensity by 2030 and achieve net-zero by 2050. Despite being the second most utilized metal worldwide, primary aluminum production is notably carbon-intensive – approximately double that of stainless steel6 and quadruple that of virgin PET plastic.

Case study: In the Netherlands, F&B companies bear the responsibility for the collection and recycling of their packaging waste. To comply with EPR, these companies collaborate with local governments and recycling companies and pay a waste contribution fee reflecting the type and total weight of packaging waste they place in the market. EPR, a subset of PPWD (Packaging and Packaging Waste Directive) is likely to catalyse analogous regulations throughout other EU nations.

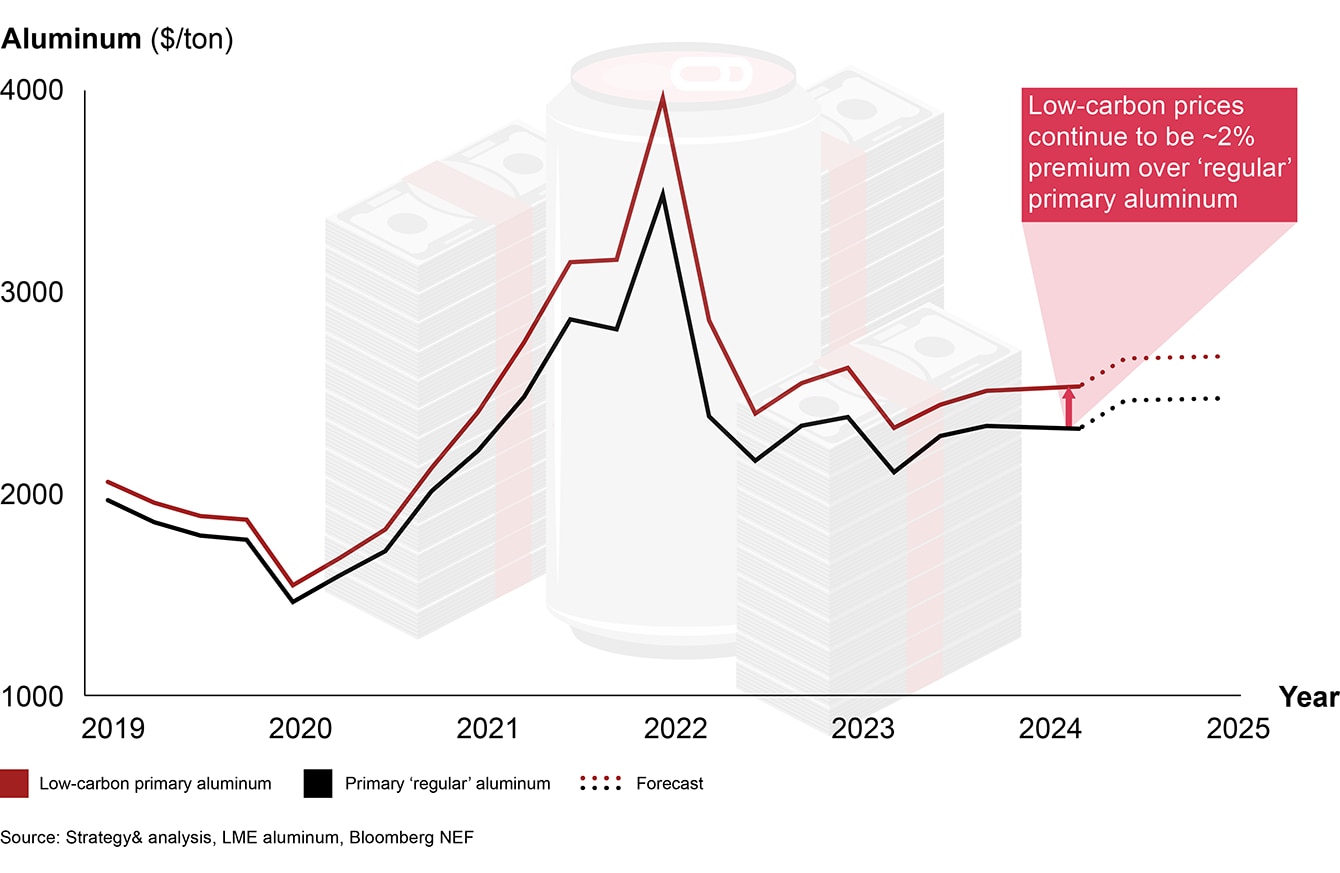

Aluminum prices have experienced volatility in recent years, with an average increase of around 40%, and peak prices surging to about 150% above pre-Covid levels7. Short-term projections indicate continued price fluctuations due to geopolitical tensions, rising energy costs, speculation on joint EU-US tariff zones, classification as critical mineral by the EU and US, and growing demand from emerging sectors including electric vehicles (EVs) and solar panels. Furthermore, low-carbon aluminum is anticipated to command higher prices, maintaining a premium as producers try to premiumize/specialize above the carbon intensive commodity aluminum.

Case study: In the Netherlands, F&B companies bear the responsibility for the collection and recycling of their packaging waste. To comply with EPR, these companies collaborate with local governments and recycling companies and pay a waste contribution fee reflecting the type and total weight of packaging waste they place in the market. EPR, a subset of PPWD (Packaging and Packaging Waste Directive) is likely to catalyse analogous regulations throughout other EU nations.

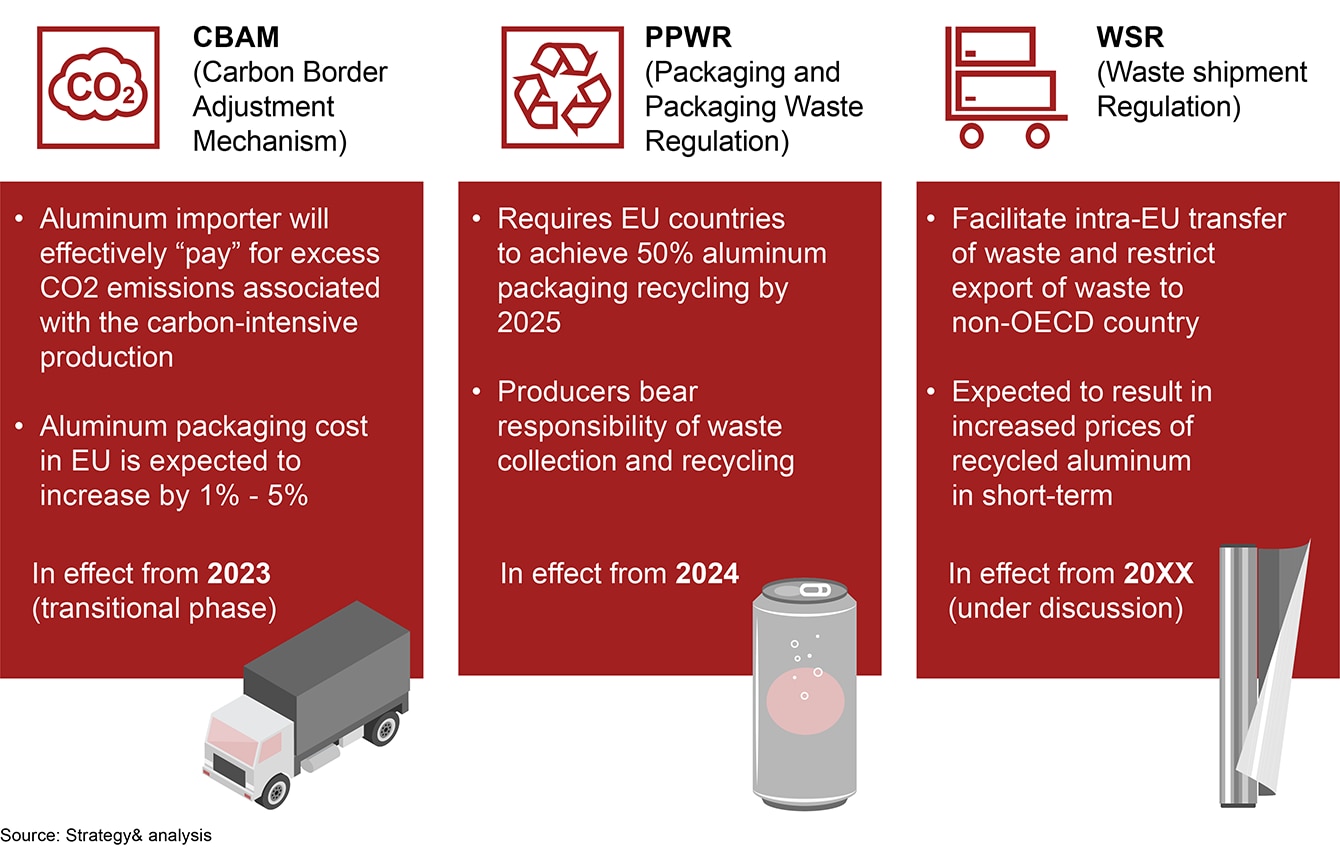

While there are a raft of regulations impacting the aluminum industry, three pivotal pieces of legislation stand out for their potential to drive a shift towards circularity. These regulations aim to boost the European supply of recycled aluminum and elevate the costs for carbon-intensive imported aluminum.

Case study: In the Netherlands, F&B companies bear the responsibility for the collection and recycling of their packaging waste. To comply with EPR, these companies collaborate with local governments and recycling companies and pay a waste contribution fee reflecting the type and total weight of packaging waste they place in the market. EPR, a subset of PPWD (Packaging and Packaging Waste Directive) is likely to catalyse analogous regulations throughout other EU nations.

A case for green aluminum

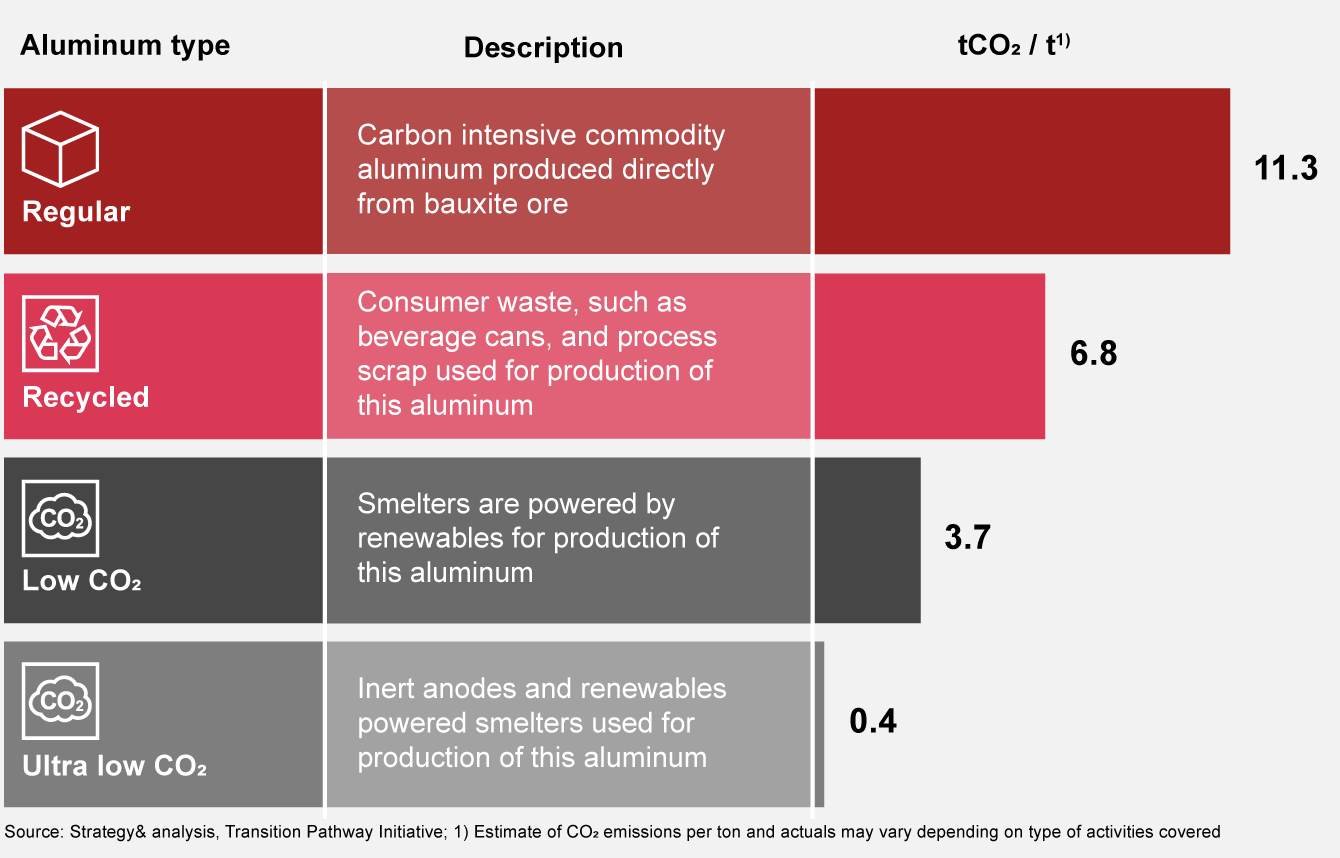

The aluminum market is poised to double in size by 2050, and the demand for green aluminum is set to rise significantly in the coming decades. Options for green aluminum are emerging and expected to be at a premium over regular carbon intensive aluminum as producers attempt to distinguish it from “commodity” aluminum. Currently, production of primary green aluminum is much more diffused8 than carbon intensive aluminum, with Europe leading its production with hydro-powered smelters. While efforts to decarbonize primary aluminum production are gaining traction, a significant opportunity to decarbonize for F&B companies is to grow the recycled secondary aluminum share in packaging. This requires facilitating the shift towards a 100% recycled aluminum can, by, for example, investing in R&D efforts with can makers. Strengthening use of recycled content in the production cycle, both at the smelting and rolling stages, helps curtail carbon emissions by approximately 80-85% compared to primary carbon intensive aluminum production.

As the green aluminum market evolves, it is important for F&B companies to first understand the origin of their aluminum and thereafter cooperate with their tier 1 and 2 suppliers, as well as retailers and waste collection players, to integrate green aluminum into their packaging products.

Case study: Large F&B companies such as HEINEKEN have already begun cooperating with their upstream aluminum suppliers to integrate green aluminum into their packaging products, an action aimed to reduce the carbon footprint of their packaging which accounts for roughly 30% of their Scope 3 emissions. HEINEKEN launched the “Packaging the Future” program, which aims to collaborate with HEINEKEN’s top 50 packaging suppliers to further decrease their carbon footprint9.

Three actions for F&B companies to navigate the complexities surrounding aluminum packaging

- 1Develop strong commodity risk modelling capabilities to address price and supply volatility: To remain competitive, F&B firms need to master commodity risk management. By investing in advanced risk modeling, they can stay ahead of market shifts, foresee shortages, and effectively manage price volatility. A deep understanding of their upstream supplier network – knowing the ins and outs of material flows, source, capacities installed etc. – empowers F&B companies to enhance sustainability, optimize packaging costs and minimize supply disruptions. Building these competencies within operations and procurement teams is essential for thriving in the volatile aluminum market.

- 2Enhance participation in recycling activities: EPR regulations are shifting the onus of packaging waste management onto producers, including for aluminum. F&B companies should adapt by engaging in waste collection and recycling initiatives. Participation in these activities can not only ensure regulatory compliance, but can also generate opportunity to optimize the financial burden associated with outsourcing EPR responsibilities and may reduce carbon emissions through an increased share of recycled secondary aluminum packaging.

- 3Engage with aluminum suppliers: F&B companies stand to gain by tapping into the green aluminum market early. To secure a steady supply of low-carbon aluminum for packaging, F&B companies should engage with upstream suppliers (in particular, smelters and rolling mills) and negotiate longer-term contracts. Additionally, they should continue to push for the increased use of recycled secondary aluminum in packaging. Vertical integration up to the rolling mill presents an opportunity to secure recycled secondary aluminum and reduce packaging costs, alternative strategies include closer negotiation with tier 2+ suppliers, including through soft and hard tolling agreements. These types of agreements have demonstrated success for F&B companies as well as other industries.

Ultimately, F&B companies must be careful not to stop at assessing the carbon footprint of aluminum production, but also to assess carbon across the complete lifecycle usage – packaging production, storage, transport, distribution, and recovery – and compare it against other packaging formats. Implementing these strategic actions and collaborating with value chain players will help F&B companies navigate these complex challenges, support a purposeful transition, and position the industry for the demands of the coming decades.

This is the third edition from our series of detailed deep dive articles on packing optimization.

Roland Daamen, Sebastian Weber, Tim Martiniak, Rajat Tiwari, Mike Lien, and Niels Burgers have also contributed to this article.