Mooring a large ship in an unfamiliar harbor has never been easy… but now winds are changing fast, tides are more pronounced and visibility is limited.

Most M&A practitioners would agree: While transformational deals are on the rise, they have always been complex. Historically, looking at executive surveys over the past 20 years, 50% of respondents did not manage to finish their integration within their planned schedule and 54% did not achieve their envisaged synergy realization.

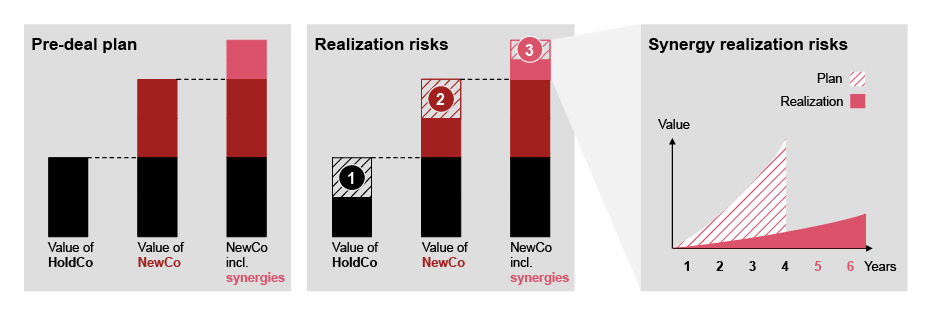

The complexity of delivering the targeted value continues to increase as several common beliefs and solid assumptions set along the last years have changed significantly. To name just a few of the evolving parameters: Multiple crises have emerged on the market front along with disruption through regulatory interventions, which create risks for any company value (#1 on above illustration), while funding costs have increased amid less favorable financing conditions (#2 in the illustration above).

Synergy realization is also risked in both magnitude and timeline (#3 of above illustration). Earlier growth assumptions are now confronted with value creation plans that barely match with business reality, promising quick wins on the bottom line that might now trigger the risk of destabilization and earlier identified headcount synergies are now replaced by labor hoarding of perceived critical talents. In this context, recently appointed chief integration officers find themselves in a daily rat race of connecting the dots across the organization while managing demanding CFO expectations.

At the same time, the competitive drum beat does not tolerate delayed integration projects, distracted top management or negative spillover effects across the pre-acquisition core business.

Despite increasing complexity, more and more transformational M&As are setting sail

Nearly half of all deals (48%, as per our recent M&A Integration Survey) are now transformational deals and they are trickier than absorption, tuck-in or standalone deals — being bigger, bolder and riskier.

To improve integration success in these complex transformations, companies are investing more into their M&A integration efforts. According to the survey, 59% of companies spent 6% or more of deal value on integration in 2022, compared with 38% of companies in 2019.

Companies are also investing in integration much earlier. Long-term operating models are in development earlier in the deal cycle, with 60% of companies planning before due diligence, compared with 25% in 2019. Almost one-third plan during deal screening, up from 1% in 2019. Among successful M&A organizations, it was even more, with 41% planning during deal screening compared with 27% of other respondents.1

1 https://www.pwc.com/us/en/services/consulting/deals/library/ma-integration-survey.html

How can you calibrate your sails, to not just brace for, but even leverage, the changing winds?

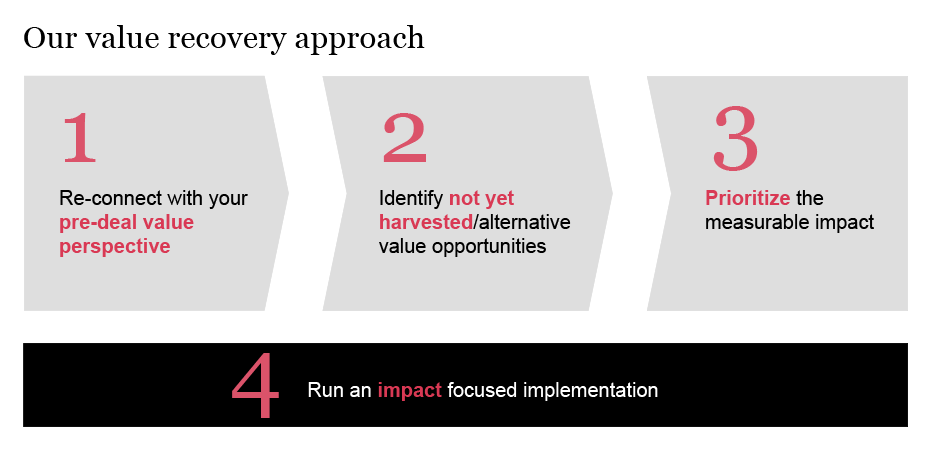

Our four-step value recovery approach, even revisiting a deal from a few years ago with a post-merger integration below plan/expectation, has proven successful, keeping in mind the following success factors:

- Step 1: Reconnect with your pre-deal value perspective

- Review the pre-deal material with an open mind and stress-test your earlier set of assumptions/potential blind spots

- Step 2: Identify your not-yet-harvested and alternative value opportunities.

- Aim for a 360° assessment (e.g., via interviews with customers and suppliers).

- Be open to challenging your status quo as well as to changing boundary conditions and to reconsidering external factors

- Appreciate the realized value and successes

- Step 3: Prioritize the measurable impact

- Focus on further impact (following the "new winds”)

- Apply data analytics to create insights on actual impact

- Step 4: Run an impact focused implementation

- Consider success factor for fix-it scenarios and be prepared to further invest.

- Consider success factors for free-it scenarios and be open to divest, embracing the possibility of sunk costs and/or opportunity costs while thinking about divestments as accelerated transformation options