In Private Equity investment, it is no longer enough to identify lucrative financial opportunities. Staying ahead of the curve, over the long term, necessitates a keen understanding of the transformative forces shaping the socioeconomic landscape – including and perhaps most importantly, the way organizations are responding to environmental, social, and governance (ESG) principles. Already, we are seeing a strong rise in assets under management by ESG-focused funds1 and we expect to see this trend grow. Why? Over the past several years, new regulations, shifting consumer preferences, and fast-advancing technologies have converged to create a compelling rationale for Private Equity to invest more intentionally in ESG-enabled sectors and companies.2

Three factors leading to growth in the now vast and diverse ESG-enabled landscape

New regulations

Increasingly, regulatory frameworks that mandate sustainable practices are no longer mere guidelines. They are enforced by local governments, compelling businesses across sectors to adopt ESG-centric strategies or risk obsolescence. From carbon emissions regulations to stringent labor standards, the regulatory landscape is evolving in favor of companies that prioritize sustainability.

Shifting consumer preferences

Today’s consumers aren’t just buying products—they're buying into values, which has really reshaped industries worldwide. Companies that champion sustainability not only resonate with eco-conscious consumers but also cultivate deeper brand loyalty and drive market differentiation.

Fast-evolving technologies

The global technological revolution has been accelerating the ascent of ESG-enabled sectors, and we expect this to continue at an even more rapid pace in coming years. From renewable energy advancements to disruptive circular economy models, technology is unlocking unprecedented opportunities for companies to thrive while minimizing their ecological footprint.

How to assess emerging ESG opportunities

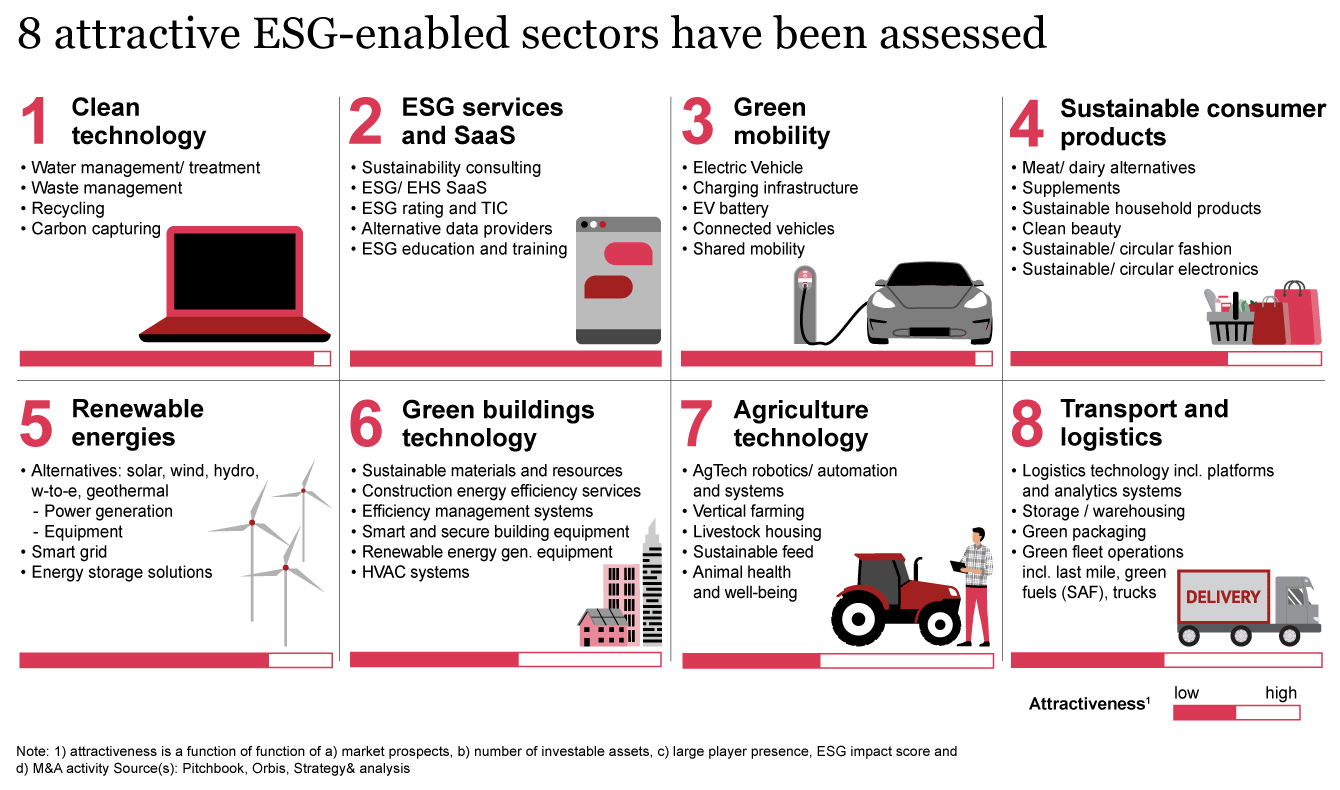

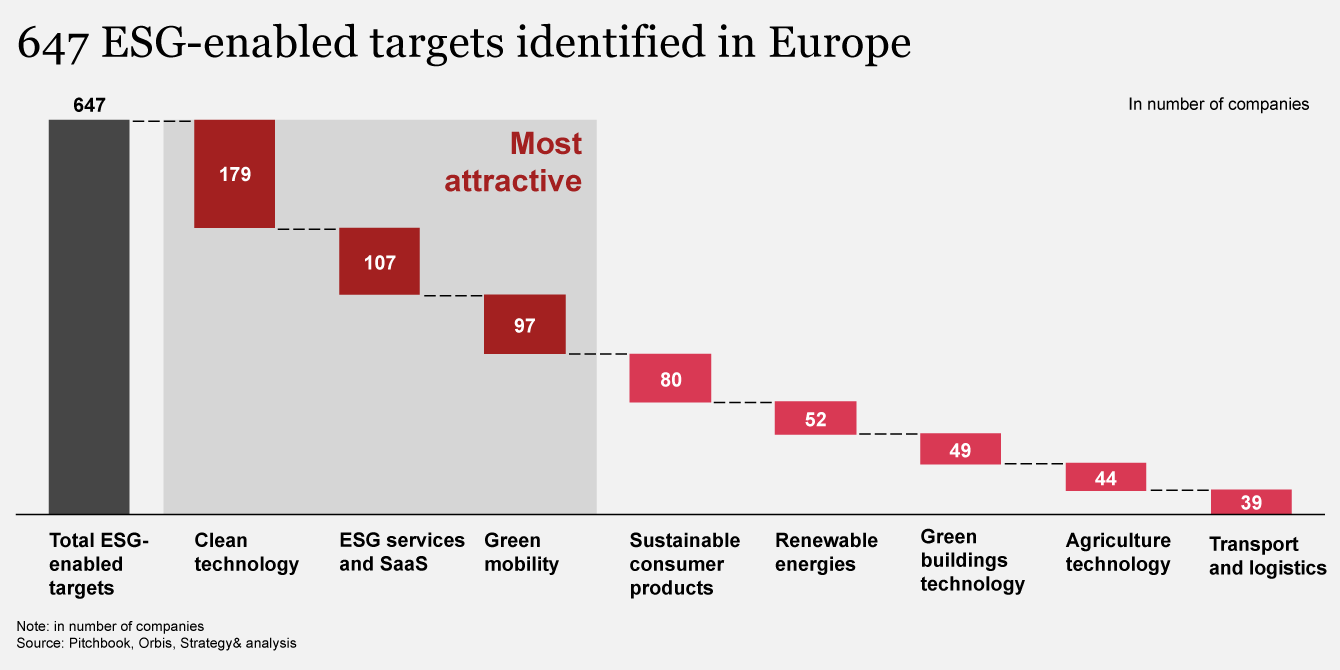

To help Private Equity investors assess the most attractive opportunities, we conducted a targeted research study. Based on our ESG impact assessment, we identified eight main sectors and, within those, a subset of 38 sub-sectors. Ultimately, we found more than 647 ESG-enabled European targets,3 demonstrating that the hunting grounds4 are rich for interested investors. From sustainable aviation fuels in the transport and logistics sector to green hydrogen in the renewable energies sector, there is no shortage of areas to explore. But based on our research, we determined that three sectors are most attractive and promising for investors.

The most attractive sectors: Clean, tech, ESG, SaaS, and green mobility

Based on our research, the three sectors that have the most assets worth exploring are ESG services and software as a service (SaaS), which we also discuss in this related article, clean technology, and green mobility.

These sectors present abundant opportunities and possess common characteristics: (1) they benefit from significant tailwinds driven by various factors such as regulation and customer demand; (2) they feature the presence of multiple major players; (3) they are witnessing a rise in deal activity; and (4) they have demonstrated robust growth trajectories in recent years.

-

1Why consider ESG services and SaaS?

As governments and regulators actively promote ESG integration in business operations, this sector offers a still highly fragmented but maturing landscape for investors. Initially emerged to support companies in enabling their sustainability journey, the sector now encompasses a range of sustainability-enabled technology solutions, including ESG alternative data provision; ESG rating and testing, inspection, and certification (TIC); sustainability and ESG consulting; ESG SaaS; and ESG education and training. Currently, the sector includes 107 maturing targets in Europe, with sustainability and ESG consulting and ESG SaaS emerging as the largest sub-sectors, representing more than 90% of the identified companies.

The ESG services and SaaS sector presents an attractive investment opportunity for Private Equity firms due to several compelling factors. First, governments, regulators, and stakeholders are actively supporting initiatives aimed at promoting ESG integration into business operations (e.g., UN SDGS and CSRD). This includes the adoption of policies that incentivize ESG reporting and disclosure, as well as the enforcement of stricter environmental and social regulations. As a result, companies are increasingly seeking ESG expertise and advisory services to navigate these complex regulatory landscapes. Second, corporate demand for ESG integration is on the rise as businesses prioritize sustainability and aim to meet stakeholder expectations. Third, technological advances further enhance the sector’s appeal, with innovative data analytics and software solutions facilitating better ESG reporting and management. This specific software sub-sector is strongly growing with CAGR 12-14%. Given its low penetration level of ~35%, the overall fragmented but more maturing provider landscape provides opportunities for consolidation and growth through strategic acquisitions.

-

2Why consider clean technology?

Clean technology has a longer investment horizon than some other areas, but it offers promising prospects driven by regulatory support and ongoing technological progress. This sector includes a variety of equipment and services aimed at eliminating or reducing waste and pollutants to avoid environmental damage at the source. Its main sub-sectors are carbon capturing, water management and treatment, waste management, and recycling. We have identified more than 179 targets in this sector, of which ~90% are in three sub-sectors: (1) waste management, (2) recycling and (3) water management and treatment, all three of which have experienced an uptick in deal activity.5 Carbon capturing is also steadily attracting investments to increase its technology maturity and economic feasibility.

In general, clean technology is highly attractive to investors for a variety of reasons. To start, regulators and governments around the world are actively investing in clean technologies (e.g., the enhancement of recycling infrastructure), while adopting policies promoting clean tech adoption (e.g., tax incentives and grants for manufacturing companies building out their recycling capabilities). In addition, high consumer awareness is driving the market – with demands for net zero neutrality and the reduction of virgin material inputs leading businesses to invest in carbon capture and circular value chains. Technological progress is also a key market driver, continuously enhancing efficiency, performance, and affordability. For example, smart/ Internet of Things applications are becoming increasingly common in waste management (e.g., smart bins that monitor their fill level and alert waste collection companies automatically) or recycling automation (e.g., material sorting robots).

-

3Why consider green mobility?

Green mobility stands out because of its potential to address climate change through transformative technologies like electric vehicles (EVs) and charging infrastructure. The sector encompasses a range of transformative technologies aimed at reducing carbon emissions and promoting sustainable transportation solutions. Key sub-sectors within this sector include – next to the aforementioned EVs and charging infrastructure – EV batteries, connected vehicles, or shared mobility. With more than 97 identified targets in green mobility, this sector represents a significant investment opportunity. Notably, EVs and charging infrastructure account for approximately 70% of the sector, which demonstrates their increasingly important role in shaping the future of transportation. Overall, the green mobility sector stands out as an attractive investment opportunity for Private Equity firms, shaped by the combination of a few compelling forces.

First, the global push toward sustainability and the urgent need to mitigate climate change create a conducive environment for investments in clean transportation solutions. Governments worldwide are implementing ambitious targets and regulations to reduce carbon emissions, providing a supportive regulatory landscape for green mobility initiatives. Second, the rapid advances in technology – particularly in EVs, battery storage, and connectivity – offer promising opportunities for innovation and growth. Investments in research and development within the green mobility sector can yield breakthroughs in efficiency, performance, and cost-effectiveness, further driving market expansion. Moreover, shifting consumer preferences toward environmentally friendly transportation options are contributing to the growing demand for green mobility solutions. As individuals become increasingly conscious of their carbon footprint, they have a rising inclination toward sustainable modes of transportation like EVs, fostering market growth and investment potential.

Finding and taking advantage of your next ESG investment opportunity

Private Equity investors are poised to seize significant opportunities in sectors that are focused on, and increasingly enabled by, ESG. As regulatory mandates, shifting consumer preferences, and technological advancements continue to accelerate progress in sustainability and related areas, this is the right time to focus on ESG in your investing strategy. But with more than 647 ESG-enabled companies identified in Europe across various sectors, it’s important to think critically about which sectors are right for you.

Methodology

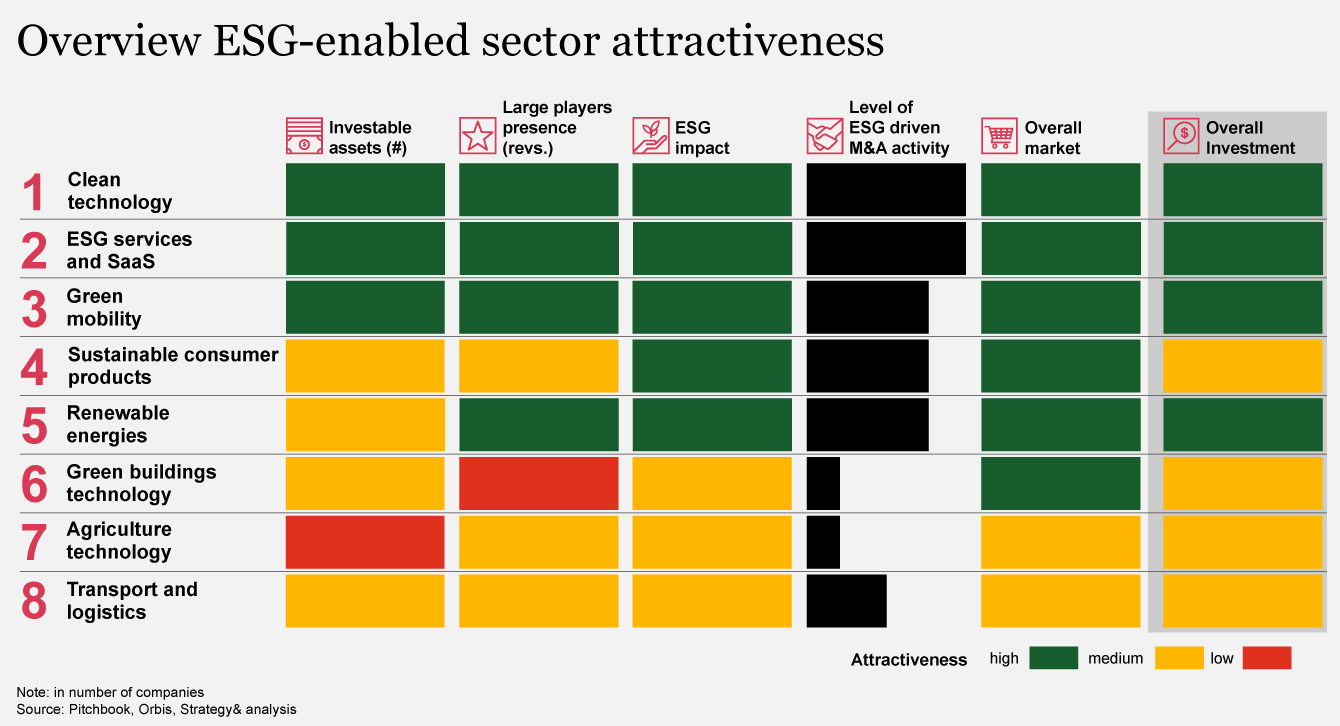

Our research was based on a comprehensive range of market data combined with Strategy& expertise. We evaluated the attractiveness of eight sectors based on the following five elements, each rated as low, medium, or high. The overall score was then decisive in determining the sector's appeal.

- 1Overall market attractiveness: This assessment was based on market size, growth outlook, maturity, barriers to enter, and the competitive/ provider landscape.

- 2Investable assets: The number of relevant companies within the sector was used to assess the attractiveness of a sector. A high count, exceeding 90, was indicative of a robust landscape offering consolidation opportunities, while a low count, below 50, suggested a low concentration and/or low maturity.

- 3Large players presence: The prominence of key players involved categorizing them based on their revenues. Sectors with average revenues exceeding €100 million were considered large, those below €50 million were classified as small, and those in between fell into the medium category.

- 4ESG impact score: The ESG impact score, developed by Strategy&, served as a key metric for evaluating the sector’s ESG relevance and considered sector-specific drivers such as regulation, technological advancements, customer behavior, and academics.

- 5M&A activities: Analyzing deal activity was an essential part of assessing each sector’s attractiveness. A high number of deals within the sector in the past year was indicative of high attractiveness, given the potential consolidation of a fragmented provider landscape. Low deal activity suggested limited appeal.

Contact us