Key findings

- 1The energy crisis has been a challenge to industrials, some of which were already suffering from supply chain disruptions and lower demand (-13% output over last 5Y)

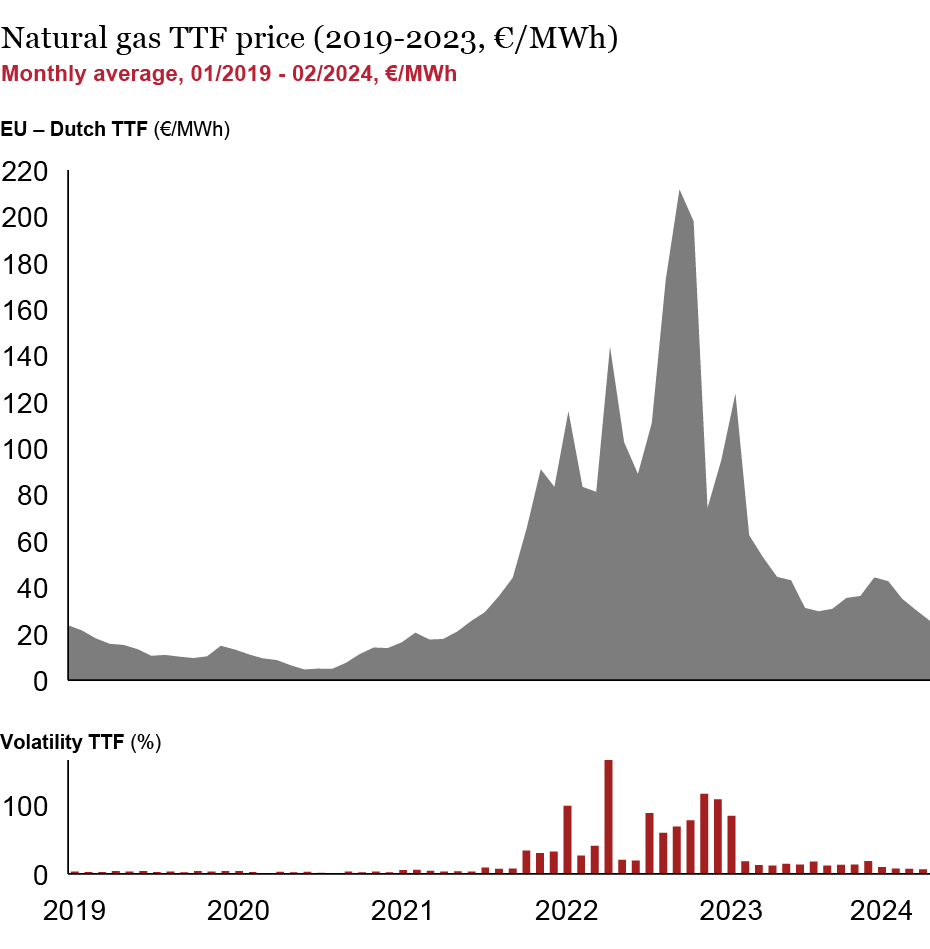

- 2Energy prices have recovered after the peak in 2022. Average February spot prices for natural gas (TTF) recovered to 12€/MWh above pre-crisis level of 2019

- 3Elevated energy prices and increased market volatility not only caused profits to decline (-14% since 2018) but also pose a risk of deterring investments (-9% vs. pre-crisis)

- 4Most firms have responded with short-term levers, while substantial levers have remained untouched. Inflation and volatility remain the top two concerns for CEOs in 2024

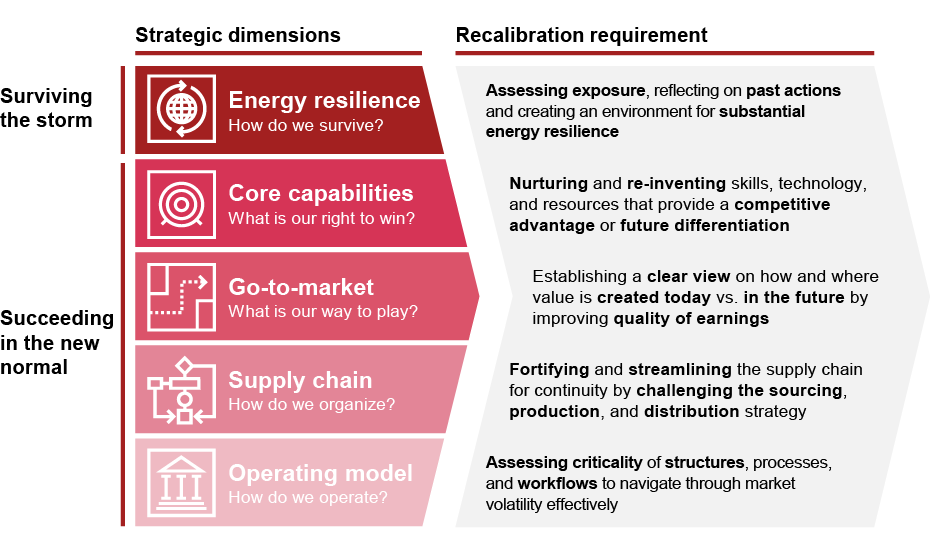

- 5Companies need to improve their energy resilience strategy to survive. To succeed in the long-term, a recalibration of the entire business strategy is required

Rough winds ahead for European industrials

Key challenges to remain for the next decade:

Initial expectation:

- Energy will remain at affordable prices and will even improve competitiveness

- Burden of decarbonization is split evenly across locally-produced products and imports

- Output from core industries to remain at stable levels

Market realities:

- Energy prices are significantly higher compared to other markets (e.g., China, US)

- Industrials lose competitiveness vs. players with less ambition to decarbonize

- Output from energy-intensive industries 11-17% lower vs. pre-Covid

Energy crisis in full swing

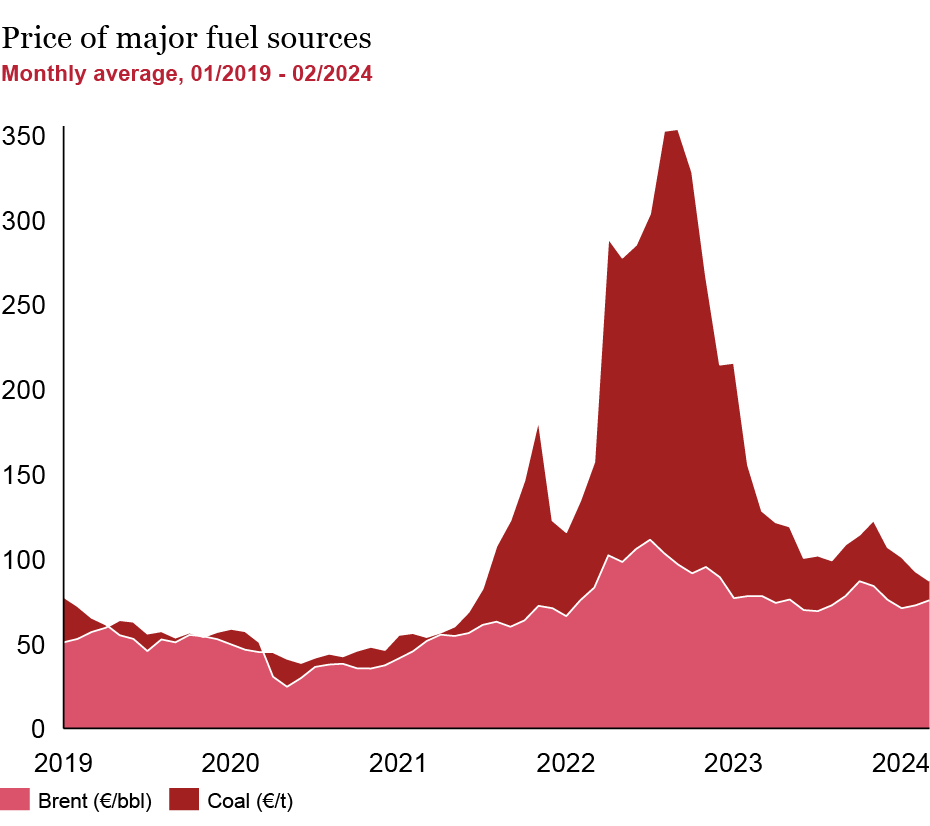

Energy prices have recovered – but are still at higher levels, and with higher volatility

Coal/ Brent

Mid-2020 plunge

Reduced global demand due to pandemic and oversupply in certain markets (e.g., oil)

Global coal price rally (until mid 2022)

Convergence of soaring coal demand (countries switching to coal-fired generation) and global supply shortages (export ban Russia, adverse weather conditions reducing supply)

Coal price recovery (since September 2022)

Increased production (e.g., from Australia) and mild temperatures have caused coal prices to decline, but still ~57% above average 2019 level

Natural gas

Pre-Covid (early 2019)

European prices determined by supply and demand, with significant imports (>40%) from Russia

War in Ukraine (since February 2022)

Sudden increase in gas prices and volatility

Market decline (mid 2022 - mid 2023)

Replacement of Russian gas and increased level of European gas storage drove prices down from mid-2022

Easing prices – back to normal? (last 12 months)

TTF recovered, and remain ~12€ above 2019 average as of February 2024

Increased volatility – the new normal? (last 12 months)

Volatility TTF of last 12 months ~4x the level of 2019

How to survive the storm and succeed in the new normal?

The new normal needs a complete strategic adjustment, starting with energy resilience to protect competitiveness.

Required actions from different decision-makers

To protect the bottom-line, decision-makers in energy-intensive industries need to…

While decision-makers in governments and public institutions will need to support Europe’s industrial core and…

Christian Brand and Michael Meyer have also contributed to this report.