Pioneering profits with digital business models in the energy sector

Utility companies presently face the digital reckoning that industries such as media and retail went through years ago. The experience of other sectors shows that there are only two options: transform your business to generate new value for customers by adding profitable digital business models – or lose your market. The good news for utility companies is that, amid the clean energy transition, adding services that are an extension of their established business of generating, transmitting, or selling energy offers unmatched opportunities. Companies that position themselves at the forefront of the transformation will have the advantage.

This study elaborates on the opportunity and challenge for digital business models (DBMs), where the greatest potential for synergies with the core business lies, and how to establish the necessary capabilities. We surveyed more than 300 European experts across the utilities' value chain about their expectations for digital transformation, their progress in adding new products and services, and the factors holding back change.

"Other industries already leverage digital business models to understand their customers better and offer improved services. Energy companies must urgently digitize their business models to meet customers’ higher expectations beyond just selling kWhs and stay competitive in the long run.”

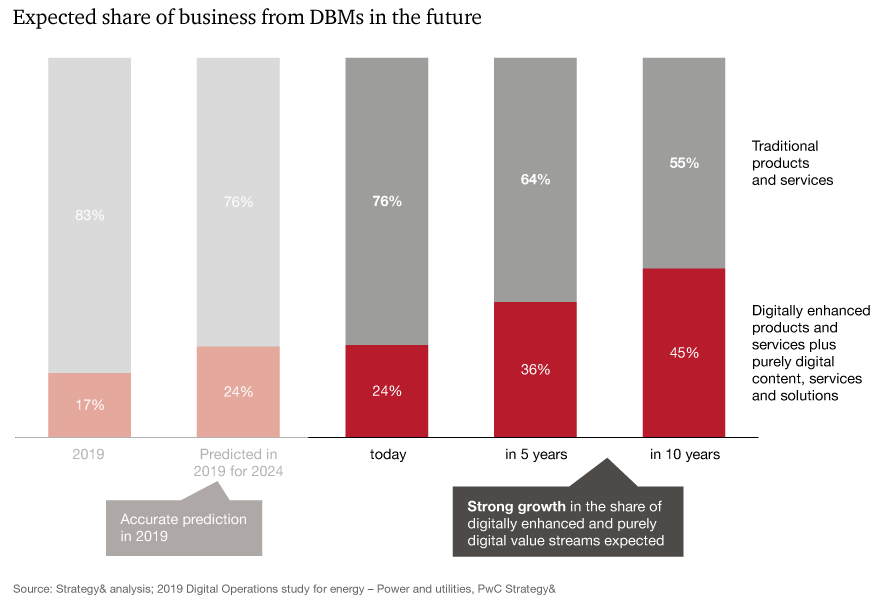

The results show that since our last study of the digital business maturity in 2019, utilities have increased the share of their digital business as predicted from 17% in 2019 to 24% in 2023, yet still lag behind their own ambitions. As a result, they risk falling behind investors' expectations and the industry's competitive challenges. Our survey, accompanied by interviews with leaders in the sector, also clarifies the factors holding back progress and how forward-looking companies are tackling them.

What is a digital business model and how does it create value?

Digital business models (DBMs) give value to private and commercial consumers and expand potential profit pools for companies through new technologies, including artificial intelligence (AI), the Internet of Things (IoT), cloud computing and energy analytics.

The perceived value generated by the DBM determines a customer's willingness to pay for a product or service for reasons including quality, convenience, innovation, and experience. For companies, the benefits come down to the profit potential, looking not just at revenue streams but also cost savings and optimization from offering a specific product or service.

Unleashing new value by complementing the core business

In our 2019 study of digital business maturity among utilities, respondents forecasted that digital business models would account for 24% of revenue by 2024 - an accurate prediction as DBMs have reached that proportion this year. Looking ahead five and ten years from now, DBMs are expected to account for 36% of revenue by 2028 and 45% by 2033.

To double the share of revenue from digital products and services as expected over the next decade, power companies must transform urgently. That doesn't mean abandoning traditional products and services but rather digitizing them to establish high-margin and scalable DBMs.

The survey looked at the relevance - defined as the potential for revenue generation in the future - of a range of DBMs and identified EV charging and smart DBMs, such as smart metering and smart grid, as most relevant because of the synergy potential with the core business. They are both located toward the consumer-facing end of the value chain: smart meters and smart home can deliver their full value add if and only if instant pricing provides financial incentives to which households adapt, making them thus better off. Lastly, smart grids decrease the energy system's costs from which grid operators benefit financially and hence households in the long run too.

Exploring the implementation gap in digital business models

There is currently a gap between the DBM's expected relevance and the current degree of implementation. The size of the gap between the two measures indicates how much companies still must do to build a business model with a profitable income stream in the future. Undoubtedly, DBMs offer an attractive new investment option for utility companies, particularly those DBMs with a large implementation gap, which includes the smart DBMs and decentralized production.

So why do these implementation gaps exist? Our survey shows the reasons fall into two broad categories:

Conclusion

Our survey respondents agree on the following actions as the most promising way to kick-start DBMs:

- 1Improve your access to external funding by identifying more lucrative investment opportunities through a better understanding of digital business models

- 2Collaborate with external partners to leverage their technological knowledge

- 3Build up internal IT knowhow to be able to tackle the challenges of the digital transformation

- 4Put in place the necessary digital capabilities, including cloud computing, energy analytics and AI, that will enable their chosen digital business models to reach their full potential

Dr. Oliver Kalsbach and Jonas Bruns have also contributed to this report.