Strengthening the electrolyzer industry to secure Europe’s leadership in renewable energy production

The electrolyzer market is at a pivotal juncture: Clean hydrogen is needed for the energy transition and has been expected to grow fast and strongly, but project realization is largely lagging. The industry faces significant overcapacity, with production rates far outpacing the slow adoption of hydrogen. This challenge is further complicated by competing electrolyzer technologies, none of which has yet become a clear front-runner.

Adding to these challenges is the competition from Chinese manufacturers who offer significantly lower prices and thereby exert pressure on European electrolyzer OEMs. This competitive environment has resulted in a loss of €2.14 billion in shareholder value over the past year alone.

To effectively navigate this uncertain market landscape, European electrolyzer manufacturers must quickly realign their cost structures and scale their operations. As the industry moves toward consolidation, some key actions are important to maintain a competitive edge and secure a strong position in the global electrolyzer market.

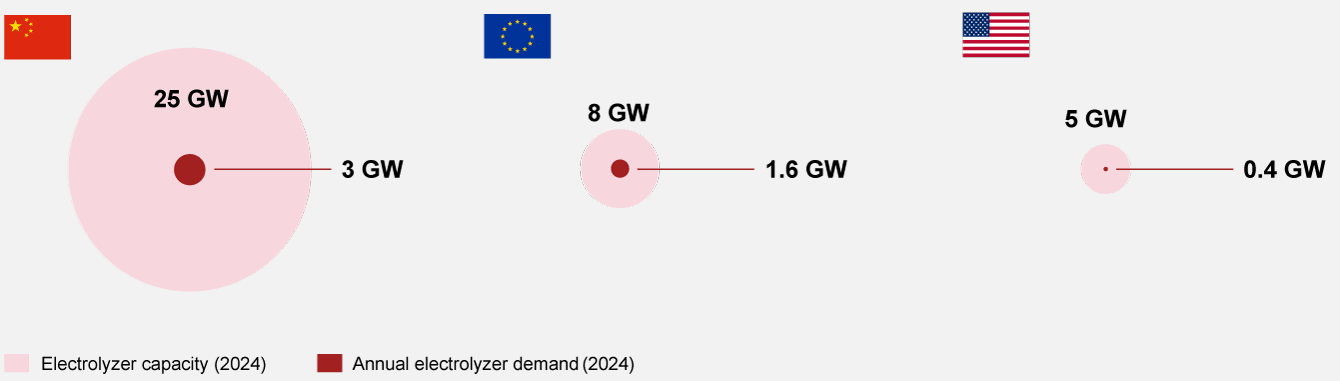

Global electrolyzer manufacturing capacity

The global electrolyzer manufacturing industry is facing significant overcapacity, with China's capacity exceeding demand by eight times and Europe's by four times. This surplus threatens profitability, as many announced hydrogen projects fail to reach the final investment decision stage, resulting in few binding orders.

Despite promising gigawatt-scale projects suggesting a bright future for renewable hydrogen, the gap between projected demand and actual uptake remains a critical challenge. To secure competitiveness and sustainability, it is vital to align manufacturing capacities with real market needs.

Two strategies for European electrolyzer manufacturers to act now

The overcapacity in production, driven by the slow uptake of the hydrogen market, has led to a significant decline in share value for manufacturers. Compounding these issues is an unclear technological landscape for various production methods and increasing competition from Chinese manufacturers entering the European market.

To secure Europe’s leadership in renewable hydrogen production, we suggest two strategic actions for European manufacturers:

- 1.Improve competitiveness internally with Fit for Growth* measures

- 2.Look for partners and M&A to increase strength and flexibility

*Fit for Growth is a registered service mark of PwC Strategy& LLC in the United States.

Ferdinand Habbel and Florian Schäfer have also contributed to this report.