The macroeconomic environment is exerting additional stress on the European banking sector. In the aftermath of the global financial crisis, banks had adjusted to a macroeconomic environment characterized by excessive monetary and fiscal stimulus – leading to an era of low for longer, fueled by quantitative easing that aimed to reactivate the economy struck by the Covid-19 pandemic. The increase in inflation led to a fast and drastic change in the monetary policy, reversing QE and low interest rates. The FED, ECB and BoE (among other central banks) have since announced severe rate hikes despite an initial sense of reluctance.

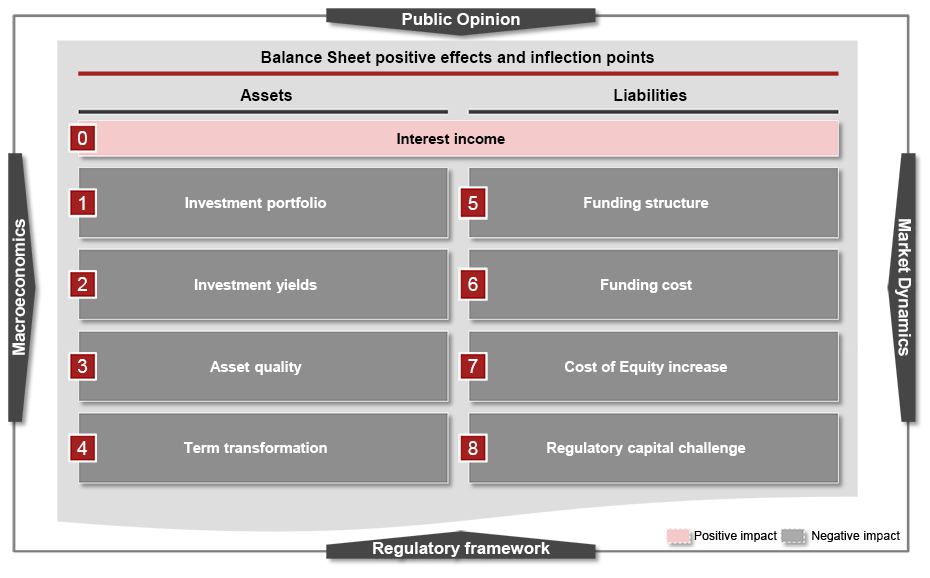

Low for longer came to an abrupt halt when geopolitical tensions intensified since the war in Ukraine, fueling a stark increase in headline inflation that was corroborated by distortions in global supply chains and hikes in energy and food prices. Higher central bank interest rates, however, could prove positive for banks and institutional investors alike, as shown by banks’ strengthened profitability in 2022. But a stronger Net Interest Margin (NIM) depends on the balance sheet’s funding structure, hedging of duration risks, liquidity of the investment portfolio, and more.

Higher interest rates do particularly lead to lower yields and greater risks:

- Short-term: (un)realized losses in the investment portfolio and duration risks

- Medium-term: deteriorating asset quality, rating migrations in corporate and SME portfolio and impairments, as well as higher funding costs

The banking system is faced with additional pressure due to core inflation remaining high and further interest rate hikes looming. Central banks started quantitative tightening around Q4 of 2022, yet struggle to manage the trade-off between fighting inflation and ensuring financial stability due to concerns around debt-to-GDP levels. The current situation will likely increase the pressure on European (SME) banks’ profitability and, ultimately, drive up Cost of Equity, leading to additional challenges for the banking sector.

Recent bank failures in the US and Europe raise questions around overall vulnerability of the banking sector. Four framework conditions exert idiosyncratic impacts on the banking sector:

- Macroeconomics: particularly the rapidly changing inflationary regime and the implications on interest rates

- Public Opinion: focusing on the rapid change of sentiment, partially enabled by digital/ social media

- Market Dynamics: pressure on profitability due to rising competition, changing customer demands, tech changes and re-skilling of talent

- Regulatory framework: increase of regulations and supervisory scrutiny leading to concerns about cost of regulations

In order to address the inflection points outlined above, banks should conduct a comprehensive vulnerability assessment to identify short- and medium-term risks, as well as strengthen their business models by adjusting business origination, risk mitigation, scenario planning and governance.