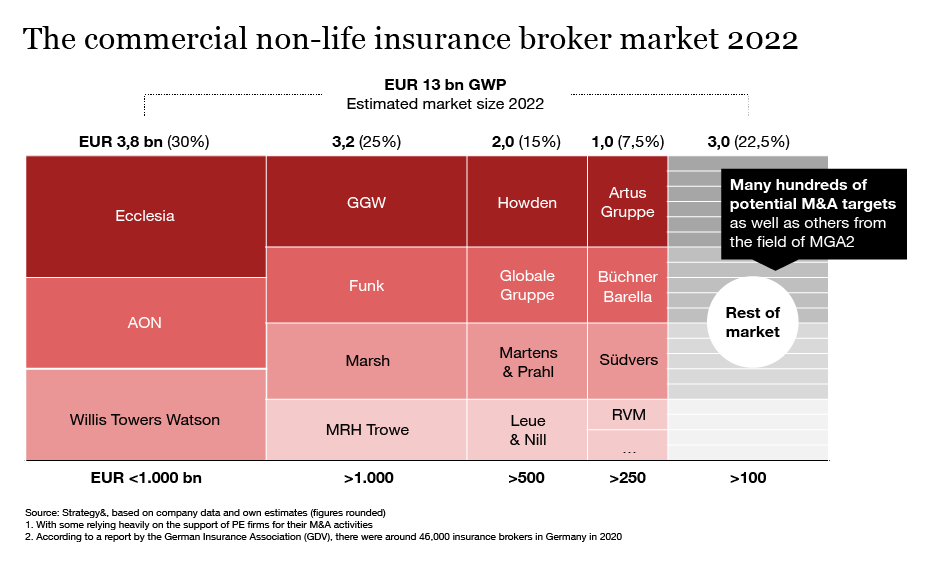

Germany’s commercial insurance brokerage market is at the beginning of a consolidation phase similar to those that started in the US and UK around 20 years ago. Acquisitions of brokerage firms by rivals and the arrival of new consolidators, many backed by private equity, are becoming a regular occurrence. The three current “consolidation leaders” – Ecclesia, Gossler, Gobert & Wolters (acquired by HG Capital in 2021) and MRH Trowe (acquired by AnaCap in 2021) – are increasing their M&A activities.

Numerous other would-be acquirers, including Söderberg & Partners of Sweden (backed by KKR), the US broker Acrisure, and the German private equity firm Castik Capital are also known to be active, aiming to replicate the strategy that has been applied successfully to the US and UK markets over the past two decades.

In addition, insurance companies have strong incentives to take an active interest in the consolidation happening in Germany, since a key aim of the consolidators is to use increased scale to push for higher commission payments. Insurers may seek to protect their margins by becoming acquirers themselves, gaining greater control over their own distribution and retaining a larger share of the overall profit pool.

An attractive market backdrop

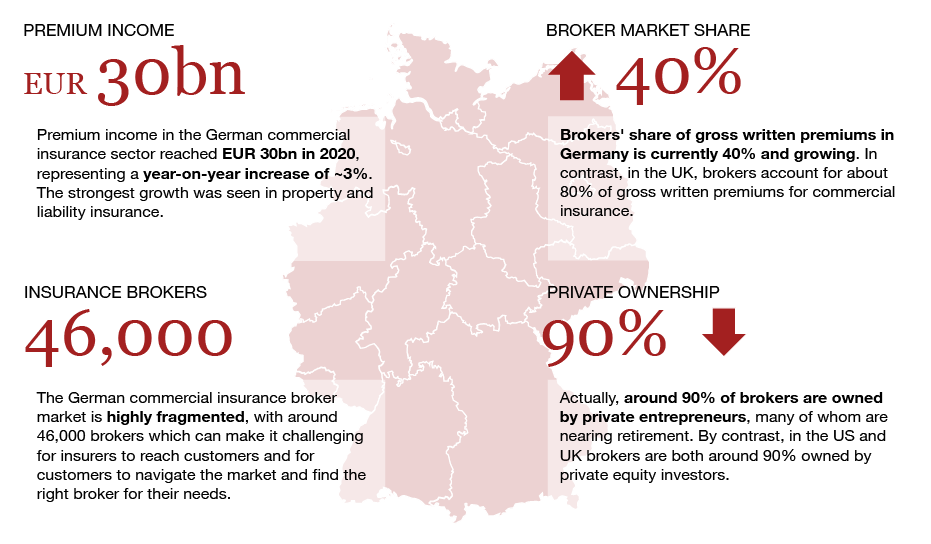

Germany’s commercial insurance brokers occupy a strong position in a market with attractive characteristics. Germany is one of the largest non-life commercial insurance markets in Europe and growth across most commercial property and casualty insurance lines has been good in recent years. Between 2019 and 2021, the non-life commercial market grew at a compound rate of 2.8 percent a year and achieved total premium income of €30 billion in 2020.

There is also ample room for further growth since premiums per capita in Germany are low relative to the country’s Northern European neighbors – around €2,650 in 2020, compared with €4,400 in the Netherlands and €3,700 in the UK.

Among the main insurance distribution channels, brokers account for a relatively small, but growing, share of premium income – currently about 40%. In the UK by contrast, brokers account for about 80% of gross written premiums (GWPs) in commercial insurance. This indicates the potential for further market share gains by German commercial brokers, particularly at the expense of tied agents. This group makes up the other major distribution channel for non-life insurance products and has particular strengths among micro-businesses and SME customers. The growth opportunity for brokers in Germany is significant.

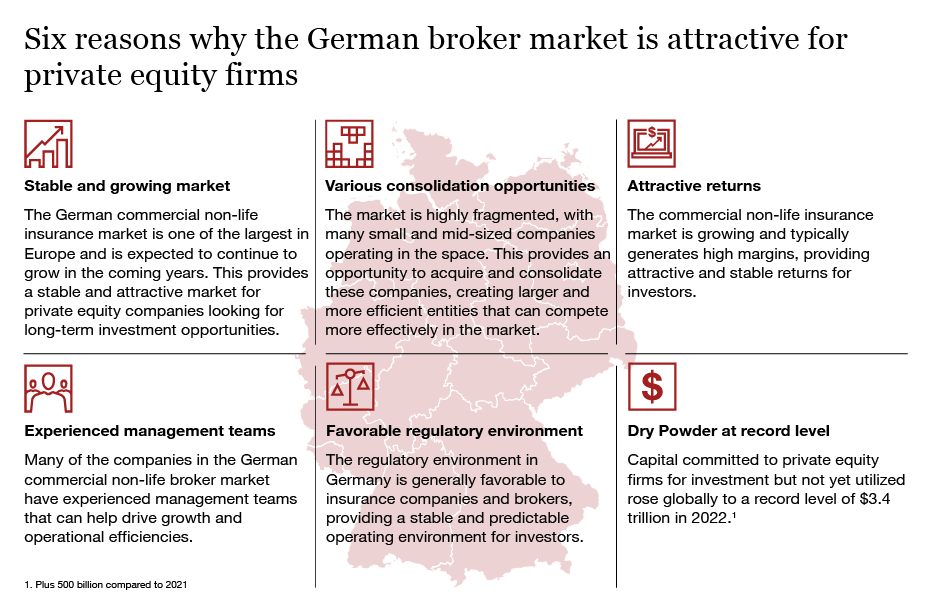

The German market, therefore, has obvious economic attractions: it offers a stable regulatory environment, shows good growth, and generates decent margins. From the perspective of consolidators, these attractions are enhanced by the fact that the market is also extremely fragmented, comprising around 46,000 brokers. Around 90 percent of German brokers are owned by private entrepreneurs, many of whom are nearing retirement and are likely to seek an exit over the next 10 to 15 years. The contrast with the UK and US, where around 90 percent of brokers are controlled by private equity investors, is plain to see.

The German commercial broker market continues to grow, largely driven by a strongly growing broker share in the P&C business.

Tim Braasch, Partner Strategy& GermanyMultiple drivers of consolidation

There are several additional powerful tailwinds for the consolidation trend in German broking. These include growing pressure on firms to provide high quality and well differentiated services for clients that are looking to manage an increasing range of risks, including cybersecurity, natural disasters and supply chain disruptions. Regulation is also adding momentum to the consolidation trend. In areas such as data protection and cybersecurity, new regulation is likely to require brokers to invest more in their technology and people, which will naturally favor larger and better capitalized firms. And as consolidators and new players enter the market, it becomes more competitive, increasing the value of synergies and economies of scale.

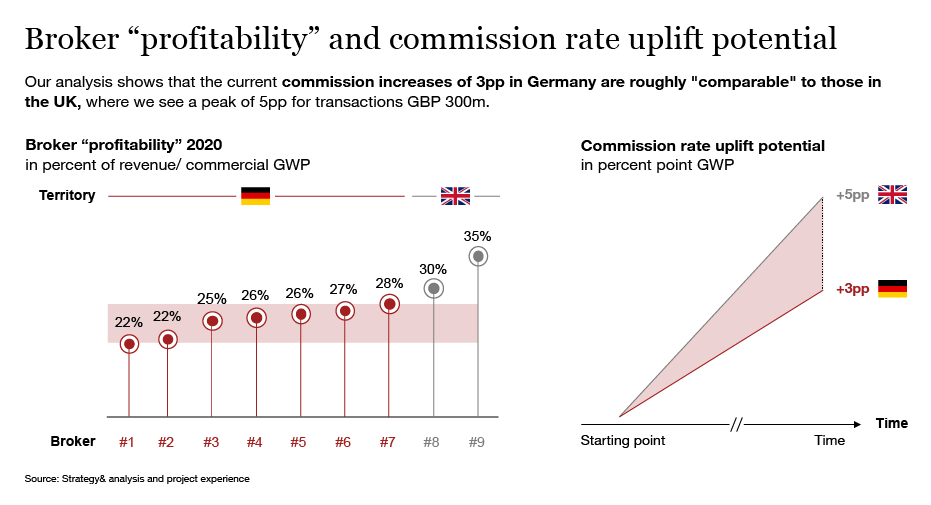

Our analysis of markets such as the UK, where consolidation is well advanced, demonstrates the potential for larger brokers to use their negotiating power to secure higher commission rates from insurers.

Current increases in commission rates in Germany of three percentage points of GWPs are roughly comparable to those we see in the UK. However, we also see UK brokers, with the benefits of scale achieved through consolidation, securing commission increases from insurers of up to five percentage points, illustrating the potential for larger brokers to capture a greater share of the industry’s profits over time.

The opportunity

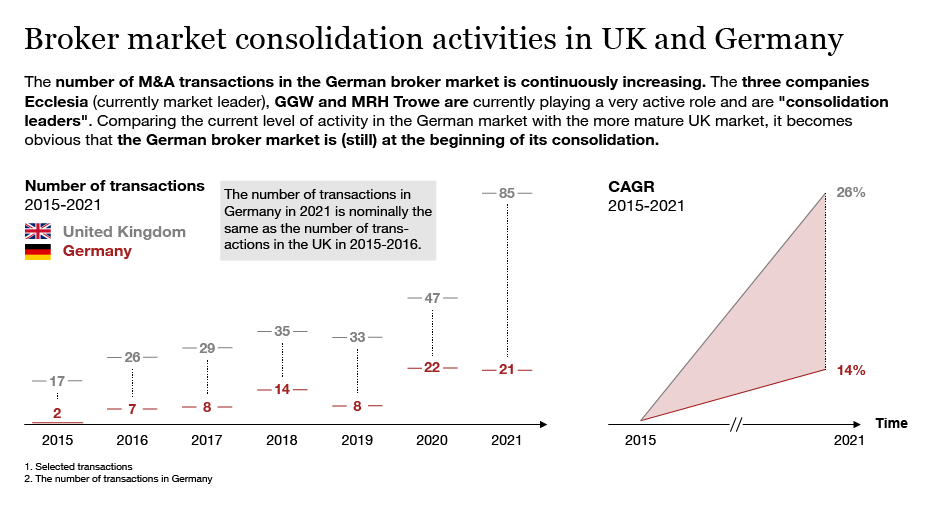

Amid this combination of positive forces, the consolidation trend in Germany is still only just beginning. During 2020 there were 22 M&A transactions in the German brokerage market and 47 in the UK. The following year, the number of deals in Germany was 21 compared with 85 in the UK.

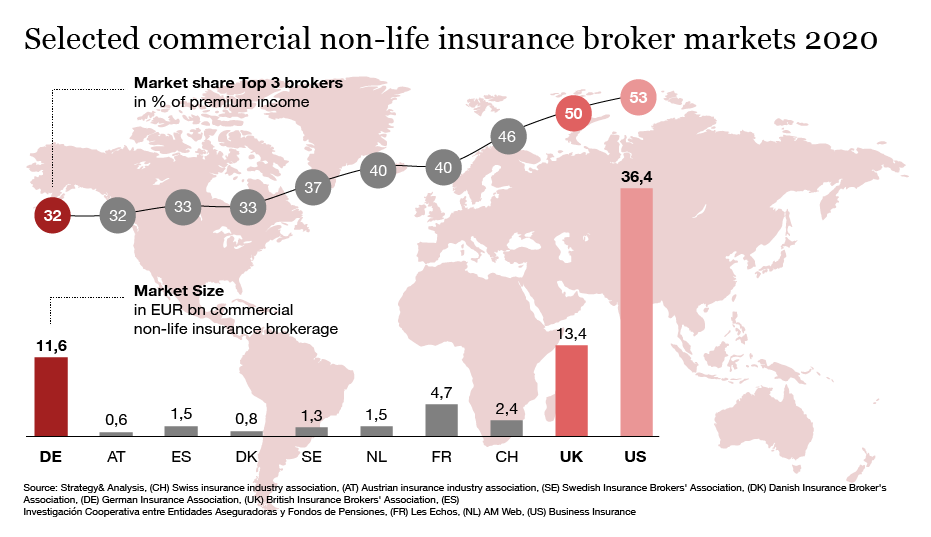

Although consolidators have begun to move in, Germany’s market remains extremely fragmented. The top three German brokerage firms account for less than a third of GWPs in the commercial non-life market. In the UK and US, the top three account for 50% and 53% respectively. The market is therefore ripe for consolidation, with the largest players controlling a relatively modest share of gross written premiums and a long tail of tail of potential acquisition targets for consolidators.

The key “platform” deals are likely to happen via acquisitions of second- and third-tier brokerage players by private equity investors. By using these platforms to roll up smaller players into a few large groups, the consolidators will be well positioned to create economies of scale that will increase their bargaining power with insurers, allowing them to negotiate higher commission rates. Equally, insurers have a strong incentive to become buyers too in order to keep control of their distribution costs and so protect their margins.

Germany offers probably the most attractive consolidation opportunity in Europe, as a large market with solid growth, relatively low insurance density and scope for margin improvement. The consolidation trend has a long way to run in this market.