Global tensions like economic and political uncertainties also left their mark on payments M&A in 2022: After peaking in 2021, global payments M&A activity dropped sharply in 2022 to pre-pandemic levels. However, the market remains vibrant and players took the chance to embrace the technologies that will shape the industry in the years to come. Even in volatile 2022, more than twice as many deals were closed compared to 2018. And further acceleration is expected during 2023.

By looking at global and regional payments M&A trends with regional deep-dives into selected markets, this report breaks down the strategic implications for payments executives and investors to succeed in 2023.

Global and regional payments M&A trends

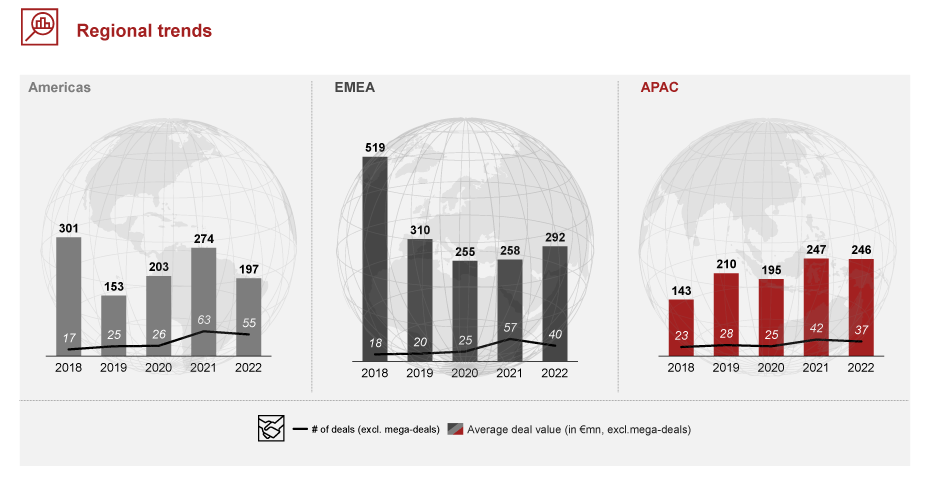

Longer-term trend varies by region

Whilst 2022 average deal values remained significantly below the 2018 peak in Americas and EMEA, deals in APAC have been growing in size and number.

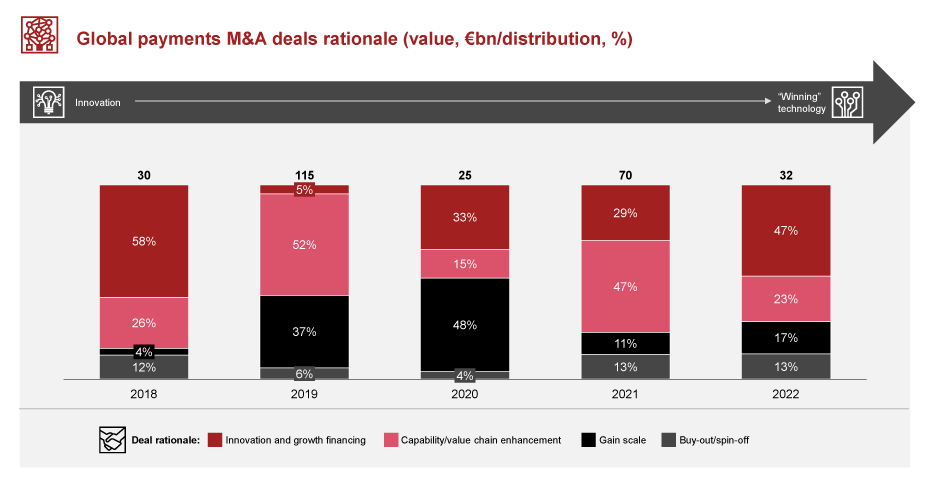

Global payments M&A deals rationale

Payments firms and investors are embracing technologies with the potential to shape the future of payments. While “innovation” was the strategic rationale for almost 50% of 2022 deals flow, “capability enhancement” accounted for another ~25%. This trend is expected to continue in 2023 as firms further integrate “winning” technologies.

Consolidation is not over

Having seen a wave of regional scale deals in Europe and the US in the years before 2022, cross-regional and global consolidation will likely shape payments M&A in the years to come.

Private Equity investors continue to believe in value creation

In their pursuit of realizing portfolio synergies and market share expansion, Private Equity investors will play a key role in global consolidation.

Strategic implications for payments executives and investors

There are six strategic levers to succeed in 2023:

1 “Succeeding through M&A in uncertain economic times” (PwC 2023), “Global M&A Industry Trends Outlook” (PwC 2023)

Source: PwC, Strategy& analysis