Navigating unprecedented disruption in the insurance sector

The European insurance industry has historically served as a cornerstone of financial stability, built on centuries of meticulous risk management and gradual progress. It offers essential protection for individuals, businesses, and the economy, helping them navigate uncertainty. However, the industry now confronts two significant challenges:

- Unprecedented disruption: Once characterized by stability, the sector is now facing an extraordinary wave of change. Modern challenges driven by technological advancements, shifting customer expectations, workforce transformation, and rapid market consolidation are reshaping the insurance landscape. Growing coverage gaps have raised consumer concerns, and substantial investments in the insurance intermediary market are demanding quick financial returns, putting unprecedented pressure on the industry to adapt.

- Lack of financial value creation: Between 2015 and 2024, the industry has not generated financial value, reporting an average annual negative economic spread of approximately ~2%.

These disruptions require urgent and radical changes. However, the industry faces significant barriers, including outdated IT systems, cultural inertia, financial constraints, and increasingly complex regulatory requirements. As always, any transformative innovation must be balanced with the operational stability that defines the insurance sector.

To better understand how leading firms are preparing for these transformations, we conducted a market-backed survey among leading insurers and brokers working with the board members in charge of transformation across the EMEA region. We engaged with the top three players in the major insurance sectors, including primary insurers, reinsurers, and brokers, as well as local and regional leaders. Our findings reveal a stark reality: very few companies are genuinely prepared for the transformation ahead.

Forces for change and barriers in the insurance industry

The insurance landscape is undergoing significant transformation, revealing structural weaknesses that have long been overlooked. Insurers must navigate entrenched barriers to adapt while maintaining the stability customers depend on.

Promoting enterprise agility for successful change

In our survey, all insurers and brokers indicated that they are radically transforming their business models, typically aiming to complete this process within three to five years. However, one in three CTOs is unsure about meeting timelines and budgets. Successful transformation requires comprehensive responsibility and upskilling to ensure teams are equipped to fulfill their roles.

How insurers can forge ahead

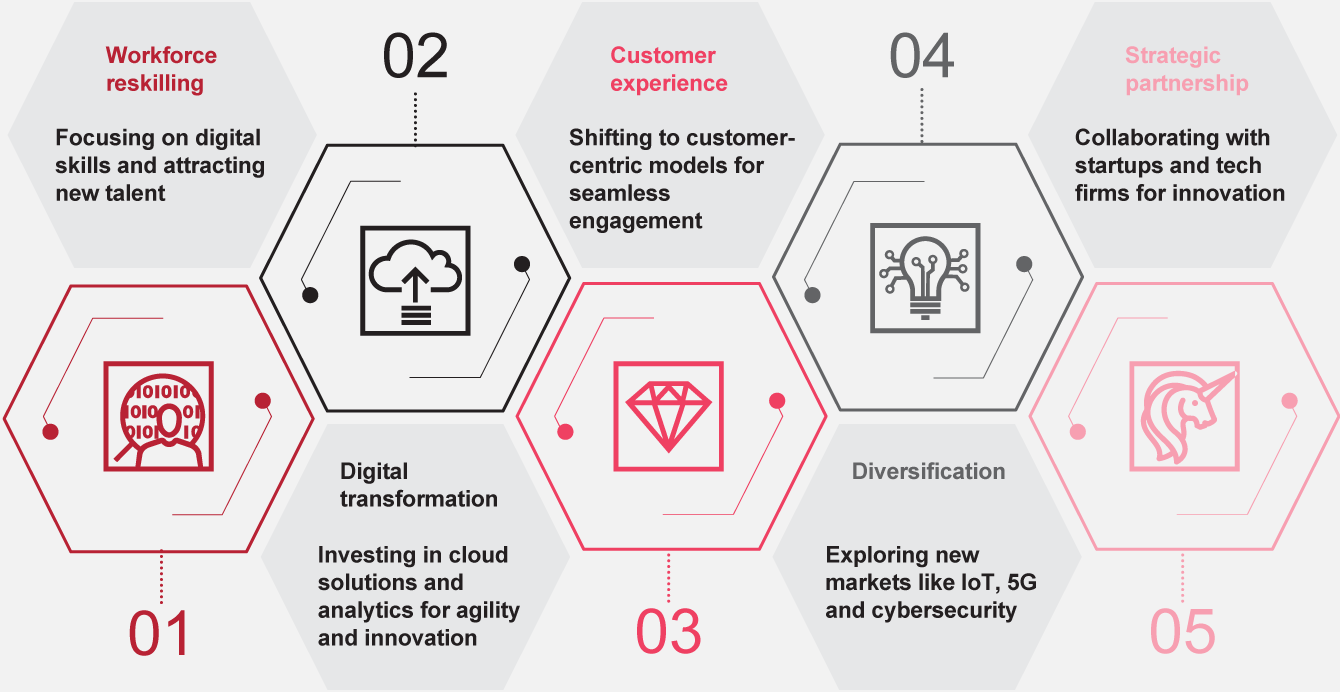

The European insurance industry is at a critical crossroads. The forces of disruption call for radical change, but navigating the path forward requires careful consideration. Insurers must embrace innovation, modernize operations, and invest in workforce development, all while ensuring their foundational stability.

To achieve sustained success in this dynamic environment, insurance leaders need to implement a transformation strategy that balances immediate operational improvements with long-term innovation. We believe the next three to five years will be crucial in determining which insurers can maintain this delicate equilibrium, positioning themselves as resilient and forward-thinking leaders in a transformed industry.

Kai Müller and Phillip Arendt have co-authored this report.

Accelerating insurance transformation

Methodology

Our survey included 19 insurers, intermediaries, and brokers with the aim to assess their readiness for impending transformation. We engaged with the top three players in the major insurance sectors, including primary insurers, reinsurers, and brokers, as well as local and regional leaders.