German insurers have pledged to reach carbon neutrality in their Scope 1 and 2 carbon emissions by 2025. If they are to meet this ambitious deadline, companies will need to make far-reaching changes in the way they operate, and one of the most important changes will be in their fleet and mobility strategies.

Vehicle fleets currently account for around 40,000 tonnes of CO2 emissions a year, around a quarter of German insurers’ overall Scope 1 and 2 emissions. Transitioning their fleets from internal combustion engines (ICEs) to battery electric vehicles (BEVs) will therefore be a key element of achieving carbon neutrality.

BEV performance is improving...

With 2025 fast approaching, insurers have no time to lose. But several important factors have recently moved in their favor, making this deadline much more achievable.

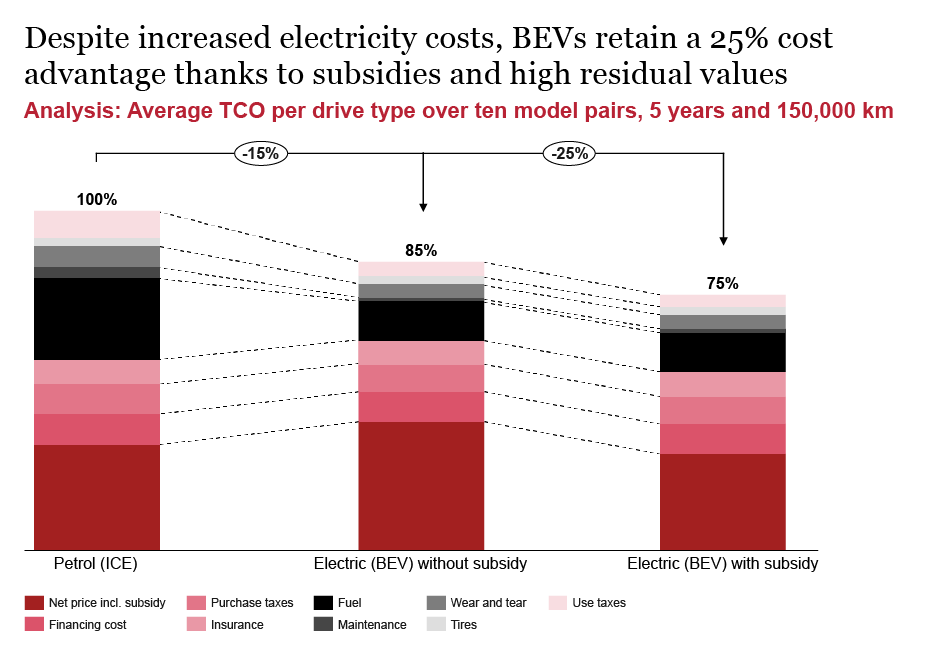

The choice of BEVs on the market has expanded significantly over the past year, while their performance in terms of range, battery life and charging times has improved to the point where they are directly competitive with traditional cars. In addition, BEV prices have fallen to the point where, even without the subsidies that lapsed in September 2023, they are 15 percent cheaper than internal combustion engines on a total cost of ownership (TCO) basis. And while last year, buyers were waiting a year for BEV deliveries, waiting times have now reduced significantly.

Insurers therefore are backed by a fair wind as they plan their fleet transformation. That is not to suggest, however, that transitioning to a BEV fleet will be plain sailing.

…however, multiple challenges remain

BEVs are still a new technology and will continue to evolve quickly, necessitating a willingness to adapt as the market develops. Likewise, energy markets can be expected to remain volatile, making major costs difficult to predict. Charging infrastructure that has not been holistically designed to reflect the differing needs of users – as well as potential shortages of charging points – creates further potential barriers to BEV adoption.

Within insurance companies, other issues must also be factored in. A mistrust of BEVs among some employees will need careful handling to ensure a smooth transition, although the growing choice of models and brands should help to overcome reluctance in some cases, at least.

Questions around the provision of adequate charging infrastructure both at insurers’ premises and at employees’ homes will require detailed planning. Driving behaviour differs significantly across insurance companies – executives are likely to be based mainly at headquarters and so require on-site charging points, while sales and claims teams spend much of their time on the road, sometimes driving long distances to remote locations. Both these groups must be confident that they will be able to access charging infrastructure that fits the way they work.

Many staff for whom driving is a key part of their role will also require home-charging points, which may bring with it legal and tax complexities for some individuals, depending on what type of house they live in. Companies need to be aware of the potential issues and take them into consideration.

So how should insurers approach the challenge of transitioning to a BEV fleet?

How to approach the switch

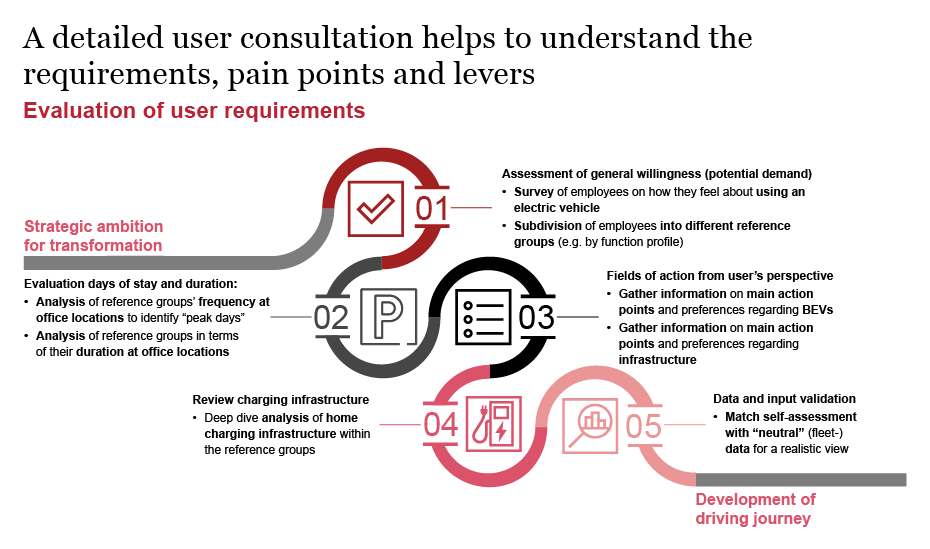

In the analysis phase, the key step will be to survey employees to gauge their appetite to switch to BEVs and gather accurate data on their typical patterns of vehicle use for work: how often they attend the office and on which days, and how much of their working week is spent “on the road”. Gathering information on employees’ needs and concerns, and their different usage patterns and typical mileage, will help companies better understand the mix of charging infrastructure they will need and how much of it should be at office locations or employees’ homes. Once this data has been validated, it can be used to match typical driving distances with range specifications for different BEVs.

Having gathered accurate data on the different driving patterns of key employee groups, insurers can develop a model to simulate the transition of their fleet. It should show their total cost of ownership during the BEV lifecycle, the emissions reductions they can expect to see as the shift to BEVs progresses, and the optimum timeline for completing the process.

It is important to recognize that successfully transforming the fleet to BEVs is a company-wide process. It will require the backing of top management and support from many departments, both to negotiate the practical complexities of executing the switch and to ensure that enough focus is given to the challenges of change management and effective, company-wide communication.

The four major success factors

We believe that four major success factors need to be in place for insurers to achieve the transition to BEVs and reach carbon neutrality by 2025:

- 1They should communicate clearly to employees the contribution to sustainability that the BEV transition will make – for example through a CO2 dashboard – and address common prejudices about BEVs with straightforward information

- 2They need to secure the active involvement of key user groups to better understand their concerns

- 3They should set up a voluntary pilot program to recruit BEV advocates among their workforce and test the new operational processes

- 4They should provide benefits for adopting BEVs, such as wall boxes for charging at home

Meeting society’s expectations

Germany’s insurers have set themselves an ambitious climate neutrality target that they will struggle to meet unless they embrace the need for fleet transformation and put in place practical strategies to achieve it.

However, they should also keep in mind their wider social responsibilities as insurers. Companies whose role is to anticipate and protect against harmful outcomes should welcome the opportunity to show that they are addressing climate change and the need to reduce CO2 emissions. Insurers have an opportunity to act as drivers of change and in doing so, help accelerate the overall uptake of BEVs, which will make a major contribution to reaching Germany’s climate commitments. Market conditions today make this an excellent time to forge ahead.

Tim Braasch, Heiko Seitz, Franziska Höhn, Fabian Müller, Jonas Meereis, Kai Müller, and Vincent Pursian co-authored this report.