The pivotal role of procurement in managing and reducing Scope 3 emissions

To achieve the goals of the 2015 Paris Agreement, almost 200 countries pledged to pursue efforts limiting the global temperature increase to 1.5°C. In this light, many companies have launched initiatives to manage and reduce their carbon footprint. However, while Scope 1 and Scope 2 emissions have been in focus for decision-makers, Scope 3 emissions have received limited attention, despite their large share in the overall emissions footprint for most industries.

By recognizing the importance of Scope 3 emissions in procurement and taking action to reduce them, companies can not only contribute to global climate goals but also reap various benefits, including enhanced reputation, cost savings, revenue opportunities, and improved access to financing options.

This study underscores the pivotal role of procurement in managing and reducing Scope 3 emissions, which often constitute up to 80% of a company's carbon footprint. By harnessing innovative approaches and engaging strategic supplier partnerships, companies can accelerate progress towards net-zero goals and drive meaningful change in combating climate change.

Advantages of addressing Scope 3 emissions

The current state of upstream Scope 3 management in procurement organizations

The study analyzed seven sub-dimensions within value creation and target operating model, delving into the areas of priority-setting, baselining and analytics, reduction and abatement efforts, organization and team, process integration, governance, and capabilities. The findings reveal that the current state of Scope 3 emissions management in procurement organizations is still in its early stages. Among the sample companies, most rank in the lower-mid section of the scoring spectrum, tending towards the bottom end.

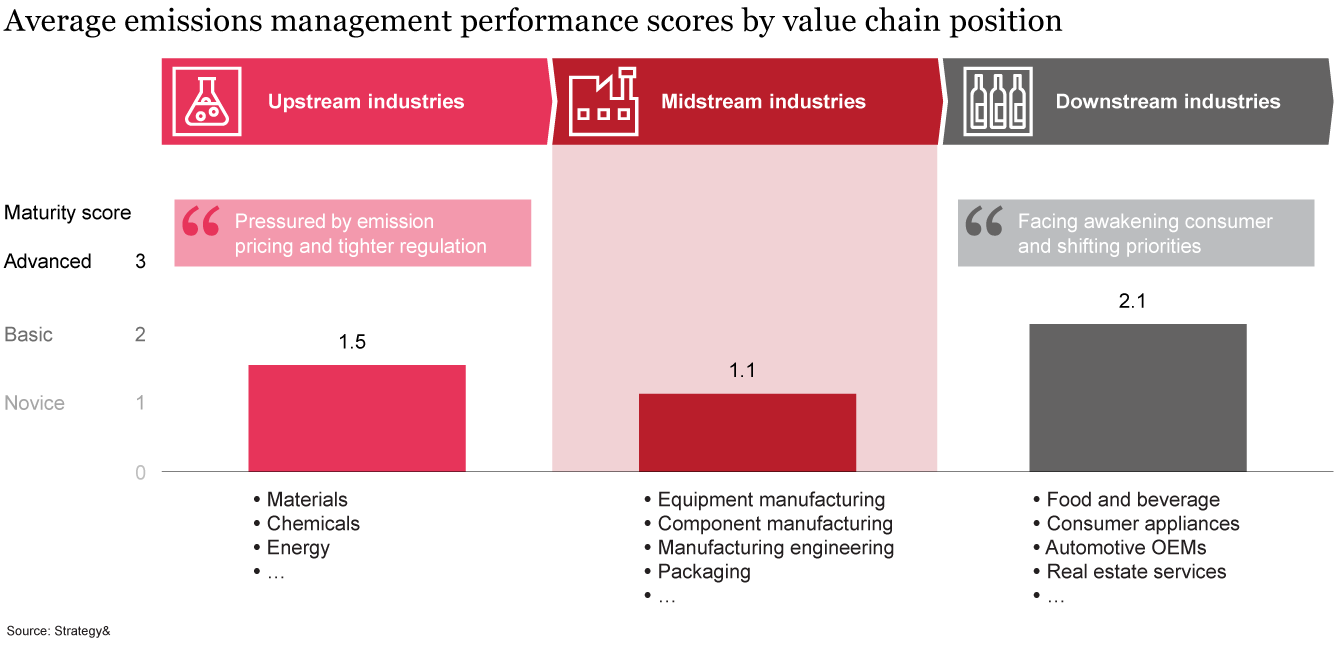

Despite the generally low decarbonization maturity scores of the companies interviewed, noticeable differences in progress could be observed depending on the companies’ positions in the value chain. In general, we clustered the industries into three buckets: Upstream (mainly related to materials and/or energies), Midstream (related to manufacturing/engineering with B2B focus), and Downstream (mainly automotive, consumer products and services with B2C focus).

Overall, we observed that midstream companies were the least advanced in terms of procurement decarbonization, compared to up- and downstream companies. We hypothesize that these companies face comparatively few financial pressures currently due to emissions in their supply chain, compared to upstream or downstream companies.

While companies in the upstream sector are increasingly feeling the pressure of emissions pricing, the continuously-growing shift in consumer requirements and preferences towards ESG-friendly products is exerting pressure on downstream companies to decarbonize their supply chain to differentiate. However, as this pressure is being passed along the value chain from their supplier/customer industries, midstream companies will also have to catch up on progress in supply chain decarbonization.

Start your journey to emissions management in procurement

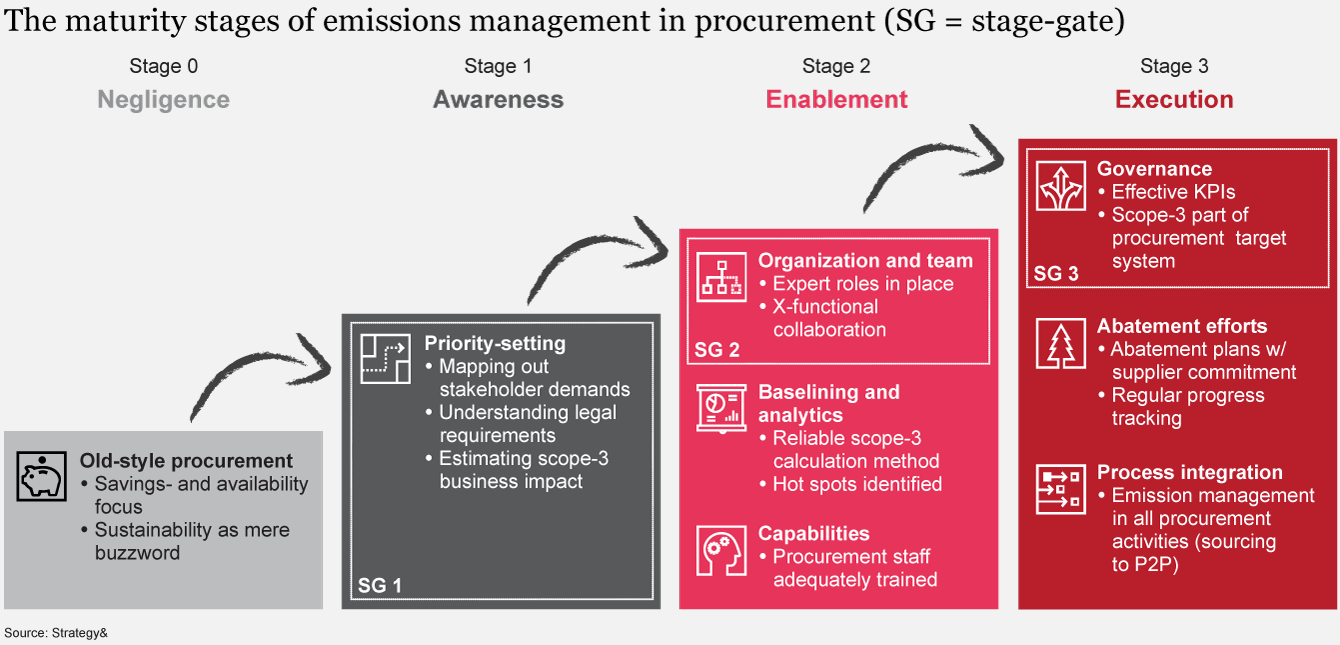

Emissions management in procurement can be clustered into three consecutive stages – awareness, enablement, and execution – with a natural pre-stage that we refer to as negligence. The negligence stage is populated by companies that are yet to develop a thorough understanding of the topic as a foundation for further progression. Priority-setting can therefore be seen as the first of three stage-gates pivotal to mastering emissions management in procurement.

Of the sub-dimensions in the enablement phase, organization and team can also be seen as a stage-gate, as it scores highly among the enablement sub-categories and correlates with them at over 75%.

Governance is the third stage-gate, being the recommended entry point into the execution stage. Analogously to organization and team, governance scores highly with almost 80%. By making the operational efforts measurable and allowing emissions performance to be actively steered, governance can greatly boost the effectiveness of companies’ Scope 3 action plans. This can happen, for example, by attaching monetary incentives or rewards to emissions reductions or by implementing “comply or explain” clauses that require buyers to justify above-target carbon expenditure.

Although progressing through the four stages of carbon management maturity may seem straightforward, with three concrete stage-gates, we observed that most of the companies interviewed were still at the negligence or awareness stages.

Strategic levers and overcoming conflicting targets for Scope 3 emissions reduction

To make the most of the untapped potential of Scope 3 for procurement, companies need to consider establishing a comprehensive emissions reduction plan. This entails creating transparency on their respective carbon footprint, screening and identifying carbon emission hotspots, and conducting detailed footprint modeling for hotspots. Companies should therefore firstly identify and prioritize their decarbonization lever. From our perspective, there are six levers of special interest that are either driven or fostered by procurement:

1. Supplier engagement and collaboration

(Reduction potential: 5 - 25%)

2. Supplier selection and evaluation

(Reduction potential: 10 - 30%)

3. Transportation and logistics optimization

(Reduction potential: up to 50%)

4. Energy mix

(Reduction potential: up to 75%)

5. Energy and resource efficiency

(Reduction potential: 20 - 30%)

6. Product and service design

(Reduction potential: 15 - 50%)

Depending on supplier characteristics and hotspots, different strategies can be utilized to collaborate for emissions reduction:

- 1Empowering suppliers for net zero: Unleashing the potential of top direct and indirect suppliers in emissions reduction

- 2Raising the bar: Collective ambition to drive net zero targets with key suppliers

- 3Leading the way: Collaborating with utility and logistics suppliers for renewable and green fleet initiatives

Today, CPOs are tasked with navigating the intricate interplay between cost, CO2 emissions, and supply resilience. Prioritizing diligently along these three dimensions is imperative to ensure sustainable and resilient procurement practices. By embracing this approach, companies not only bolster their bottom line but also contribute meaningfully to sustainability targets and ensure the long-term viability of the supply chain.

Christian Brand and Lorenz Reschen also contributed to this report