The term "human microbiome" refers to the trillions of bacteria and their genomes in the human body, predominantly prevalent in the gastrointestinal system and on the skin. Microorganisms have a role in almost every biological system, for instance, in supporting metabolic functions, warding off pathogens, and interacting with the immune system.i

Various disorders can be caused by imbalances in the microbiome, called dysbiosis, which can be brought on by factors including viruses, antibiotics and unhealthy diets. Hence, microbiome-based treatments have the potential to treat a wide range of symptoms, with mounting evidence that focusing on and modifying the microbiome could enhance human health and treat more than 25 conditions across different therapeutic areas. These include infectious diseases, especially Clostridioides difficile infections, and autoimmune diseases such as Inflammatory bowel disease (IBD), Ulcerative colitis and Crohn’s disease, and even cancer.ii

In recent years microbiome-based therapeutics, also referred to as microbiome modulators, have made rapid advances, with several promising candidates moving forward through the clinical pipeline. Two breakthrough approvals in the past twelve months have been Seres Therapeutics’ Rebyota®, which got the green light from the US Food and Drug Administration (FDA) in November 2022, and Ferring Pharmaceuticals’ VOWST™, which was approved in April 2023. Both products promise to offer safe and effective treatments for patients with recurrent Clostridioides difficile infection (rCDI), which in the US alone is a $1bn market.

In this rapidly evolving landscape, pharma and life sciences (PLS) companies and investors need to know answers to four key questions regarding microbiome-based therapeutics, which we analyze below:

- 1What is the potential market opportunity for microbiome-based therapeutics?

- 2How advanced are therapeutic approaches and which players are driving development?

- 3What are the remaining challenges?

- 4Who could potentially accelerate development?

What is the potential market opportunity for microbiome-based therapeutics?

The commercial market for microbiome-based treatments is still at an early stage, with widely varying assessments of its global value. Strategic Market Research estimates that the prescription-based market was only worth $115 million in 2021, but forecasts that it will reach $1.3bn by 2030. Another report from Research and Markets predicts that the worldwide microbiome market will increase from $390 million in 2022 to $570 million by the end of 2023.iii

Despite these variations, all market size estimates for microbiome-based therapeutics are rather small compared with other major therapeutics markets such as oncology. However, such estimates usually do not consider the potential for microbiome-based therapeutics to replace conventional therapeutics in healthcare. This is a likely scenario given the breadth of potential use, and we expect microbiome-based prescription products to be a global multi-billion-dollar market by 2030.

These products have a far longer history focused on more consumer-oriented products such as probiotic supplements for gut health, which dominate the sector. The market is still substantially larger than for prescription-based products and more mature, as indicated by a more moderate forecast growth. For example, one estimate predicts the market will increase by a compound annual growth rate (CAGR) of 6.4 percent in the next four years to be worth $85.4bn by 2027.iv

How advanced are therapeutic approaches and which players are driving development?

The earliest reported basic research on using bacteria to treat disease was in 1891, when William Coley, a surgical oncologist at New York City’s Hospital for Special Surgery developed a mixture containing toxins filtered from the dead bacteria of Streptococcus pyogenes and Serratia marcescens to treat cancer.vi However, it was not until the late 20th century that the rise of sequencing technologies and synthetic biology intensified systematic microbiome research.

Between 2007 and 2012, the EU-funded Metagenomics of the Human Intestinal Tract (MetaHIT) program marked a new stage in collaborative research, involving 15 institutes from eight countries. The program explored the genetic potential of human microbial companions and their impact on health and wellbeing, significantly increasing our understanding of the human microbiome importance way beyond the digestive system.vii

Drawing on these insights and advances in modern synthetic biology, researchers have been able to create microbial strains with unique and complex characteristics. These include altered metabolic pathways and new capabilities such as secretion of specific compounds, for example (see below).viii

How advanced are therapeutic approaches?

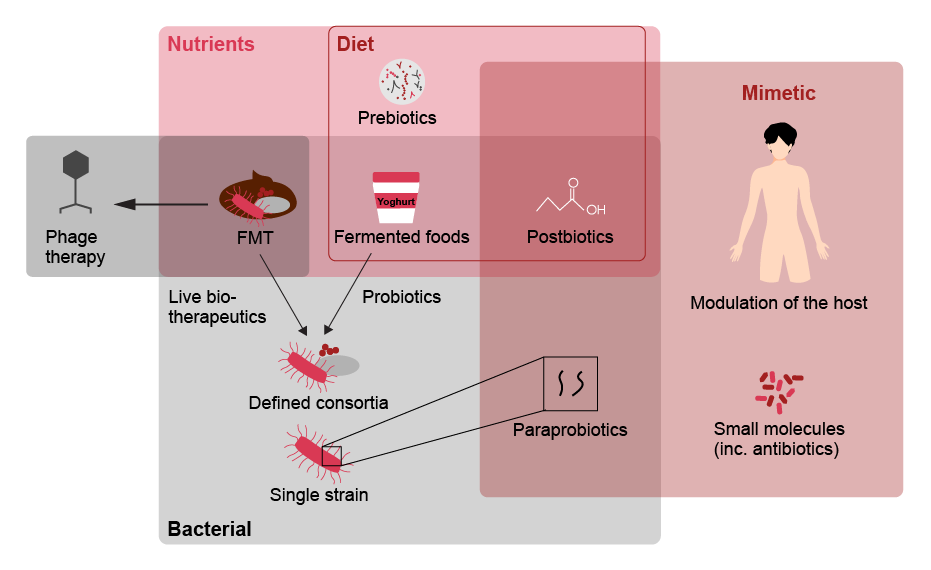

| Therapeutic | Advantages | Disadvantages | Future directions/ implications | |

|---|---|---|---|---|

| Probiotics | Live microorganisms which, when administered in adequate amounts, confer a health benefit on the host |

|

|

Efficacious following antibiotics and in the prevention of NEC. Potential as non-specific treatments to increase bacterial diversity |

| Synbiotics | Probiotics that are synergistically combined with prebiotics (components in food supporting beneficial bacteria) |

|

|

Efficacious in the treatment of metabolic diseases. Further combinations should be explored for the treatment of other diseases |

| Antibiotics | Substances that destroy or slow down growth of bacteria |

|

|

Examination for use in targeted microbiome manipulation; however, caution is required to avoid off-tar-get, adverse effects |

| Phage therapy | Viruses that exclusively infect bacterial cells |

|

|

Examination for use in altering microbiome structure due to their highly specific nature |

| FMT | FMT (faecal microbiota transplantation) can restore bacterial diversity and health-associated functions such as colonization resistance by introducing a faecal-associated microbiota from a healthy individual |

|

|

Further work is required to determine causality in FMT treatment. This will allow for FMT to be considered for the treatment of other diseases |

| Live biotherapeutics | Live organisms (such as bacteria) that are applicable to prevention, treatment or cure of a disease |

|

|

Determination of causality required to allow for developement |

| Microbiome mimetics | Microbiome mimetics describes any intervention that replicates the interaction between the microbiome and the host, that yields a therapeutically beneficial outcome. This can include bacterial derived products, small molecules, conventional therapeutics or host derived products |

|

|

More research required to identify candidates as mimetics and mechanisms of delivery, including diet, should be explored |

Fecal microbiota transplantation (FMT) and live biotherapeutics are currently attracting the most attention of pharma companies in the prescription-based market. Besides the two recent breakthrough approvals mentioned above, we see promising opportunities in advanced FMT assets in ongoing Phase III clinical trials conducted by MaaT Pharma for the treatment of Graft-versus-host disease and by Mikrobiomik Healthcare for the treatment of Clostridioides difficile infections, for instance. Advanced live biotherapeutics in Phase III clinical trials include therapeutics targeting conditions such as Hyperoxaluria (OxThera) and chronic renal failure (Kibow Pharmaceuticals).ix

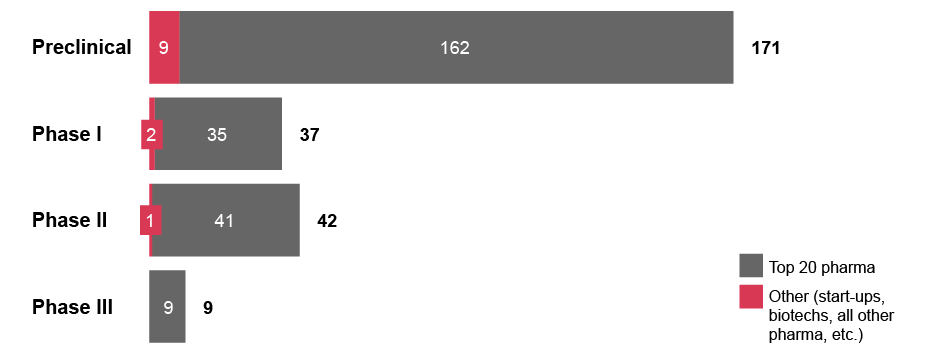

Currently, microbiome R&D is driven by small and medium-sized companies. Among the more than 100 companies actively developing a total of 243 microbiome modulator candidates as of August 2023, only five top 20 pharma companies are represented.x Furthermore, looking at investment deals for microbiome assets since 2015, start-ups and biotechs have been the technological originators in 56 percent of the cases, with Big Pharma only accounting for 3 percent.xi

Exhibit 3: Number of microbiome-based therapeutics candidates at each clinical stage

What are the remaining challenges?

We believe the following challenges demand the most urgent attention:

-

Evidence generation

Microbiome therapeutics do not have the same pharmacokinetic profile as conventional “non-living” therapeutics.xii In addition, each individual’s microbiome has unique characteristics due to several factors such as genetics and differences in diet. Academic and clinical studies must account for this to ensure that they are representative of large patient populations and generate sufficiently reliable data to meet robust safety and efficacy standards.xiii

-

Technology for R&D and manufacturing

R&D in microbiome therapeutics relies heavily on both sequencing and bioinformatics capabilities to generate genetically modified microbes with therapeutic characteristics, but it is still rare to find companies that are good in both areas.xiv On the production side, manufacturing and quality control processes require specialized expertise and infrastructure that most contract development and manufacturing organizations (CDMOs) do not yet have to a sufficient degree, and therefore struggle to maintain the microorganism’s viability throughout the entire manufacturing process.xv

-

Local regulatory challenges

The contrast between national regulators in the EU, which individually decide if microbiome-based therapies should be classified as a drug or not, and the US FDA, which narrowly defines them as drugs, has created uncertainty for PLS companies and investors, especially in Europe. However, a recently proposed EU directive for medicinal products covering microbiome-based therapies, which was proposed in April 2023, may bring more clarity. If passed, it could encourage more marketing approvals for microbiome-based therapies in the EU, and by extension in other non-member European countries such as the UK and Switzerland.xvi

-

Need for stakeholder education

The rapid pace of innovation in microbiome-based therapies means stakeholders, from healthcare providers and regulators to investors and patients, often do not fully understand the nuances of different approaches. PLS companies should educate their target customers and clearly convey a therapy’s mechanism of action (MoA) and value proposition to encourage its adoption and realize its full market potential.xvii

To overcome these challenges, carefully designed, large-scale clinical trials that generate robust, objective data on patient outcomes, combined with an increasing body of real-world evidence, will likely help convince stakeholders about a therapy’s efficacy and encourage regulatory clarity and consistency across markets. In addition, the proliferation of microbiome R&D partnerships between industry, academic institutions and governments can help continue to boost both specialist knowledge and public awareness about microbiome-based therapies.

Who could potentially accelerate development?

Looking ahead, we expect Big Pharma to play an increasingly important role in bringing microbiome-based therapies to the market, by leveraging their experience and resources in clinical studies, regulatory and market access, and commercialization. A few years ago, Big Pharma started to move into this space with a series of partnering deals.xviii For example, in 2014 Pfizer partnered with the San Francisco startup Second Genome to use its microbiome discovery platform to look for disease triggers and possible therapies.xix In 2020 Boehringer Ingelheim entered its first collaboration with BiomX, focusing on identifying biomarkers associated with patient phenotypes in IBD.xx

However, since 2020 leading pharmaceutical companies have become more cautious about deal-making after several failed clinical programs.xxi In 2021, for example, Seres Therapeutics’ microbiome-based candidate SER-287 failed to improve outcomes in a phase II trial in ulcerative colitis. This setback raised questions about the use of consortia of bacteria for conditions other than recurrent Clostridioides difficile infection, casting a shadow over the emerging field.

A number of more recent deals show that Big Pharma’s interest in collaborations with start-ups and biotechs has refreshed. Boehringer Ingelheim has expanded its IBD partnership with BiomX,xxii while Merck (MSD) has partnered with Korean Genome & Co for a Phase II trial combination therapy for biliary tract cancer.xxiii However, most of these deals are backloaded, with the largest share of payments assigned to the later stages of collaboration in the event of successful commercialization.xxiv

Meanwhile, venture capital (VC) and private equity (PE) funds could provide additional funding to support innovation at start-up and biotech level. The number of VC or PE-backed human microbiome deals is still relatively modest, with most funding rounds at the seed or early stage. In 2022, for example, there were 43 VC-backed deals with a total value of $321 million. North America and Europe are the biggest regions for microbiome funding rounds, although there is an increasing number in the Asia-Pacific region.xxv

Microbiome modulator firms are slowly winning over investors as robust clinical data surfaces, with one company, Microbiotica, recently hitting the record for the largest microbiome-related financing in Europe.xxvi Co-led by Flerie Invest and Tencent, the UK-based company raised $67 million in a Series B round in 2022. Microbiotica utilizes a proprietary platform technology to discover and develop live bacterial therapeutics and biomarkers from clinical datasets and has a portfolio of programs in IBD, Immuno-oncology and Gut Epithelial Repair. The funds will be used to develop its two lead candidates through Phase Ib studies starting this year.xxvii

Conclusion

Collaboration is the key to realizing the full market potential of microbiome-based therapeutics

As we have noted, advances in sequencing technologies and synthetic biology in recent decades have transformed the human microbiome R&D landscape and the view on their immense therapeutic potential. At the same time, increasingly health-conscious consumers provide a vast potential market for a widening range of clinically approved microbiome-based therapies and over-the-counter products for diseases and conditions that extend well beyond the digestive system.

So far, the missing link in this field has been optimal collaboration between Big Pharma, startups and biotechs and investors. There are still significant hurdles to overcome, but as research on the human microbiome gains ever-greater momentum, and viable clinical pipelines emerge, the risks of steering clear of the market are also increasing for all these players. Now is the time to address the remaining challenges and reap the commercial rewards of further breakthroughs in microbiome research in the next few years.

Dr. Malte Kremer, former Partner, and Edward Hamer, former Director at Strategy& Germany, as well as Sebastian Kwisda, former Manager at Strategy& Switzerland, also contributed to this article.