The relevance of contingency plans for pharma companies

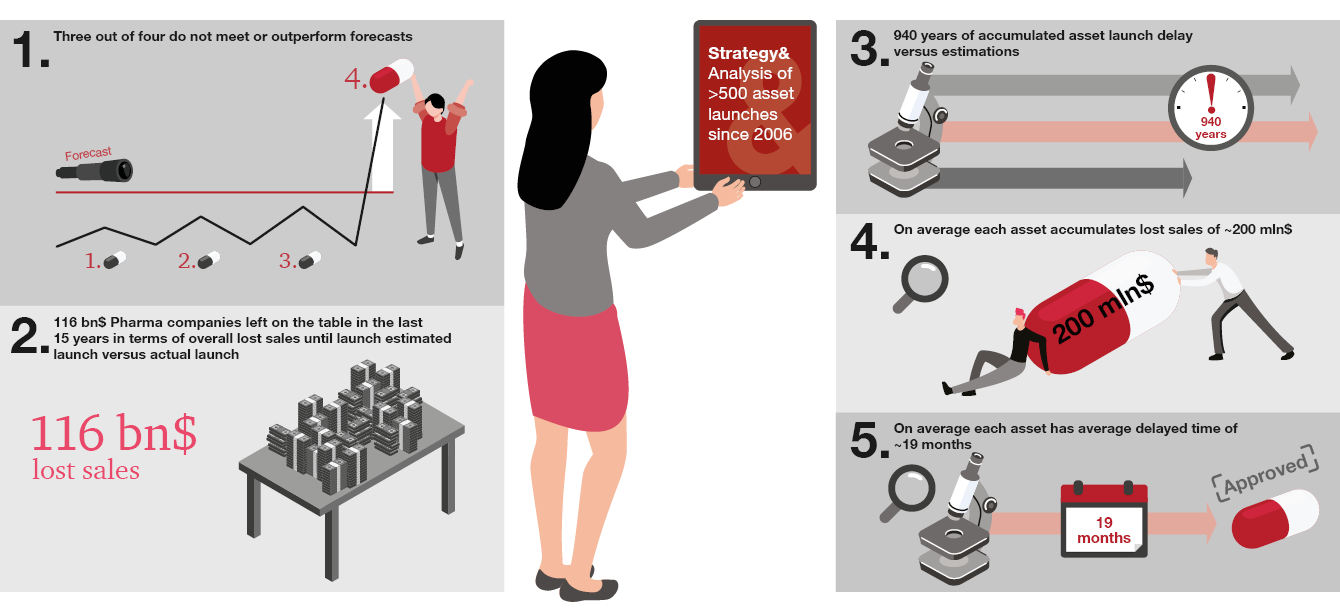

With the ever-increasing complexity of clinical development and market dynamics, more pharma companies are under-achieving against commercialization timelines and commercial expectations, leaving significant value on the table. Our analysis of new molecular entity (NME) launches over the past two decades shows that 75% failed to meet launch expectations. They missed the targeted launch dates by an average of 19 months per asset and underperformed at a rate of around $200 million per asset versus market expectations. This suggests significant room for improvement.

One major contributor to underperformance is companies’ restricted ability to react in a timely manner to change. The need to balance multiple launch programs simultaneously is leaving R&D, franchise, and therapeutic area leaders with limited bandwidth for contingency planning. Too often, companies have little in the way of alternatives to Plan A for their pipeline assets. Despite having identified different scenarios and associated forecasts, current models of contingency planning are typically insufficient to enable companies to switch gear easily when needed.

To minimize delays and maximize revenue potential, companies need to allocate time and dedicated budgets to mapping out alternative development routes and implementing well-structured contingency plans, affording them vital agility. To scope the challenge facing PharmaCos, we conducted a deeper quantitative analysis of launch activity over the past 15 years and have developed a new and more structured approach to developing differentiated assets within the anticipated timelines, on a consistent basis.

The growing complexity of clinical development

For a long time, the pharmaceutical market and therefore clinical development was almost exclusively driven by large multinational pharma companies (PharmaCos) focusing on large and lucrative therapeutic areas. The ability to demonstrate a benefit in a particular therapeutic or disease area (TA or DA) was relatively easy, as standardized treatment plans typically had not been established. In this context, clinical development required less focus on external events, execution being the biggest lever of success.

Over recent decades the market environment has changed, with the result that optimal planning during clinical development has become significantly more important as a lever for success. Now, large disease areas have established Standards of Care (SoCs), challenging pharma R&D teams to demonstrate more than an incremental benefit for each new product seeking authorization.

This in turn has demanded more significant innovation. Many companies have moved to rarer, or even orphan diseases, with less competition, where it is easier to differentiate and justify the need for new products. In the meantime, regulatory changes and increasing market access complexity have made successful clinical development and therefore successful commercialization a more challenging and costly endeavor.

Simultaneously, the pressure on healthcare expenditure has created new challenges around price negotiations.

In this increasingly dynamic environment, with a plethora of additional internal and external influences on success, planning beyond the base-case scenario is becoming paramount to maximize an asset’s TPP.

Up to now, many companies have struggled to achieve this for a number of reasons:

Internal influences

- Increasing pressure on R&D budgets

- A higher number of more complex, parallel programs

External influences

- Higher price and value scrutiny

- Increased competition and established treatment paradigms

Analysis of launch successes and opportunities for improvement

To scope the challenge facing PharmaCos, we conducted a deeper quantitative analysis of launch activity over the past two to three decades.

Each product is unique, so the reasons for delays in commercialization or for launches underperforming will vary from case to case. However, our analysis reveals that most PharmaCos lack institutionalized contingency-planning processes during clinical development and commercialization preparation, and that this is contributing significantly to their outcomes. To navigate the complexity of future asset development, PharmaCos need to rethink contingency planning during clinical development – and include a new and more structured approach to developing differentiated assets within the anticipated timelines, on a consistent basis.

Contingency Planning 2.0

Contingency Planning 2.0 is the next generation of contingency planning, designed to holistically de-risk development and optimize choices beyond clinical development. It differs from current practices in five main ways – specifically, it ...

- 1… involves rethinking clinical development entirely, with an assessment of potential organizational biases toward upside or base case TPPs before moving to the asset level

- 2… starts with initial planning of the asset development before or at the latest during Phase I, when the initial clinical development plan is outlined

- 3… is strongly connected to key resource, governance, and financial planning processes

- 4… requires organizations to move into continuous monitoring of internal and external influences, enabling a stronger and earlier commercial presence to be leveraged, as well as differentiated competitive intelligence capabilities

- 5… and demands that asset teams set up new roles and responsibilities, so people are included early in the development process to reduce the gap between the scientific and commercial perspective of a new asset’s potential

Conclusion

With the increasing pressure on R&D budgets, structured and integrated contingency planning can systematically optimize protection against an asset’s downside position, or at least help PharmaCos to understand which assets should fail fast due to market developments. Contingency Planning 2.0 is therefore a must-have for PharmaCos looking to improve their R&D productivity in the future.

Sebastian Kwisda, former Manager at Strategy& Switzerland, also contributed to this article.