Battery-electric trucks on the rise

Our biennial report provides a comprehensive analysis of the global truck market's shift toward electrification. This year's findings reveal that regulatory mandates, such as EU requirements for truck OEMs to reduce new fleet emissions by 45% by 2030 and 90% by 2040, are driving this transition. In response, OEMs have introduced initial generations of battery-electric truck (BET) products, initially based on passenger car technology, enabling the first pilot use cases.

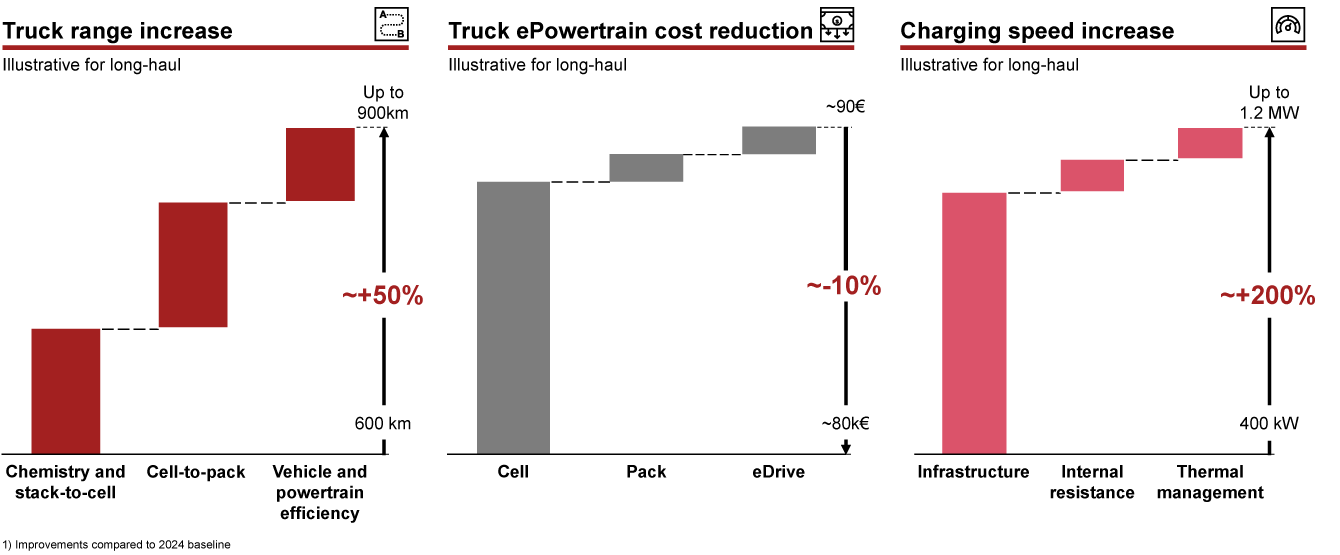

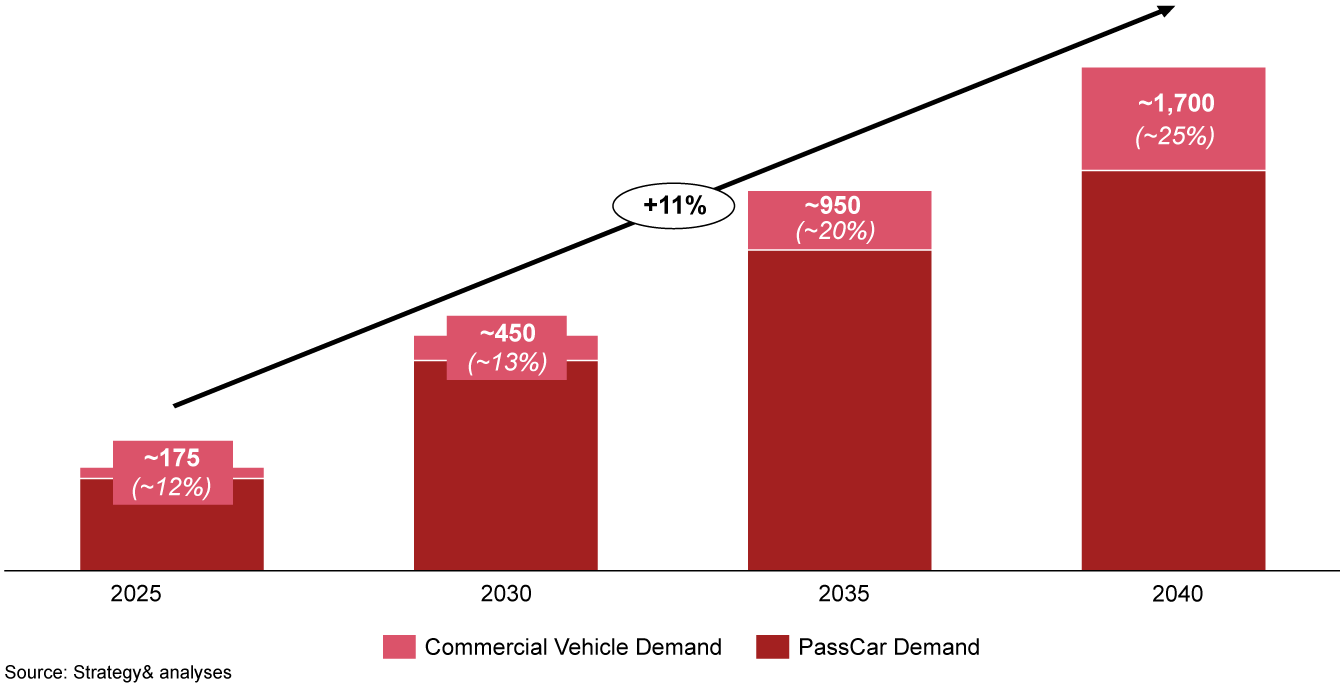

Further truck electrification requires new platforms meeting varying customer requirements and use cases. Innovations in battery and cell chemistry, eDrive systems, and high-voltage architecture use cases are making truck-specific advancements critical market differentiators. While higher initial investments are a challenge, the total cost of ownership (TCO) clearly pushes towards electrification. By 2030, we expect that more than 20% of transportation will be electrified. Looking further ahead to 2040, truck batteries will require over 1,700 GWh, with lithium iron phosphate (LFP) technology becoming increasingly important.

The electrification of logistics and transportation requires substantial investments in both public and private infrastructure and updated operating models. To make the BET transition a success, cross-industry efforts are required – from regulatory, via automotive and energy towards logistics facilitated by financial services.

Full battery-electric truck portfolio enablement requires further truckification

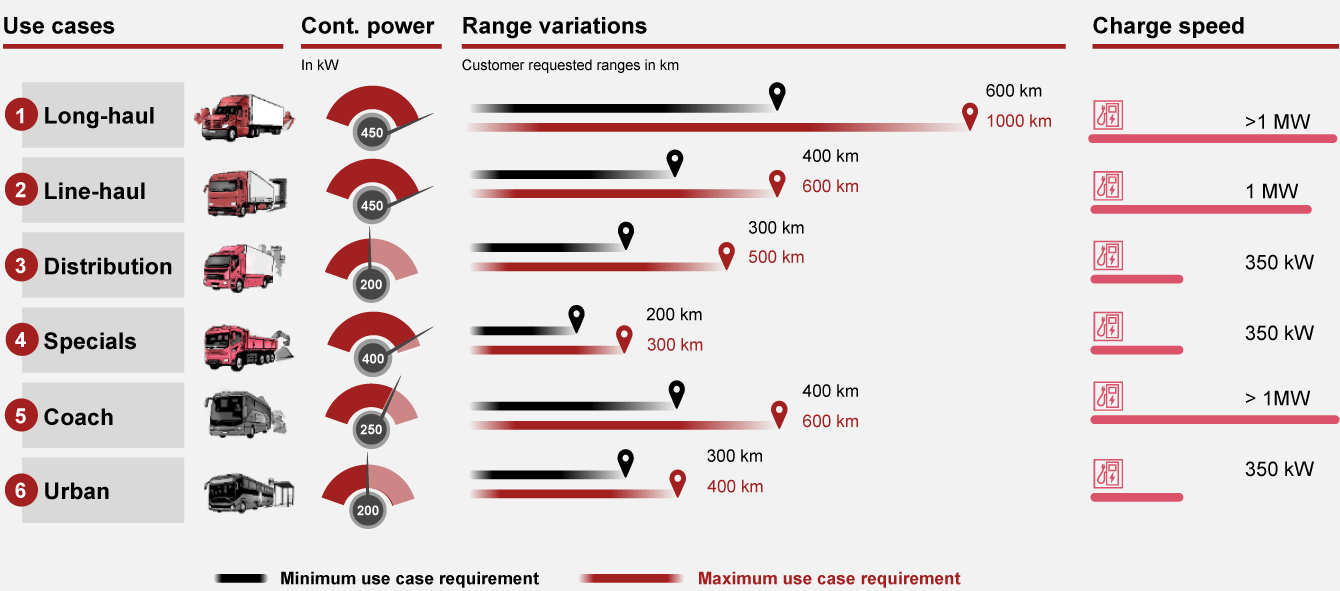

The global truck market can be segmented into six primary use cases, with long-haul, line-haul, and distribution having the highest emission impact. To meet diverse customer needs, both standard and long-range variations will be necessary across these platforms.

Battery-electric trucks are set to offer substantial total cost of ownership benefits

While higher initial investments in BETs pose a challenge, the total cost of ownership (TCO) clearly pushes towards electrification. The primary cost driver remains the battery cell, making BET investments higher than those for conventional internal combustion engine (ICE) powertrains. To become economically viable, managing TCO and depreciation costs is crucial.

From 2025 and beyond, BETs are expected to offer TCO advantages across various use cases, especially for mileage- and payload-sensitive applications. Competitive energy and charging costs will be essential to realizing these benefits. BET efficiency and optimal utilization of charging infrastructure are key factors driving TCO.

Charging prices significantly impact BET TCO. While baseline electricity costs show moderate variance, infrastructure markups can vary widely depending on the charging technology and its utilization. Therefore, efficient BET operation and strategic use of charging infrastructure are critical to maximizing TCO advantages.

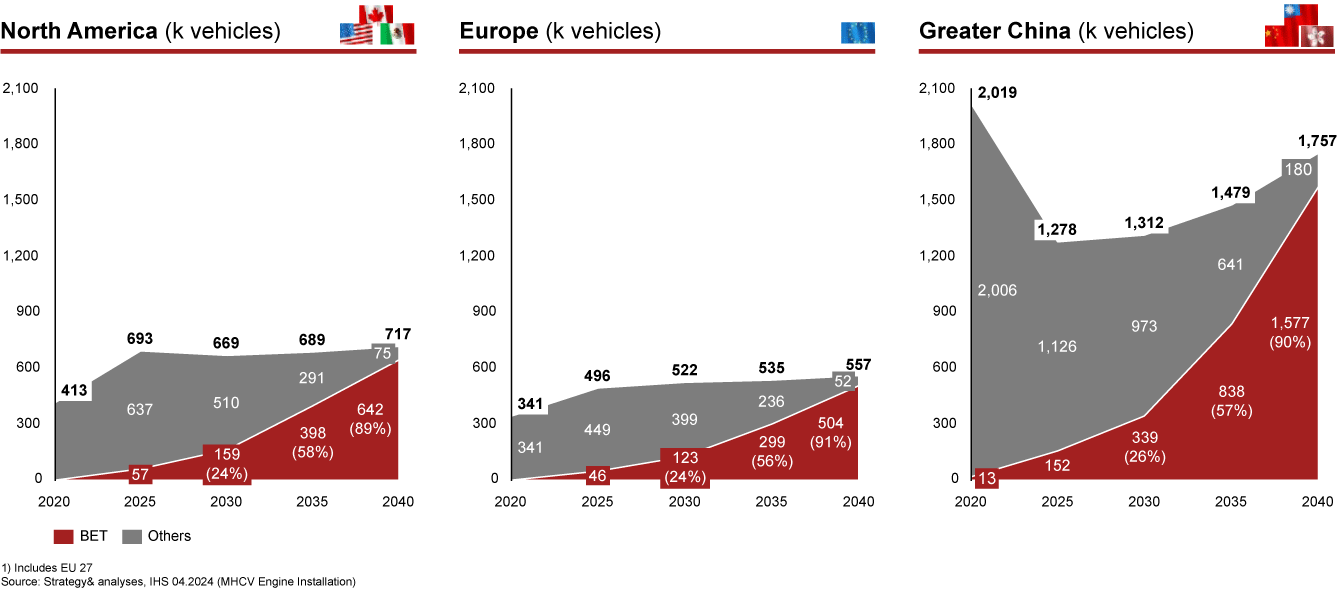

Electric truck market poised for tipping point by 2030

Strengthened CO2 regulations and favorable total cost of ownership across regions and use cases will accelerate electrification. Key drivers of this shift include energy costs and decarbonization efforts. By 2030, over 20% of transportation is expected to be electrified, driven by the adoption of heavy-duty vehicles and urban buses. By 2040, BETs are projected to dominate the market with a 90% share.

Global BET battery demand is forecasted to surpass 400 GWh by 2030 and exceed 1,700 GWh by 2040, with increasing importance placed on lithium iron phosphate (LFP) technology. By 2030, battery and cell demand for BETs will reach 450 GWh, constituting about 13% of the market share, which will rise to 25% by 2040. This surge will drive truck-specific battery development and production.

Recommendations to making truck electrification real

- 1Develop new financing models: To accelerate electrification, innovative financing models are essential. A collaborative effort involving OEMs, suppliers, and logistics providers will be crucial.

- 2Ensure regulatory stability: Facilitate the transition with a clear regulatory framework that supports strategic long-term planning. This stability will encourage investments in infrastructure and fleet transformation.

- 3Promote leasing over purchasing: Reduce the investment barrier for new trucks by offering competitive leasing options. Improved understanding of battery aging and second-life/end-of-life opportunities can help manage risk premiums in leasing contracts.

- 4Build and invest in the necessary infrastructure: Both public and depot infrastructure need significant development. To enable sufficient utilization of infrastructure equipment, optimized logistics operations are pivotal.