Limiting climate change with clean hydrogen?

Clean hydrogen is widely acknowledged as the solution to reduce carbon emissions in difficult sectors, including steel production, the chemical industry and long-haul truck transportation, as well as a feedstock for PtL fuels for aviation and shipping. For this reason, clean hydrogen has been given a significant role in national and regional strategies to limit climate change. Despite these ambitions, globally the market remains in its very early stages and progress has been – with a few exceptions – quite slow.

In this report, we offer a detailed analysis of the clean hydrogen market in seven regions: Europe, Australia, North Africa, China, the Middle East, Latin America and North America. For each, we assess the progress made to date on clean hydrogen projects, and what needs to happen to increase the pace of development. Additionally, we set out how each of the ecosystem players can act in a consistent joint effort to build a well-functioning clean hydrogen market that will contribute to decarbonizing the global economy at the speed required.

Global clean hydrogen market dynamics

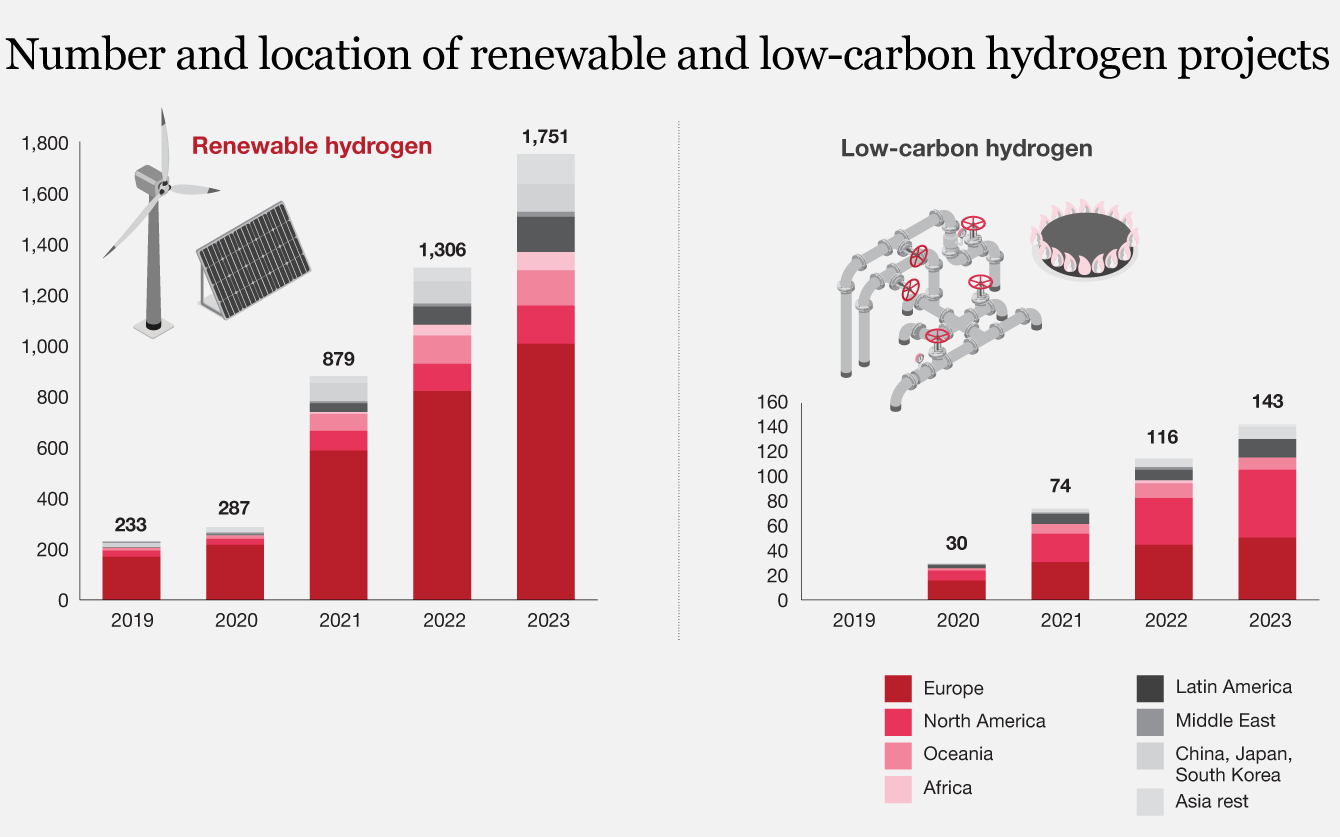

The number of low-carbon and renewable hydrogen projects announced worldwide is rising steadily, with more than 1,400 new production projects announced between 2020 and 2023. When it comes to renewable hydrogen, produced using renewable electricity to split water into oxygen and clean hydrogen, Europe continues to dominate – with more than half of the world’s known renewable hydrogen projects located there.

Looking at low-carbon hydrogen – produced using methods including carbon capture and storage (CCS) technology to reduce emissions created in the process of producing clean hydrogen from natural gas – North America took the lead by the number of projects announced in 2023. When looking at renewable hydrogen capacity rather than numbers of projects alone, Europe leads with the largest announced capacity until 2023 (200 GW) followed by Africa (170 GW) and Oceania (130 GW). However, it is important to note that ‘announced’ is not the same as built, and risks remain that these projects will never be completed.

In the future, around 100 million tons of clean hydrogen will be needed globally by 2030 to meet the Paris climate targets. By 2050, the global economy will need 500 million tons of hydrogen every year to meet these targets. This will likely involve using some low-carbon hydrogen because of its reliability and cost-effectiveness.

Currently, only around 1 GW of electrolyzer capacity is operational globally. This is only enough to produce around 80,000 tons of renewable hydrogen if enough renewable power is accessible. To increase this towards 500 million tons by 2050, there is no time to lose in building up production capacity worldwide.

Required actions

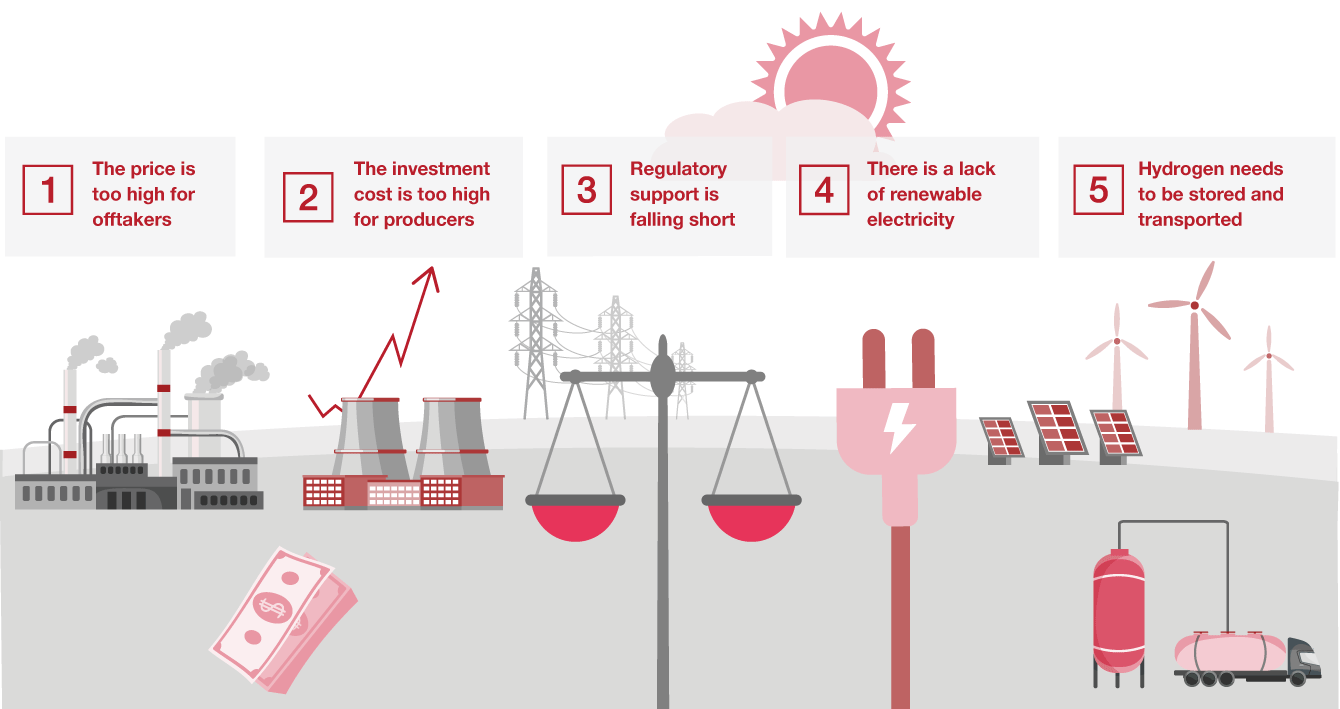

Several obstacles are hindering the development of a thriving global clean hydrogen market. These obstacles include cost, regulations, renewable energy availability, and storage and transportation issues.

As a result, regions and countries are finding it challenging to fulfill their climate goals. The scale of these challenges can only be overcome by joint industry efforts and all ecosystem players pulling in the same direction. The following actions have been identified for each group:

To provide a stable foundation for the high levels of investment needed in clean hydrogen production, regulators around the world must establish clear and supportive regulatory frameworks. That will include setting clear targets and standards, and not holding back production with sometimes overly detailed regulation that further complicates technologies and processes.

With the support of clear regulation and sufficient financial incentives, improving cost competitiveness is the main priority for future clean hydrogen producers. To narrow the gap with fossil fuels, producers must focus their efforts on technological advancements, economies of scale, and optimizing production processes.

To meet their emissions reduction obligations, offtakers in hard-to-abate sectors will need to commit to incorporating clean hydrogen into their energy mix and set clear timelines for hydrogen utilization. The knock-on benefit is that by creating a stable level of demand for clean hydrogen, producers and distributors will invest in the required infrastructure. Producers can then start building up volumes to the point where they can capture economies of scale, lowering the cost for offtakers.

A successful global clean hydrogen market relies on distributors and traders investing in expanding the necessary infrastructure, including pipelines, storage facilities, and refueling stations. This will ensure the smooth distribution and transportation of clean hydrogen to end-users. Transport routes would ideally be aligned with planned clean hydrogen projects in their country or region, to connect producers with offtakers.

Aggregators like H2-Global are important for scaling up the clean hydrogen economy. They aggregate demand, enabling larger projects to be built and transforming long-term contracts required for producers into short-term contracts required for offtakers. Their role is crucial in creating a robust and sustainable clean hydrogen market.

Conclusion

The global clean hydrogen market holds immense potential for decarbonizing hard-to-abate sectors and reducing greenhouse gas emissions. However, significant challenges remain, including high costs, regulatory barriers, limited renewable energy supply, and a lack of infrastructure. To overcome the challenges and unlock the full potential of the clean hydrogen market, all ecosystem players must work together in a coordinated and collaborative manner. This includes governments, regulators, producers, offtakers, distributors, intermediaries, research institutions, and investors.

By addressing the barriers and taking collective action, the clean hydrogen market can grow rapidly, enabling the transition to a low-carbon economy and helping to achieve climate targets. The time for action is now, and the potential benefits are immense.

Find a detailed analysis of the clean hydrogen market in the several regions in the report.

Florian Schäfer and Marie Hufen have also contributed to this report.