Despite the continuing surge in global data consumption, European telco players have been unable to capitalize on this trend, experiencing a decline in total revenue in recent years. Combined with continuously high infrastructure investments, these stagnant revenues result in an overall “squeeze” on profit margins.

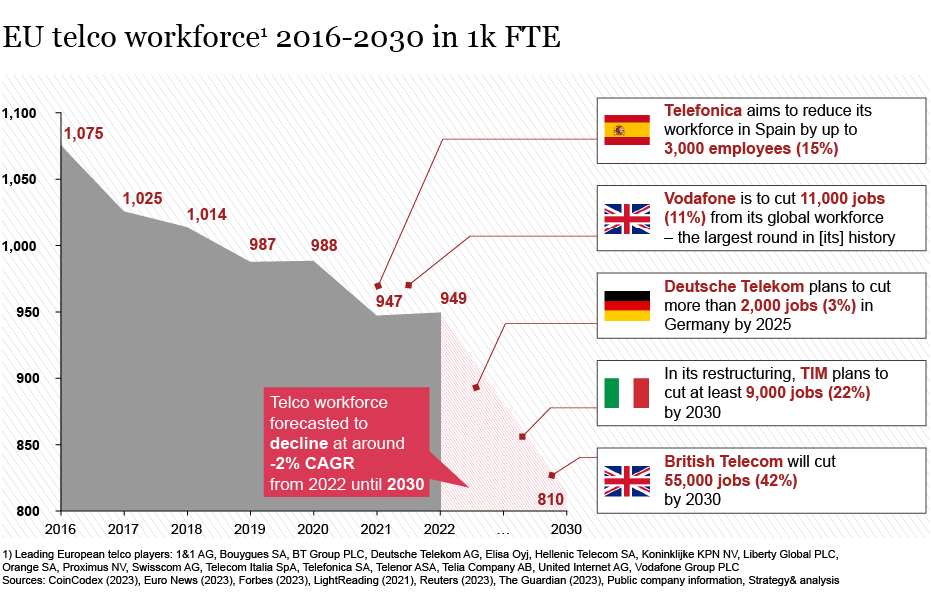

To address this margin pressure, telcos have implemented various cost-cutting strategies. Especially workforce reduction and optimization have been widely adopted within the industry to improve cost efficiency.

While reducing costs may have led to short-term improvements in the past, telcos should position themselves for future technology shifts to remain competitive.

Making telco future-ready: Top five trends

Source: Strategy& analysis

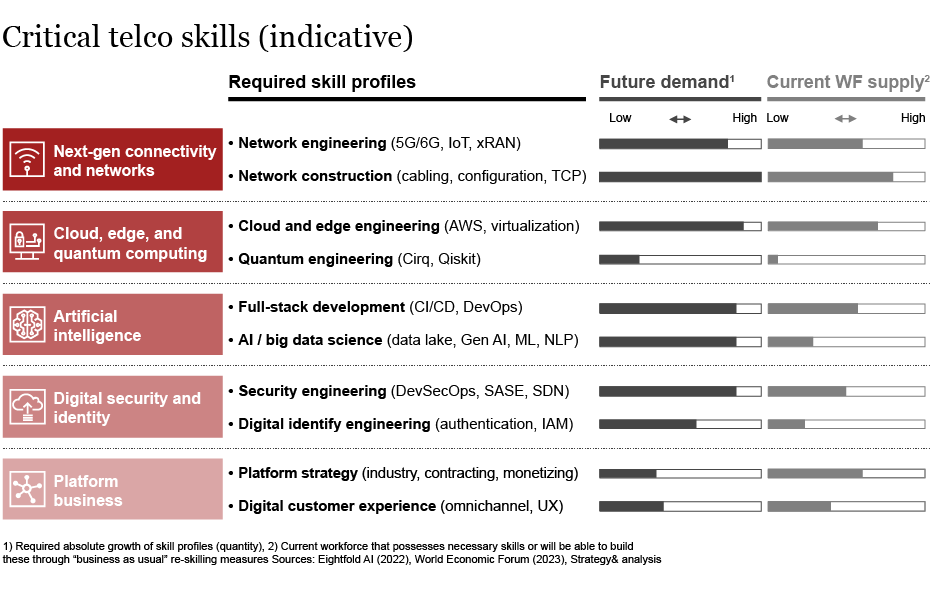

To keep up with these trends, several critical skill profiles are required. These profiles are in high demand, scarce, and only partially available within the current workforce.

Using conventional workforce strategies, telcos face difficulties in hiring these profiles – especially when competing with tech players that remain the gold standard in terms of talent attractiveness.

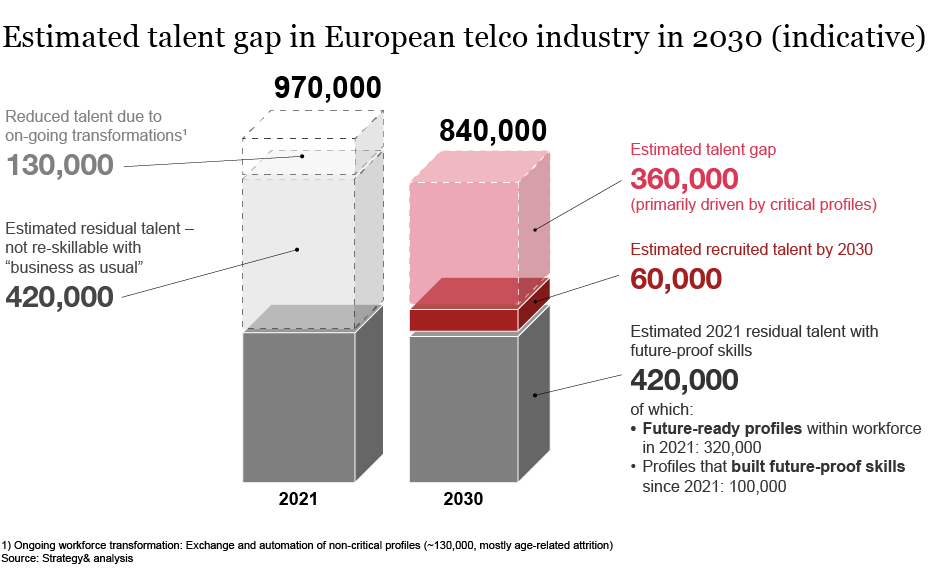

As a result, telcos are facing a steadily growing talent gap with an estimated shortfall of 360,000 skilled professionals by 2030. This issue is exacerbated by the inability to effectively reskill substantial portions of the residual workforce using 'business as usual' methods. This not only threatens value creation but the future competitiveness of European telcos.

To address these challenges and build a workforce that enables a future-proof positioning of telcos, new approaches are needed:

- Connect your strategy with your workforce planning: Ensure that you reflect and adopt the future vision and business strategy of your company within your talent strategy, as an enabler of an impactful strategic workforce planning

- Derive critical skill profiles: Analyze which profiles and skills are critical to success, based on the aspired future business positioning, and understand how big the actual talent gap is within the organization

- Define and prioritize specific measures: Follow a holistic strategic workforce planning approach to bridge the identified talent gap by implementing strategic measures along the BUY, BUILD, BORROW, BOT framework

This report was co-authored by Andrea Deublein, Frauke Frank, Pascal Fehst and Niklas Frings.