Executive summary

During the last few years, the eGrocery landscape in major European markets has endured its share of turbulence. In this market update, we examine the twists and turns of the industry in Germany, the United Kingdom, France, and the Netherlands. We also conduct an exclusive deep dive into Germany's market trends and discover insights that could transform grocery shopping across Europe.

These are our five main conclusions:

- After experiencing extremely steep growth followed by a significant slowdown, the eGrocery sector in key European markets is poised for a robust resurgence in 2024 and beyond, outpacing the traditional grocery market

- Efficiency-focused eGrocery players in Germany significantly outperformed the competition during the difficult years of 2022 and 2023, building on four core strengths

- Many quick commerce players had to exit the market due to high unprofitability - without a full turnaround we expect this model to extinct soon

- We anticipate that the efficiency-driven model will gain even greater traction, bolstered by favorable market conditions, favorable consumer trends, and further refinements of business models

- The recent announcement of the cooperation between Amazon Fresh and Rohlik Group in Germany underlines the assumptions mentioned above and is expected to add further impetus to the market

Market overview

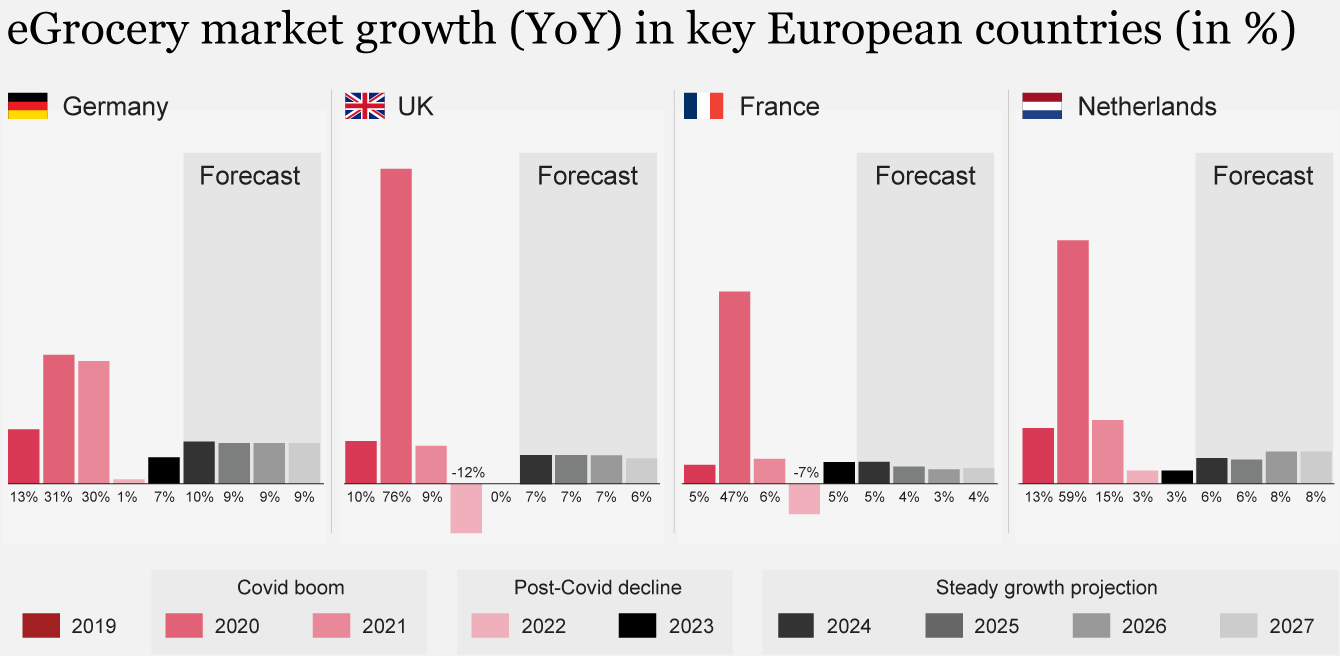

Following a large-scale boom during the Covid-19 pandemic, the eGrocery market experienced a significant slowdown in the last two years in key European countries (Germany, UK, France, and the Netherlands). In 2022, growth almost came to a standstill (Germany and the Netherlands) or even declined (France and the UK), although it should also be acknowledged that this state of affairs is rather more nuanced on closer examination, with some companies departing the market and others showing significant growth (see our analysis in the later sections).

Several factors have contributed to this slowdown: the end of the Covid-induced e-commerce boom; geopolitical crises such as the war in Ukraine; and subsequent high inflation and slower economic growth, particularly in Germany. There has also been a shift in customer behavior, with lower consumer confidence and increased price sensitivity. The return to physical stores has placed additional pressure on eGrocery players.

Despite the recent reversal of fortunes, there is optimism that strong overall market growth will resume from 2024 onwards, propelled by the normalization of the economy and the changing consumer preferences that will emerge as a consequence. Against a challenging overall economy trajectory, eGrocery is projected to grow annually by ~9% in Germany, ~8% in the UK, ~7% in the Netherlands, and ~4% in France, until 2027. In contrast, the forecast for traditional annual grocery growth is ~3% in Germany, ~2% in the UK, ~3% in the Netherlands, and ~2% in France.

Customer perspective: Preferences and behaviors in eGrocery (GSA focus)

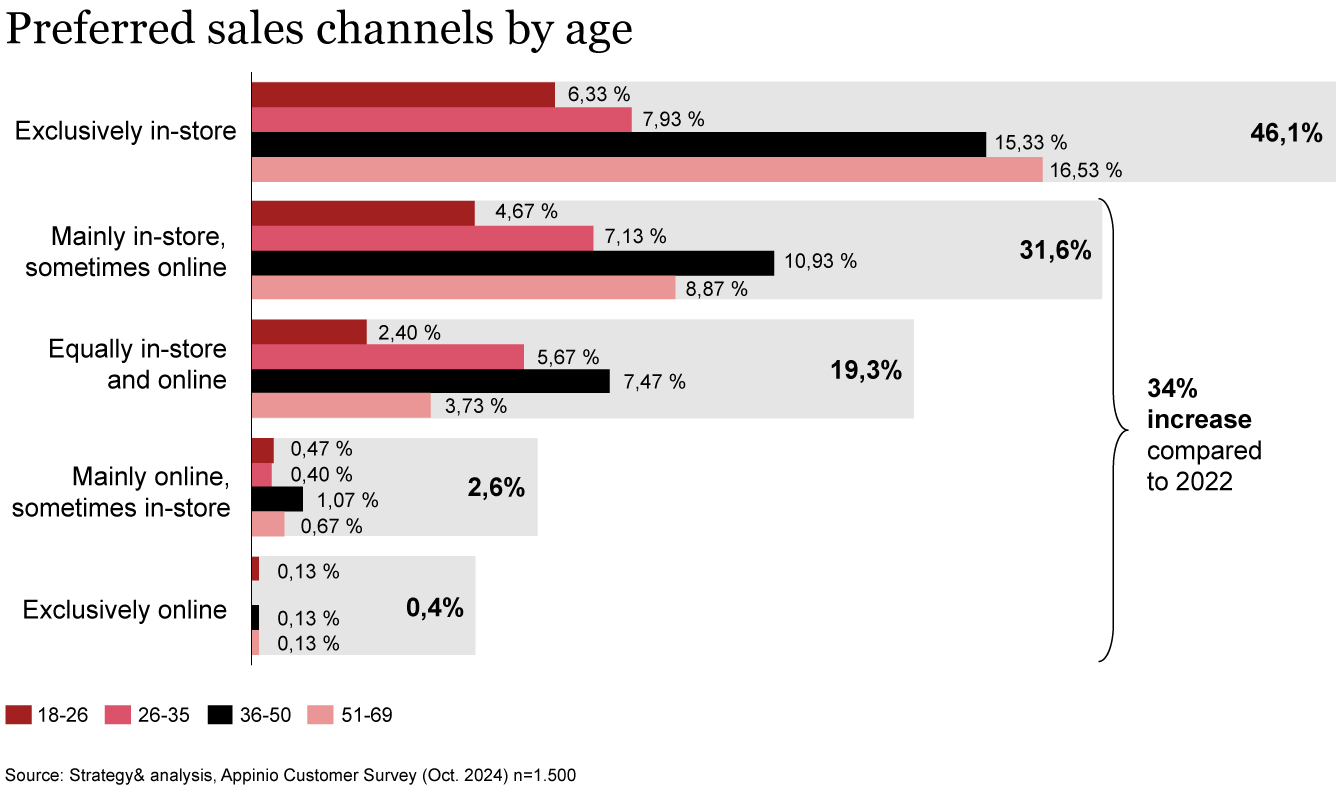

Even though consumer behavior is inherently volatile and unpredictable, we identified four important trends likely to impact the eGrocery market from 2024 onwards and verified them through a customer survey with 1,500 participants across Austria, Germany and Switzerland.

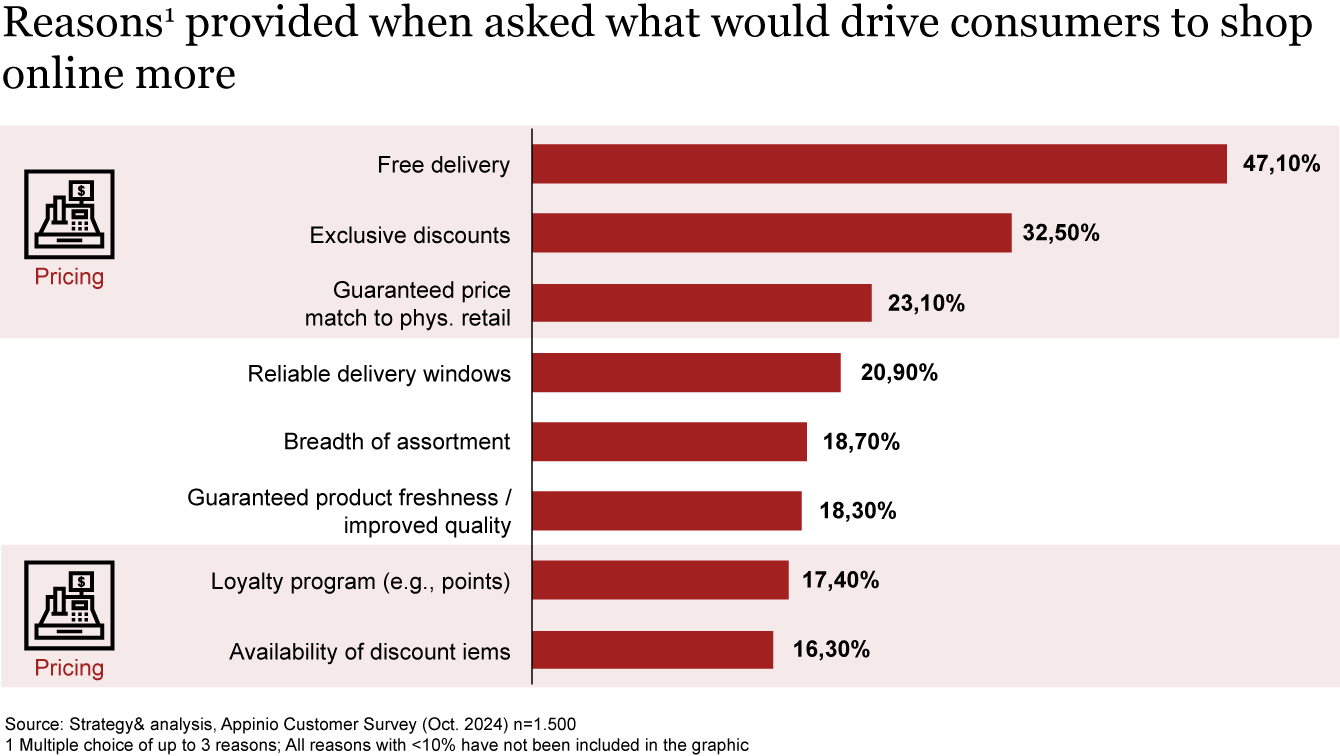

When being asked which factors would lead to increased usage of online options, almost 50% stated free deliveries and 32,5% mentioned exclusive discounts. Price matching, loyalty programs and availability of discount items are also among the top reasons to shop online more, showing the interest in more affordable online shopping options.

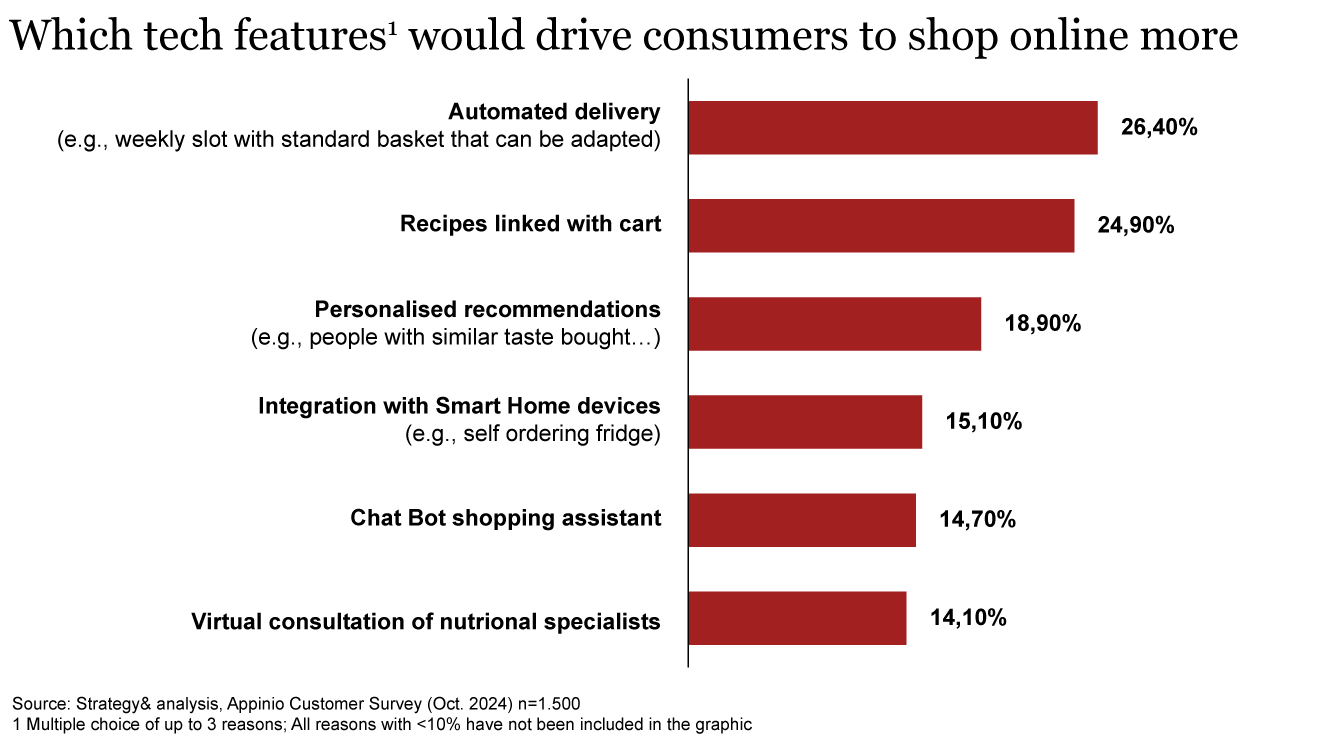

The PwC Voice of the Consumer Survey found that around 50% of consumers trust AI with product search and recommendations. At the same time, 44% of consumers trust AI to handle customer service requests. In our survey almost 26,5% of consumers stated they would shop more online if they could have automated deliveries (e.g., a fixed time slot per week with a standard basket that they can adapt). This customer receptiveness can allow eGrocery players to make use of their technology capabilities.

The three main eGrocery business models

The turbulence in the eGrocery market has had different effects on the market participants. We want to introduce three key eGrocery business models that help us to interpret past developments and offer a perspective on where the market is headed.

Quick-commerce players, such as Gorillas, Flink, and Getir in Europe, or Gopuff, Buyk, and Blinkit in the United States and Asia, experienced significant growth in the early eGrocery years. Fueled by the low interest-rate environment and enormous venture capital funding, these companies appeared to dominate the eGrocery market. Ten-minute-deliveries at supermarket prices held a strong appeal for many customers. However, as can be seen from the below deep dive, the market has now entered more difficult times.

Deep Dive: The future of quick commerce hangs in the balance

The market consolidation of quick-commerce players is currently in full swing. But even with this consolidation, the current business model will require readjustment to achieve the profitability that has so far proved elusive. In the long term, quick-commerce players will need to reduce costs, while also creating additional revenue streams.

Notable mergers, acquisitions, and strategic partnerships continue to reshape the competitive landscape in the quick-commerce industry. This structural realignment has come about in large part due to concerns about profitability, caused by intense competition, thin margins, and high operational costs. Indeed, the substantial venture capital investment in the industry witnessed between 2019 and 2022, attracted by the huge wave of optimism surrounding quick commerce during the Covid-19 pandemic, has now waned considerably.

Looking ahead, the quick-commerce landscape is likely to witness further consolidation, with only very few players ultimately being able to establish a firm foothold in the market. But how will the resulting smaller group of quick-commerce players be able to sustain profitability and survive in the long term?

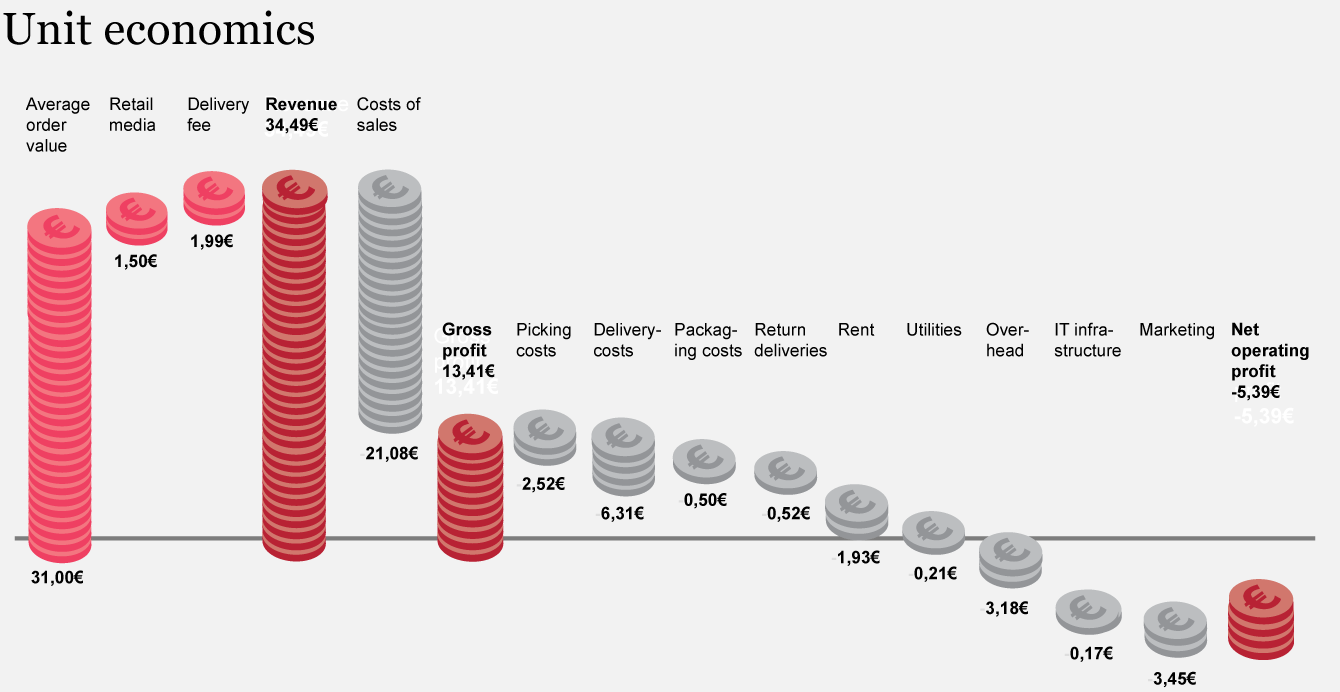

The unit economics in quick commerce have been negative since its birth. While the exact losses per order have to date not been established, we have formulated a calculation, based on readily available information, expert opinions, and Strategy& analysis, to derive some approximate figures:

- The current average quick-commerce order generates an approximate revenue of €34.49, based on an order value of €31, plus a delivery fee of €1.99 and retail media revenue amounting to €1.50. However, the costs of fulfilling each order outweigh this revenue by €5.39, meaning that every quick-commerce order incurs a significant loss. These costs involve cost of goods sold (an average of €21.08 per order), direct expenses such as picking costs (€2.52) and delivery costs (€6.31), and indirect expenses such as rent and utilities.

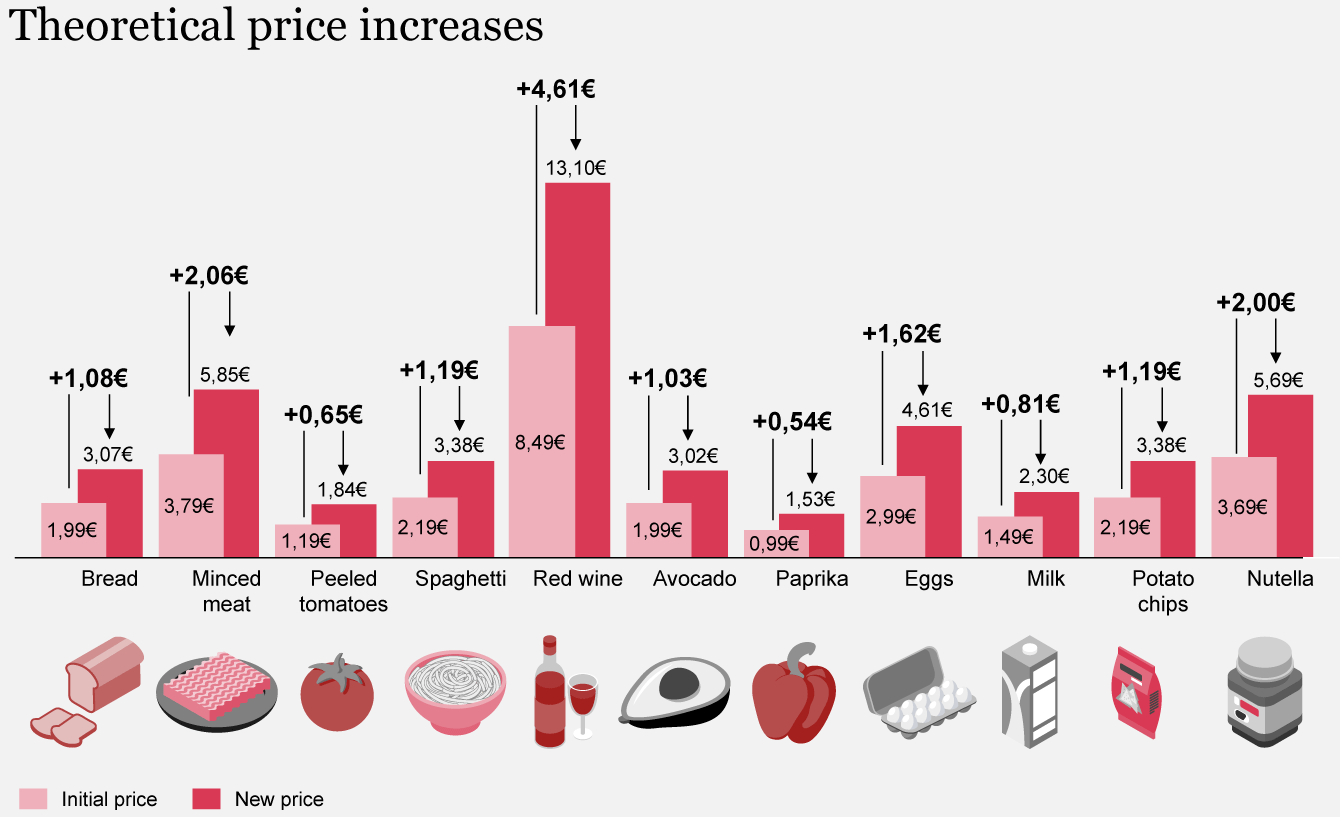

Increasing retail prices and delivery fees by the drastic amount required to reach profitability does not by itself present a viable solution, especially in such challenging economic times when customers are especially conscious of price. To show the extreme extent to which QuickCom players would have to increase their prices, we have calculated theoretical new prices for a typical basket:

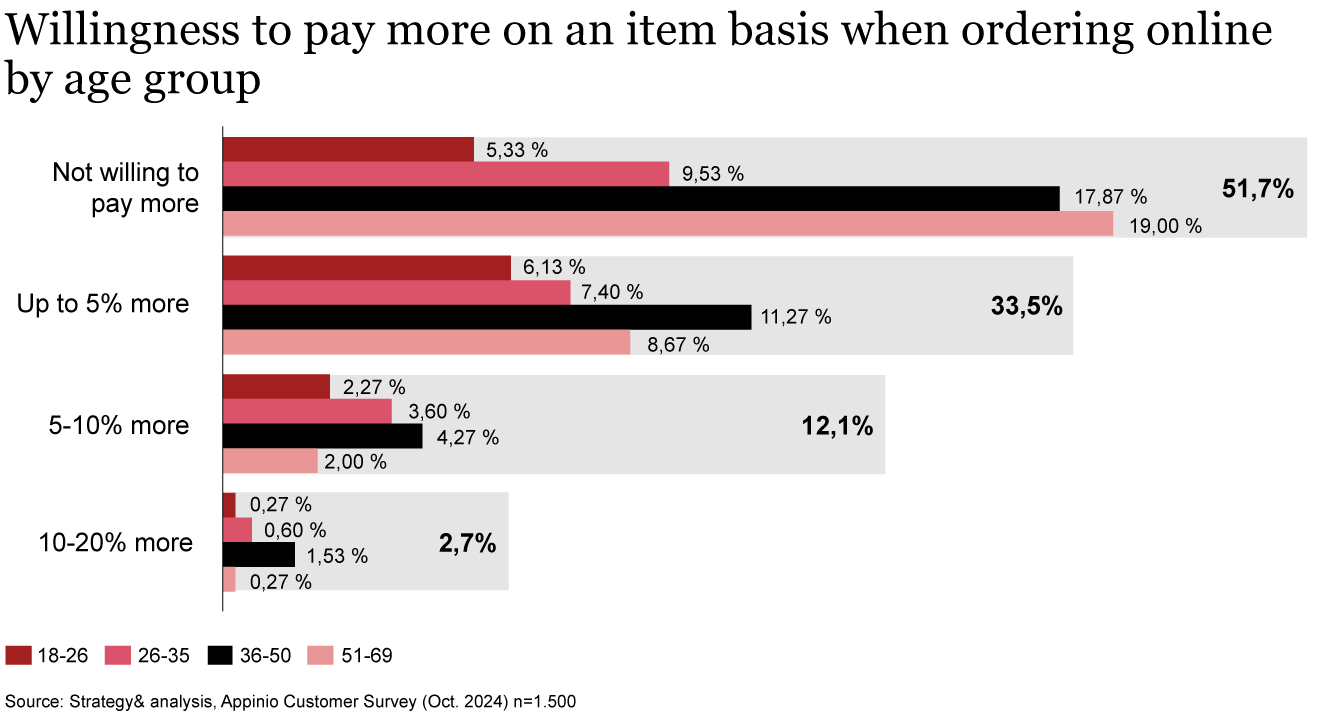

If we recall the consumer sentiment regarding price premium on an item level from the previous section, it is clear to see that consumers would not accept the price increase required to achieve profitability.

Meanwhile, a sole focus on picking and delivery costs, which comprise nearly half of all direct and indirect expenses in quick commerce, does not provide the answer either. If other parameters remain unchanged, the additional workload that would need to be imposed on pickers and delivery riders to achieve profitability is simply not feasible.

Therefore, quick-commerce players can only solve the profitability puzzle if they both boost revenue and optimize costs. Our calculations reveal, for example, that through an adjustment of the delivery fees (+€1.01) and an optimization of the picking process (+€1.26) and delivery costs (+€3.15), quick-commerce players will be able to register a profit. Indeed, introducing all these three proposed levers simultaneously results in a net operating profit of €0.03 per order.

Quick-commerce players can also explore other strategies to influence revenue and costs. Implementing dynamic pricing, adjusting delivery fees with premium memberships, and making full use of retail media can further boost revenue. On the cost side, renegotiating purchasing terms, reducing marketing expenses, and enhancing operational flexibility can certainly help. These measures enable order bundling and optimize employee utilization, significantly reducing picking and delivery costs to improve profitability.

Although capital injections into the industry have subsided due to persistent negative economics and significant operational losses, investors have still opted to maintain a foothold in a market which promises high potential if the model can be reshaped to achieve profitability. The recent $150 million funding round for quick-commerce start-up Flink illustrates this continuing interest (Source: Flink press release, Sept. 2024) However, investor patience should not be taken for granted, and we are now at a critical juncture. Flink, one of the few remaining players, should capitalize on this investment to move towards a more sustainable model and demonstrate the sector’s long-term viability.

Unlike quick commerce, efficiency-focused eGrocery companies performed well in the challenging market of recent years. Companies such as Rewe, Picnic, Rohlik Group (including Knuspr/Gurkerl) and Sainsbury’s benefited from aiming for larger shopping baskets while optimizing middle-mile and last-mile logistics. They were the first to achieve operational profitability in certain more mature markets. Due to this recent success, underlined by increased investor interest, we investigate this eGrocery model in the next section, focusing on the German market.

Young logistics outsourcing providers have recognized the complexity of the eGrocery logistics chain and the need for significant investment. Companies such as Ocado or Oda have therefore made it possible for online grocery players to outsource some of their logistics processes. These larger players bring important hardware assets (such as automation technology), software (a logistics platform, for example), and skilled human resources to the table. Their subscription-based service model boosts the ability of eGrocery players to adapt quickly to changing circumstances, while they also obtain access to state-of-the-art logistics solutions. Nonetheless, outsourcing this part of the business involves certain risks for companies, including third-party dependency in a business-critical process and limited access to customer data.

Beyond Logistics-as-a-Service (LaaS), there is also the option of merely outsourcing the picking of orders (in stores), as seen in collaborations such as between Coop and Uber or between Hofer and Roksh. While limiting the risk of third party-dependency, these collaborations entail a more difficult route to profitability due to inefficient picking processes in stores, limited daily deliveries per store, and comparatively high external costs per order. Overall, eGrocery logistics outsourcing could be a compelling offering, but it must prove its worth in the long term.

Germany case study: Efficiency-focused players forge ahead

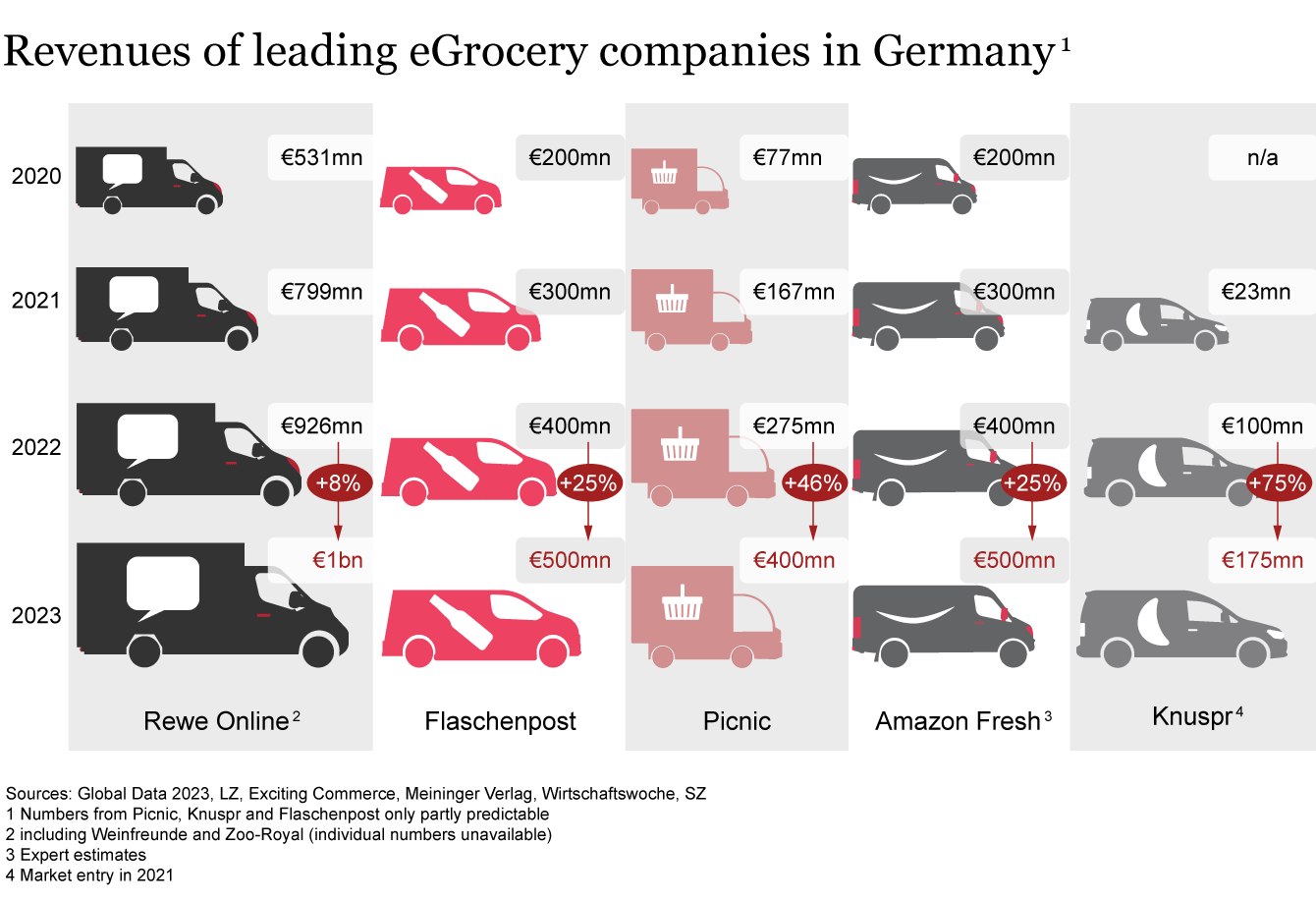

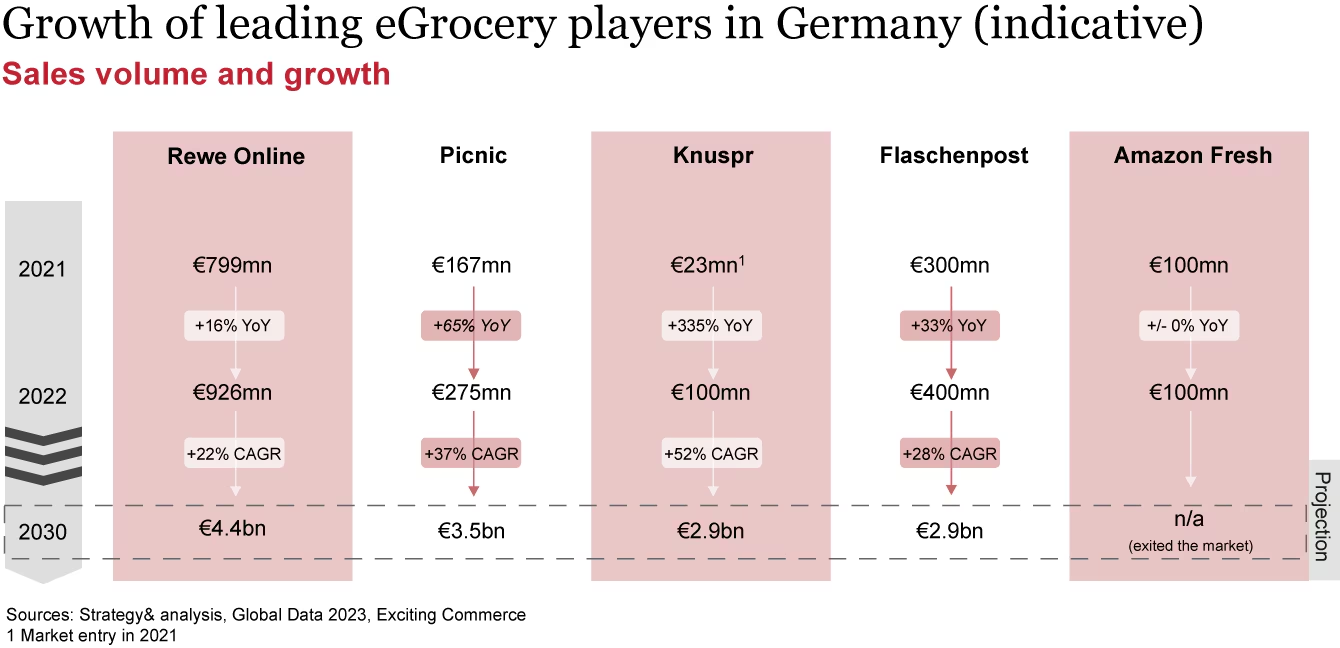

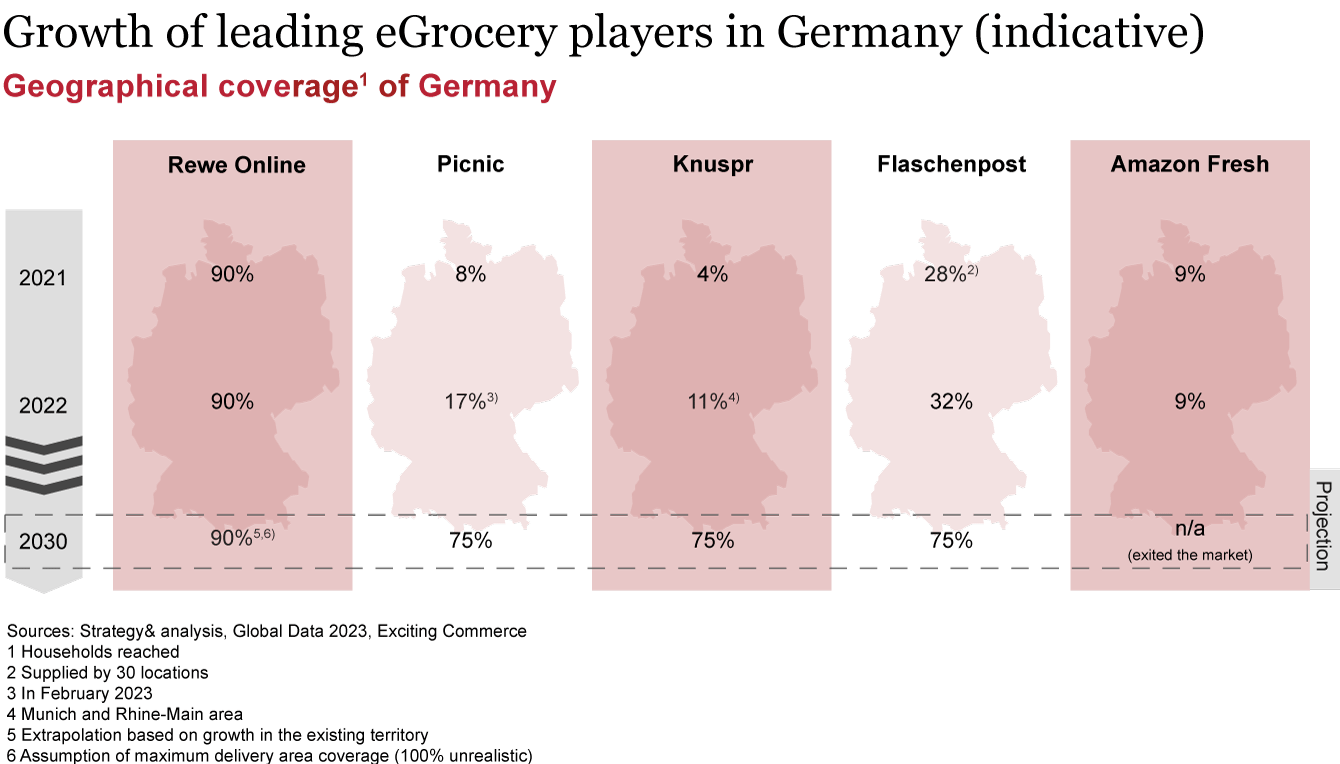

When looking at the German eGrocery market in more detail, we see a development that has already been mentioned: efficiency-focused companies have shown strong growth in recent years. Leading companies such as Rewe, Picnic, Knuspr, Flaschenpost and Amazon (despite the lower revenues of Amazon Fresh lately) have significantly outperformed the market and withstood the crisis.

Of course, these companies follow their own strategies and there are differences between them, such as their size or age. However, we believe that four common overarching factors have made them successful:

Breaking market update

After declining sales figures in the last year, Amazon has just announced that they will draw back from their Amazon Fresh operations in Germany. Instead Knuspr will build on their fast growth of the past years and take over the operations. This development demonstrates that running a promising eGrocery business requires a high level of commitment, focus, and investment. Amazon took the chance to benefit from Rohlik Group’s growth trajectory, giving Knuspr the chance to make another major move in the German market after its acquisition of Bringmeister in 2023.

Outlook

Based on these findings from our German market analysis, we believe that efficiency-focused players are well positioned in all of Europe to achieve significant growth, improved profitability and increased market share in the coming years. Their potential can be attributed to the following three reasons:

- 1Strong eGrocery market growth: In all countries analyzed, the markets are expected to grow at a strong year-on-year rate (4%-9%) in the forthcoming years, outperforming the general grocery market. The leading efficiency-focused players have constantly been able to grow faster than the overall eGrocery market in recent times. The same factors that explain their success to date should also enable them to continue performing well.

- 2Optimized customer acquisition: The growth of eGrocery will likely make shoppers more familiar with the concept. This awareness should help to optimize marketing efficiency and conversion rates. Market leaders could benefit the most given their existing brand recognition.

- 3Higher share of wallet: Efficiency-focused players are expected to continue to optimize their assortment and delivery options to increase the amount of weekly grocery purchases on their platform. This will help lead to higher basket values and more revenue on their platforms vis-à-vis traditional grocery offerings.

For those traditional grocery retailers that have not yet really started their eGrocery initiatives, these insights could help to create a new mindset: there is now an eGrocery model which has a clear route toward profitability and could significantly cut into their market share, customer loyalty and profitability.