2030 and Beyond: Despite recent figures, achieving sustainable growth remains a challenge for the Turkish Chemicals Industry

The Turkish chemicals industry achieved significant growth driven by Turkey’s cost advantage, proximity to major consumption markets, disruptions in global supply chains, innovation and changing regulatory environment.

We believe, that going forward, Turkish chemicals companies need to identify a unique market positioning (way-to-play) and invest in their capabilities to benefit from future trends underpinning growth.

As Strategy&, we foresee eight future trends ranging from ESG and sustainability to shifts in global economy, rising ecosystems, a reset of the global supply chain, novel business models, disruptive technologies, power of M&A and war for talent.

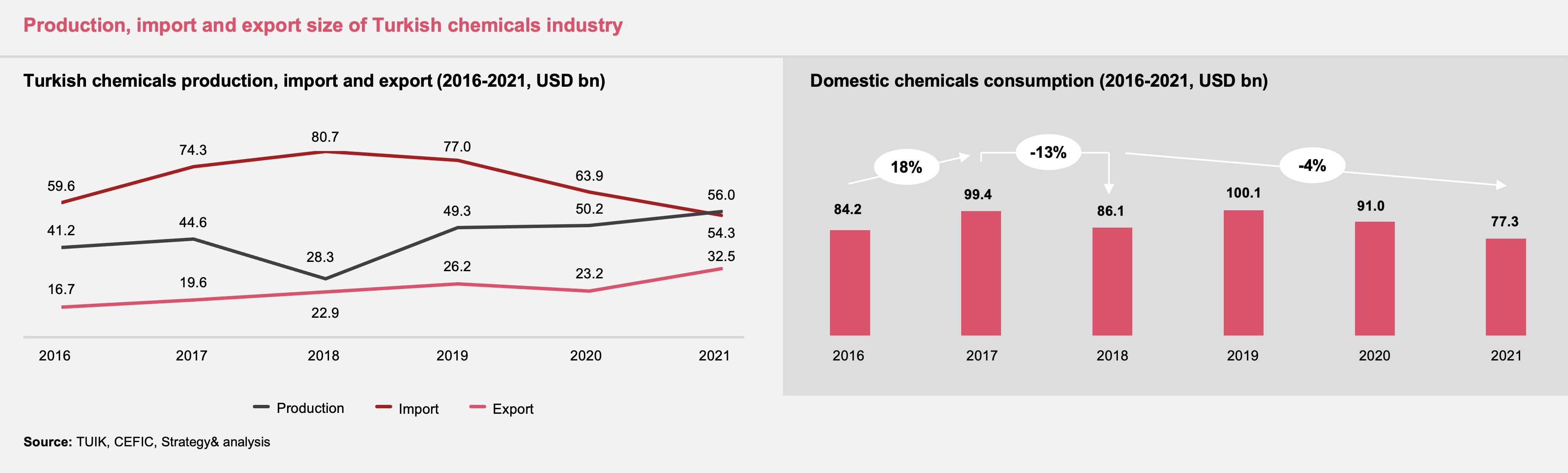

The Turkish chemicals industry is one of the key growth industries in Turkey, second largest industry consisting 14% of the country’s total exports. Although several challenges from FX fluctuations to increasing input costs impacted the industry, last year the export and production figures of the Turkish chemicals industry reached a peak since 2016 with the impacts of shifts in the global supply chains between Asia and major consumption markets such as EU and US and increasing logistics costs.

In the first quarter of 2022, the Turkish chemicals export reached USD 7.5 bn and achieved ~40% y-o-y growth.

Impact of growth drivers, competition and regulation

Five growth drivers impacted the Turkish chemicals industry during the last years. These key trends consist of:

1.

Cost leadership with TRY exchange rate fluctuation

2.

Geographical proximity with major markets including US and Europe

3.

Disruptions in the global supply chain from APAC

4.

Major investments and innovations from the leading Turkish chemicals players

5.

Supporting regulations

Leading Turkey to also become a favorable near-proximity supplier country with competitive labor costs, although the local chemicals industry is still reliant on foreign currency denominated import of feedstock.

Turkish chemicals industry benefited from low costs, proximity, int’l SC disruptions, investments and supporting regulations

Five main drivers of Turkish chemicals market

The eight future trends influencing existing and future capabilities

ESG and sustainability disruptions

- ESG driven transformation and net zero commitments

- Fast changing business model incl. circular economy

- Value creation beyond “compliance” and “license to operate”

Shifting of global economy

- Shift of economic power to emerging players

- Increasing trade conflicts among incumbents

- Emerging deglobalization and national focus

Rising of ecosystem interplay

- Increasing importance in ecosystem collaboration

- Building complimentary capability to act as a one-stop-shop

- Reconfiguration of whole value chains with rising new players

Reset of supply chain footprint

- Ensuring supply chain resilience

- Securing access to critical materials

- Balancing environmental, social and IP impact

Novel business models

- Integrating essential eight of tech to achieve business agility

- Emphasizing customer centricity and needs

- Coherent to company’s authentic identity and value proposition

Disruptive technologies and innovations

- Technological advancement for new product development

- Investments to become sustainable and tech driven

- Enabling new ways of operation and governance

Powerful mergers and acquisitions

- Sustainability driven portfolio consolidation and diversification

- Fast capability buildup and resource security via synergy realization

- Cross-national engagement of emerging markets players

War of talent

- High urgency of upskilling requirements

- Adoption of new way of working in the new normal

- Sustainable development and diversity agenda

Critical questions to be answered before a bold move

In summary, in line with their unique way-to-play, leading Turkish chemicals companies need to focus their efforts and investment around eight future trends shaping the global chemicals industry.

They need to answer the following critical questions to determine their growth strategy:

What is the way-to-play (market position) in the chemicals market?

Which capabilities do we need to sharpen against the global competition?

How can we align our product and services portfolio?

How can we leverage the global chemicals trends for our commercial success?

What are the strategic options for a sustainable growth in mid to long term?

Which partnership opportunities are necessary for an ecosystem play?

Which options should we pursue? How can we realize these options?

After answering these critical questions, Turkish chemical companies will be able to sustain their growth by developing new capabilities or improving their existing capabilities around these eight global chemicals trends so that the Turkish chemicals industry can pave the way towards achieving 2030 targets.

As Strategy& Turkey we have helped numerous chemicals players to answer these strategic questions and develop a future-proof growth strategy with a five-years implementation plan, which included 20+ initiatives targeting at above 30% revenue growth.