{{item.title}}

{{item.text}}

{{item.text}}

Global hydrogen demand is expected to increase toward 2030 and further, under the recent energy crisis triggered by geo-political shifts, price increases, decreasing cost of production and COP27 net-zero targets. After several pilot projects, the National Hydrogen Strategy and Roadmap, published in January 2023, has put Türkiye into the global landscape as one of the leading green hydrogen economies.

As Strategy& Türkiye, we forecast the green hydrogen demand in Türkiye can exceed 1-1.5 Mt in 2030 and 2-2.5 Mt in 2050. We suggest the energy industry stakeholders to conduct a thorough assessment of the market potential and a diligent competitive assessment for designing a game-changing market entry strategy for the new business models for the emerging green hydrogen economy in the country.

Hydrogen is the most common element in the nature and consumed in several manufacturing processes across a wide-spread spectrum of major industries including oil refinery, steel manufacturing and glassmaking. Green hydrogen, produced with the renewable energies including wind, solar, hydropower, and bioenergy, is considered as a major energy source to reduce emissions 45% by 2030 and to meet the global net zero commitments by 2050 under the Paris Agreement.

With the technology advancements, the cost of production is expected to decrease competitive levels for many countries from 2030 onwards. Alkaline electrolyzer, the most popular and the cheapest technology for green hydrogen investments, contains potassium hydroxide and water or sodium hydroxide and water are used as catalyst, which releases hydrogen towards cathode. Polymer electrolyte membrane (PEM) electrolysis separates the hydrogen and oxygen through a solid polymer electrolyte (SPE) and can operate at high current densities. Solid oxide electrolyzer (SOE) is the newest technology using solid ceramics as electrolytes which enables it to be applied in fuel production, carbon dioxide recycling, chemical synthesis and having advantages include long-term stability, fuel flexibility, low emissions and low operating costs.

The global demand for green hydrogen is expected to increase at a rapid pace especially after 2030. According to IEA’s predictions, the world's hydrogen demand is expected to increase from 94 million tons (Mt) in 2021 (95% of global production is currently grey) to nearly 200 Mt in 2030 and 450-500 Mt in 2050 (99% of global production needs to be clean), as per net-zero emission (NZE) scenario. If the announced pledges of the countries’ energy policies (APS scenario) are considered, the forecasts for the green hydrogen volume can remain at half of this figure.

According to APS scenario, Europe is expected to become the largest importer of the green hydrogen with ~50 bcme (billion cubic meter equivalent of natural gas) net import volume, followed by Japan and Korea. The USA and China are expected to rely on their domestic supply of 150 bcme for each. Australia, Middle East, North Africa and Latin America are expected to become the largest net exporters with the abundance of their renewable energy sources. Leading countries including USA, Germany, Netherlands, United Kingdom and Japan already announced large-scale green hydrogen projects, official capacity targets and their support programs.

Two largest electrolyzers started operating in 2022: A capacity of 150 MW in China as a captive electrolyzer supplying to a methanol and chemicals plant and a solar-powered 20 MW capacity in Spain. Two 200+ MW projects are expected in China and Netherlands until 2025.

The EU aims to install 17.5 GW capacity of electrolyzers by 2025 under REPowerEU plan. For instance, Germany already has commissioned 120 pilot projects for green hydrogen production, while several import projects are being discussed with several countries South America, Africa and Australia, according to the German Energy Agency, Dena.

On the incentives side, Japan’s Green Transformation (GX) Program, while USA’s Inflation Reduction Act in 2022 offered 10-year production tax credit for clean hydrogen production facilities.

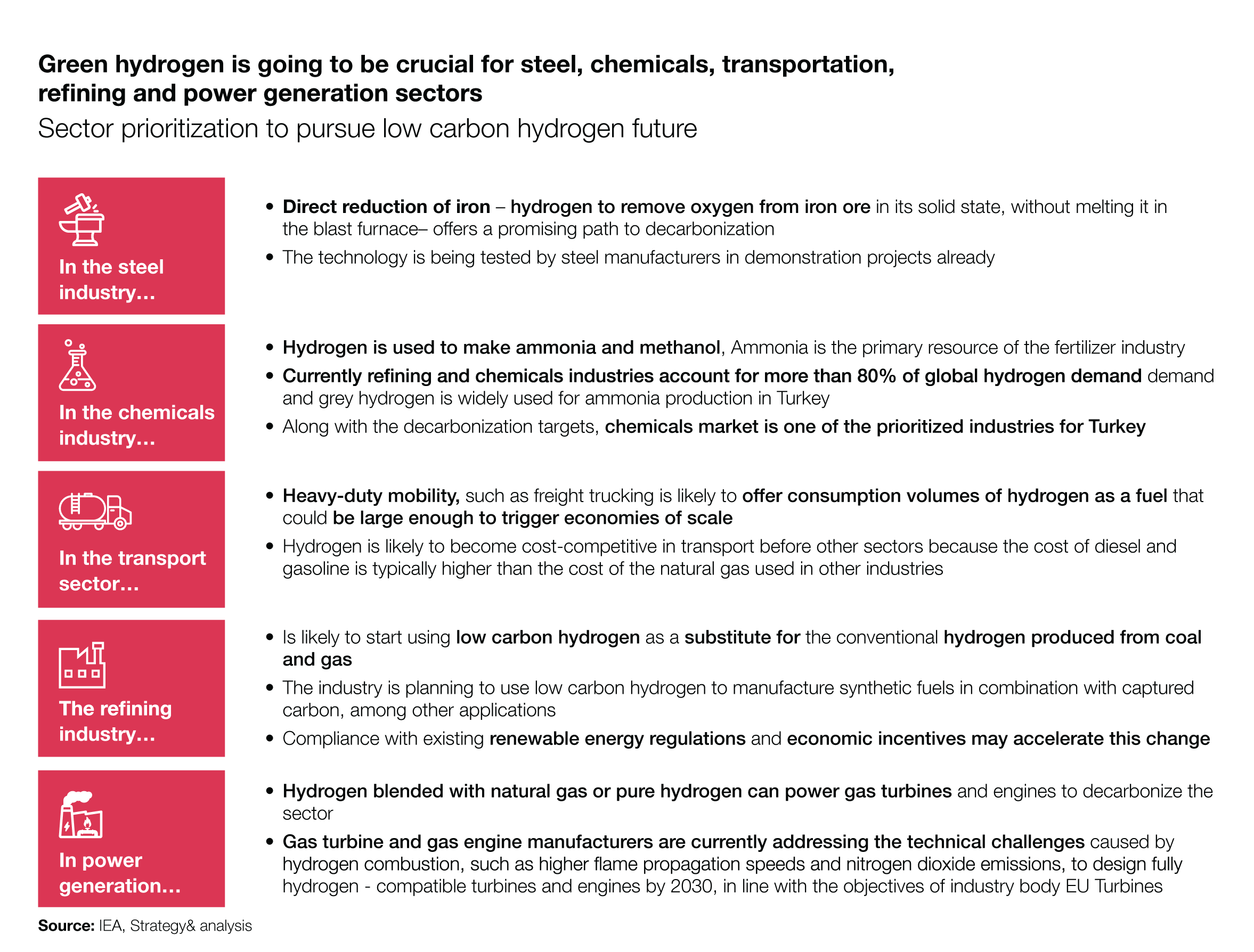

Since 41% of global emissions is directly effected via thermal energy needs, green hydrogen will be crucial for energy-intensive industries including steel, chemicals, transportation, refining and power generation. Each industry utilizes green hydrogen for a different application area, and the green transition is expected to change the share of end-user industries until 2050.

Steel: With the expectation of direct reduction of iron (DRI) becoming a primary technology in the long term, 3% of energy consumption used for steel-making can be generated from hydrogen by 2030 and 25% in 2050. This will increase the share of steel and iron industry in the global hydrogen capacity to 8% in 2050.

Chemicals: Hydrogen is used to make ammonia (primary resource of the fertilizers) and methanol. Consuming 53% of the global hydrogen volume, he demand of clean hydrogen in the chemicals sector is expected to reach almost 60 Mt by 2050.

Refining: While refineries were the biggest source of demand for global clean hydrogen in 2020, the demand is expected to decrease from 41% share to 2% share over the other sectors at the end of 2050.

Transportation: Hydrogen is expected to transform heavy-duty mobility with a high scale of economies. The growth rate of clean hydrogen demand in transportation sector is anticipated to surpass all the other sectors with a CAGR of 12% between 2020 and 2050 reaching almost 100 Mt demand in 2050, including applications in sustainable aviation fuel and methanol for ships.

With the expectations of emerging regulations, selected energy players in Türkiye have accelerated their efforts and investments. While several Turkish energy players are discussing the potential and challenges of the green hydrogen, initial pilot projects, including Enerjisa’s green hydrogen capacity in Bandırma, Bozcaada Hydrogen Project (cancelled), TÜPRAŞ Green Hydrogen Investment and GAZBİR-GAZMER Hydrogen Project, already emerged.

Turkish Ministry of Energy and Natural Resources published “Türkiye’s National Hydrogen Strategy and Roadmap" in January 2023 and placed the country among the leading green hydrogen economies on a global scale. The published strategy lays out important strategic priorities among electrolyzer capacity targets by 2053, reduction in the cost of green hydrogen production, R&D support for domestic sources, public-private collaboration, export of green hydrogen and ammonia, priority green hydrogen industries and hydrogen transportation / distribution. According to the national hydrogen strategy, Türkiye aims to establish 2 GW hydrogen production capacity by 2030, 5 GW by 2035 and 70 GW by 2053.

As Strategy& Türkiye, we forecast the green hydrogen demand in Türkiye can exceed 1-1.5 Mt in 2030 and 2-2.5 Mt in 2050, based on the growth trajectory of the green hydrogen demand from the energy-intensive industries. Steel, cement, transportation, chemicals, ceramics, oil & gas and power generation industries are expected to capture the highest share in the overall demand. Research and development activities are ongoing for the conventional usage of new green hydrogen production technologies.

New business models and leading players in Türkiye are expected to emerge from raw material supply, electrolyzer and equipment manufacturing, production (local consumption and export), distribution and retail sales. Among these,

Majority of the local investments in the country can be concentrated around electrolyzer and equipment manufacturing (e.g., special pipeline materials), production and distribution. Türkiye Energy, Nuclear and Mining Research Institute (TENMAK) issued an R&D call for clean hydrogen technologies under the Technology-Focused Industry attempt program with a focus on clean hydrogen production, storage and liquification and fuel cells.

Secondly, with the increasing demand from key consumption industries and the emergence of the local ecosystem players, Türkiye can be positioned as a net green hydrogen supplier for the major European countries and other nearby countries with its growing installed renewables capacity, geographical proximity to major countries, extensive natural gas pipeline, logistics infrastructure, rich natural resources and relatively lower costs of green hydrogen production. Therefore, the leading energy producers, energy distributors, pipeline operators, logistics solution providers and technology companies can play a historical role in this new business opportunities.

We can suggest the companies that consider entering the Turkish hydrogen market by thoroughly assess the potential of the market in terms of the size, growth and application areas. A diligent competitive assessment can help you identify a unique market positioning across the value chain and reveal the differentiating capabilities that needs to be invested.

After that, several key strategic questions need to be answered to develop and implement a game-changing market entry strategy for a right-to-win in the Turkish hydrogen market.

As PwC Strategy&, we leverage our strategy-through-execution capabilities to help our clients in the energy industry from day zero of their investment evaluation to various support areas including market and competition assessment, financial due-diligences, M&A research, and program management with an integrated approach.