In our packaging article series, we’ve explored pathways to sustainable packaging, returnable packaging systems, and the shifting aluminum packaging market. Building on these discussions, we now turn to the capabilities that F&B companies need to optimize packaging in conjunction with their value chain partners.

Economic, geopolitical, regulatory, and social pressures force F&B companies to simultaneously improve in three fields that pull in (seemingly) conflicting directions: financial performance, sustainability, and resilience. Packaging is relevant for all three: packaging costs have surged to account for typically ~10-~20% of F&B product prices, emissions account for typically ~25-~35% of a company’s total GHG emissions, and packaging value chains have proven vulnerable over the past years.

In our overarching report, we outlined four action areas – Rethink, Reduce, Reuse, and Recycle – that companies can use to optimize their packaging holistically. With these, F&B companies can decrease packaging costs by 30%, significantly cut emissions, and safeguard value chain reliability. To stay competitive, F&B companies need to prioritize action today.

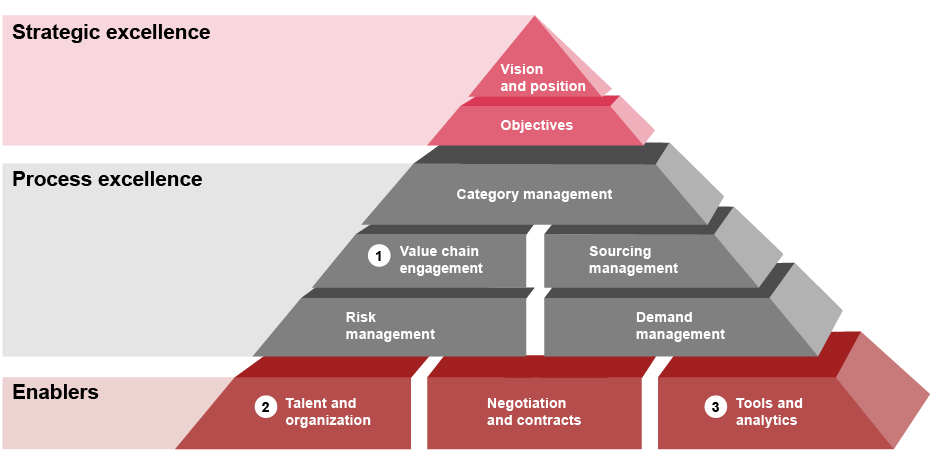

Many F&B companies, however, are struggling to execute holistic packaging optimization as they are yet to develop the supporting capabilities. Our capability framework for procurement across the value chain details which capabilities are required (see Exhibit 1): In terms of strategic capabilities, companies must define their vision and position for holistic packaging optimization, as well as cost, resilience, and sustainability objectives. To attain these, companies need to build and leverage several supporting capabilities. In this article we put the spotlight on three – the ones where we see that F&B companies need to make the biggest leap.

Exhibit 1: Capabilities required for tier-1 to tier-N value chain engagement

Capability type 1: Value chain engagement

Effective value chain engagement is critical for driving cost, resilience, and sustainability improvements through holistic packaging optimization. This is where supplier relationship management (SRM) and vertical integration come in.

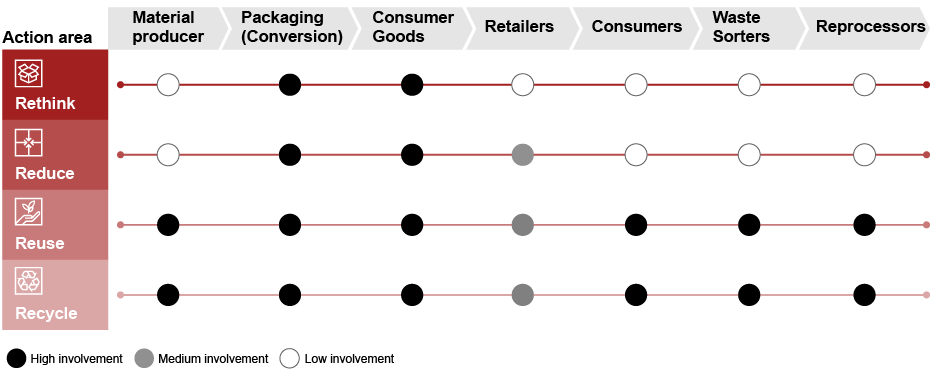

A range of value chain partners are needed to make progress against the packaging action areas that F&B companies are tackling – and the players that are key to making gains differ with each action area.

Exhibit 2: Supply chain players’ typical involvement per action area

Companies that effectively use SRM typically adopt a systematic approach for developing and managing partnerships that is focused on joint growth and value creation; partnerships are based on trust, open communication and a win-win orientation3. Companies that excel show that they engage partners across the complete value chain, effectively spearhead continuous improvement discussions, and use value engineering to overcome potential resistance. Additionally, they use their influence to drive initiatives beyond contractual enforcement to drive cost, resilience, and sustainability improvements, from tier-n suppliers to retailers (and beyond).

To build next-level SRM capabilities, companies should shift their perspective from transaction-based to collaboration-based relationship management. In addition, their purview should be expanded in two ways. First, extending beyond tier-1 suppliers, to include key partners along the entire up- and downstream value chain and second, broadening the discussion scope to include not only cost reduction efforts, but sustainability, resilience, and innovation.

Alternatively – and complementarily – to SRM, companies can use vertical integration to secure their value chains. This can take various forms including minority stakes, joint ventures, and acquisitions across the value chain. Companies opting for vertical integration need to ensure that they have a clear strategic rationale for doing so, targeting value chain players where acquisition provides clear value-add over SRM.

Regardless of how value chain engagement is achieved (whether through SRM or vertical integration), it enables companies to be the driving force behind (collaborative) packaging efforts.

Examples:

- Schwarz Group acquired a paper mill in 2022 to ensure supply of packaging materials, as well as a recycling company in 2018 to handle its recycling efforts1.

- Tesla works directly with the broader value chain, collaborating with tier 2-N suppliers to secure availability of lithium batteries, boosting value chain reliability2.

Capability type 2: Talent and organization

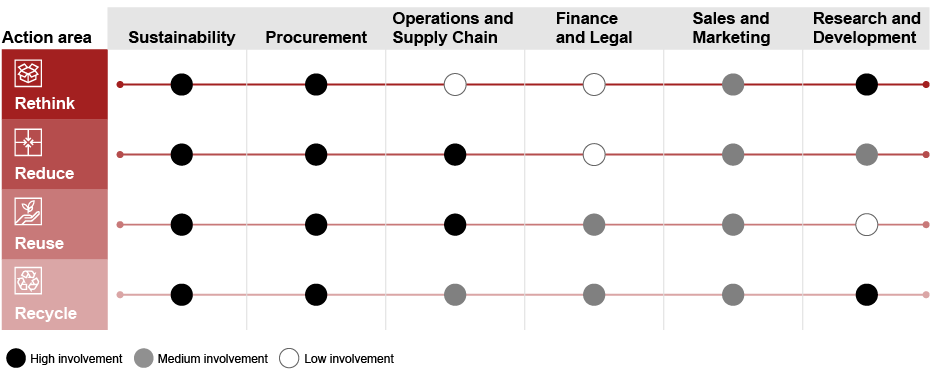

Holistic packaging optimization also hinges on having the right talent and organizational setup in place. Companies that excel have initiatives across multiple procurement categories, frequent training programs and knowledge sharing initiatives, and intensive cross-functional collaboration. Packaging is integrated horizontally into these organizations, as these initiatives often require a radical rethink of products and their position in the market. The level of involvement for each business function differs per initiative, typically depending on whether it concerns rethinking, reducing, reusing, or recycling packaging (see Exhibit 3). When leveraged effectively, these capabilities provide the internal foundation that enables companies to lead value chain initiatives that improve cost, resilience, and sustainability through packaging optimization.

To get there, F&B companies can set up a focused project team that pilots packaging initiatives across the organization. This team should educate the organization on holistic packaging optimization’s benefits, embed the required capabilities across all relevant functions, ensure that these functions collaborate, and push them to think end-to-end about packaging optimization. Once holistic packaging optimization is embedded into functions’ daily work going forward, the project team’s objective is achieved (and the team can be disbanded).

Exhibit 3: Business functions’ typical involvement per action area

Examples:

- Danone has dedicated packaging staff in its Plastic Material Technology Center which conducts research efforts to explore sustainable packaging solutions4.

- Mars Wrigley has a designated Chief R&D, Procurement and Sustainability officer, combining the three functions under one roof, facilitating close collaboration and achievement of joint objectives5.

Capability type 3: Tools and analytics

Additional critical enablers for holistic packaging optimization are fit-for-purpose tools and analytics. These tools enable F&B companies to gather and analyze information required to identify, execute, and track packaging improvements that boost value chain cost-effectiveness, resilience, and/or sustainability. Key examples are RFID/IoT technology, sustainability KPI trackers (on factors such as emissions, water usage, etc.), and alternative life cycle assessment tools. Collectively, tools and analytics serve to track materials in (near) real-time throughout the value chain, evaluate performance, and map and manage risks. Once in place and effectively used, they provide the informational baseline required to rethink packaging across the value chain.

F&B companies can start by establishing visibility into their main cost and sustainability KPIs across different steps of the value chain, and by setting up a should-cost model. Subsequently, they should refine insights into the broader value chain by using analytical tools that help map the relationship network and evaluate material decompositions (e.g. bill of materials) and critical components. Finally, they should establish control towers: by leveraging automated information exchange with tier-1 to tier-N suppliers and retailers, these allow for full data availability and transparency in real-time across the packaging value chain.

Examples:

- Nestlé implemented software to gain insights into quality and sustainability KPIs at every level of the value chain for baby food, aggregated into a single platform6.

- McDonald’s works on implementing food-safe RFID technology into its reusable containers in France. The initiative aims to increase reusable container usage, reduce unnecessary packaging, and contribute to better recycling systems7.

Case study

Value chain sustainability - Danone’s Connect4Growth and Path to Positive Impact

Danone works closely with its suppliers to boost packaging sustainability. These relationships go “far beyond a transactional B2B relationship”8 and rely on mutual trust and transparency. In this context, Danone runs a range of related initiatives.

One such initiative, dubbed Connect4Growth, targets the upstream end of the value chain9. It pushes suppliers to integrate Danone’s sustainability commitments into their ways of working. Key paper suppliers are required to gain a comprehensive understanding of their traceability, deforestation and land conversion, and carbon reduction obligations. In addition, Danone helps suppliers construct roadmaps, detailing how they intend to help improve the (sustainability of the) value chain. This initiative both enables Danone to track paper suppliers’ sustainability performance and to improve the overall value chain.

Towards the other end of the value chain, Danone has various initiatives to help boost recycling and waste management. An example is “Path to Positive Impact”10, an initiative in Poland where Danone worked with DP Recykling and REKOPOL to set up an innovative recycling program for its yogurt cups. Within this, the parties collaborated with scientists from a local university to use a newly developed technology with which used polystyrene cups can be cleaned and transformed into highly recyclable material. The initiative is an extra step in the company’s goal to use 100% recycled or renewable packaging materials by 2025.

Conclusion

Holistic packaging optimization is a powerful tool for F&B companies to tackle multiple problems at once. After getting the visioning, positioning and objectives in place, success depends on a set of key capabilities: value chain engagement enables companies to realize change beyond tier-1 suppliers, talent and organization lay the required internal foundation, and tools and analytics help to identify improvement points and monitor changes.

The F&B industry is evolving rapidly and faces a variety of pressures. To help deal with these, F&B companies need to prioritize building the priorities required to use holistic packaging optimization to increase cost-efficiency, improve sustainability, and safeguard value chain resilience.

Roland Daamen, Tim Martiniak, Camille Ané, Mike Lien, Marc Wangrin, Lasse Vos and Pieter Teer have also contributed to this article.