Gulf Cooperation Council countries are producing increasing amounts of data, yet the economic return remains small. We estimate that the GCC data economy was worth US$4.7 billion (around 0.3 percent of regional GDP) in 2018, a smaller proportion than in the European Union, where it was estimated at 1.9 percent of GDP in 2015. This is due to a lack of awareness of the value of data in the region. Moreover, there is a lack of government policies and regulations to safeguard data use, and a shortage of the necessary human and technical capabilities to support further expansion.

Enabled effectively, data will be a driving force for economic growth in the region, creating value when companies, governments, and individuals use them to improve, and even transform, decisions and business processes.

Rapid growth but insufficient value

Improved technology and connectivity, such as the ongoing deployment of 5G, are accelerating the growth of data and the improvement in quality.

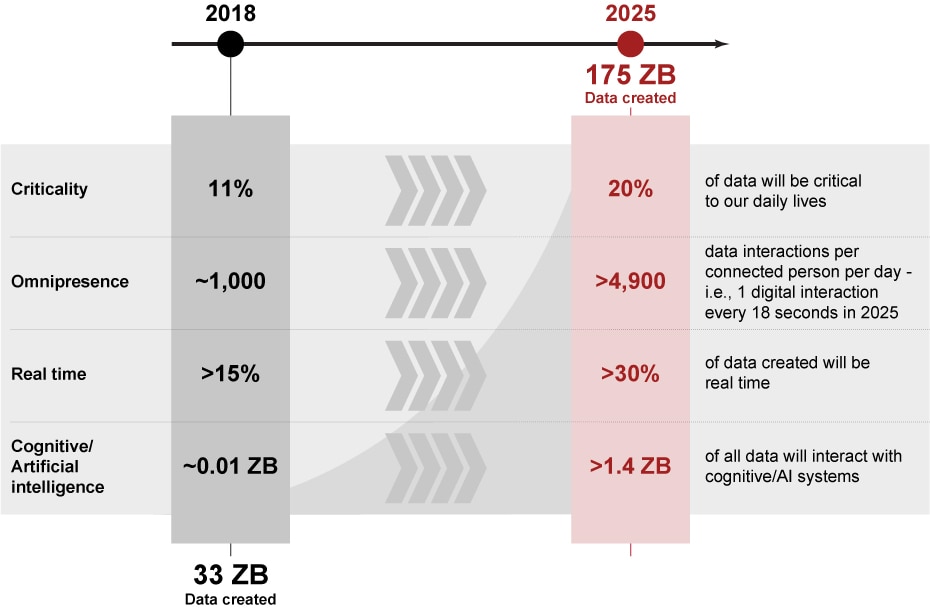

The total size of data generated globally in 2025 is expected to be 175 zettabytes, more than five times the volume in 2018.

The trend is also noticeable in Saudi Arabia, where data consumption grew by 35 percent from 2014 to 2018, compared with 24 percent in the U.K for the same period.

“To develop the data economy in their region, GCC governments must put in place the right ecosystem enablers and introduce regulation to safeguard data’s safe and fair use. This means clear guidelines for ownership, accountability, consumer protection, and privacy.”

Mapping the ecosystem players

There are several players that contribute to value creation in the data economy.

- Data producers

- Data consumers

- Ad-driven online platforms

- Data brokers

Data producers

Individuals, companies, and government agencies, along with data-producing machines, that create a digital footprint.

Data consumers

Companies and government agencies that use data insights to guide internal business decisions.

Ad-driven online platforms

Online platforms use insights from data gathered from their online users to offer improved targeted advertising services.

Data brokers

Stakeholders with access to large volumes of data relevant to consumer behavior produce insights, and share them in a raw or analyzed format with decision makers.

How can the GCC unleash its data economy

The data economy in the GCC will start realizing its full potential when regulators can guarantee that the rights of actors are well protected and actors are compensated fairly, when companies identify opportunities and then shift their focus to building their data-driven culture and undergoing the required organizational changes, and when individuals become more comfortable sharing their data.

- Governments

- Corporations

- Individuals

Governments

Corporations

Individuals

The case of Majid Al Futtaim: Embarking on an Advanced Analytics transformation

In 2016, with the ambition to become as prominent digitally as it is physically, the Majid Al Futtaim Group identified data, analytics, and technology as key enablers for its success. It uses rich data sets of 13 million customers across thousands of touch points to optimize operations, improve customer retention, and facilitate decision making. The data collected by Majid Al Futtaim are secured and managed by the company in line with local laws and regulations.

Majid Al Futtaim embarked on an Advanced Analytics transformation in 2016 by instilling a data-driven culture.

Where do GCC online users stand?

As individuals become increasingly aware of the value of their data, it is questionable whether the Internet giants will be able to maintain their dominance. In terms of GCC-region countries, Strategy&’s 2018 GCC data sentiment survey found that users are aware of the value of their data but are unwilling to share too much.

23% of GCC respondents would be willing to share more data if they were in control of it.

19% would share more data if they were getting paid for it or if they understood better how their data is used.

More than 33% of people in the GCC know the worth of their data, compared to 41% in the U.S., according to a Washington Post poll.

Facebook would need $7 per month from everyone in the U.S. to maintain its current revenue from targeted advertising. How much would you pay?

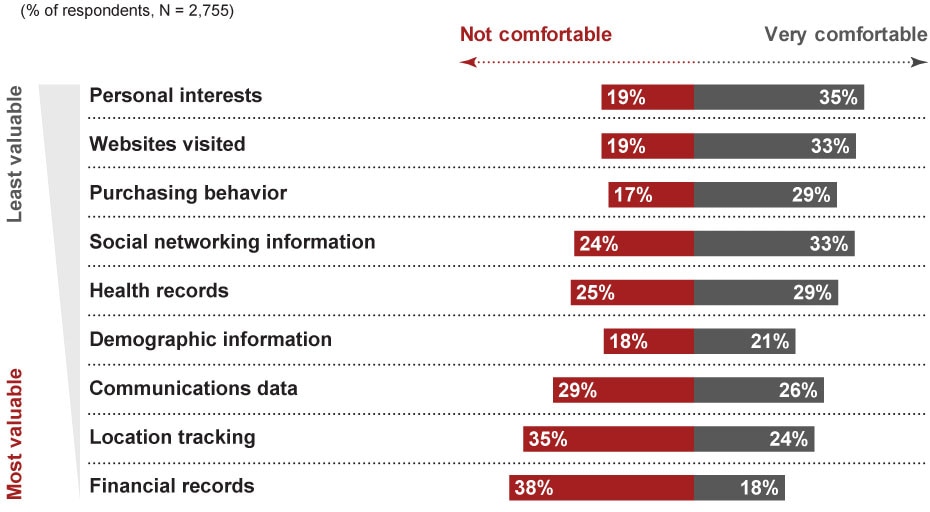

GCC citizens are currently least comfortable sharing telecom-related data, such as location-tracking and communications, and financial services-related data. Both are important parts of the global data trade.

Comfort levels for sharing data

Contact us

Menu