Executive summary

There is a strong recognition among Middle East national oil companies (NOCs) today of the need to build differentiating capabilities through investing in research and development (R&D). Globally, R&D spending in the oil and gas sector has grown despite volatile oil prices that have affected revenues, thanks to the long-term benefits R&D confers on companies in the sector, enabling them to become innovation leaders rather than simply adopt existing technologies. Traditionally, Middle East NOCs have had a relatively low R&D intensity — the ratio of R&D spending to revenues — compared with their global peers however, they are now taking steps to change this. Their efforts so far have been geared toward establishing research centers and pursuing collaboration opportunities with universities, service providers, and other partners — including international ones — in the innovation ecosystem.

In order to step-change their capability and create a best-in-class R&D setup, Middle East NOCs need to adopt a comprehensive framework that begins with defining a clear strategy covering upstream exploration and production, as well as downstream refining, processing, marketing, and distribution. Depending on their R&D ambitions and priorities, they should determine which technologies to import and which to develop internally. Next, they must build a fitfor- purpose R&D operating model to facilitate the transfer of new technologies from development to deployment. To make full use of their R&D infrastructure, they will need to hire and retain the right talents, whether at home or in affiliated research hubs in Europe or the U.S. In addition, they should consider building strategic or project-based collaborations with innovation partners to develop capabilities in the form of new technological products and services. Given the right commercialization framework, incentives, and support, they could monetize these capabilities. Finally, they should institute a culture of innovation across their organizations to complete their transformation into world-class innovative enterprises.

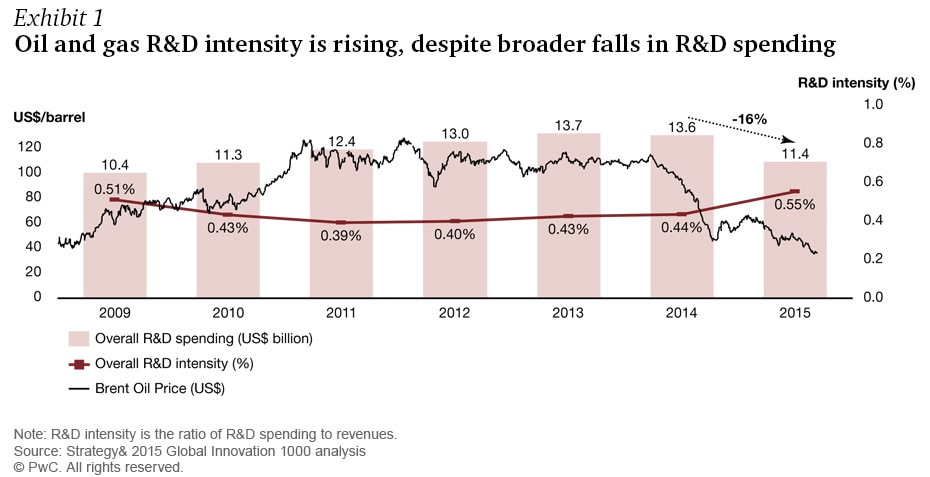

Research and development spending has remained healthy

The global oil market has gone through a period of considerable volatility and weak prices which had an adverse impact on companies’ overall investment levels. Several oil and gas companies are now geared toward cost reduction in many areas, including spending on R&D. According to Strategy&, global R&D spending dropped by 16 percent between 2014 and 2015. However, despite the decline in oil prices and overall R&D spending, oil and gas companies have bucked this trend, maintaining a relatively higher allocation of investments to R&D as a proportion of their sales. In fact, their overall R&D intensity (the ratio of R&D spending to revenues) has grown (see Exhibit 1). Oil companies need to address specific technical challenges and are already aware of how R&D can act as a differentiating capability with long-term benefits. For example, many firms need to find solutions to improve recovery, increase production, boost operation efficiency, unlock resources, and reduce costs.

R&D trends in Middle East NOCs

NOCs in the Middle East have not kept up with their global industry peers when it comes to R&D intensity (see Exhibit 2). The figures, however, only tell one part of the story: There is a strong recognition among leading Middle East NOCs of the need to build R&D capabilities so that they move from being technology adopters to becoming innovation leaders. NOCs are thus increasingly investing time, efforts, and money in research and technology to enhance in-house research and foster linkages with the innovation ecosystem.

At a national level, NOCs are establishing dedicated oil and gas R&D facilities. For instance, the Abu Dhabi National Oil Company (ADNOC) is in the final stages of inaugurating its Petroleum Institute research center. They are also playing a more significant role in the integration of the oil and gas innovation ecosystem into that of their home economies. Indeed, NOCs are creating effective linkages between their own in-house R&D centers and other research and academic institutions, service companies, and universities. These linkages make the innovation ecosystem work, thereby promoting the NOCs’ innovation agenda and meeting their business needs. Moreover, NOCs are taking on a more active role in establishing technology parks to create forums that bring partners and academic institutions closer to their operation sites. Saudi Aramco, for example, is actively shaping the vision of the Dhahran Techno Valley Company to attract major oil and gas players.

At an international level, NOCs are also expanding their investments in physical oil and gas R&D facilities. Saudi Aramco recently opened a research center in Detroit, its eighth satellite research facility and its third in the U.S. Additionally, NOCs are strengthening their portfolio of relationships by establishing large-scale strategic collaboration agreements with external parties. By doing so, they are delivering specific R&D projects, advancing their own capability development, and increasingly participating in shaping the global discussion on oil and gas R&D and innovation. Notable examples include Qatar Petroleum’s collaboration with Imperial College London in the Qatar Carbonate and Carbon Storage Research Centre and Saudi Aramco’s Aramco Fuel Research Center, created in collaboration with France’s Institut Français du Pétrole - Energies Nouvelles (IFPEN).

Conclusion

Middle East NOCs are ambitious. They want to become technology innovators and solve their country-specific technical challenges themselves. If they can develop the right capabilities, they can build a fully functional R&D setup. This will position them to deal more effectively with the greatest challenges to their long-term business strategy. It will provide global recognition and influence research trends in the oil and gas industry. Most important, it will secure the place of Middle East NOCs in the global oil and gas innovation ecosystem.

Contact us

Menu