To build a more sustainable future, the world needs green electrons to power energy grids, green molecules to make products including chemicals and metals less carbon intensive, and innovative greener technologies that can reduce or eliminate emissions. And all of this is needed at a time when demand for power is growing. To give one example, an internet search using GenAI consumes 10 times more energy than doing the same search with a traditional web browser—and we are still only at the beginning of the GenAI era.

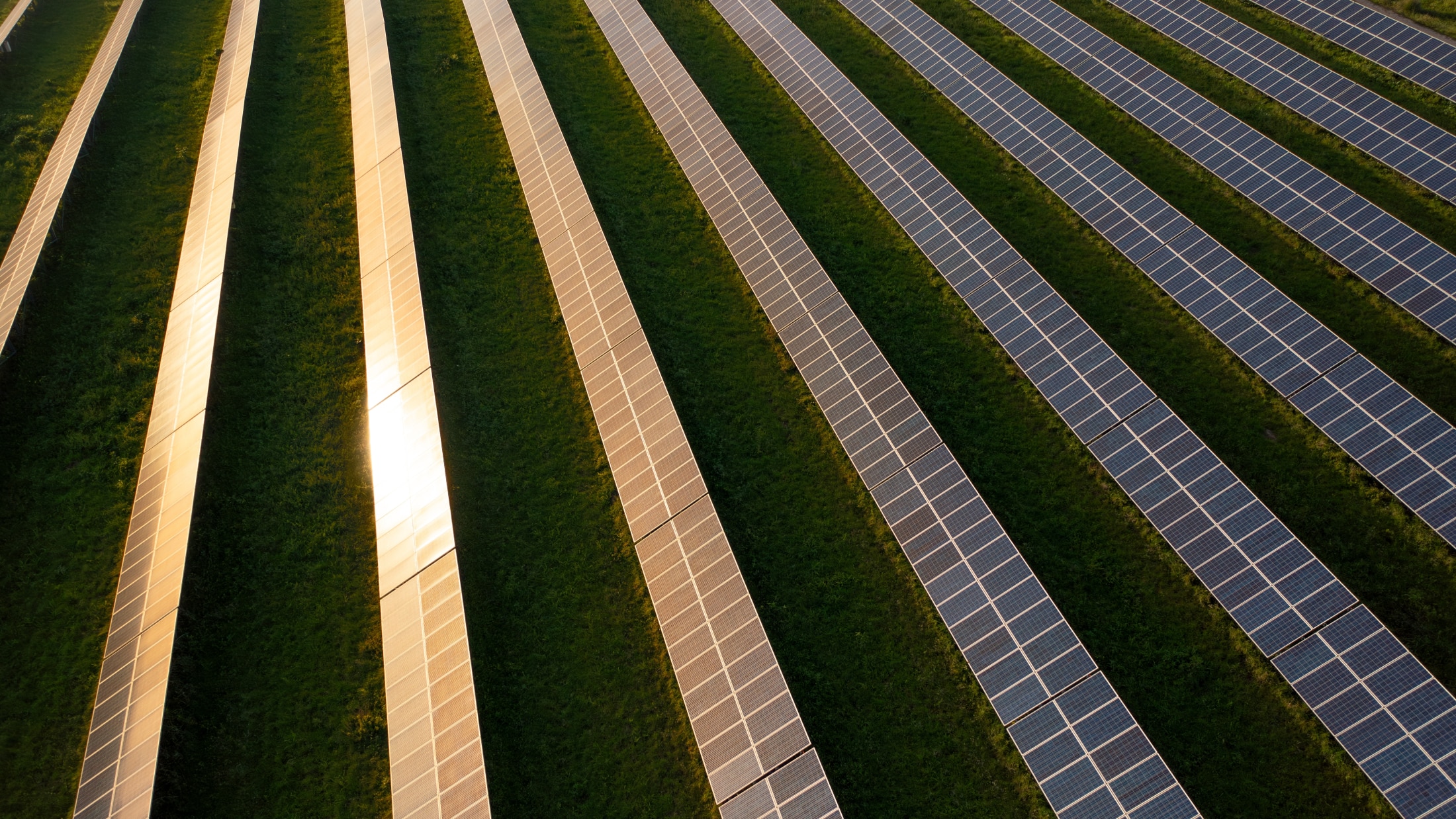

In this context, the Middle East has some unique advantages that mean it could lead global sustainability efforts now underway. Saudi Arabia, the UAE, and other Gulf Cooperation Council countries are both highly vulnerable to the effects of climate change and exceptionally well placed to become the most important global producers of various forms of green energy, thanks to abundant sunshine, wind, and available land on which to build the installations that can generate these new energy sources. Saudi Arabia alone is home to the world’s cheapest solar electricity at Shuaiba—almost 1 cent per kilowatt-hour. Four of the ten most cost-effective solar projects are here.

Listen to this article here!

The region can turn this renewables competitive advantage into a molecular one offering all colors of hydrogen at competitive prices and becoming a hub for precision fermentation producing protein-based foods. It also has the potential to become a cost-competitive center for green manufacturing.

So far, green foreign direct investment is not flowing here, however. Foreign direct investment data shows that more than $0.9 trillion in large-scale green FDI has been announced, with more than 80% of it allocated to hydrogen, renewable energy, and batteries. For now, Europe is the main destination—while the Middle East is missing out, despite its considerable advantages.

To pick up the mantle of green leadership, the region needs to focus on several critical elements.

In a book I co-authored with my colleague Shihab Elborai, Arabian Gambit, we estimated that GCC countries will need to spend about US$3 trillion if they want to truly revamp and reorient the economy to become a green powerhouse. The incentives will need to be aligned among all the actors to ensure the money is well spent. The fossil economic linkages that have been built within the region will need to evolve into green ones with green economic corridors.

Ultimately, to make green tech viable, “green diplomacy” is needed in the form of partnerships that can make transition investments fruitful. Technologies like hydrogen face risks of high costs and uncertain returns. Along with innovation, green technology needs infrastructure and investment. To scale up, it also needs customers.

It’s time to think beyond borders. Imagine a “green corridor” linking Europe and the Middle East, where historical hydrocarbon routes become pathways for greener energy, products, and bytes. Green diplomacy and cross-regional partnerships will help de-risk investments in the electricity grid and make critical technologies like hydrogen viable. To avoid energy instability, sustainability, affordability, and security will need to become priorities. Above all, a comprehensive vision is called for—a multi-nation “Green Charter* that binds countries together in the pursuit of a sustainable, inclusive, and prosperous future.

This article originally appeared in Finance Middle East, November 2024.

Contact us

Menu