{{item.title}}

{{item.text}}

{{item.text}}

Green finance represents a significant, and currently untapped, opportunity for the countries of the Middle East, in particular the Gulf Cooperation Council (GCC) countries, which have well-developed capital markets. Investors around the world are pouring capital into projects with a strong environmental, social, and governance (ESG) angle, precisely the area in which the GCC countries have an advantage because of their abundant and low-cost renewable energy. Our analysis has found that green investments in six key GCC industries could have a profound impact by 2030, unlocking up to US$2 trillion in cumulative GDP contribution, creating more than 1 million jobs, and encouraging foreign direct investment (FDI).

To capitalize on this opportunity, and continue the process of diversifying regional economies away from fossil fuel–based industries, governments in the region need to focus on four priorities: promoting environmental sustainability; creating a green sovereign wealth fund; strengthening capital markets; and developing standard and transparent reporting mechanisms for environmental performance.

Governments and businesses in the GCC are devoting significant attention and capital to environmental sustainability. However, until now the financial sector has not kept pace. Green finance, which takes into account the environmental impact of investments in addition to purely financial returns, remains relatively underdeveloped. That needs to change, because developing the right structure and mechanisms for green finance can help unlock a significant opportunity for the GCC region: $2 trillion in economic growth and more than 1 million jobs by 2030, according to our analysis. Moreover, green finance can accelerate the region’s goals of economic diversification and job creation. If structured correctly, it can attract FDI.

To capture this opportunity, GCC governments should focus on four priorities: promoting environmental sustainability; creating a green investment body; strengthening capital markets; and developing standard and transparent reporting mechanisms for environmental performance.

In addition to the six sectors in our analysis, GCC governments can seek opportunities in other areas. For example, they can encourage sustainable tourism, demand for which has increased significantly over the last decade. A growing number of travelers seek authentic cultural experiences and activities such as cycling, hiking, and road trips. Green financing opportunities in tourism could support the construction of resource-efficient tourism infrastructure, including eco-friendly hotel sand natural heritage destinations. In Saudi Arabia, for example, the government has been collaborating with the agricultural sector to offer holidays on farms. Similarly, Oman and the United Arab Emirates (UAE) have made efforts to preserve biodiversity and further develop co-tourism offerings.

GCC countries have already begun the transformation to sustainability. The question now is how they can support these initiatives in a differentiated manner and capture the largest share of the economic prize. Four strategic priorities should be on the agenda of all governments in the region.

Promoting environmental sustainability

Governments should enact policies that promote environmental sustainability in all industries, including incentives, market mechanisms, and standards. Market mechanisms such as fees on carbon, plastic, and other materials with harmful environmental impacts provide a true cost of a company or industry’s activities. Incentives in areas such as renewable energy usage and electric vehicles can boost adoption.

Governments also need to continually update regulatory standards for emissions, recycling, and building codes to ensure the economy is keeping pace with advances in innovation and technology. Furthermore, governments can phase out existing inefficient subsidies for electricity, fossil fuels, and water. When such subsidies are poorly targeted, as has often been the case, they promote wasteful consumption of resources, economic distortion, and harmful environmental outcomes.

Creating a green sovereign wealth fund

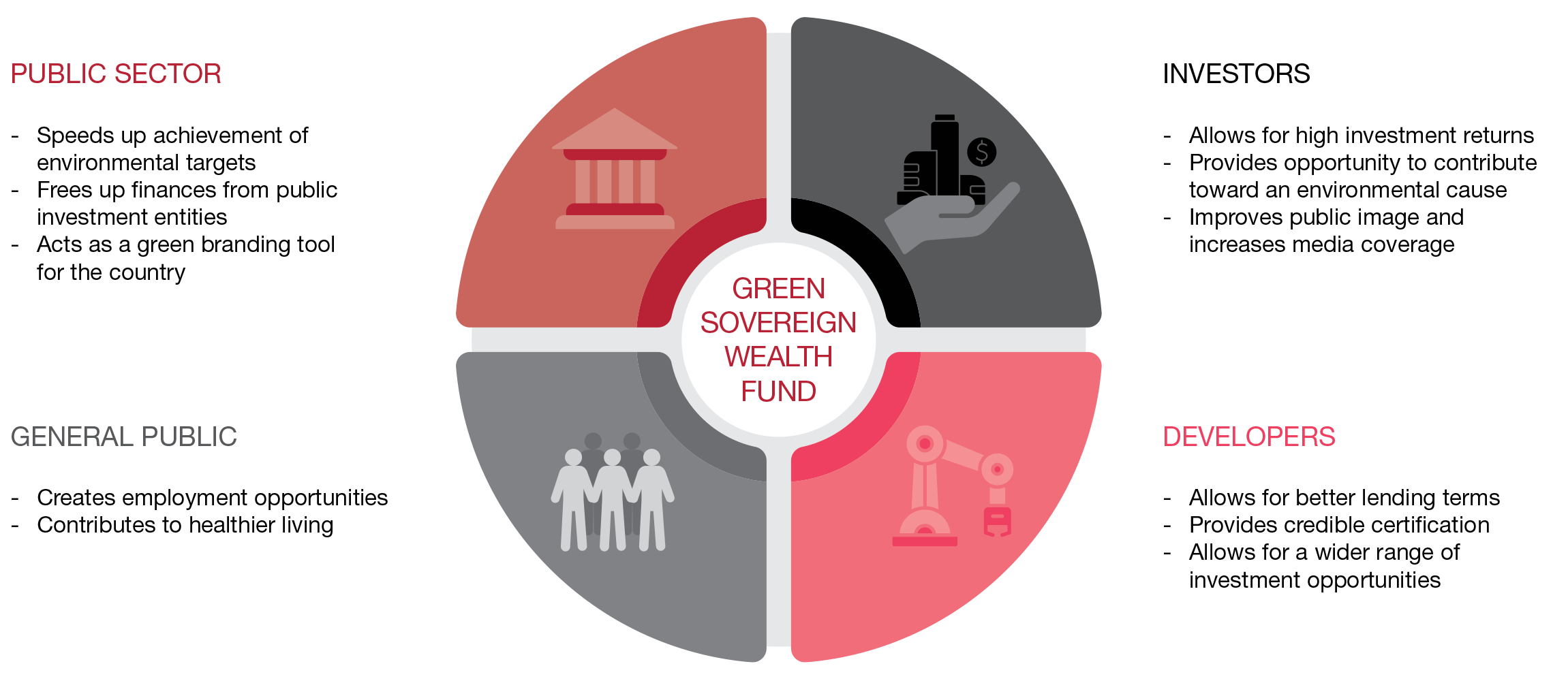

Each GCC government should create a green sovereign wealth fund. This organization should have the credibility and capabilities to engage with, and attract, international investors. The green sovereign wealth fund should not be beholden to the region’s legacy mindset regarding sustainability, which treats it as a cost burden, rather than an opportunity. Establishing a green sovereign wealth fund will unlock substantial benefits to all stakeholders, including the public sector, investors, developers, and the general public.

Most importantly, this green sovereign wealth fund should act as a credible minority partner attracting international and local private investors, rather than keeping them out. The right approach is akin to seed capital—governments that create the right environment for green finance can invest a small slice of the required capital and attract the remainder from institutional investors and other players from around the world. Indeed, a leading government-owned green bank managed to draw 11 times the government’s stake in equity from private players.

In addition, proceeds including asset sales, dividends, and interest payments are subsequently being recycled and reinvested. Sustainable investments have garnered relatively solid performance, and returns from equity and debt investment made in green funds have proven to be comparable to those of conventional indices. An analysis comparing the financial performance of the S&P 500 Index to the S&P 500 ESG Index shows that during the five-year period through March 2019, the sustainability benchmark provided an annualized return of 8.8 percent, compared with the S&P 500 Index’s 8.2 percent return. Furthermore, the S&P 500 ESG recovery in 2020 outpaced that of the S&P 500 Index.

In creating such a fund, it is critical to strike the right balance between environmental impact and financial performance and risk. Determining the portfolio focus and the sectors to invest in, defining what risk profile to adopt, and identifying the types of investments require an in-depth analysis of local needs, regulatory requirements, and international best practices. They also require a rigorous investment process, robust financial tools, and strong internal capabilities.

Strategic options for the green sovereign wealth fund

GCC governments have made some headway in transitioning away from carbon-based industries, diversifying their economies, and stopping the decline in FDI. They can do far more by capitalizing on their advantages in renewable energy and embracing green finance.

{{item.text}}

{{item.text}}

Menu