In 2020–2021, Poland’s e-commerce market was characterized by considerable uncertainty and periodic closures of retail stores as a result of the COVID-19 pandemic, which significantly accelerated e-commerce growth. The years 2022–2023, in turn, will be defined by struggles with galloping inflation, sagging consumer demand, the implications of Russia’s invasion in Ukraine, and mounting international tensions. All of these factors mean that we will not return to the predictability of the 2010s any time soon, and doing business in an environment of high volatility and uncertainty will become the new normal.

Key factors expected to drive e-commerce growth

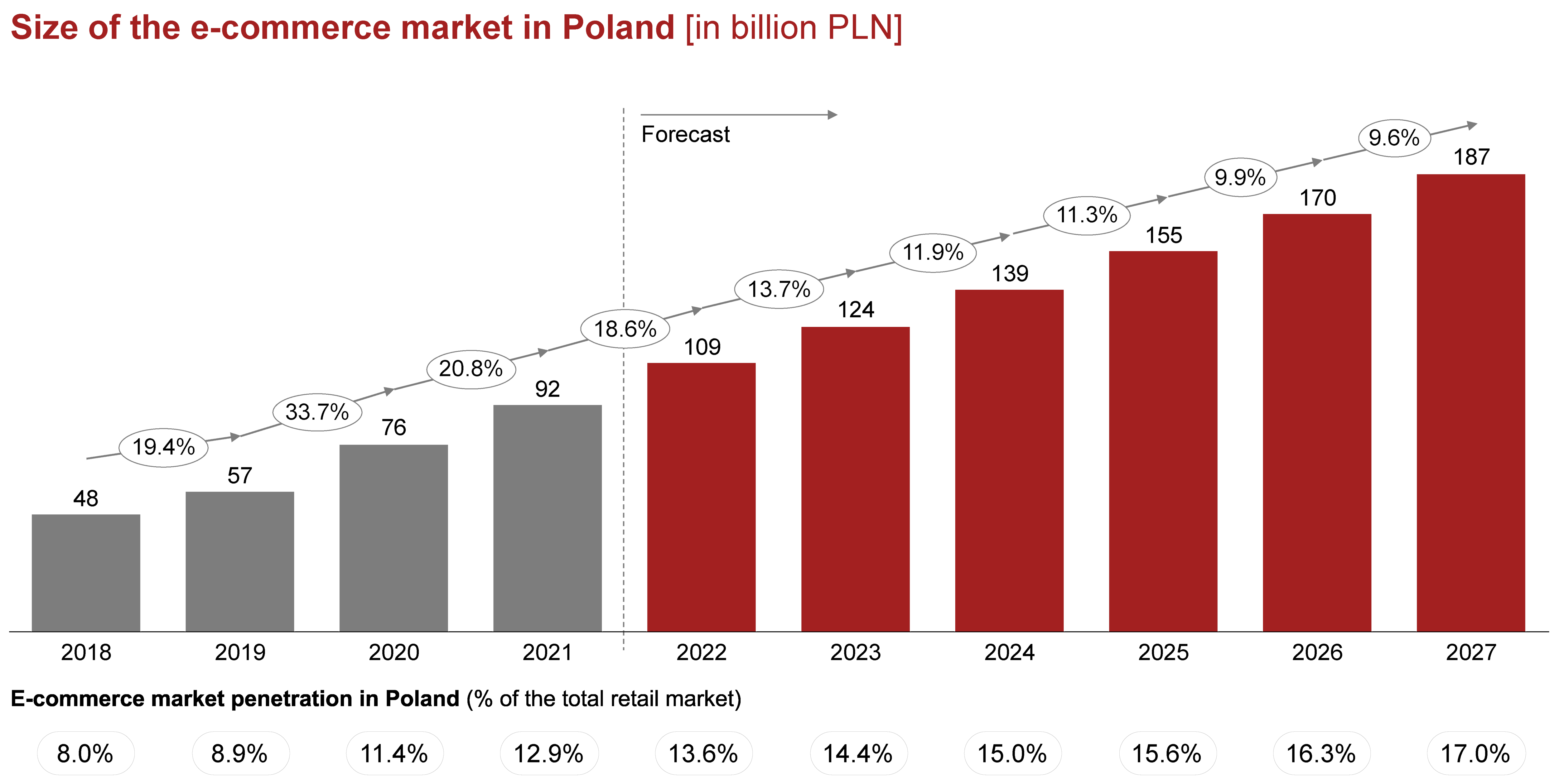

Several players have made their debuts in the Polish e-commerce market, which has impacted significantly on competition and the offerings for customers. These players included both q-commerce operators, which appeared in Poland’s largest cities, and major marketplaces that decided to enter the Polish market, such as Amazon, Shopee, and eBay. The emergence of new competitors, combined with the rising importance of the digital channel for all retail businesses, translates into continued growth prospects for the e-commerce market in Poland over the next five years. The sources of this growth will change depending on the year. Apart from the typical linear continuation of the trend from years ago, the key factors influencing the market will be:

- The rise in inflation resulting from the long-term effects of economic policy aimed at sustaining economic growth during the pandemic, and supply problems resulting from supply-chain disruptions and Russia’s invasion of Ukraine, which is driving up the prices of energy commodities. Higher inflation will affect the value of the e-commerce market, becoming the key driver of market growth in 2022–2023. In the long term, persistent inflation may also act as a force accelerating the shift towards the online channel as consumers will be looking for lower prices and special deals.

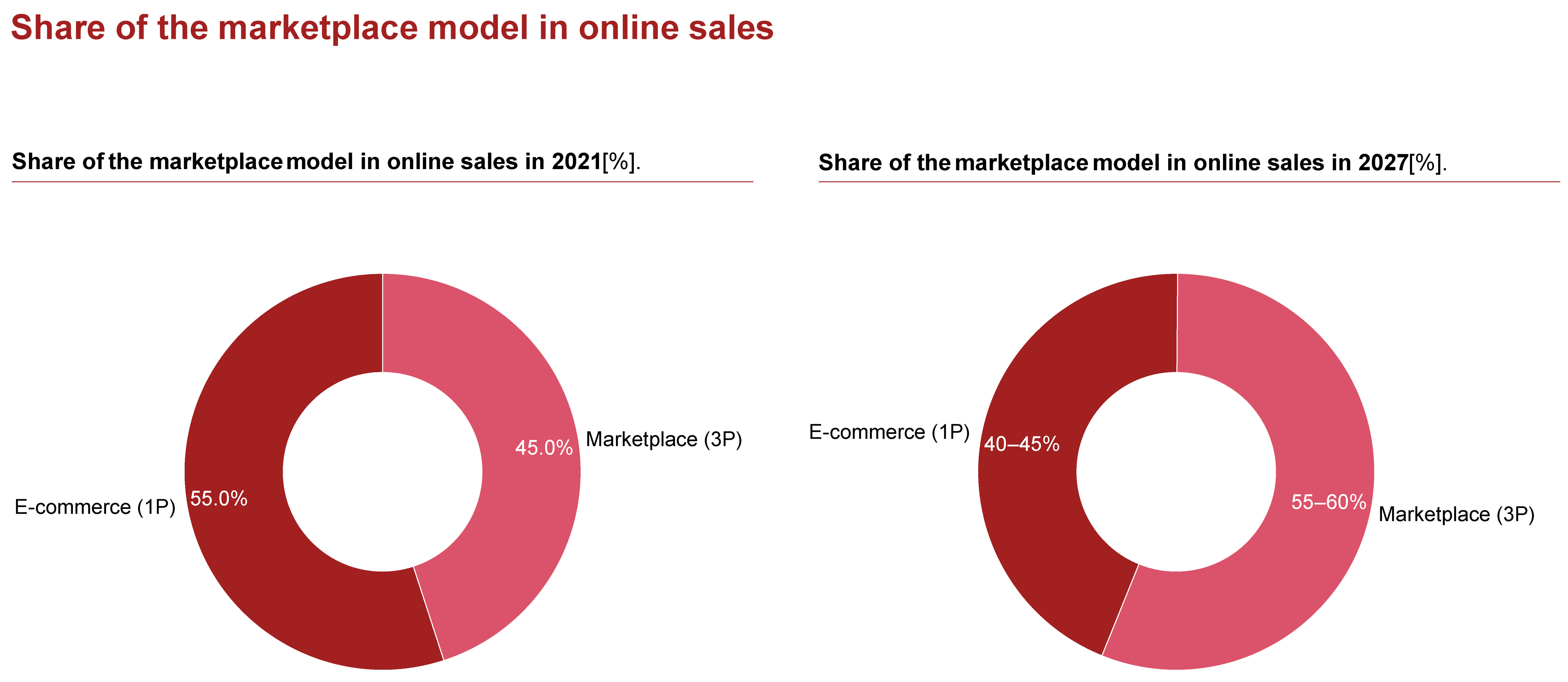

- The battle for customers between marketplaces – the appearance of leading global e-commerce marketplaces in the Polish market may substantially accelerate the growth of the online share. In the times of greater price sensitivity, aggressive promotions aimed at increasing the market share of specific players and supported by intensive marketing campaigns may affect changes in the buying decisions of the Poles.

New technologies – other important factors driving growth in the online market will include the continued emergence of innovations aimed at improving customer experience in the sphere of online shopping and lower order fulfillment prices. The key technologies and solutions playing an increasingly important role include logistics automation, the density of parcel lockers networks, Buy Now, Pay Later (BNPL) arrangements, and instant home delivery (resulting from growing customer needs in this respect). All these solutions boost the shopping experience for customers, and some of them also reduce delivery costs. In this way, they also improve the competitiveness of the online offerings versus the offline ones, and consequently speed up the move of customers to the digital channel.

- Continued generational replacement – overall consumption will be characterized by growth in the share of the generations of “digital natives” (Millennials & Generation Z), who see online shopping as a natural and often also preferred option.

Product categories generating the highest projected growth in e-commerce

Between 2021 and 2027, the value of the e-commerce market in Poland will grow by more than PLN 94 billion. More than half of this amount will be generated by three categories: fashion (PLN 21 billion), electronics (PLN 19 billion), and health & beauty (PLN 11 billion). The key factors driving growth in the category “fashion” will be growth in consumption after a periodic decline during the pandemic, the inflow of a new group of consumers from Ukraine, and continued improvements in the shopping experience. Growth in the electronics category will be driven by further online growth, which will slowly begin to approach the level of saturation. We estimate that the share of the digital channel in the electronics category in 2027 will account for two-thirds of the sales volume in this category, which will remain the category with the highest penetration level.

Food products are also gaining in importance, chiefly due to the highest base level of all categories, accounting for nearly half of total retail sales in Poland in terms of value. Growth in this category will be driven mainly by the further development of q-commerce players, the strategic importance of this category for many leading e-commerce marketplaces, including Allegro (online auction and shopping website), as well as the opening up of retail giants such as Biedronka and Lidl (discount retail chains) to online sales.

Food products are also gaining in importance, chiefly due to the highest base level of all categories, accounting for nearly half of total retail sales in Poland in terms of value.

Strategic implications

Further growth of the e-commerce market intensifies existing challenges and poses new ones for retail companies. Three key strategic implications are:

The past two years have seen a significantly faster pace of growth in the Polish e-commerce market. However, numerous battles have yet to be resolved, with the Polish e-commerce market facing further growth prospects. In such a market, companies are facing an enormous challenge, but also a business opportunity to significantly improve their competitive position. The key to a victory will lie in efficiency in managing multiple channels for reaching customers, a flexible supply chain based on numerous strategic partnerships, and better customer lifecycle management resulting from better use of data.

Contact us