{{item.title}}

{{item.text}}

{{item.text}}

The current high inflation and the spectrum of the economic crisis, critical challenges of the upcoming year 2023, may slow down the shift to the online channel due to the typically additional costs associated with order fulfillment. Nevertheless, they will not reverse the long-term trend of increasing the digital channel share in grocery categories.

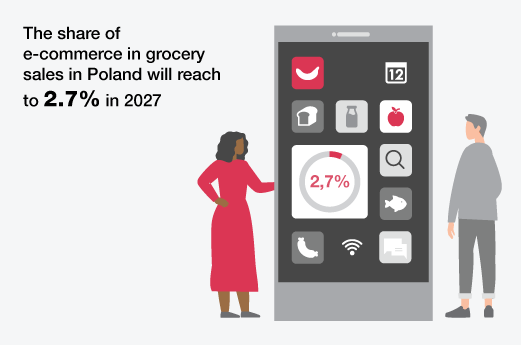

In Poland, our forecasts project e-commerce's share of grocery sales at 1.4% by the end of 2022 and 2.7% in 2027. However, the saturation of the online channel in this category will be concentrated mainly in large cities. Online penetration may exceed 10% in the second half of this decade in the most significant agglomerations. At the same time, rural areas or smaller towns will often be deprived of the opportunity to order fresh groceries via the digital channel.

Moreover, the number of consumers who grocery shop in the digital space will grow yearly. Thus, despite the relatively low saturation of grocery sales in the digital channel nationwide, quite quickly districts where the share of the online channel already exceeds 10% and shortly may exceed 20% will be appearing on the map of Polish cities.

In the long-term perspective, the direction of change may be set by Western European countries, where, according to forecasts, the share of grocery sales through the online channel is expected to grow to 26% in the UK, 25% in the Netherlands, 23% in France, 11% in Germany and 10% in Türkiye by 2030. Additionally, the share of online grocery sales is expected to reach between 35% and 50% in each of these countries by 2050, according to a Strategy& study.

The significant increase in the share of the digital channel in grocery sales means that leading retailers must take their e-commerce strategies seriously. The winning sales model in the grocery category will be the omnichannel model, which is characterized by the integration of online and offline sales. Both home ordering and various additional digital services that will support the shopping experience will gain in importance. Examples of such services include: grocery sales through the online channel are expected to grow to 26% in the UK, 25% in the Netherlands, 23% in France, 11% in Germany, and 10% in Türkiye by 2030. Additionally, the share of online grocery sales is expected to reach between 35% and 50% in each of these countries by 2050, according to a Strategy& study.

Compared to Western countries, Poles do their grocery shopping more often, about 2-3 times a week on average (versus 1-2 times a week in the West). In addition, about 40% of Poles say they do their grocery shopping every day. Polish consumers value fresh products, which to some extent, justifies this difference. The availability of convenience stores and discounters further supports the higher shopping frequency. Moreover, discounters and convenience stores are expected to grow the fastest at the cost of supermarkets, hypermarkets, and traditional stores.

The "convenience" trend is growing very dynamically in Poland. The main reasons customers use self-service checkouts, for example, are greater convenience (76%) and time-saving (73%). The same reasons are given as the main drivers for online shopping, which is reflected in the growing popularity of convenience chains, as they provide customers with short service times, availability, and a tailored assortment. Additionally, marketing campaigns are increasingly highlighting these aspects of convenience stores. The prospective path of convenience stores is the further development of standalone stores, of which Poland currently has the most significant number in Europe. At the same time, approximately 70% of Poles express a desire to use such solutions.

Technology and new hardware solutions are further factors that will significantly impact the food market's future. Among the potential solutions, one should mention the following:

New technologies and the strongly unequal level of saturation of grocery shopping via the digital channel nationwide will lead to the development and coexistence of players operating in different business models. Discount stores will remain the dominant format, but in selected areas, their sales will be squeezed by the offer of q-commerce players (deliveries in 10-15 minutes) or pure e-commerce companies, including leading shopping platforms. An important role may also be played by convenience players, who, supported by a more extensive online offering and convenience foods, can influence consumer behavior, encouraging them to increasingly rely on their convenience and consequently abandon cooking on their own.

The Future of Grocery shopping study includes interviews with 57 experts from Western European markets. It is an attempt to take a longer-term view of the directions in which the grocery industry is evolving, including technologies and processes at the operational and supply chain levels. The report identifies critical changes and areas of work that leading players in the grocery category should consider being ready for future challenges.

For more information please contact our local and foreign experts.

{{item.text}}

{{item.text}}

Krzysztof Badowski