{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

What are Polish consumers like? What has the greatest impact on their attitudes and purchasing behavior? The Strategy& "Optimism only where the price is low. Attitudes and purchasing behavior of Polish consumers" report, as part of the global Voice of the Consumer study, shows the perspective of Polish society compared to the inhabitants of Europe and the whole world. It is based on data collected from over 20,000 consumers from 31 countries and covers areas such as purchasing behavior, health and well-being, digital, social media, technology, ecology and sustainable development.

From our region - Central and Eastern Europe (CEE) - six countries took part in the study: Poland, the Czech Republic, Slovakia, Ukraine, Romania and Hungary, from which almost 2,000 responses were collected. The representative sample size allowed us to draw statistically significant conclusions and compare consumer trends between individual countries and at the regional and global level.

Mieczysław Gonta

Leader of the retail and consumer goods sector in PwC CEE, Partner of PwC Poland

Krzysztof Badowski

Managing partner of Strategy& in Poland

Robert Żygowski

Senior Manager

Strategy& Poland

What are Polish consumers like? What guides them in their purchasing decisions? This is a question for all of us, because each of us is a consumer. Our Voice of the Consumer research shows that consumers are characterized by a practical approach to spending, readiness to use new technologies and a tendency to use social media. This also heralds many challenges for both producers and retail chains, who, in order to be successful in reaching and acquiring customers in a modern, dynamic environment, must understand changing preferences and build a strategy for next steps based on them.

This year's edition of the Voice of Consumer survey is particularly crucial because a lot has happened over the last year - both in the area of changes in consumer preferences: consumers returning to pre-pandemic habits, as well as checking new solutions, tools often supported by artificial intelligence, the use of which in business and private life aroused curiosity, hopes and fears at the same time.

The beginning of 2024 also brought a change in economic conditions - we are registering the lowest inflation levels in 3 years, which, although present in numbers, do not necessarily have to be immediately noticed by consumers. Poles are continuously price sensitive, but currently, due to expected inflation increases, they are looking for promotional opportunities and often put the financial aspect before health aspects.

Despite declarations of commitment to climate protection, this commitment diminishes significantly when it means a noticeable impact on the household budget and then environmental criteria become secondary. Even though a significant part of consumers are in favor of personalized advertising in social media, indicating it as the best channel to reach them, they are still skeptical about solutions based on AI, where sometimes the level of integration of artificial intelligence exceeds consumers' confidence in its use.

We asked consumers in Poland, the CEE region and all around the world about these and other areas and would like to share a selection of conclusions that, in our opinion, define the modern consumer, their ambitions, prospects and key areas of uncertainty. We invite you to read the Voice of the Consumer 2024 report.

We invite you to read the Voice of the Consumer 2024 report.

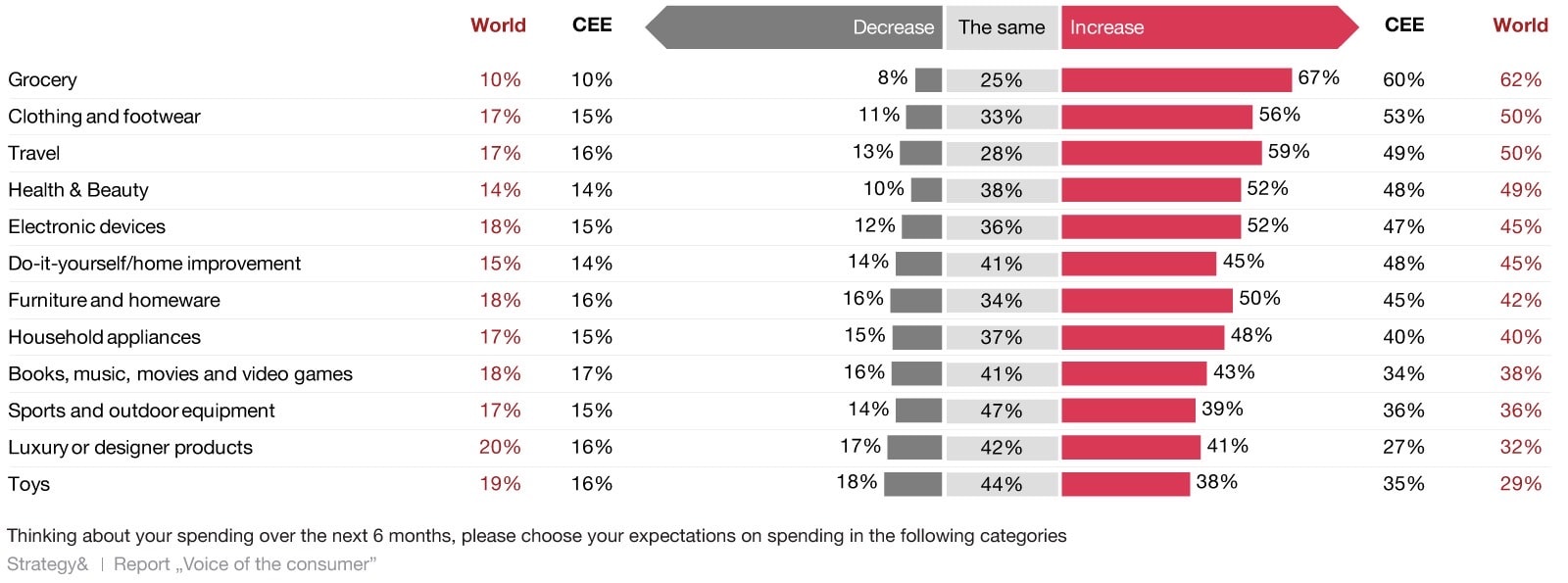

The Polish consumer, like consumers in Central and Eastern Europe, is preparing to increase spending in various categories over the next six months. The most important of them are groceries, clothing, travel, health and beauty and electronic devices.

Predictions about the amount of spending over the next six months in various categories

In light of the stringent requirements of the European Green Deal on food quality and sustainable production, the food sector is expected to reach its highest level of spending ever. These regulations play a key role in increasing food prices, and this trend is further exacerbated by the high inflation rates observed in Poland in recent years. We also face additional challenges related to uncertainty over Ukrainian grain exports, which have been disrupted since the Russian invasion in February 2022.

This applies in particular to Poland, where 67% of consumers expect higher spending on groceries.

Within the European Union, Poland and the countries of Central and Eastern Europe (CEE) consistently have some of the highest inflation rates. However, these countries also experience rapid economic growth, which distinguishes them from the rest of Europe. This dynamic growth fosters expectations of rising incomes among the inhabitants of Central and Eastern Europe, leading to increased purchasing power and, consequently, consumer spending. Nevertheless, the specter of progressive inflation and, subsequently, the possibility of conflicts and threats to one's health are key concerns for consumers from Poland and CEE.

The greatest threats and factors that Poles are most afraid of

The observed increase in consumer spending in all categories is a multi-faceted indicator of economic behavior. It not only signals a recovery in consumer confidence, but also suggests that household purchasing power has resisted or even strengthened in the face of inflationary pressures. This upward trend in spending is a reflection of an economy in which consumers are willing to spend not only on necessities such as food, but also on improving their lifestyle and well-being by increasing spending on luxury goods and broadly understood secondary needs.

In Poland and the Central and Eastern Europe (CEE) region, a trend can be observed in consumer behavior, particularly emphasizing the priority of financial factors (60% and 63%, respectively) over health (55% and 53%, respectively) and climate issues (20% and 13%, respectively), when it comes to food choices. This characteristic contrasts with the global norm in which health often takes precedence over financial considerations.

Food choices and their motivations

In Poland and the CEE region, the financial aspect is the main concern of residents, as shown by data for the entire region.

In Hungary and Slovakia, a large majority of consumers - 75% and 74% respectively - consider the cost of products to be one of the three most important factors influencing their dietary decisions. This is a notable deviation from the usual patterns seen in other parts of the world, where the financial aspect at 52% is crowded out by health factors at 57%.

The predominance of financial considerations in Poland can be attributed to high inflation rates in 2021-2023, which significantly impacted consumers' purchasing power. As a result, financial constraints become a key factor in decision-making processes, especially when it comes to basic items such as food.

A significant difference is also visible in how many Polish consumers value "seasonal" food when making grocery shopping choices. These preferences can be attributed to the significant share of agriculture in the Polish economy and simply to cultural aspects, such as the strong tendency of part of society to use local, seasonal ingredients.

In Poland, the use of different shopping channels is evolving, reflecting a mix of traditional and digital options. While the global trend is largely based on integrated digital platforms that combine social interactions such as physical trade and group purchases with e-commerce, Polish consumers are striking a balance between their online and in-store shopping experience. They still value the in-store shopping experience, suggesting a more gradual shift to digital channels.

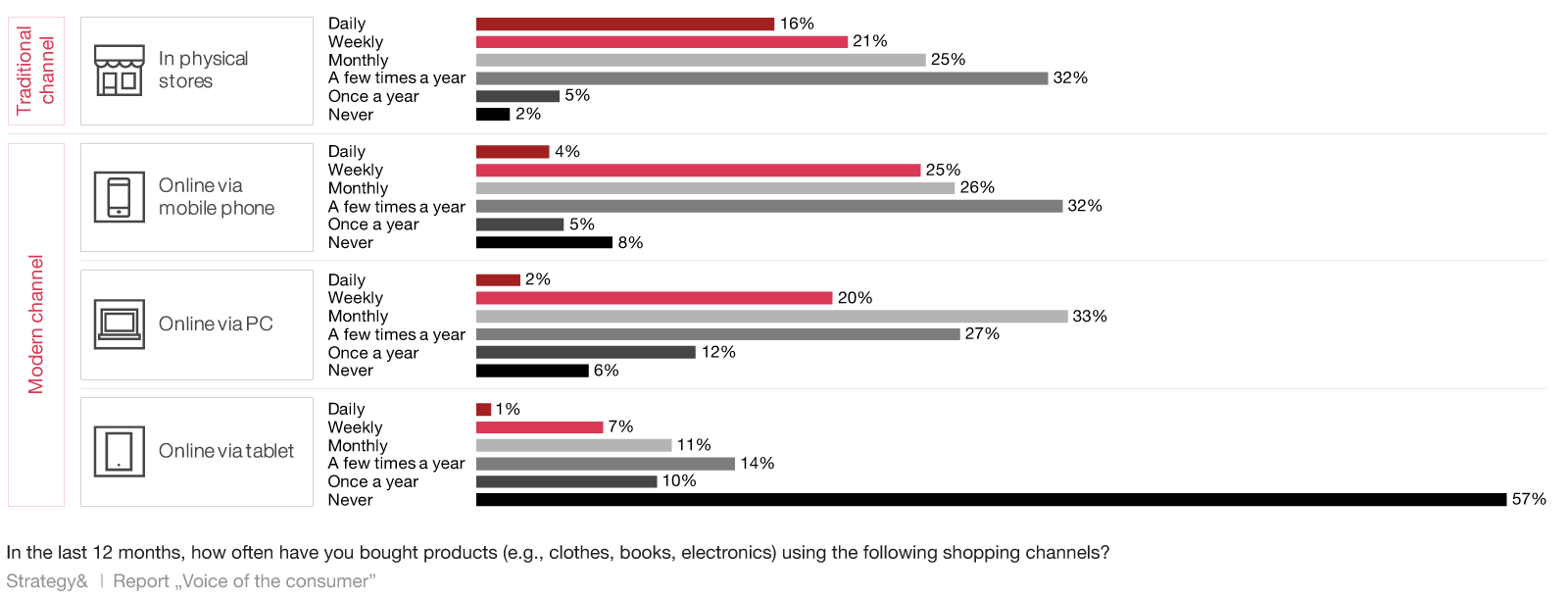

Frequency of using different sales channels

For Poles (45%) and residents of Central and Eastern Europe (43%), delivery speed is very important when shopping online. However, this is not the most important factor for Polish consumers - compared to CEE citizens (31%), they attach much more importance to promotions - as many as 47% of respondents indicated this factor as key.

According to Strategy&'s study "A new image of the Polish consumer" from 2022, 38% of respondents indicated promotions as a factor on the basis of which they make choices, and in 2020 - 31%.

Factors that consumers value most when shopping online

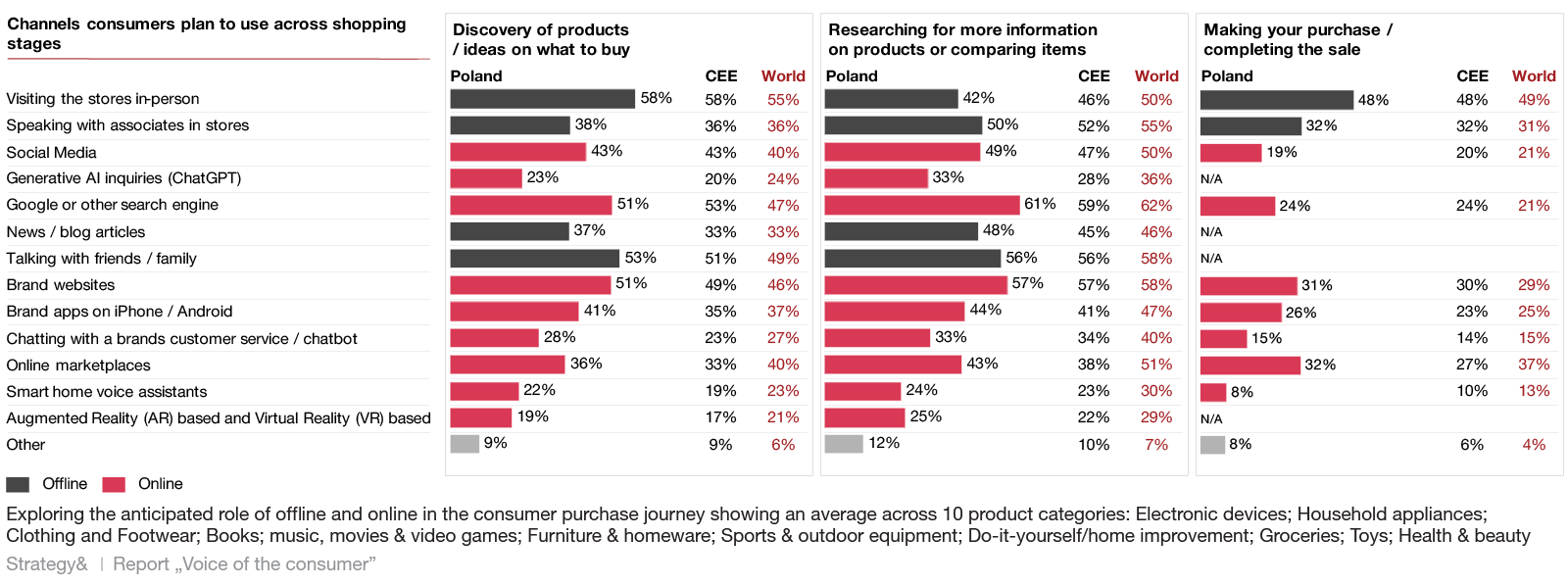

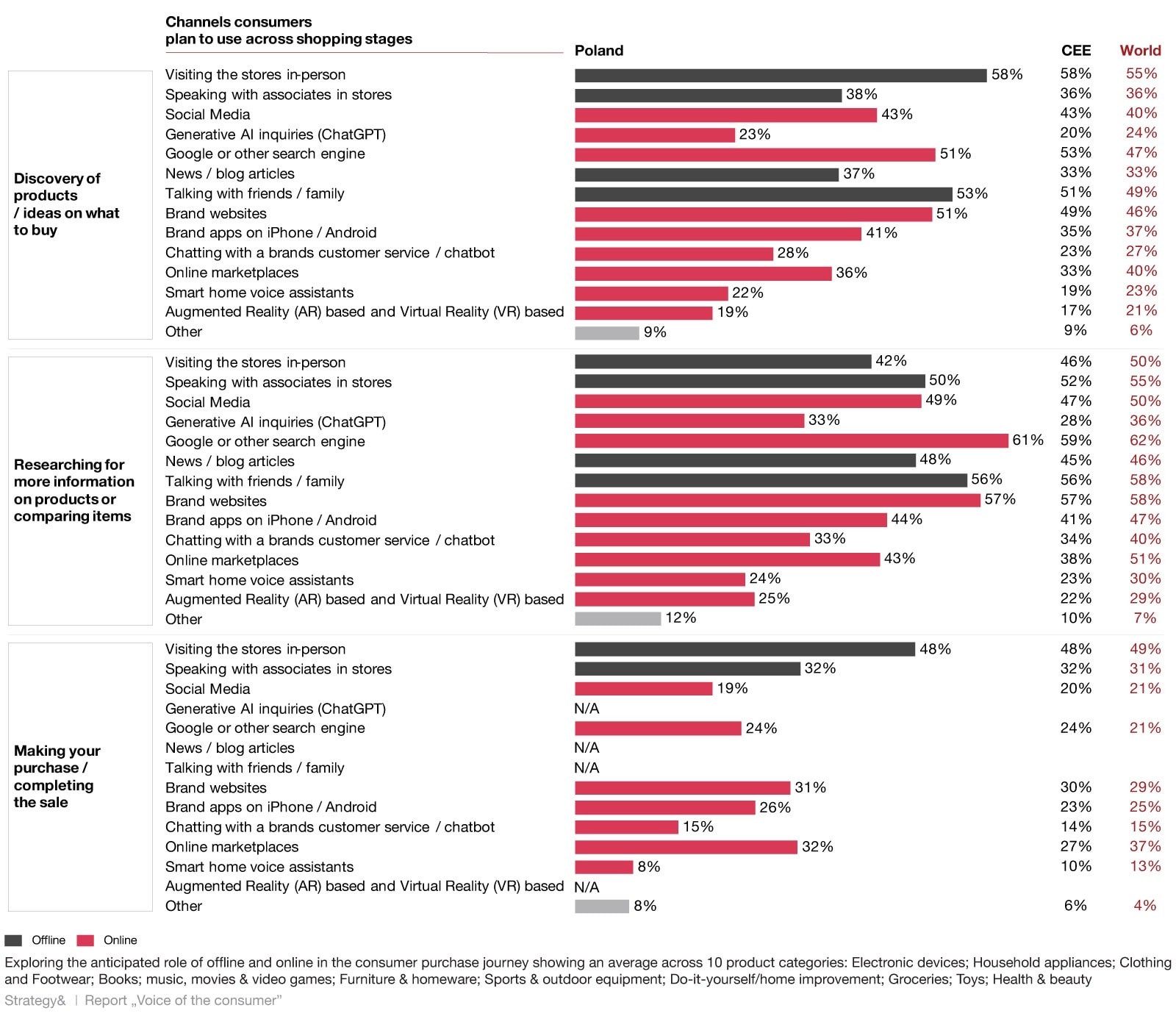

A consumer's journey to purchasing products typically occurs in three key phases: discovery, research, and final purchase. In the initial phase of the purchasing process, potential consumers usually come across a product by physically walking through store aisles (PL-50%, CEE-50%, Global-55%) or, more often, through recommendations from friends and family (PL-53%, CEE-51, Global-49%). The later research phase is crucial as consumers analyze detailed information to make a purchasing decision. In the Central and Eastern European region, this phase takes place mainly through online channels, with search engines such as Google playing a key role (PL-61%, CEE-59%, Global-62%). The last stage, purchase, is most often carried out in-store (PL-48%, CEE-48%, Global-49%), reflecting the combination of traditional and modern shopping habits.

Sales channels usage

It is worth noting that in the Central and Eastern European region, about half of consumers prefer the traditional method of purchase, which is consistent with the global consumer pattern. To adapt to changing consumer preferences, it will be extremely important to adopt a hybrid approach to retail sales. This strategy should integrate the performance of digital channels while maintaining the personalized experience offered by traditional in-store interactions. Such a sustainable retail sales model is essential for companies that want to remain competitive and respond to the dynamically changing retail reality.

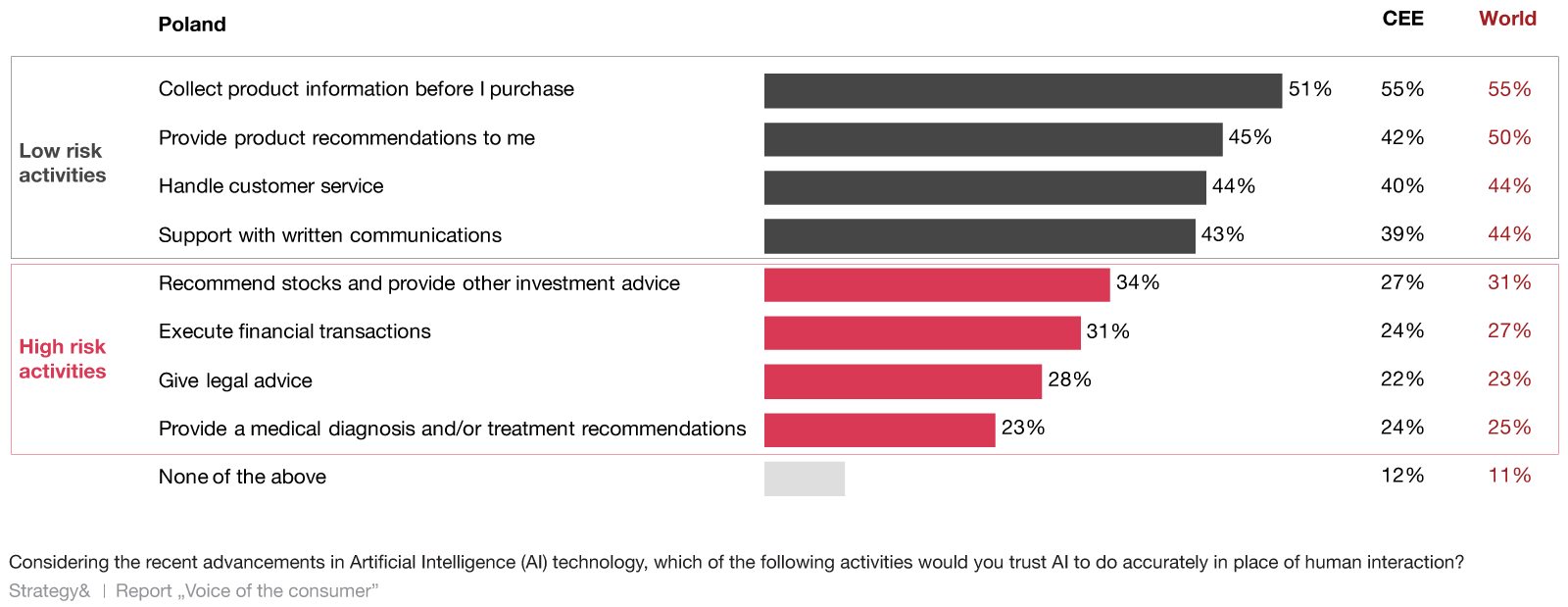

Consumer confidence in AI varies, but there is a general sense of optimism about the benefits of AI, as well as concerns about its potential risks. Consumers from Poland and Central and Eastern Europe highly value the human factor when receiving product recommendations or when they need to consult someone to obtain information they consider important. On the other hand, they feel comfortable using AI for lower-risk activities, such as compiling product information before purchase or basic customer service.

Trust in artificial intelligence to replace humans in tasks with various levels of risk

Compared to global results, Polish consumers are less afraid of potential job loss due to artificial intelligence. This may be due to the specificity of the Polish labor market, characterized by a larger number of jobs that are more difficult to replace with artificial intelligence, as the economies of Poland and the Central and Eastern European region are still relatively rich in heavy industries, such as automotive and mining.

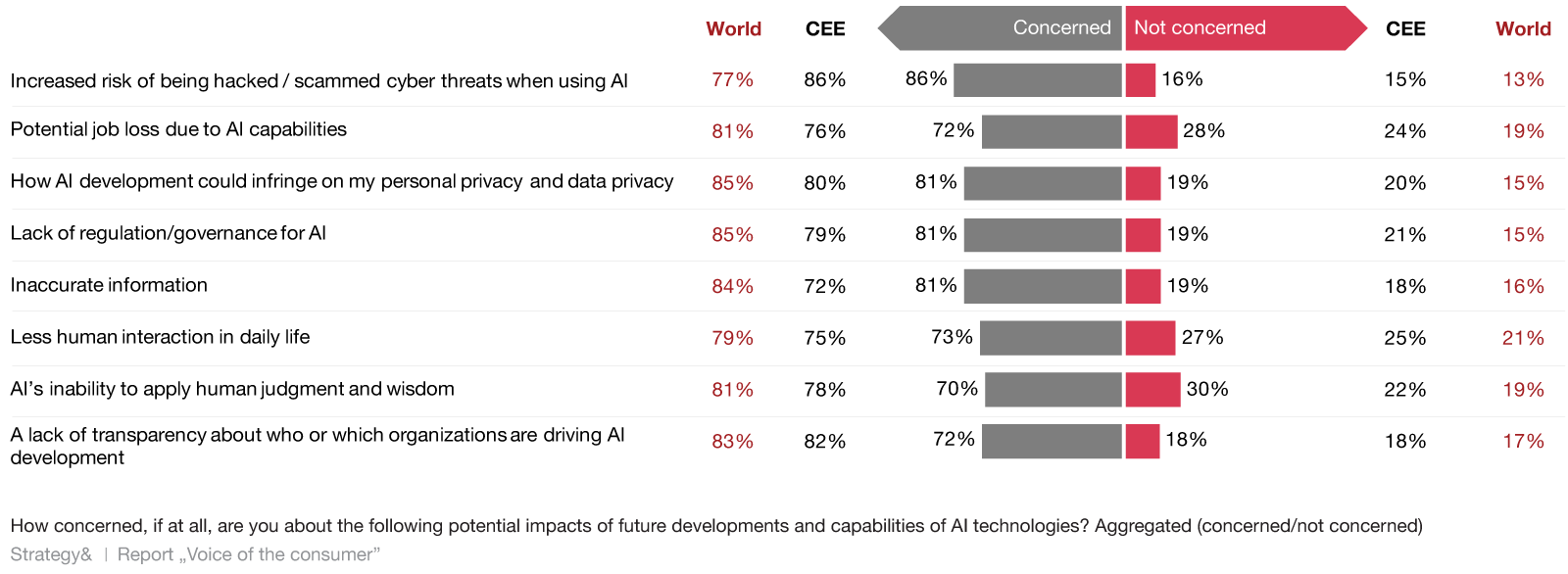

86% of customers are afraid of fraud when using artificial intelligence

This is noticeably higher than the already high global average of 77%. Interestingly, compared to the rest of the world, Polish consumers are much less willing to share their data to obtain a more personalized experience (39% vs 49%) and for analytical purposes (36% vs 50%).

Most common concerns regarding further deelopments and capabilities od AI

Polish companies can adapt to changing consumer preferences for artificial intelligence by developing hybrid customer service models that combine the efficiency of AI with an irreplaceable human approach to more complex issues. Transparency about AI operations and decision-making processes can reduce fear of fraud and build consumer trust. Finally, a commitment to ethical AI practices and respect for consumer privacy will strengthen trust in this technology, facilitating harmonious integration into everyday life and business activities.

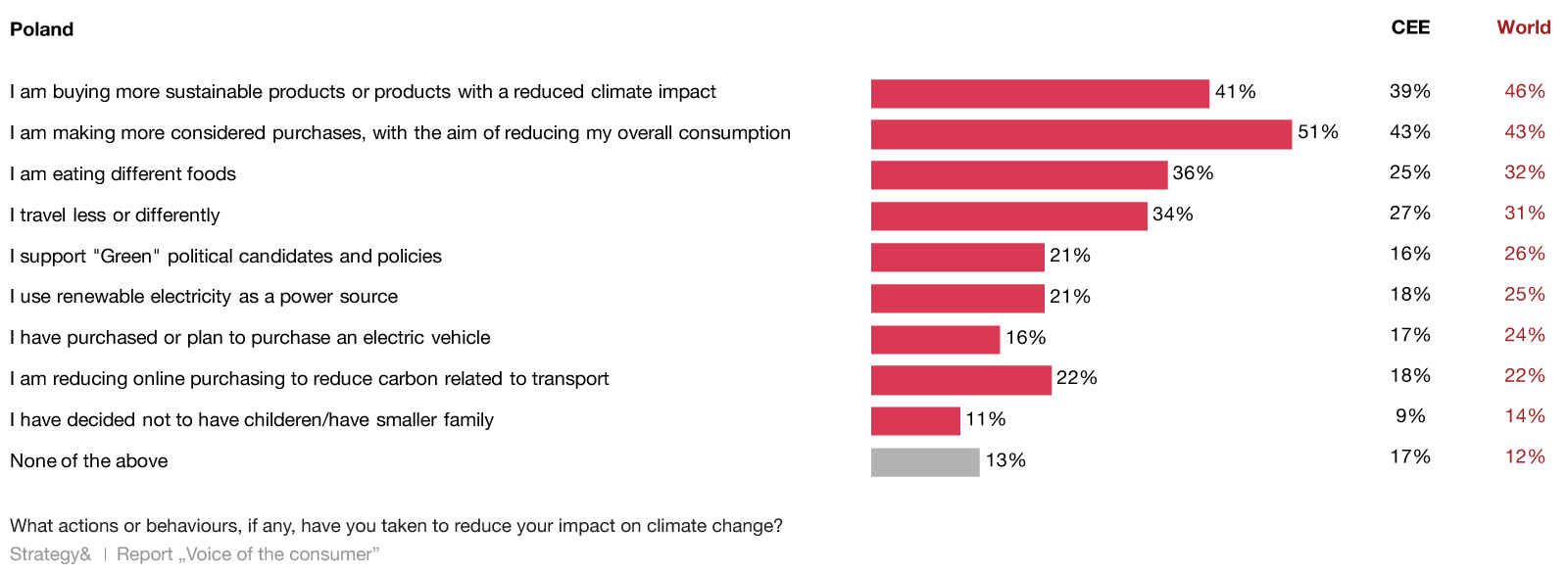

Polish consumers, focusing on the cost of goods when making purchasing decisions, are less willing to mitigate climate change by changing consumption habits. However, they are aware of climate change and want to be seen as caring about the environment - 87% say they are taking action to reduce their personal impact on climate change. The differences seen in consumer actions to protect the environment are shaped by a combination of global and local trends, regulatory frameworks and macroeconomic conditions, all of which are changing rapidly.

Percentage of those declaring taking pro-environmental actions

The report clearly shows that consumers in Poland are much more prudent when planning their total consumption (51% compared to 43% in the CEE region and the rest of the world).

They travel less or try to find climate-friendly ways to travel more often. Both actions are considered very effective in mitigating the effects of climate change. Additionally, Polish consumers pay much more attention to working conditions in a given company when making purchasing decisions compared to global results, especially the rest of the CEE region.

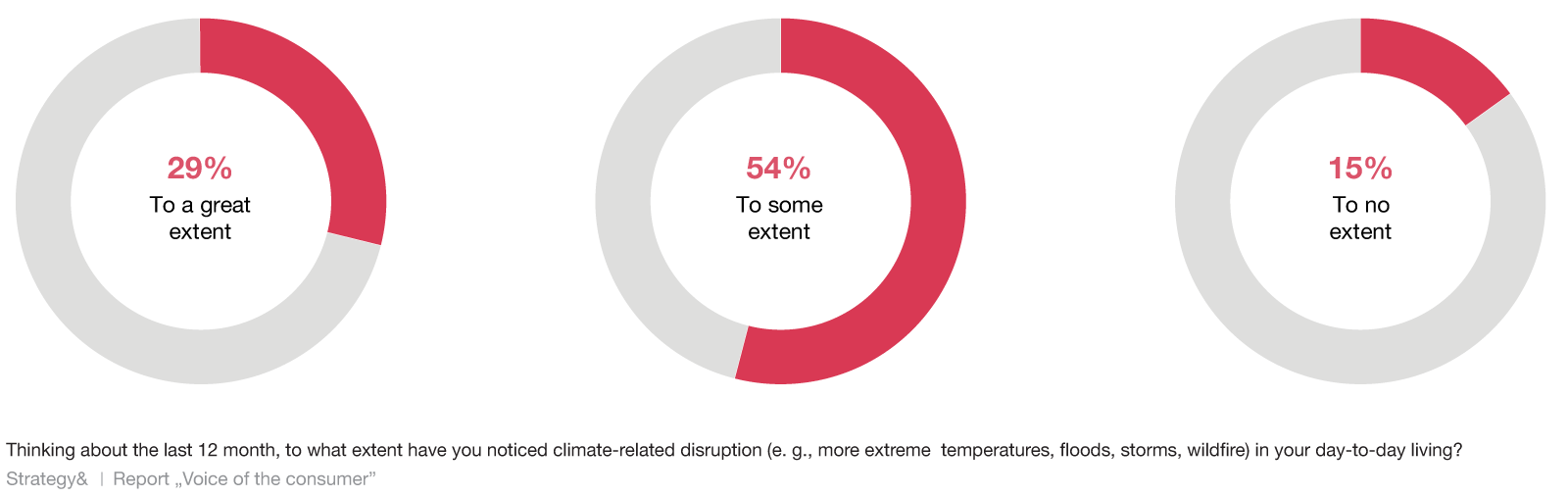

Noticing climate-related discruptions in day-to-day life

How important sustainability is to customers may also change rapidly in the coming years due to the introduction of multiple EU regulations around recycling and ESG reporting. Implementation of the Corporate Sustainability Reporting Directive (CSRD), requiring large companies to publish reports on measures taken to mitigate climate risks from 2025, and the introduction of deposit return systems (DRS) by EU countries to meet the requirement to achieve certain levels recycling rates by 2029. Sustainability will be brought closer to consumers, and more data on companies' ESG performance will become readily available. This trend, combined with greater environmental concern among the younger generation, indicates that companies, especially in the retail sector, must prioritize environmentally friendly practices to attract and retain customers.

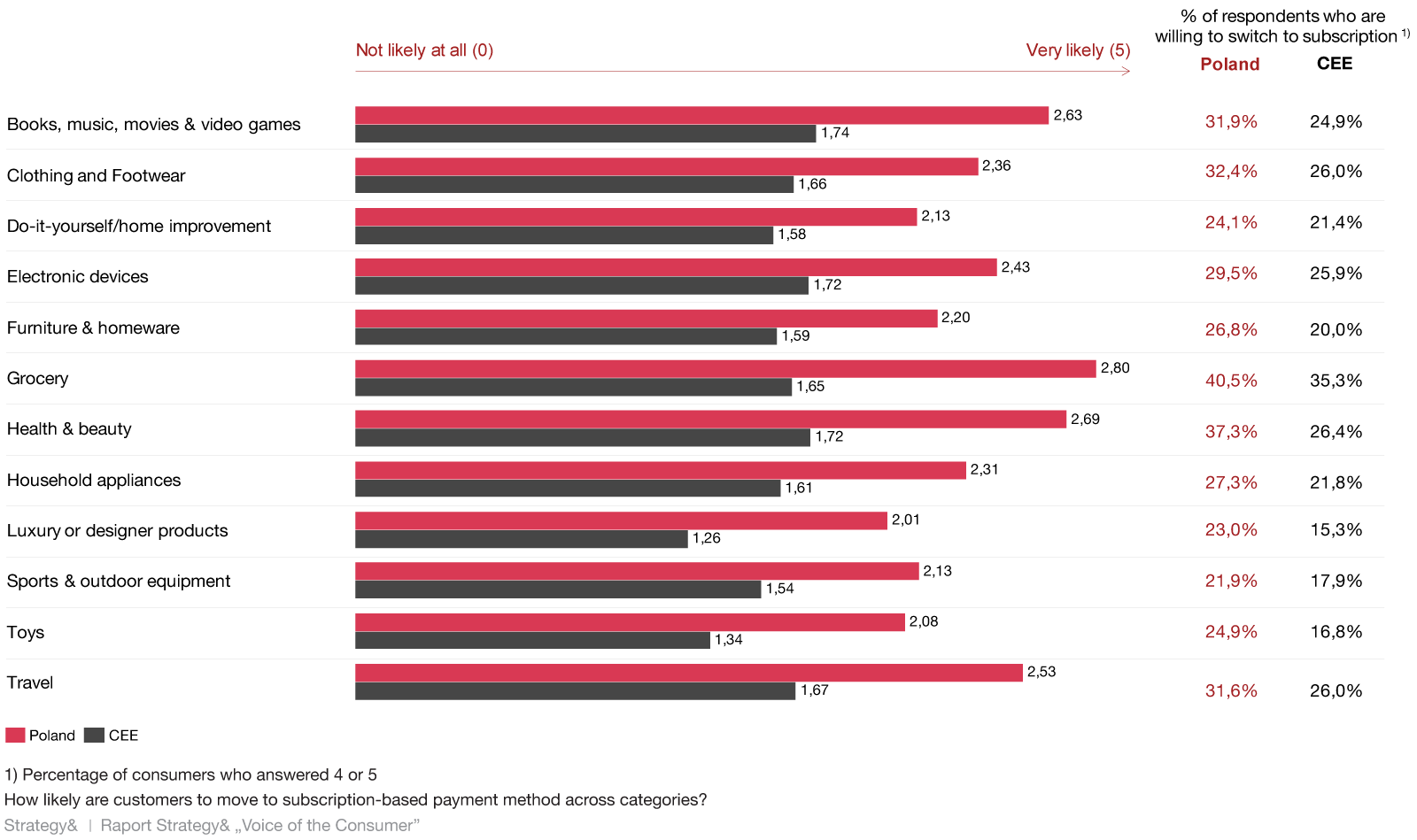

Customer preferences for subscription services are influenced by a number of cultural, economic and business factors, including market maturity and the level of development of payment infrastructure. Poland stands out for its advanced e-commerce market and is a world leader in contactless and online payments. Grocery chains and coffee shops have already started experimenting with subscription models to familiarize consumers with this shopping method, with coffee and soft drinks being the most subscribed products.

How likely are customers to move to subscription-based payment method across categories

The subscription model should be looked at from two perspectives: the consumer and the producer. The subscription-based sales model brings numerous benefits to manufacturers. It facilitates more accurate demand forecasting, which translates into revenues, strengthens customer loyalty and provides opportunities for dynamic pricing strategies and increasing sales by introducing premium plan options.

From a customer perspective, a subscription is a commitment to consume a certain level of goods or services. Attitudes towards subscription models in retail vary. It's convenient and potentially customizable with different plans, and often cheaper compared to the value of the same products sold traditionally. Consumer attitudes can vary significantly depending on product type, with some categories more suited to a subscription model than others.

The categories in which most Poles are willing to switch to a subscription-based model are groceries (40.5%), health and beauty (37.3%), clothes and footwear (32.4%), books, music, movies and computer games (31.9%) and travel (31.6%).

Interest in these areas is most likely driven by predictable consumer demand for these products and the convenience of a subscription-based solution, but also the expectation of better offerings on subscription plans or access to additional services such as personalized recommendations.

Overall, in the CEE region, 35% of consumers are willing to switch to a subscription-based grocery shopping model. However, this percentage varies significantly between Central and Eastern European countries. In Hungary and Slovakia, less than 30% of customers want a subscription-based plan, while in Poland and the rest of the country the figures are 41% and 47% respectively. According to respondents' responses, the country with the best attitude towards retail subscriptions in Central and Eastern Europe is Poland, with an average readiness to switch to subscription across all retail categories of 2.23 (scale 0-5).

In January and February 2024, PwC surveyed 20,662 consumers in 31 countries and territories: Australia; Brazil; Canada; China; Czech Republic (Czech Republic); Egypt; France; Germany; Hong Kong; Hungary; India; Indonesia; Ireland; Malaysia; Mexico; Netherlands; Philippines; Poland; Runny nose; Romania; Saudi Arabia; Singapore; Slovakia; South Africa; South Korea; Spain; Thailand; United Arab Emirates; Ukraine; United States; and Vietnam.

From the Central and Eastern Europe region, responses were collected from 6 countries: the Czech Republic, Hungary, Poland, Romania, Slovakia and Ukraine from a total of 1,681 respondents.

370 people from Poland took part.

Respondents were 18 years of age or older and were asked about a range of topics related to consumer trends, including purchasing behavior, emerging technologies and social media.

Robert Żygowski

.png)