{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

The report: ‘Healthcare in Poland - Growth Potential and Opportunities for Investors’ provides a comprehensive summary of the domestic healthcare market, current challenges, and potential for development. It also presents a detailed comparison with markets in Western European countries and offers possible explanations for the differences.

The rapidly developing Polish healthcare industry is attracting more investors, as evidenced by the increasing number of transactions on the market. At the same time, it faces the challenges of staff shortages and rising operating costs of healthcare entities.

Krzysztof Badowski

Managing Partner

Strategy& Poland

In recent years, there has been a lot of transaction activity in the market as local and international investors recognize its high attractiveness and growth prospects. An important aspect is the consolidation of smaller facilities by the most significant private healthcare entities, which are keen to take over facilities in the outpatient specialist care and laboratory and imaging diagnostics segments, among others.

Michał Sławuta

Senior Manager

Strategy& Poland

Grzegorz Orski

Senior Manager

Strategy& Poland

The convergence of the Polish economy to the European Union is positively influencing the development of many sectors, including healthcare.

Social and demographic trends, such as healthcare and an aging population, contribute to increased demand for medical services and higher government spending on healthcare.

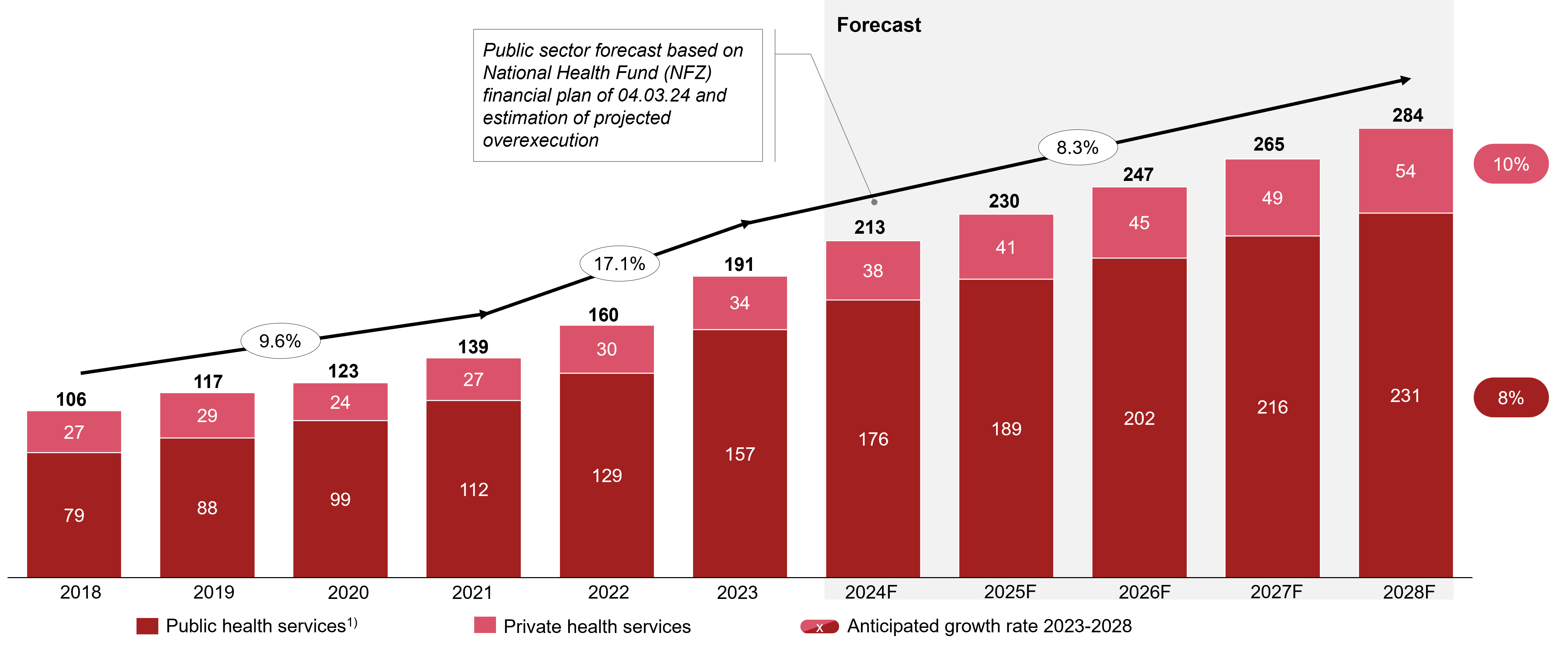

The Polish healthcare market will reach a value of PLN 191 billion in 2023, with an average annual growth rate forecast at 8.3% between 2023 and 2028, mainly due to increasing public spending.

Trends currently observed in Polish society have and will continue to impact the functioning of the health market. The most significant trends include:

The Polish healthcare system is distinguished by a smaller number of general practitioners (GPs) but a more significant number of specialists than in Western Europe. Some health systems in Western countries operate on a different model, in which the general practitioner (GP) has more competence, so there is less need to refer patients to specialists, which also impacts queue length.

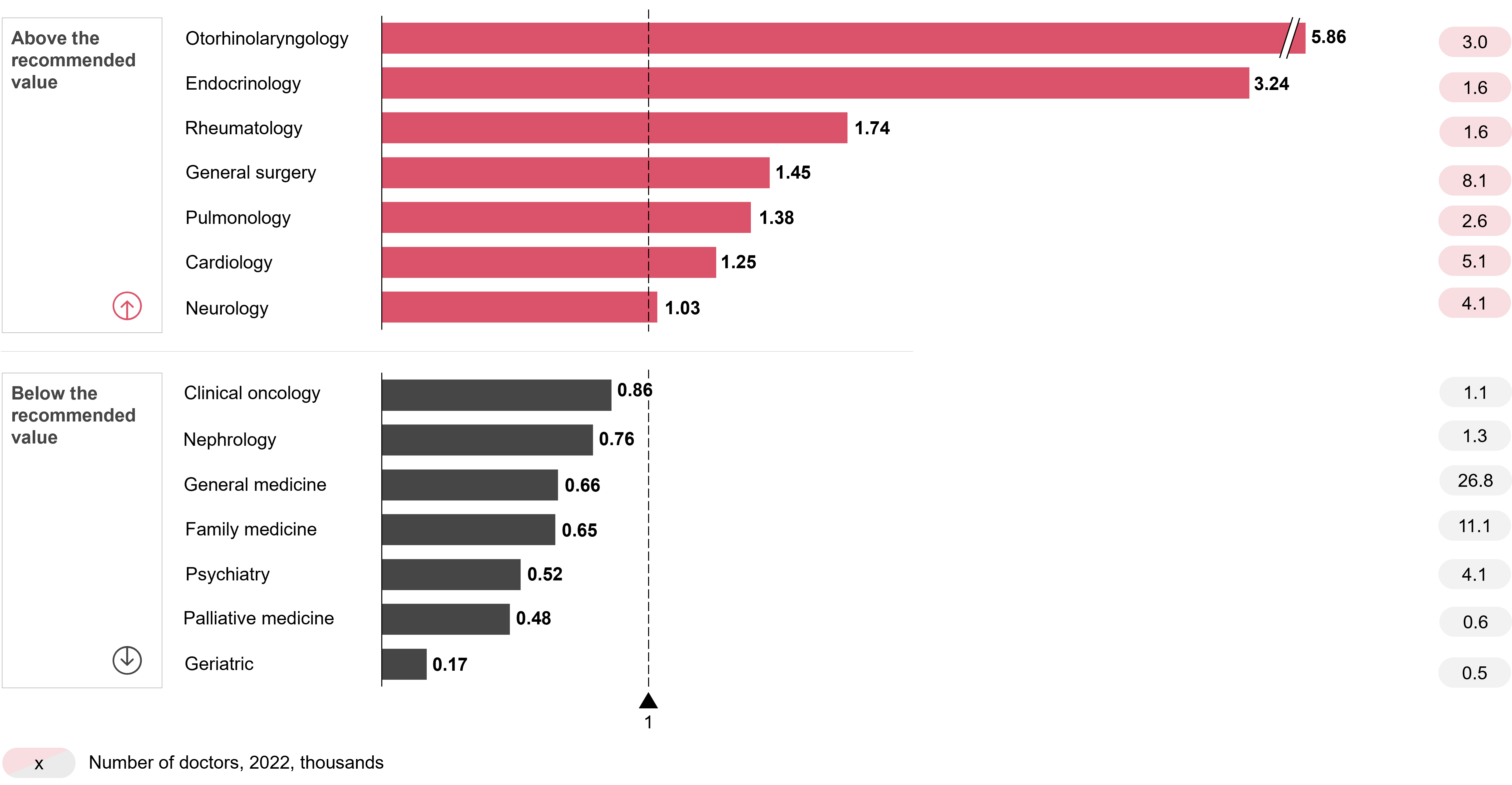

The average per capita expenditure on healthcare in Poland is 57% lower than in Western Europe (2022), and the number of doctors and nurses does not meet market needs. Among specialists, we have the most significant access to otolaryngologists and endocrinologists; the most minor accessible are geriatricians and psychiatrists.

Potential solutions to reduce the doctor shortage include increasing the tariffing of services and raising the number of doctors training for particular specialties. The spread of preventive care in Poland may contribute to reducing expenditures on interventional treatment and avoiding some deaths.

Although the Polish healthcare market faces challenges, local and international investors recognize its high attractiveness and growth prospects. This can be evidenced, among other things, by the more than 8 percent increase in healthcare spending between 2023 and 2028. Despite significantly higher spending on public healthcare, the projected growth is more robust in the private sector.

1) Public expenditure estimated based on the National Health Fund (NFZ) financial plan, without taking into account additional funds from the state budget

Source: OECD, Eurostat, CSO (GUS), Strategy& analysis.

Rapid growth is likely to be observed in the segments of hospital care, outpatient specialized care (AOS), primary health care (POZ), rehabilitation, and psychiatry. An increase in funding for long-term care and preventive health care is also expected, while Poland's extremely low spending on laboratory tests indicates high growth potential for diagnostics.

It is worth noting that, compared to Europe, the Polish healthcare sector is characterized by a high level of digitalization and intelligent solutions, which include the Internet Patient Account (IKP), e-prescriptions, e-referrals, tele-referrals, remote monitoring systems, and Electronic Medical Record. This creates an excellent basis for further investment in the digitalization of the market.

Value-Based Healthcare (VBH), which focuses on maximizing the health outcome, i.e., the quality and efficiency of treatment, rather than maximizing the economic outcome, is increasingly gaining ground. Activities related to coordinated care, performance monitoring, reform of the financing model, systems integration, and IT infrastructure development are the areas with high investment potential.

Michał Sławuta