By Akshara Chandhok, Alex McPherson, Angus Firth and Amelia Garone

How does car subscription work?

Subscription schemes let you have a car for as long as you want, from as little as one month to several years. There is either no fee or a small charge to sign up and you can end the contract or swap the car when you feel like it, subject to conditions.

How big could this market be?

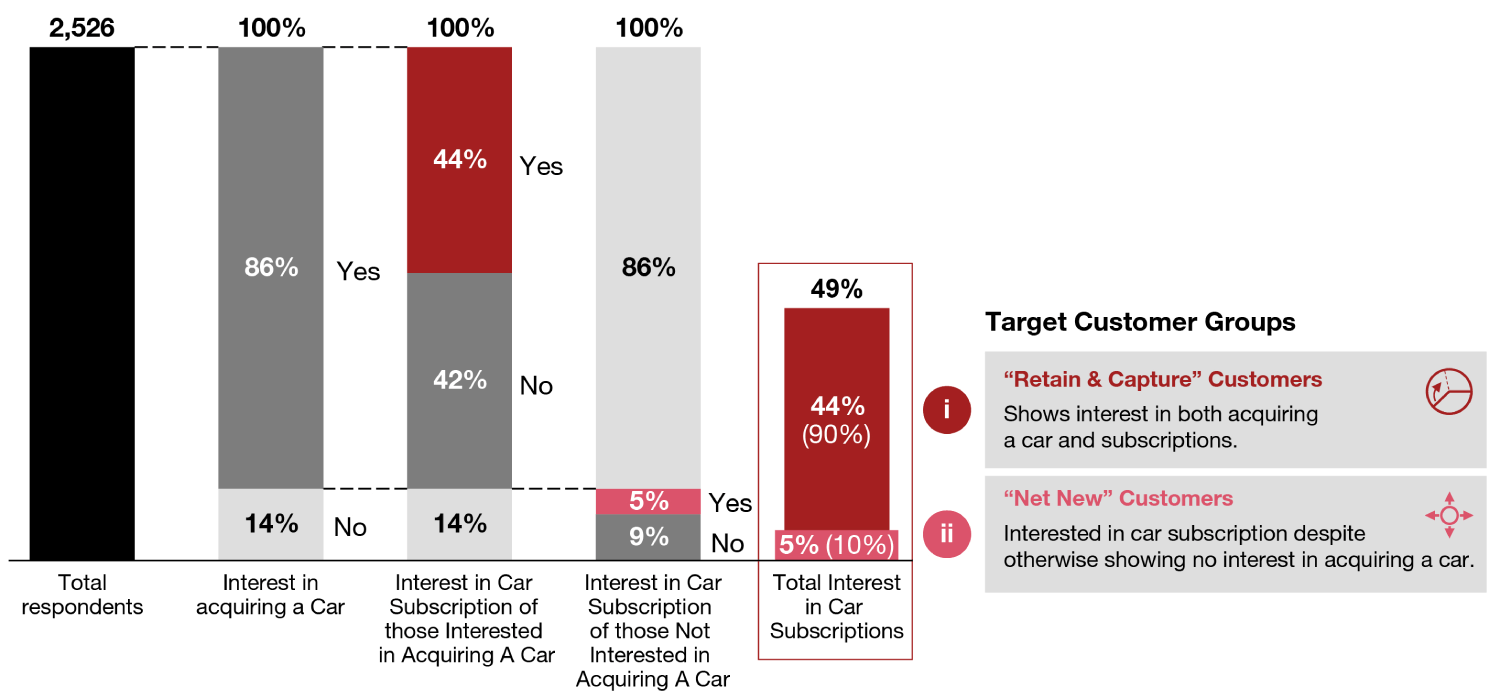

New Strategy& research reveals that 49% of consumers are likely to take up a vehicle subscription.

- 90% were already planning to buy a car in the next five years: Over half of these would choose subscription over traditional ownership

- 8% currently have a car but were not planning to buy another in the next five years: A subscription offer could accelerate their repurchase

- The remaining 2% do not have a car and were not planning to buy one in the next five years: A subscription offer could entice them to get one.

Who are the customers?

Across both the premium and volume market, we’ve identified three sets of potential subscription customers:

- ‘Vehicle explorer’: Wants the flexibility to access newer or better cars and a shorter commitment to reflect lifestyle seasonal needs or desire for the very latest model and technology.

- ‘Conscious budgeter’: Wants the budgetable certainty of an all-inclusive package, with one guaranteed monthly fee.

- ‘Value & convenience seeker’; Wants a convenient and commitment-light option. This includes avoiding the hassle of car admin and taking advantage of cost savings when not using the car. Also wants to avoid concerns over depreciation and battery life.

How can OEMs capture and protect value?

- Identify which customer segments to target based on commercial strategy, brand positioning, and vehicle lineup.

- Design and develop subscription offerings to come out in front in the target segments. Key considerations include which elements are incorporated in the package (e.g. insurance, parking, charging), the pricing structure, delivery channels and customer experience.

- Establish in-house capabilities and/or form third-party partnerships to deliver the subscription offering.

- Strategically integrate the subscription offering into broader operations as a way to manage volumes, loyalty, and residual values.

A new Strategy& survey of what appeals to drivers reveals that 49% of consumers considering acquiring a personal car in the next five years are likely or highly likely to do so through vehicle subscription .

Which customers would be most receptive to subscription? What elements and features are they looking for? How can your business capture this market in a sustainable and profitable way?

The competitive landscape and drivers for take-up

What is a vehicle subscription?

Subscription is an alternative way to acquire and pay for a personal car. Unlike owning or financing, drivers pay lower upfront fees, can sign up for just a few months at a time and can cancel the contract or switch models at relatively short notice. To ease hassle and provide budgetable monthly costs, many subscription offerings include a package of additional benefits such as insurance, digital services, maintenance and roadside assistance.

Struggling to make headway

The evolution of car subscriptions reflects a broader shift towards flexible ownership models in the automotive industry. However, the concept of subscriptions isn’t new: Numerous original equipment manufacturers (OEMs) and independent providers (including start ups such as MyCarDirect and rental companies such as SIXT) have offered subscriptions over the past decade. The latter group have focused on offering value and convenience enabled through digital platforms, while the former (largely premium and luxury OEMs) seek to offer enhancing services, such as exclusive event access and ‘white-glove’ concierge support.

Achieving sustained profitability remains a significant challenge for many. Car subscription packages often include vehicle swap options, but this can escalate costs due to the need for cleaning and maintenance with each exchange. Market dynamics have further impacted certain players, notably electric-vehicle-focused ones, with Onto going into administration in 2023 due to a downturn in the EV market. Despite the diverse offerings available from a variety of firms, only 1% of cars in the UK are acquired through subscription.

Lift-off ahead?

The potential catalyst for a big rise in subscription demand is the shift to electric vehicles (EVs), ushered in by regulation and policy somewhat ahead of consumer sentiment: While consumers express an interest in acquiring a sustainable EV, many baulk at the high upfront cost and are concerned about value depreciation. These concerns have been exacerbated by high interest rates in the UK, which make more traditional lease financing less attractive. With battery technology and digital features advancing so fast, many consumers are also concerned about being saddled with a vehicle that could quickly become outdated and difficult to sell. Subscription could help to overcome these misgivings and accelerate the take-up of EVs by offering a readily affordable option, while enabling owners to avoid the risks of obsolescence, battery deterioration and value depreciation.

Gauging the potential opportunity

The Strategy& research underlines the market potential. Of the more than 2,500 consumers taking part in the survey, nearly half (49%) would be likely or highly likely to take-up a vehicle subscription.

Better serving existing customers… and winning new ones

Of consumers who are planning to buy a car in the next five years, more than half (51%) would choose subscription over traditional ownership as it would better meet their needs. These consumers make up 90% of the market.

But in addition to converting these car buyers into subscribers, the subscription offering could also expand the market by attracting those who would not have otherwise been customers. One in ten of the potential customers likely to choose a subscription were not otherwise intending to purchase a new car in the next five years: Of these, 22% do not currently have a personal car.

Car Subscription Market Opportunities

% of respondents

Source: Strategy& Auto Finance Consumer Survey, 2500 customers in UK, 2023; Office of National Statisctics; Strategy& Analysis

Prime targets

So — who are these consumers with an appetite for car subscriptions?

The study suggests there are three target segments with distinct motivations for their interest in subscription:

- 38% of interested customers are ‘vehicle explorers’ who want to access newer or better cars and/or a shorter, more flexible commitment to reflect their lifestyle, seasonal needs. These customers could opt for a subscription agreement out of desire to always have the very latest vehicle technologies, to avoid public transport during the rainy winter months, or to accommodate a new addition to the family during a year of parental leave.

- 33% of interested customers are ‘conscious budgeters’ who want the budgetable certainty of an all-inclusive package, with a predictable monthly fee

- 29% of interested customers are ‘value & convenience seekers’ who want a convenient experience and/or value for money. This includes avoiding the hassle of car admin, taking advantage of cost savings when not using the car, and relinquishing risks around depreciation and battery life.

The mix of customers - across these segments, across demographic characteristics, and across locations - varies between premium and volume car buyers, and indeed by brand.

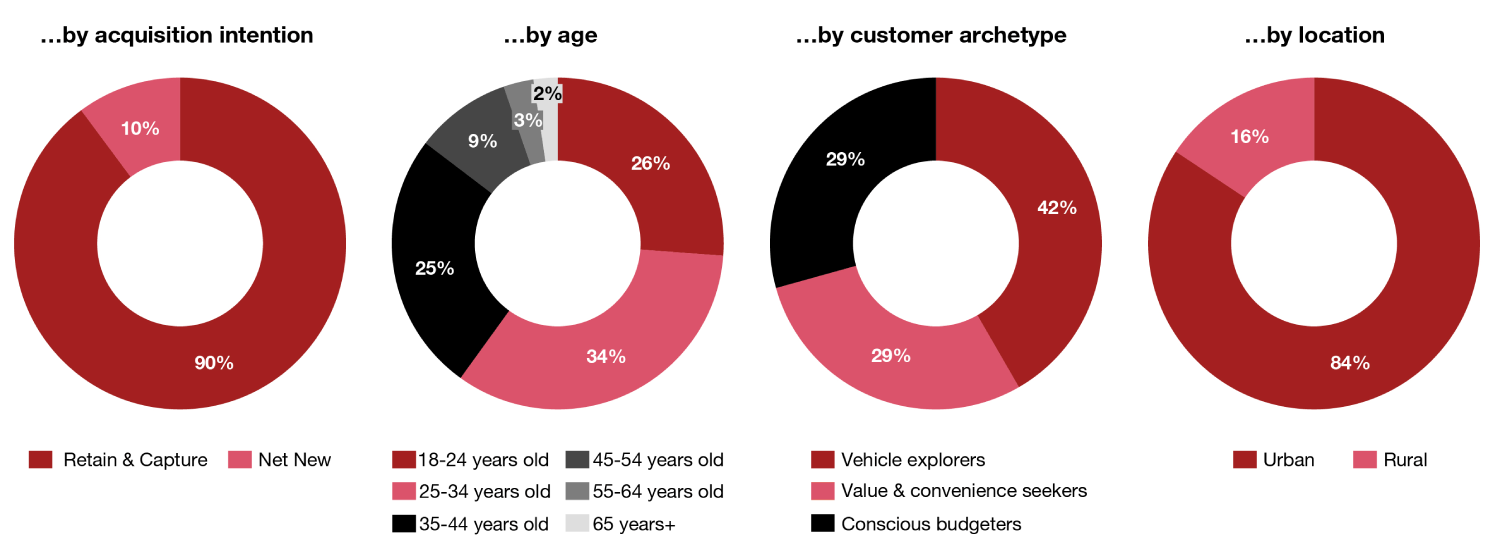

Premium & luxury brand customers

For premium & luxury brands, the primary target for subscription are vehicle explorers between 18-44 years old, with 84% in London or other urban areas. For these customers, subscription is a way to access high-end models with all the latest vehicle and digital technology. This includes those who may not have been able to afford a new premium or luxury vehicle under a traditional model, for whom the subscription structure offers the opportunity to upgrade from a lower cost brand.

Interest in Car Subscription from Premium Brand Customers

% of respondents

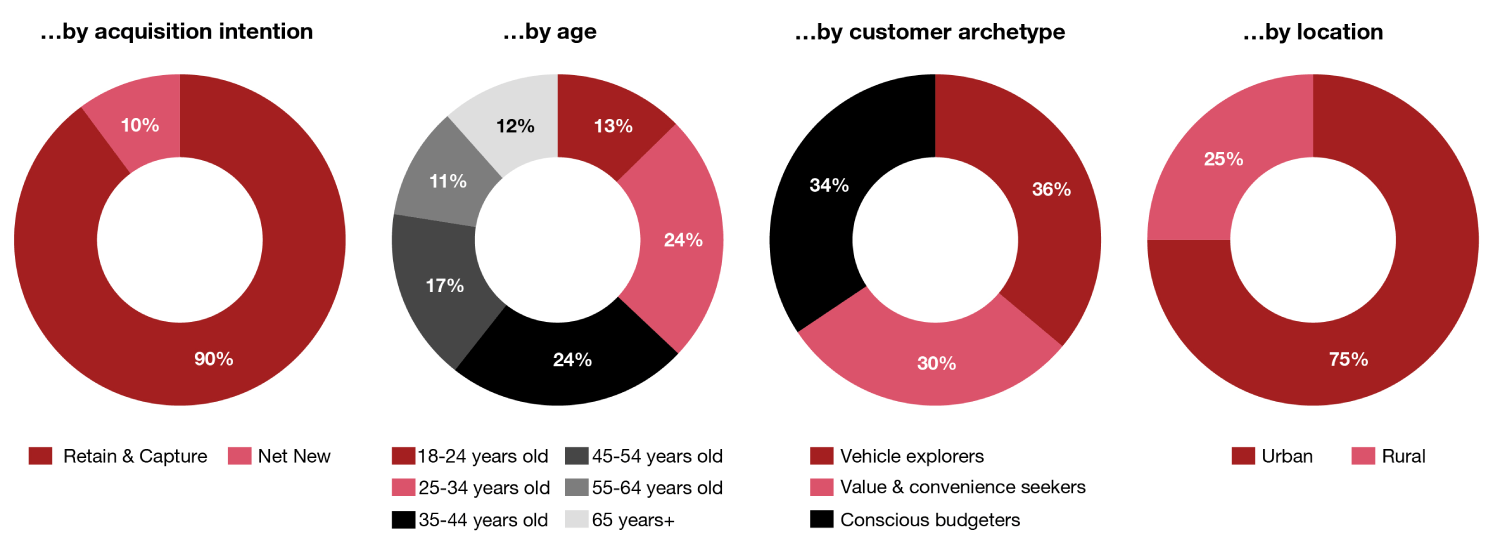

Volume brand customers

For volume brands, the primary target for subscription are across all customer archetypes, between 25-54 years old, with 75% living in London or other urban areas. For these customers, subscription is a way to manage finances and maintain flexibility.

Interest in Car Subsription from Volume Brand Customers

% of respondents

Creating and capturing sustainable value

The clear takeaway from our study is that, while there will still be demand for more traditional financing options, there is a real and sizable consumer appetite for vehicle subscription which the current market offerings are failing to capture. With a wave of new EV brands set to enter the market, incumbent OEMs that fail to offer and promote a suitable subscription offering are at risk of losing meaningful market share to those who do.

But the question of how to turn the potential into profit remains. Five priorities stand out:

Find out more

If you’d like more about the findings from our survey, how subscription fits into the wider shifts in the automotive market and how you could capitalise on the potential, please get in touch.

Methodology

A UK-based, 15 minute online survey, accessing a UK sample via a panel provider, conducted between 25 September and 13 October 2023.

A two pronged approach to targeting; a core base of 2,000 nationally representative UK consumers, with an additional boost of 500 EV drivers.

Key demographic profiles have been explored and statistically significant differences have been taken into consideration where appropriate, unless otherwise noted.