Increasing transactions, business model transformation and new market entries will continue to drive growth

The pharmaceutical and life science industry is in transition, as large and small players look to global markets for growth.

Following significant activity in 2020, the volume of acquisitions and divestitures will continue to rise, driven by companies looking to shed non-core business units and focus on building speciality platforms - such as cell and gene therapies or mRNA - to drive value through innovation.

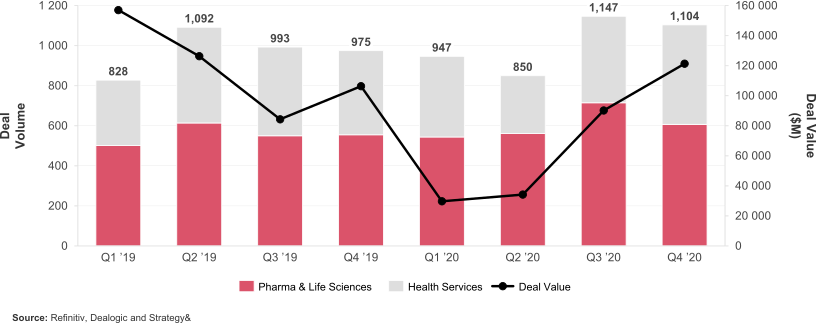

Chart 1: Volume of transactions and available capital in the markets

In addition, increasing pricing pressure is forcing companies to reexamine business models to protect their bottom line. Some may rethink global operating models, while others may adjust go-to-market approaches to optimise profitability.

Other companies may build on prior successes, growing revenue from their existing product portfolios by capturing opportunities in previously untapped markets.

With over 67% of the late stage development pipeline comprised of life science companies that have never commercialised a product before, we expect a wave of new market entrants.

Chart 2: Proportion of products under development that will be a manufacturers first marketed product

Understanding local market requirements is crucial for successful growth

Companies must have a strong understanding of the local requirements of the countries they are looking to enter in order to capitalise on the market opportunities and to minimise risks.

Often, companies understand what it takes to operate in larger, more established markets. However, as they expand into new geographies or look to change models in smaller markets, access to key information is critical.

Local market requirements can be dynamic and exist across a wide range of functions, including regulatory, supply chain, legal, quality and commercial. And these requirements will nearly always require the coordination of cross-functional teams.

- Commercial Requirements

- Entity Formation Requirements

- Finance & Legal Requirements

- Regulatory Requirements

- Supply Chain and Quality Requirements

Commercial Requirements

- Local Business Licenses and Permits

- Health Technology Assessments

- Pricing & Reimbursement Process

- International Reference Pricing

- Local Payor Structure and Tender Prevalence

Entity Formation Requirements

- Local Entity Formation Timelines

- Foreign Ownership Restrictions

- Local Nationality Director Requirements

- Minimum Share Capital Thresholds

- Local Bank Account Requirements

Finance & Legal Requirements

- Asset Transfer Timelines

- Valuation Requirements

- Shareholder Approval Requirements

- Share Transfer Timelines

- Filing Requirements

- Solvency Testing Requirements

- Audit Reporting Requirements

Regulatory Requirements

- MA Approval Timelines

- Orphan Drug Fast Track Approval Timelines

- CPP Requirements and Reference Markets

- Local MA Holder Requirements

- Local Clinical Trials Requirements

- Artwork Approval Times

- MA Transfer Timelines

- Artwork Production Grace Periods

Supply Chain and Quality Requirements

- Import License Timelines

- Distribution / Wholesaler License Timelines

- Local Manufacturing Requirements

- Importer Registration Requirements

- Import / Registration QC Testing Requirements

- Local Release Requirements

- Local Qualified Person for Pharmacovigilance

Requirements, timelines and compliance needs vary significantly by local market

The significant variation of requirements and timelines for conducting local business can add further complexity.

For example, in Indonesia, companies must have a pharmaceutical licence and conduct manufacturing in the country to commercialise products in the market. However, in Saudi Arabia, local manufacturing is not a requirement to enter the market, but can lead to beneficial pricing and preferential tender considerations.

And it is not just manufacturing requirements that can pose a barrier to entry. Some markets require companies to own import testing laboratories locally, hold their regulatory licenses in a local entity or employ quality representatives in the market. Some markets allow companies to outsource some of these activities, but this varies from country to country.

The timelines to obtain regulatory approvals, business licenses, quality approvals and distribution permits vary significantly and are often sequential. This timing needs to be factored into planning early on, so realistic market entry targets can be set.

(1) Entity Formation and P&R

(2) MA Approval & Transfer Times

(3) Local Manufacturing and Quality

How to navigate these complexities

PwC’s Global Insights Tool can help you better understand your requirements.

Developed from a rich dataset and years of experience supporting life science companies with global expansion, the tool provides an end-to-end cross-functional view of requirements and timelines for each country. Coupled with the right team, it can help companies ensure that go-to-market models are compliant and implementation timelines are accurate.

Where new assets are being acquired, divested or new markets are being entered, it enables regulatory compliance, supply continuity and business value preservation. The Global Insights Tool can also be customised to meet bespoke needs, such as status reporting.

If you would like to learn more about our Global Insights Tool or support that our team can provide in understanding market requirements, please do not hesitate to get in touch with our team.

Global Insights Tool

Contact us