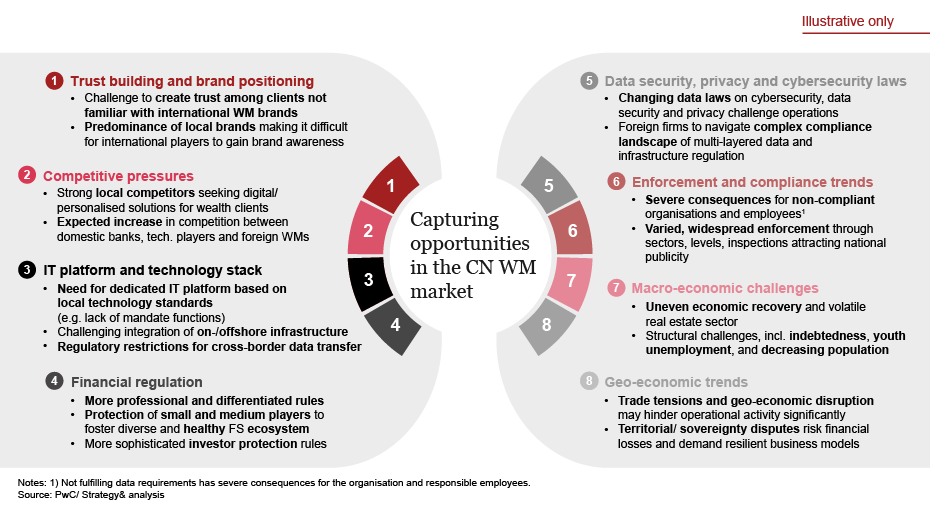

The mainland market opens up as financial regulation matures

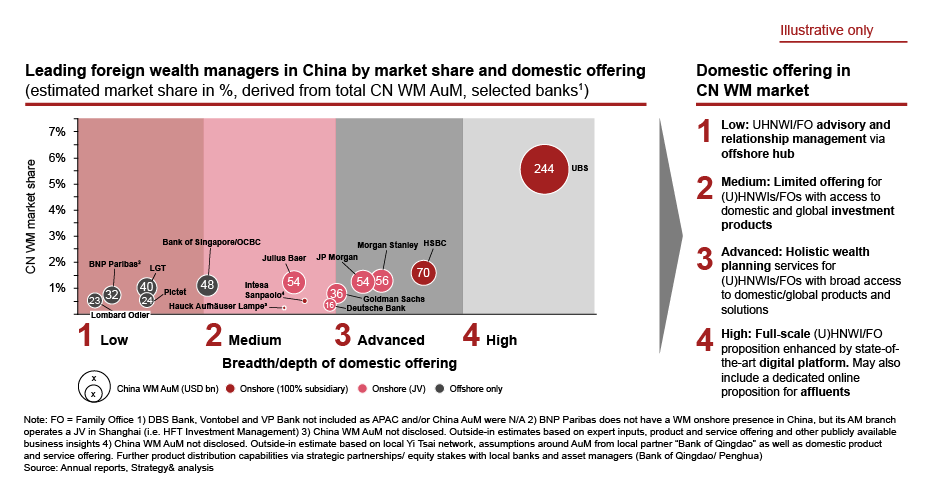

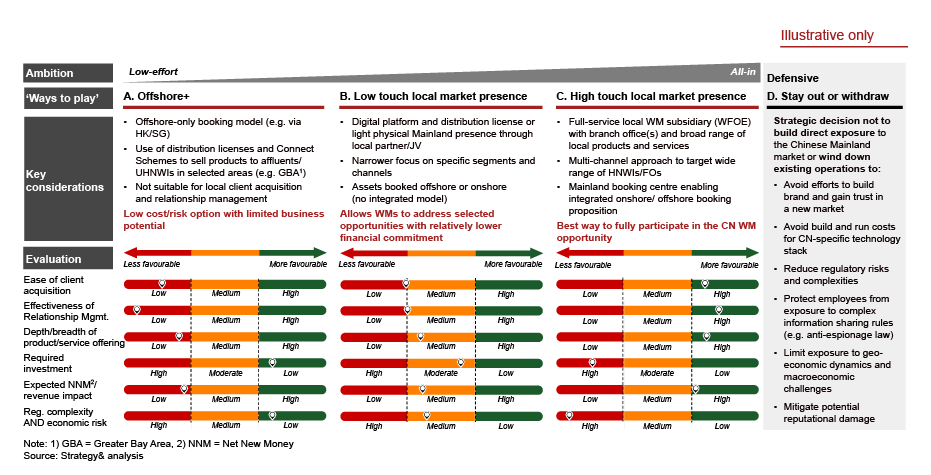

In recent years, China has developed its financial markets regulations in ways that also benefit foreign players and enable further opening of the market. In particular, regulation now allows foreign wealth managers to establish wholly owned onshore subsidiaries as an alternative to joint ventures with local players. This enables international banks to take ownership of Chinese customer relationships and to decide on their product and service offering independently. For banks serving the market via Hong Kong, “Connect Schemes” now allow financial products and services to be distributed within selected mainland areas from the offshore hub. All in all, these developments provide international banks with a wide range of options to choose from when defining their own way-to-play in the Chinese onshore market.

In our view, China’s financial markets regulation has steadily professionalized, for example with the adoption of more sophisticated rules in areas such as Know Your Customer (KYC), investor education, product information disclosure, and suitability assessments. The aim of these efforts to regulate product distribution more stringently is both to protect investors and to ensure a more secure and predictable operating environment for banks and other product providers. The Chinese regulator has also taken steps through other policies to protect small- and mid-sized players and so ensure a diverse and competitive financial services landscape.