Grasping at differentiated straws: Commoditization in the wireless telecom industry

The commoditization of the global wireless telecom industry continues apace. Thanks to saturated markets, booming data demand, new market entrants, ongoing consolidation, and vicious price wars, wireless service providers are fighting for market share and the average revenue per user (ARPU) is declining in many markets around the world.

There are, however, pockets of resistance to the trend toward commoditization. Several markets have managed to maintain a comfortable level of differentiation, and others have even reversed the commoditization trend.

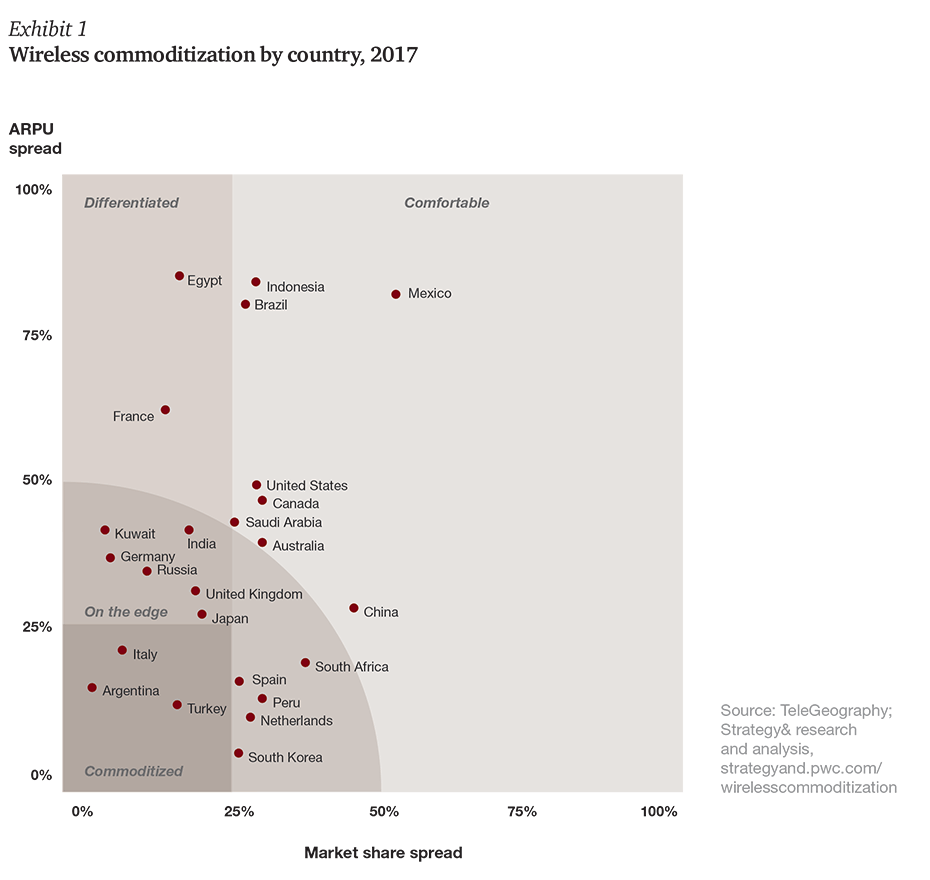

In this study, our second annual analysis of commoditization in wireless markets across the globe, we measured the degree of commoditization in 59 markets using two key factors — the “ARPU spread” (the difference between the highest and lowest ARPUs among the operators in a particular market), and the “market share spread” (the difference between the largest and smallest shares). The goal is to create a picture of each market’s efficiency — the degree to which price wars have consumed the ability of players to create and sustain value in their market, and the willingness of consumers to switch from one provider to another.

The results offer a detailed picture of the state of the industry, the regulatory and pricing factors putting pressure on industry players, and the strategies they are using to maintain their market differentiation and the overall value of their product and services offerings.

This report discusses key findings at the global and regional levels. The complete data set with country-level analyses can be found at strategyand.pwc.com/wirelesscommoditization.

Efficient market theory

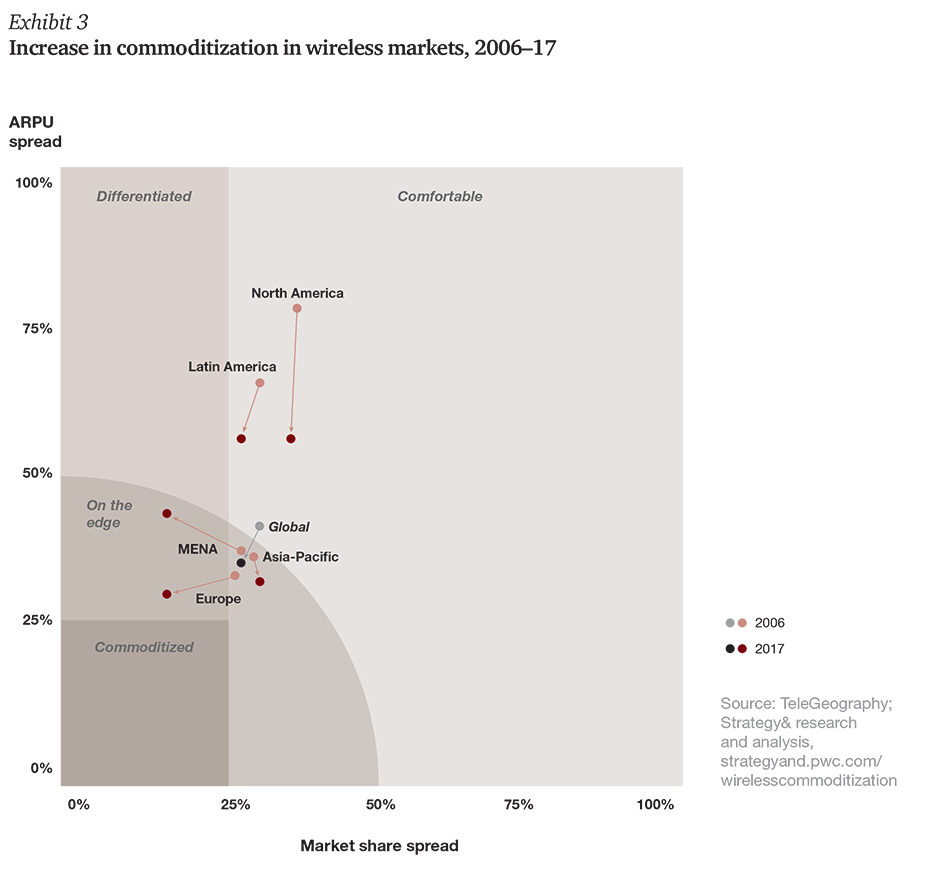

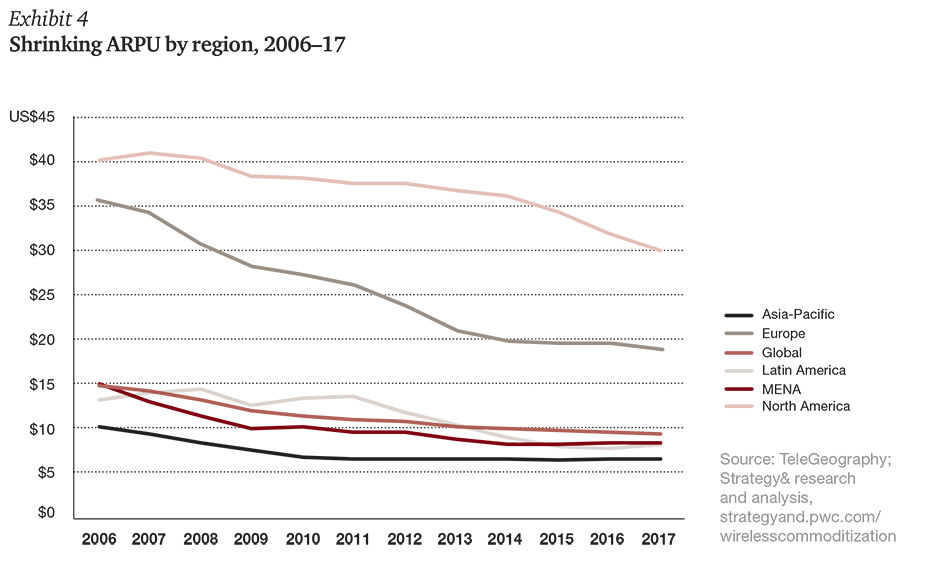

As beneficial as the commoditization trend has been for consumers, wireless operators are unlikely to be as pleased. Our global aggregate commoditization index, which is based on our second annual analysis of commoditization in 59 wireless markets across the globe, rose from 0.66 in 2016 to 0.67 in 2017, a 2 percent increase, and a 9 percent increase since 2007.

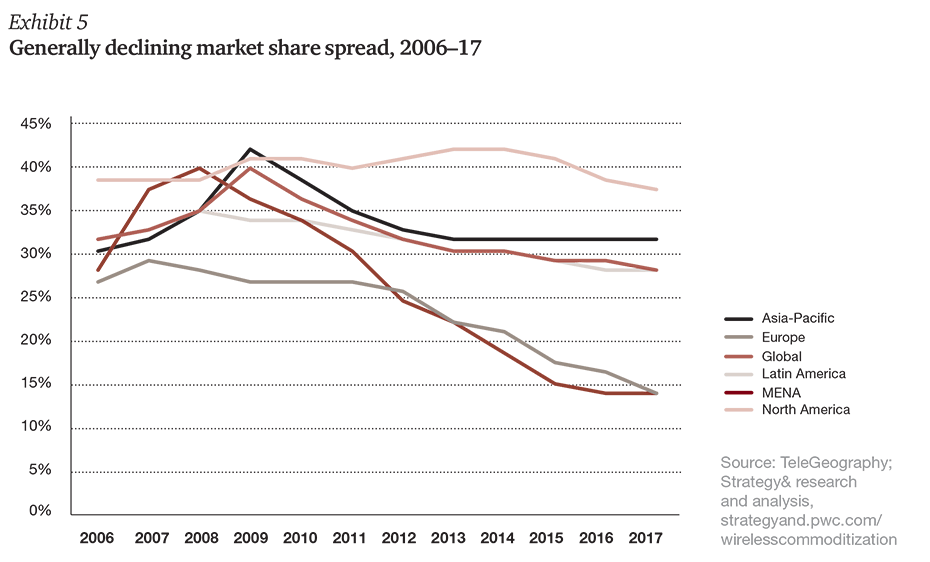

The primary driver of this shift has been the decline in average revenue per user (ARPU) that providers have been able to extract from their customers, which has fallen 3 percent since last year, and 34 percent over the past 10 years. The ARPU spread, too, has contracted, by 7 percent since last year and by 17 percent over the past 10 years.

Market share spread declined by 2 percent over the past year, and by 11 percent since 2007. This suggests that providers have been reasonably able to maintain their market positions, even in the face of the greater pricing efficiency of their markets.

In a regional view, however, distinctions arise. Exhibit 2 lays out the differences in degree of commoditization in the five regions we studied, and the changes since 2006. Put briefly, no region has managed to buck the trend since 2006, and only the MENA region (the Middle East and North Africa) has become less commoditized in the past year.

Asia-Pacific. Most markets in the region are on the edge of commoditization; only Indonesia, still dominated by a single player, remains considerably differentiated. Providers in Japan have been increasing their ARPUs by shifting away from unlimited plans and focusing on content offerings and e-commerce services.

Europe. Every market here is highly saturated, and revenues in most markets are shrinking, due to declining ARPUs and very tight market share spreads. The French market, however, has stabilized into a dual market with low-cost players on the one hand and premium players on the other, reversing the commoditization trend.

Latin America. This region’s markets are highly saturated, but the shift from prepaid to postpaid plans is allowing premium segment players to retain market share. Still, average ARPUs continue to trend downward.

MENA. This region, too, is highly saturated, especially in the Gulf Cooperation Council (GCC) markets. Still, significant differences abound. Turkey, for instance, is heavily commoditized, Kuwait and Saudi Arabia are on the edge, and Egypt remains in a more differentiated state.

North America. Despite a 29 percent increase in commoditization, North America remains the least commoditized region. The rate of commoditization, however, appears to be speeding up, as both technology and new regulations reduce barriers to entry. The U.S. market is already highly saturated, while players in Canada and Mexico continue to grow their subscriber base.

Differentiation strategies

As inevitable as the trend toward commoditization appears to be, providers have tried a variety of strategies to stem the tide and create more value from their product and services offerings. Most of them focus on generating more revenue per user through different pricing mechanisms, while some rely on capturing more market share.

Pricing and packaging. Pricing strategies commonly involve offering deep discounts in hopes of capturing market share — at the risk of triggering an all-out price war. However, providers in some markets where demand for data is rising have moved away from unlimited data plans in an effort to better monetize their data traffic.

Micro-segmentation. This typically involves creating sub-brands for different types of customers, usually the most price-sensitive. In markets where prepaid plans are common, some providers have distinguished themselves by offering postpaid plans to specific segments.

Value-added services. More and more providers are offering additional services as part of their wireless plans. This can work in two ways. Some package free digital content — including social media, video, music, and gaming — as well as perks such as discounts on online shopping, movie tickets, and flights into certain plans typically offered to premium customers. Others are trying to capture nontraditional, non-telecom revenues by expanding into areas such as electronic commerce, finance, and education.

Consolidation and convergence. A sure way to improve market share is by buying or merging with rivals, although such efforts are increasingly running into regulatory hurdles as policymakers seek to boost competition in their markets. However, convergence plays for richer bundles that combine wireless with wire-line and cable capabilities are seeing continued M&A momentum, especially across Europe.

Network investments. Network coverage, capacity, and quality of service remain competitive differentiators in emerging markets, while providers in more developed markets continue to upgrade their networks to protect their core connectivity revenues.

Brand. Brand value remains a differentiator in certain markets, although this is most common in markets such as Saudi Arabia and Indonesia where a provider with a strong brand already dominates the market.

Wholesaling. Some companies are looking to augment their consumer and business revenue by providing wholesale network services to other companies, typically mobile virtual network operators (MVNOs) but also other carriers, through national roaming and network sharing agreements. Eventually, this could include providing connectivity services to industrial companies, financial-services firms, e-health providers, and others.

Surviving the storm

Perhaps it is inevitable that wireless markets around the world are becoming commoditized so rapidly. After all, most markets are saturated with subscribers, and the fast-rising popularity of the smartphone is creating enormous demand for data. It is indeed a perfect storm. Some providers will thrive by differentiating themselves through a clear strategic identity and a strong customer value proposition; the rest will end up surviving as fully commoditized utility providers.

Contact us