Two trends are coming together to transform the global telecom industry over the next several years. They will radically change how telecom companies operate, and how customers consume telecom services.

The first trend is commoditization, the narrowing of market share and shrinking spreads between low- and high-priced services. For the first time in 10 years, what has seemed like an inexorable process of commoditization has stalled, at least temporarily. The second trend is convergence – the continued erosion of the boundaries between fixed and mobile telecom services. A host of new technologies are finally bringing about the long-predicted marriage of these two sectors, though at very different rates in different markets. As the markets for fixed and mobile services become increasingly blurred, carriers will have new ways to differentiate their services, and thus new ways to compete.

Together, commoditization and convergence are shaping the way the global telecom industry does business.

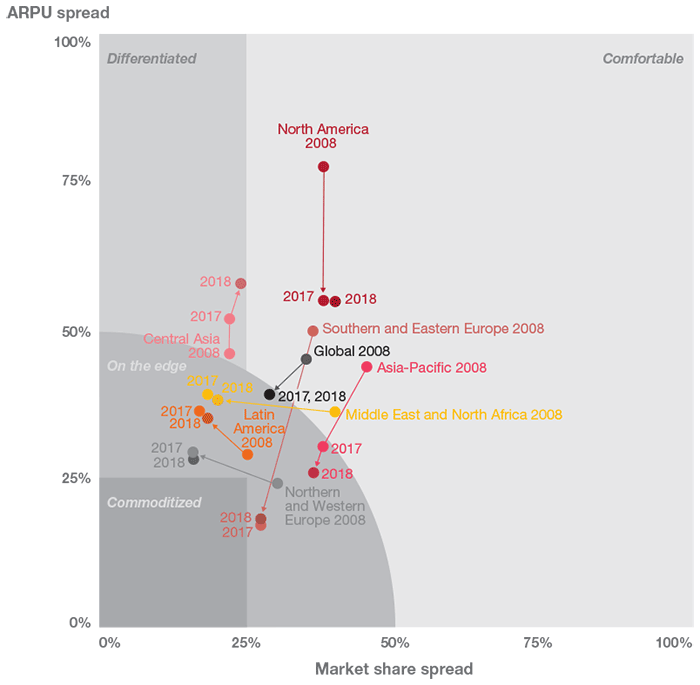

In this study, our third annual analysis of commoditization in wireless markets across the globe, we measured the degree of commoditization in 59 markets using two key factors — the “ARPU spread” (the difference between the highest and lowest ARPUs among the operators in a particular market), and the “market share spread” (the difference between the largest and smallest shares). The goal is to create a picture of each market’s efficiency — the degree to which price wars have consumed the ability of players to create and sustain value in their market, and the willingness of consumers to switch from one provider to another.

Though telecom has often been seen as a fairly homogenous business, with most companies making their profits the same way, that is no longer the case. Every company needs its own focused strategy. Commoditization can be avoided; convergence can be exploited. In this study, we describe the underlying dynamics of these two trends, and show how they can help you crystallize your own company’s strategy.

This report discusses key findings from the study at the global and regional levels, providing a detailed picture of the state of the global telecom industry, the regulatory and pricing factors putting pressure on industry players, and the strategies they are using to maintain their market differentiation and the overall value of their product and services offerings.